Construction Equipment Finance Market Outlook:

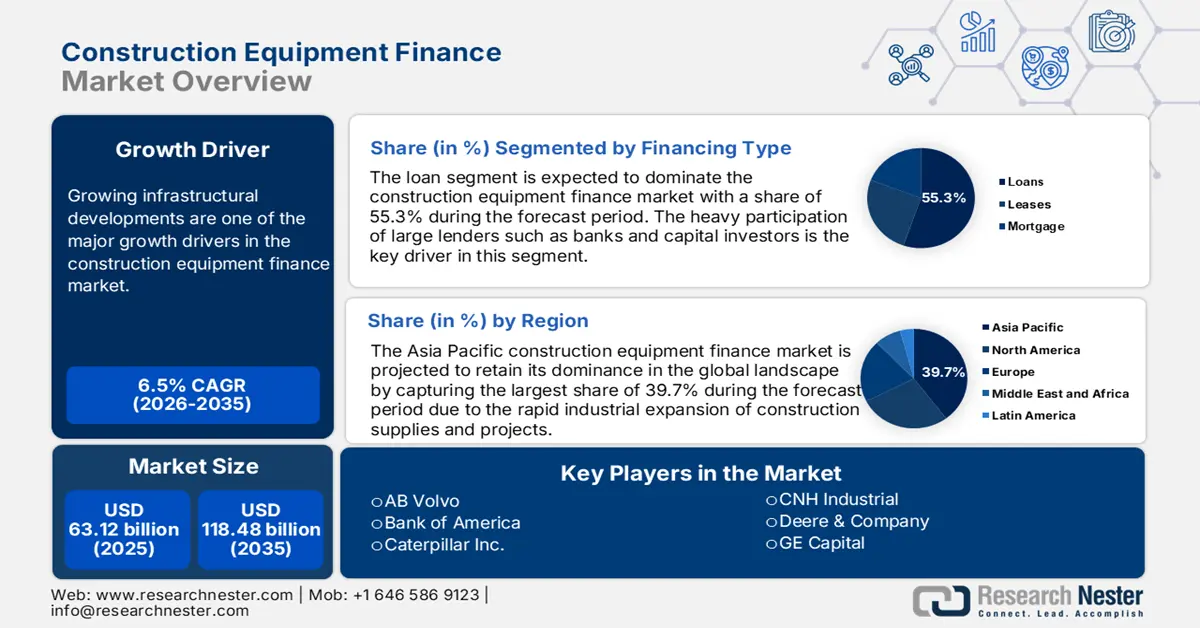

Construction Equipment Finance Market size was valued at USD 63.12 billion in 2025 and is likely to cross USD 118.48 billion by 2035, registering more than 6.5% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of construction equipment finance is assessed at USD 66.81 billion.

Growing infrastructural developments are one of the major growth drivers in the market. Efforts to fasten urbanization in developing countries are accumulating massive investments in this sector. The increasing need for efficient equipment in these construction projects is further fueling the demand for finance solutions. According to a report published by government of the UK, in June 2021, 28% of the total global population is expected to live in cities with at least 1 million inhabitants by the end of 2030. The report further states, that the number of megacities with more than 10 million inhabitants is projected to grow significantly, reaching 43 in 2030.

The growing population is compelling a trend of investing heavily in the construction industry, creating opportunities for investors in the construction equipment finance market. According to Census Bureau of the U.S. report, published in December 2024, the world population reached 8.0 billion. The report marks the most populated countries being India, China, the U.S., Indonesia, Pakistan, Nigeria, Brazil, Bangladesh, Russia, and Mexico. The emphasized volume of people worldwide is forcing governing authorities to allocate living spaces for each citizen, raising the need for new constructions. Furthermore, emerging economies are heavily investing in this sector with the goal of improving their capital efficiency.

Key Construction Equipment Finance Market Insights Summary:

Regional Highlights:

