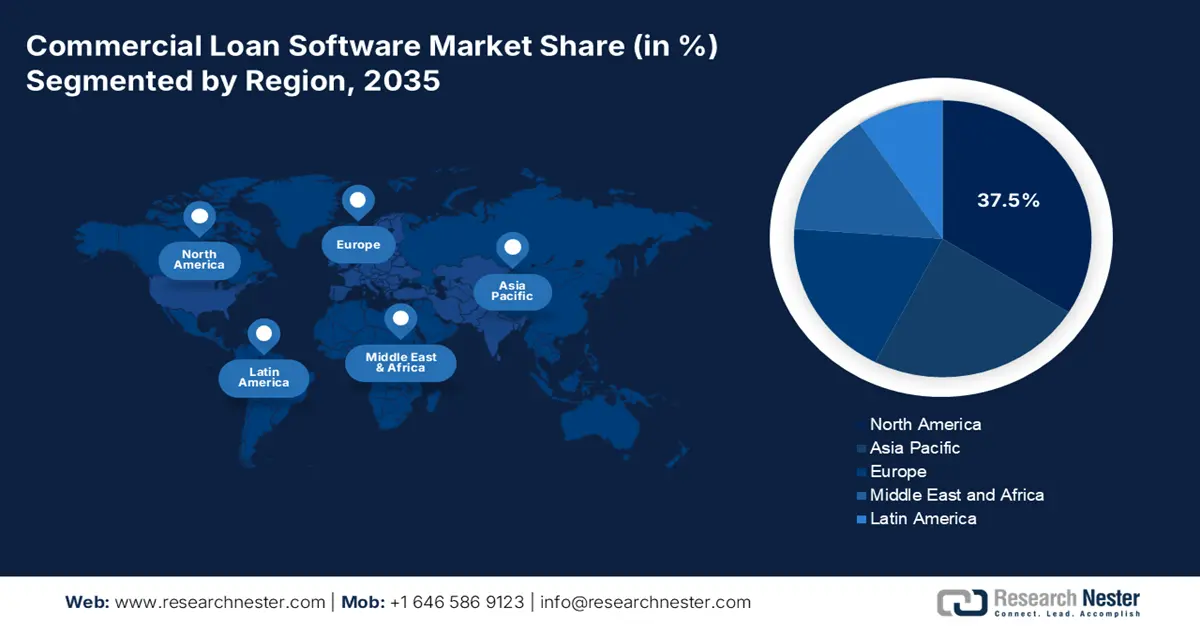

Commercial Loan Software Market Regional Analysis:

North America Market Analysis

By 2035, North America commercial loan software market is set to capture over 37.5% revenue share spurred by the maturation of both technology and regulation in the sector and adoption of digital technologies notably in the banking and finance sectors. The commercial loan software market is dominated by players such as Finastra, Fiserv, and FIS which provide integrated loan origination systems (LOS) and loan servicing software to cater to the complex demands of commercial lenders. Also, the region is making significant investments in high-intensity digitization to enhance operational efficiency, minimize instances of human intervention, and align with progressively evolving customer expectations.

The U.S. commercial loan software market is witnessing lucrative growth owing to the rising need for streamlined loan processing solutions. Also, the commercial loan software market is shifting towards a trend of accuracy in the approval of loans and risk assessment and management solutions. For instance, in December 2021, Temenos collaborated with Microsoft Azure to meet the rising demand for its banking cloud.

In Canada, the commercial loan software market is expected to grow at a rapid rate during the forecast period owing to rising demand for advanced solutions to secure financial transactions and increasing adoption of automation and digital transformation in the financial services sector. In July 2023, Aryza a financial health company that strives to transform the loan application process introduced loan origination software, Aryza Originate in Canada.

Asia Pacific Market Analysis

Asia Pacific in commercial loan software market is growing at a healthy pace, driven by rapid digital transformation and reshaping of the financial ecosystem and the ever-growing demand for automated solutions in lending. It is evident in major economies such as Japan, India, and China, whose lending landscape has undergone a complete overhaul with the latest developments in fintech.

China has been deemed to be the largest fintech market for commercial loan software as the adoption rate has increased, and government policies have been at the forefront of driving financial inclusion and digital banking. It includes the policy regulations of the local government on the peer-to-peer lending platforms and the implementation of a well-crafted framework for operations involving fintech, which have been motivating factors for banks and other financial institutions to invest in technologies that bring advanced loan processing and credit risk assessment.

Also, the government's shift toward a cashless economy and digital banking in Japan has catalyzed demand for sophisticated commercial loan software in the country. The Financial Services Agency (FSA) actively encourages fintech innovation and lets banks embrace digital lending platforms that may streamline loan origination, risk assessment, and compliance processes.

Digital lending markets in India are growing exponentially with the intervention of the government through the Unified Payments Interface (UPI) and the Digital India initiative. In August 2024, the Reserve Bank of India (RBI) enforced stiff rules for NBFCs and digital lenders regarding true transparency and consumer protection such as they will be unable to provide features such as options for liquidity and tenure-linked guaranteed minimum returns and further increased the adoption of sophisticated loan management software in compliance with regulatory requirements and achieving an efficient operation.