Commercial Loan Software Market Outlook:

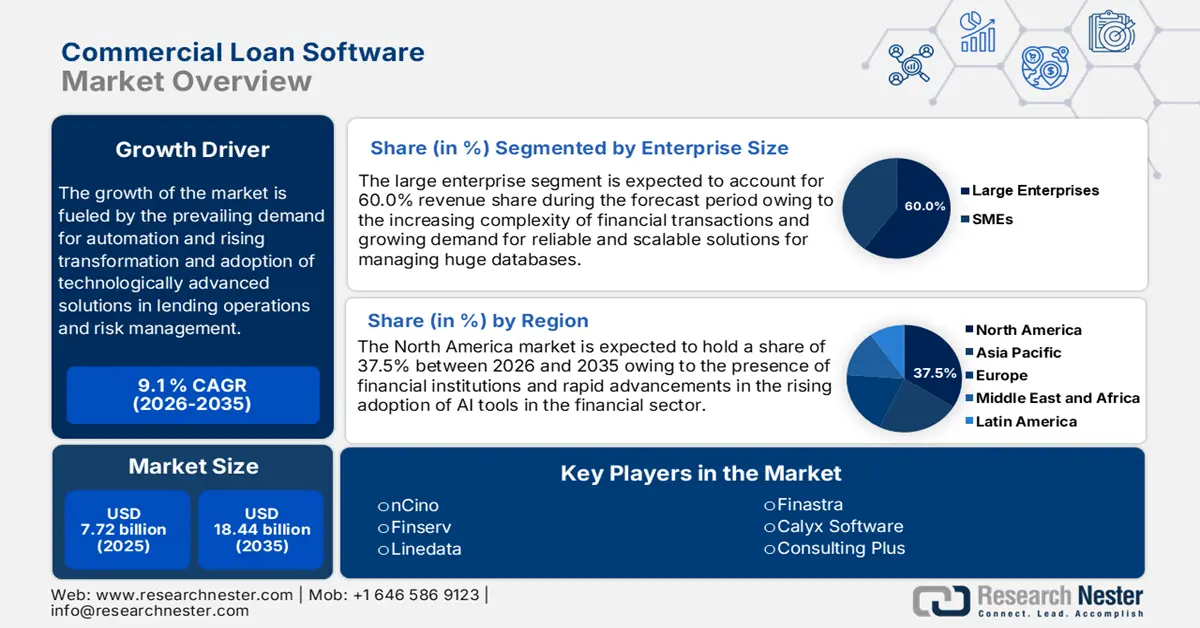

Commercial Loan Software Market size was over USD 7.72 billion in 2025 and is anticipated to cross USD 18.44 billion by 2035, witnessing more than 9.1% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of commercial loan software is assessed at USD 8.35 billion.

The factors fueling the growth of the commercial loan software market include increasing demand for automation and digital transformation in the financial services sector to enhance efficiency and eliminate errors. Also, the cloud-based solution is a promising cause for the growth of this market with its prospective scalability, flexibility, and lower costs, augmenting lenders of any size. Fintech and alternative lending platforms have created enhanced competition in the marketplace which has led traditional lenders to adopt advanced technologies to remain competitive.

In addition, regulatory compliance and cybersecurity advancements have led innovation through solutions that provide better data encryption and real-time monitoring and reporting options in loan management. The adoption of blockchain technology for the secure and transparent record of transactions, with further transformation through open banking and API-driven ecosystems, allows third-party integrations and partnerships with fintech companies to deliver more agile and innovative products to lenders. Overall, these trends seem to represent a shift towards more automated, more secure, and flexible loan management systems responsive to customer expectations.