Commercial Loan Software Market Outlook:

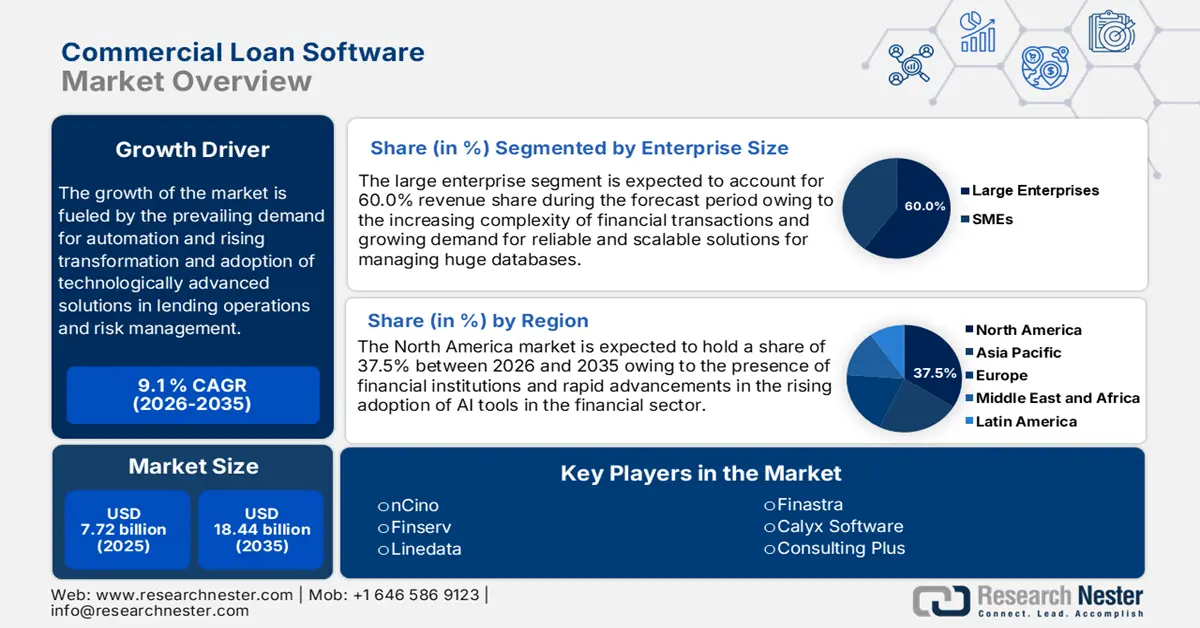

Commercial Loan Software Market size was over USD 7.72 billion in 2025 and is anticipated to cross USD 18.44 billion by 2035, witnessing more than 9.1% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of commercial loan software is assessed at USD 8.35 billion.

The factors fueling the growth of the commercial loan software market include increasing demand for automation and digital transformation in the financial services sector to enhance efficiency and eliminate errors. Also, the cloud-based solution is a promising cause for the growth of this market with its prospective scalability, flexibility, and lower costs, augmenting lenders of any size. Fintech and alternative lending platforms have created enhanced competition in the marketplace which has led traditional lenders to adopt advanced technologies to remain competitive.

In addition, regulatory compliance and cybersecurity advancements have led innovation through solutions that provide better data encryption and real-time monitoring and reporting options in loan management. The adoption of blockchain technology for the secure and transparent record of transactions, with further transformation through open banking and API-driven ecosystems, allows third-party integrations and partnerships with fintech companies to deliver more agile and innovative products to lenders. Overall, these trends seem to represent a shift towards more automated, more secure, and flexible loan management systems responsive to customer expectations.

