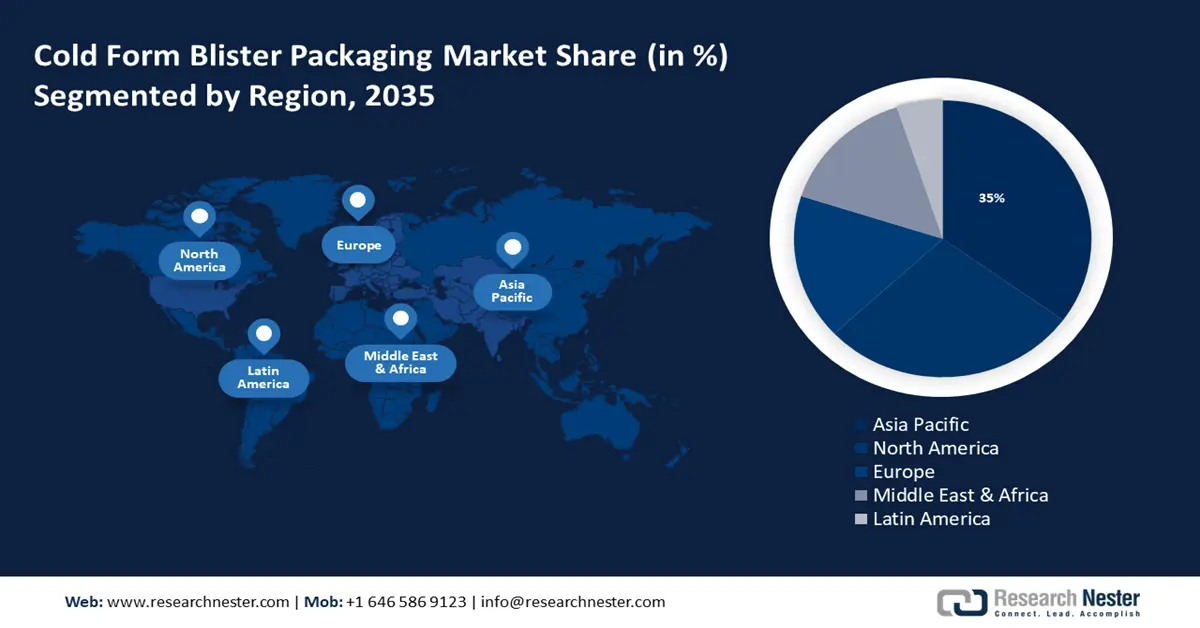

Cold Form Blister Packaging Market Regional Analysis:

APAC Market Insights

Asia Pacific industry is likely to hold largest revenue share of 35% by 2035. The booming e-commerce industry in the region is a major driver of the market, fueled by the need for secure, compliant, and efficient packaging solutions for a wide range of products. For instance, the e-commerce industry in Asia Pacific was valued at USD 2980.1 billion in 2022. As e-commerce continues to grow, the demand for advanced cold form blister packaging is expected to rise accordingly.

Also, a noticeable change in packaging trends has been observed in Japan in recent years, primarily due to increased public awareness of environmental issues, and the growing need for medicine delivery devices including autoinjectors, transdermal patches, inhalers, and prefilled syringes, which call for specific packaging options.

With over 25% of all blisters packaging machine procedures performed annually worldwide, China is the country with the greatest consumption share of blister packaging machines for pharma. Along with this, China is the world's leading producer of PVC, which may augment the market demand for cold form blister packaging.

North American Market Insights

The North America cold form blister packaging market is also predicted to have notable growth during the forecast period fueled by the increasing need for fast-moving consumer goods (FMCG), also called consumer packaged goods (CPG). For the majority of consumers in the region consumer packaged goods (CPG) are an essential component of daily living, which may boost the cold form blister packaging market share.

The existence of numerous producers of medical devices in the U.S. including Johnson & Johnson and Pfizer Inc., have converted to cold form blister packaging solutions used for over-the-counter items and prescriptions that need to be taken precisely, such as birth control pills.

In Canada, blister packaging is gaining traction as a packaging substitute due to the rising need from end-use industries including food, healthcare, consumer goods, and industrial items.