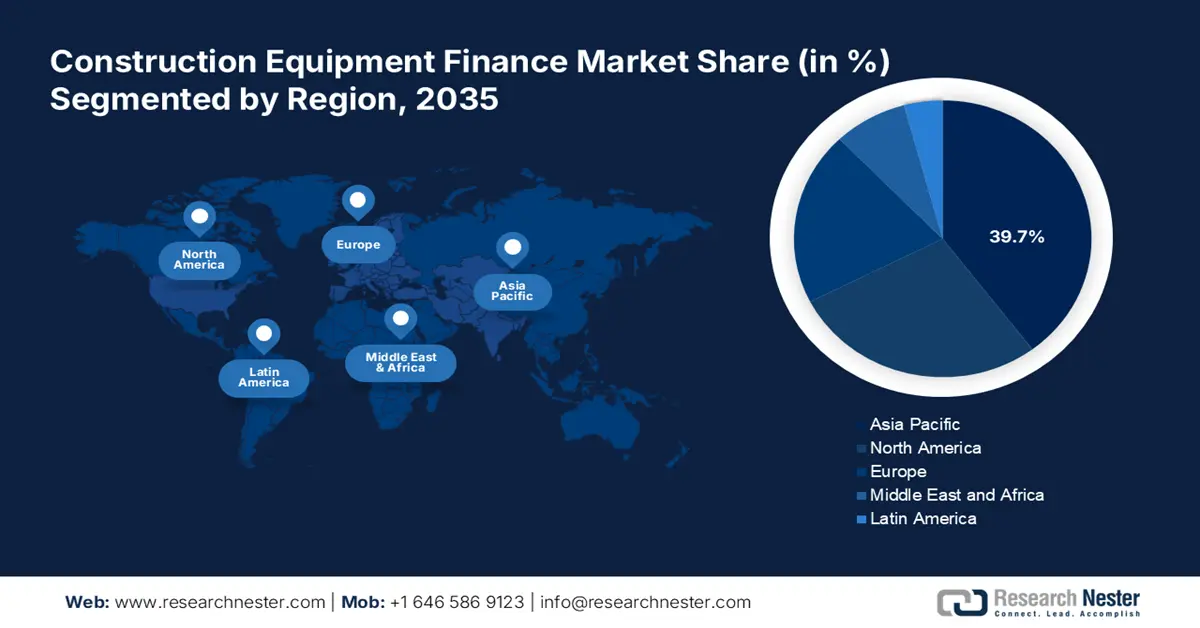

- Asia Pacific leads the Construction Equipment Finance Market with a 39.7% share, propelled by the rapid industrial expansion of construction supplies and projects in the region, driving the demand for financial assistance through 2026–2035.

- North America's construction equipment finance market expects the fastest growth by 2035, driven by the growing demand for construction machinery in both residential and commercial sectors.

Segment Insights:

- The Construction segment is forecasted to achieve a significant share by 2035, propelled by the rapid growth in the global construction industry and demand for financing solutions.

- The Loan segment is expected to achieve a 55.3% share by 2035, driven by participation of large lenders and growing infrastructure development projects.

Key Growth Trends:

- Increasing government investments

- Technological advancements in equipment

Major Challenges:

- Uncertainty in economic growth

- High interest rate and asset valuation

- Key Players: AB Volvo, Bank of America, Caterpillar Inc., CNH Industrial, Deere & Company, GE Capital, John Deere, JP Morgan Chase, Well Fargo.

Global Construction Equipment Finance Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 63.12 billion

- 2026 Market Size: USD 66.81 billion

- Projected Market Size: USD 118.48 billion by 2035

- Growth Forecasts: 6.5% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (39.7% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, India, United States, Japan, Germany

- Emerging Countries: China, India, Japan, South Korea, Singapore

Last updated on : 13 August, 2025

Construction Equipment Finance Market Growth Drivers and Challenges:

Growth Drivers

- Increasing government investments: Initiatives such as public-private partnerships, smart city projects, and infrastructure development programs taken by the governments are driving the construction equipment finance market. For instance, in September 2024, the Ministry of Housing & Urban Affairs of India published a report stating the investments in their Smart City Mission. It mentioned around 8,000 under-development multi-sectoral projects with the aim to construct 100 cities, amounting to USD 1600 billion. These projects have further boosted the demand for construction equipment, raising need for financing options.

- Technological advancements in equipment: The ongoing innovations in construction equipment to improve their efficiency and performance are succeeding in generating profitable revenue. Growing trend of adopting automation and sustainability is also fueling the industry by offering financers the scope of earning carbon credits. For instance, in April 2023, Commonwealth Bank of Australia launched a range of green asset finance solutions to support businesses investing in green vehicles, equipment, and machinery. The new Green Vehicle and Equipment Finance offers discounts and incentives to lower operational costs and energy wastage.

Challenges

- Uncertainty in economic growth: Fluctuations in an economy including recessions, inflation, and geopolitical tensions may restrict the progress of construction, hindering growth in the construction equipment finance market. These issues can further cause a lack of investments in construction projects, resulting in a loss of profit margin. This can discourage companies from financing the equipment. The economic factors are also co-related with the loan repayment capacities, which may lower the customer’s credit score, impacting their eligibility for future transactions.

- High interest rate and asset valuation: The market may lose consumers due to the fluctuating interest rates. The financing options can face rejection or lack of adoption in price-sensitive regions due to the concern about increasing repayment amounts. In addition, this can raise the cost of financing, making it difficult for construction firms to afford new equipment. Moreover, the burden of existing debt may dissolve the interest of consumers in future association with these financing facilities, hindering the growth in this sector.

Construction Equipment Finance Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

6.5% |

|

Base Year Market Size (2025) |

USD 63.12 billion |

|

Forecast Year Market Size (2035) |

USD 118.48 billion |

|

Regional Scope |

|

Construction Equipment Finance Market Segmentation:

Financing Type (Loans, Leases, Mortgage)

The loan segment is projected to account for around 55.3% construction equipment finance market share by 2035. The heavy participation of large lenders such as banks and capital investors is the key driver in this segment. The supportive tendency and growing interest in regional or international infrastructural development projects have encouraged these financial forums to invest. For instance, in February 2024, Japan International Cooperation Agency signed an ODA loan agreement of USD 1.5 billion with the Government of India in Delhi for developmental projects in India. Further, IoT integration has created unified platforms for these financial options, increasing accessibility.