Key Commercial Loan Software Market Insights Summary:

Regional Highlights:

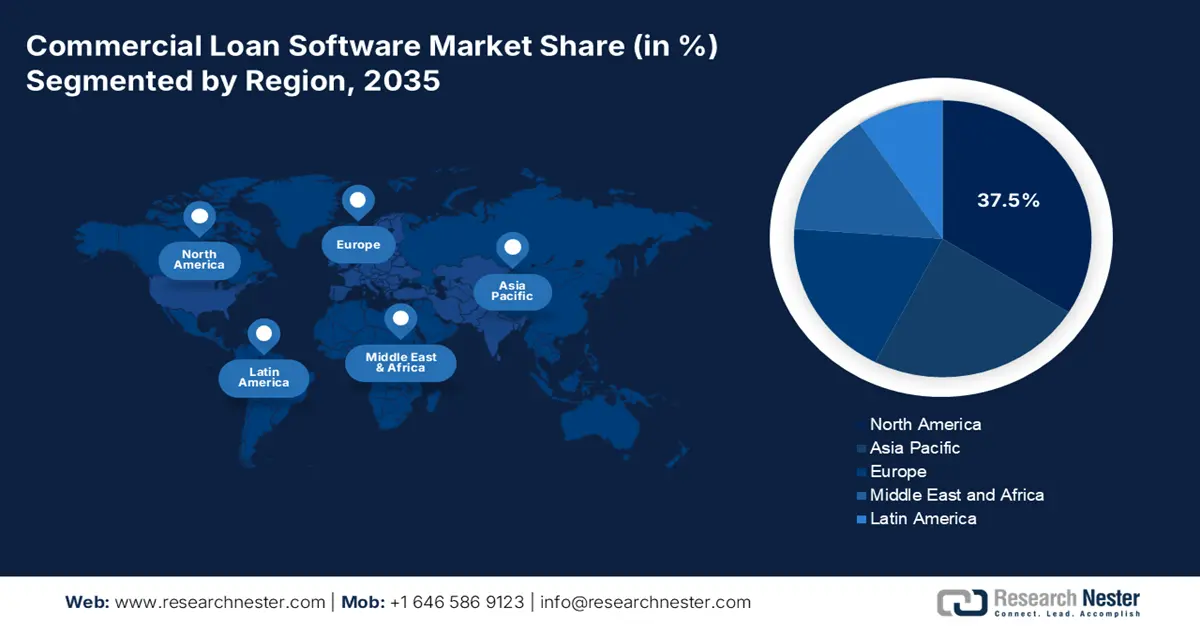

- North America leads the Commercial Loan Software Market with a 37.5% share, driven by maturation of technology and regulation in the sector and adoption of digital technologies, fostering robust growth through 2026–2035.

- The Asia Pacific commercial loan software market is set for healthy growth through 2026–2035, driven by rapid digital transformation and reshaping of the financial ecosystem.

Segment Insights:

- The Large Enterprise segment is poised for substantial growth by 2035, driven by increasing financial transaction complexity and the need for scalable solutions.

- The Cloud-based segment is projected to capture more than 68% share by 2035, driven by high adoption across financial institutions due to its efficiency and cost-effectiveness.

Key Growth Trends:

- Rising demand for efficacy in credit risk management

- Regulatory and policy support

Major Challenges:

- Complexity in customization

- High implementation costs

- Key Players: nCino, Fiserv, Finastra, Linedata, Q2 Software, Calyx Software, FIS.

Global Commercial Loan Software Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 7.72 billion

- 2026 Market Size: USD 8.35 billion

- Projected Market Size: USD 18.44 billion by 2035

- Growth Forecasts: 9.1% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (37.5% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Canada, United Kingdom, Germany, Japan

- Emerging Countries: China, India, Singapore, South Korea, Japan

Last updated on : 14 August, 2025

Commercial Loan Software Market Growth Drivers and Challenges:

Growth Drivers

- Rising demand for efficacy in credit risk management: The growing need to control credit risk is driven by the endeavors of financial institutions to mitigate risks amidst economic times becoming increasingly challenging. Advanced technologies such as AI and ML are used to assess risks by automating the assessment and even predicting possible defaults to enhance decision-making and avoid human error. Additionally, the increased growth of non-performing loans during an economic crisis highlights the need to implement credit risk management systems for any financial institution.

- Regulatory and policy support: Regulatory and policy support from formal bodies largely contributes to the commercial loan software market growth. Regulation frameworks for example, Basel III, IFRS 9, and anti-money laundering regulations have made compliance stricter on financial institutions, making them implement more advanced loan management software. Such regulations focus on risk management, transparency, and accurate reporting, thereby increasing the need for the depth of automated solutions to handle complex calculations and real-time monitoring.

Government policy on SME lending, financial inclusion, and digital transformation have encouraged banks and lenders to invest heavily in digital platforms that help them meet regulatory requirements and provide efficiency. Recent developments, including data privacy laws and the ascendance of ESG reporting, continue to push institutions to upgrade their software systems to remain compliant and competitive.

Challenges

- Complexity in customization: Complexity in customization, as financial institutions have a variety of internal business processes and regulatory requirements is one of the key challenges in the commercial loan software market. Most lenders face numerous problems in finding software that could easily be adapted to their operations without fundamental modifications, leading to increased costs and even longer implementation periods. Customized software often requires a huge investment of inputs from IT departments and end users, which may divert their attention from core business activities.

- High implementation costs: One of the major challenges in the commercial loan software market is its high implementation cost, which often dissuades even the most sophisticated systems from being adopted-primarily by smaller financial institutions. Also, the installation period can be a problem for the normal running of day-to-day activities, thus further deterring investment in new software.

Commercial Loan Software Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

9.1% |

|

Base Year Market Size (2025) |

USD 7.72 billion |

|

Forecast Year Market Size (2035) |

USD 18.44 billion |

|

Regional Scope |

|

Commercial Loan Software Market Segmentation:

Enterprise Size (Large Enterprises, SMEs)

The large enterprise segment is likely to dominate commercial loan software market share of over 60% by 2035, driven by the growing complexity of financial transactions and the consequent need for a robust and scalable solution. Additionally, major financial institutions are spending lavishly on advanced loan management systems to improve operational efficiency and comply with regulatory requirements. These organizations aim to create a unified, effective, and agile framework to support and render expertise to a diverse loan portfolio. Besides, the transformation wave in the banking industry forces large conglomerates to accept newer technologies such as artificial intelligence and data analytics which will give way to the advent of automation and experience enhancement in financial services.

For instance, in January 2023, Temenos unveiled the next generation of its AI-driven Corporate Lending solution for enabling banks to streamline servicing and combine international commercial loan portfolios in which large enterprises and regional banks can experience loan lifecycle management and processing across lending lines and geographies effortless.

Deployment Mode (Cloud-based, On-Premises)

In commercial loan software market, cloud-based segment is projected to hold revenue share of more than 68% by 2035 owing to the high adoption of cloud-based solutions across financial institutions for its efficiency, flexibility, and cost-effectiveness. Financial institutions and banks are discovering means of convenience for their core operations such as fetching data and handling it securely with cloud-based platforms in real-time, to promote digital transformation.

For instance, in February 2020, Intellect Design Arena introduced Contextual Banking eXperience–Origination (CBX-O), a cloud-based, end-to-end loan origination solution to automate procedures, optimize operations, reduce operating expenses, and offer a better customer experience. It is built on modern cloud-native, cloud-agnostic, and API-first technology and is intended to provide intelligent credit decisions and uses AI and ML to aggregate data, analyze credit risk, and provide real-time contextual insights that increase productivity throughout the credit ecosystem.