Industry Vertical (Construction, Mining, Government & Public, Rental)

Based on industry vertical, the construction segment is projected to hold a significant share of the construction equipment finance market by the end of 2035. Demand in this segment is inflated by the rapid growth in the global construction industry. The increasing number of construction projects creates a need for specialized and heavy equipment. This further encourages many economic firms to finance these requirements. For instance, in June 2022, SBI Africa partnered with Komatsu Europe to offer a real asset finance scheme in the Africa region. According to the agreement, both parties aim to put their efforts into leveraging the marketplace for exporting and selling new Komatsu construction equipment in this region.

Our in-depth analysis of the global market includes the following segments

|

Financing Type |

|

|

Equipment |

|

|

Industry Vertical |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Construction Equipment Finance Market Regional Analysis:

APAC Market Statistics

By the end of 2035, Asia Pacific construction equipment finance market is set to dominate around 39.7% revenue share. The rapid industrial expansion of construction supplies and projects has inflated the need for financial assistance and support in this region. This is further creating a scope of collaboration between financial firms and equipment manufacturers, attracting more capital investors to participate in this sector. For instance, in November 2022, Federal Bank partnered with JCB India to boost the financing options for customers. The partnership offers an option to borrow loans at competitive interest rates to purchase a wide range of world-class equipment from JCB.

India is taking the fast-paced infrastructural development as an opportunity to oppose excessive liquidity in the domestic economy. The country considers investments in the market as accumulating assets for its economic growth. This is further inspiring several equipment suppliers and financial institutions to strengthen their trading relationships to broaden their offerings. For instance, in February 2024, Mahindra Construction Equipment signs an MoU with the Bank of Maharashtra to provide customers with the best interest rate and loan tenure. The partnership aims to offer unique financial assistance for the purchase of current and forthcoming BSV range of construction equipment.

China is showcasing notable progress in the market with the support of government subsidies, plans, and incentives. For instance, in July 2024, the State Council of China released a five-year action plan for deepening the people-centered new urbanization strategy. The plan includes the construction of affordable houses and underground pipelines and the renovation of urban infrastructure to improve intercity commuting efficiency. The country is further promoting sustainable options in manufacturing and adopting construction equipment due to the increasing emissions. This is further creating a new business line for both the domestic and international leaders of this sector.

North America Market Analysis

North America is estimated to become one of the fastest-growing regions in the construction equipment finance market during the forecast period, 2026-2035. The growing demand for construction machinery in both residential and commercial sectors is contributing to the progress of this region. This is attracting many global leaders to invest in this region to empower the construction field of this region. For instance, in November 2021, Hitachi partnered with ITOCHU Corporation and Tokyo Century Corporation to build a joint venture company to offer financial support for construction machinery in North America. The JV company, ZAXIS Financial Services Americas, LLC provides financing for sales of equipment sold by the Hitachi Construction Machinery Group.

The U.S. construction equipment finance market is expected to grow exponentially due to its contribution to availing financial support for its robust construction machinery industry. The manufacturers of this country are eager to promote their product line by offering lucrative financial options to the customers. This has attracted many lending firms to arrange maximum funding to serve this sector. For instance, in December 2023, Machinery Partner raised USD 11 million to offer procurement, financing, and support for a wide range of industrial equipment and heavy machinery.

Canada is also expected to experience significant growth in the market due to its positive impact on the economic growth of this country. The increased number of construction projects in this country is inflating the demand for machinery. Thus, the need for purchasing and leasing these equipment is further expanding the marketplace for investors. For instance, in February 2023, BMO Financial signed a bilateral agreement with BNP Paribas to provide clients with continuity of leasing services across Canada and the U.S. for construction equipment.

Key Construction Equipment Finance Market Players:

- AB Volvo

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Bank of America

- Caterpillar Inc.

- CNH Industrial

- Deere & Company

- GE Capital

- John Deere

- JP Morgan Chase

- Well Fargo

- Capitus

- Action Construction Equipment

The market has become a key medium of promotion and expansion for machinery manufacturers. This raises a surge in companies to avail good financing options for their consumers, particularly builders with limited budgets to attain maximum adoption. Many leading manufacturers are now binding collaboration with financing institutions to offer better financial solutions, solidifying their grip on consumer loyalty. For instance, in March 2024, Sany India partnered with J&K Bank to offer its customers comprehensive financial solutions such as competitive interest rates and flexible repayment plans for construction equipment. Such key players include:

Recent Developments

- In October 2024, Capitus acquired Oaks Commercial Capital to launch an equipment finance division, expanding its portfolio. The acquisition aims to support SMEs in sectors such as construction, healthcare, manufacturing, and hospitality.

- In June 2024, Action Construction Equipment partnered with Bank of Baroda to offer tailored financing options for construction equipment businesses, entrepreneurs, and startups across India. The pact empowers businesses by availing BOD finance options.

- Report ID: 6846

- Published Date: Aug 13, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.