Our in-depth analysis of the commercial loan software market includes the following segments:

|

Enterprises Size |

|

|

Deployment Mode |

|

|

Product |

|

|

End user |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Commercial Loan Software Market Regional Analysis:

North America Market Analysis

By 2035, North America commercial loan software market is set to capture over 37.5% revenue share spurred by the maturation of both technology and regulation in the sector and adoption of digital technologies notably in the banking and finance sectors. The commercial loan software market is dominated by players such as Finastra, Fiserv, and FIS which provide integrated loan origination systems (LOS) and loan servicing software to cater to the complex demands of commercial lenders. Also, the region is making significant investments in high-intensity digitization to enhance operational efficiency, minimize instances of human intervention, and align with progressively evolving customer expectations.

The U.S. commercial loan software market is witnessing lucrative growth owing to the rising need for streamlined loan processing solutions. Also, the commercial loan software market is shifting towards a trend of accuracy in the approval of loans and risk assessment and management solutions. For instance, in December 2021, Temenos collaborated with Microsoft Azure to meet the rising demand for its banking cloud.

In Canada, the commercial loan software market is expected to grow at a rapid rate during the forecast period owing to rising demand for advanced solutions to secure financial transactions and increasing adoption of automation and digital transformation in the financial services sector. In July 2023, Aryza a financial health company that strives to transform the loan application process introduced loan origination software, Aryza Originate in Canada.

Asia Pacific Market Analysis

Asia Pacific in commercial loan software market is growing at a healthy pace, driven by rapid digital transformation and reshaping of the financial ecosystem and the ever-growing demand for automated solutions in lending. It is evident in major economies such as Japan, India, and China, whose lending landscape has undergone a complete overhaul with the latest developments in fintech.

China has been deemed to be the largest fintech market for commercial loan software as the adoption rate has increased, and government policies have been at the forefront of driving financial inclusion and digital banking. It includes the policy regulations of the local government on the peer-to-peer lending platforms and the implementation of a well-crafted framework for operations involving fintech, which have been motivating factors for banks and other financial institutions to invest in technologies that bring advanced loan processing and credit risk assessment.

Also, the government's shift toward a cashless economy and digital banking in Japan has catalyzed demand for sophisticated commercial loan software in the country. The Financial Services Agency (FSA) actively encourages fintech innovation and lets banks embrace digital lending platforms that may streamline loan origination, risk assessment, and compliance processes.

Digital lending markets in India are growing exponentially with the intervention of the government through the Unified Payments Interface (UPI) and the Digital India initiative. In August 2024, the Reserve Bank of India (RBI) enforced stiff rules for NBFCs and digital lenders regarding true transparency and consumer protection such as they will be unable to provide features such as options for liquidity and tenure-linked guaranteed minimum returns and further increased the adoption of sophisticated loan management software in compliance with regulatory requirements and achieving an efficient operation.

Key Commercial Loan Software Market Players:

- nCino

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Fiserv

- Finastra

- Linedata

- Q2 Software

- Calyx Software

- FIS

- Forvis

- Consulting Plus

- BankPoint

- Loandisk

- AllCloud Enterprise Solutions

There are several commercial loan software companies focused on efficiency, automation, and accuracy in lending processes. These companies deliver origination, underwriting, servicing, and risk management platforms using various technologies like cloud computing, AI, and data analytics. Consequently, financial institutions get to decrease operational costs, ensure regulatory compliance, and improve customer experience. Their contributions are invaluable in modernizing the landscape of lending and allowing a faster approval process on loans, efficient risk assessment, and far better scalability for lenders regardless of size.

Key companies dominating the commercial loan software market include:

Recent Developments

- In May 2024, a partnership between Finastra and Newgen Software was announced to seek improved customer experiences, increase return on investment (ROI), and streamline lending procedures for financial institutions where Finastra's all-inclusive solutions will revolutionize the consumer, business, and mortgage lending loan origination processes by utilizing Newgen's AI-powered automation suite.

- In April 2024, nCino, a pioneer in cloud banking for the international financial services sector announced its plans to improve its consumer banking solution with new features to engage with customers effectively while maintaining a high degree of flexibility and agility.

- Report ID: 6542

- Published Date: Aug 14, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Commercial Loan Software Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.