Cold Form Blister Packaging Market Outlook:

Cold Form Blister Packaging Market size was valued at USD 4.82 billion in 2025 and is likely to cross USD 8.71 billion by 2035, registering more than 6.1% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of cold form blister packaging is assessed at USD 5.08 billion.

The cold form blister packaging market expansion is attributed to the increasing demand for secure and tamper-evident packaging in the pharmaceutical industry. With the rising need for reliable and protective packaging solutions for sensitive medications and drugs, cold form blister packaging has become a preferred choice due to its superior protection against environmental factors such as moisture, light, and oxygen. This enhanced protection helps in maintaining the efficiency and safety of pharmaceutical products, which is crucial for both manufactures and consumers.

The growing pharmaceutical sector’s focus on product safety, efficacy, and patient compliance continues to fuel the demand for cold form blister packaging. Pharmaceuticals such as high-value drugs, complex generics, and specialty medications often require cold form blister packaging to ensure protection against moisture and light. Thus the growing demand for pharmaceuticals drives the adoption of cold form blister packaging.

Key Cold Form Blister Packaging Market Insights Summary:

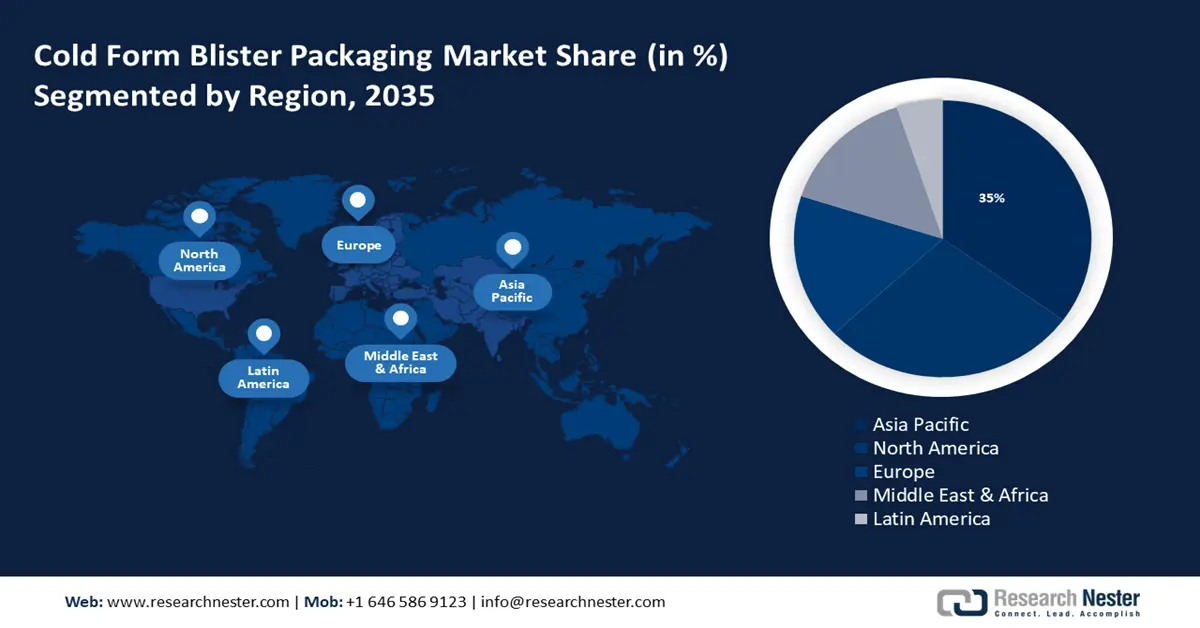

Regional Highlights:

- The Asia Pacific cold form blister packaging market will secure over 35% share by 2035, driven by the booming e-commerce industry, driving the need for secure, compliant packaging solutions.

- The North America market will register notable growth during the forecast timeline, driven by rising demand for FMCG products and the need for efficient cold form blister packaging in consumer goods.

Segment Insights:

- The aluminum segment in the cold form blister packaging market is expected to see significant growth till 2035, fueled by increasing usage of aluminum for packaging in pharmaceuticals and canned drinks.

Key Growth Trends:

- Surging need for food safety

- Increasing focus on sustainability

Major Challenges:

- Fluctuations in aluminum prices

- Presence of alternatives

Key Players: SteriPackGroup, Klöckner Pentaplast, ACG, Amcor plc, Constantia Flexibles, Sonoco Products Company, WINPAK LTD., Bilcare Limited, Svam Toyal Packaging Industries.

Global Cold Form Blister Packaging Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 4.82 billion

- 2026 Market Size: USD 5.08 billion

- Projected Market Size: USD 8.71 billion by 2035

- Growth Forecasts: 6.1% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (35% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, China, India, Japan

- Emerging Countries: China, India, Brazil, Mexico, Indonesia

Last updated on : 17 September, 2025

Cold Form Blister Packaging Market Growth Drivers and Challenges:

Growth Drivers

-

Surging need for food safety: Cold form blister packaging offers superior properties against moisture, light, and oxygen, which are crucial for preserving the freshness and extending the shelf life of food products. Moreover, the increasing popularity of specialty foods such as organic products and dietary supplements is driving demand for packaging solutions that ensure product safety and quality, and cold form blister packaging is well-suited to such needs. For instance, according to the United States Department of Agriculture (USDA), U.S. organic retail sales in 2021 were estimated to be more than USD 52 billion, or about 5.5% of all retail food sales.

- Increasing focus on sustainability: The drive for sustainability is leading to significant advancements in cold form blister packaging, with a focus on reducing environmental impact and meet consumer and regulatory demands for more eco-friendly solutions. Governments and regulatory bodies worldwide are implementing stricter regulations on packaging waste. For instance, the European Packaging and Packaging Waste Directive (PPWR) aims to minimize packaging waste and promote recycling. To comply with these regulations, manufacturers are adopting more sustainable cold form blister packaging options.

- Expanding consumer electronics sector: As consumer electronics become more advanced, they often come with numerous small parts and accessories that need secure and organized packaging. Cold form blister packaging offers precise and customizable compartments to keep these components neatly arranged and protected.

Challenges

-

Fluctuations in aluminum prices: Thin aluminum-containing laminate film sheets are used in the cold-forming blister packing method, which can be expensive, and impact the overall production cost. Globally, the price of aluminum has fluctuated significantly over the last ten years owing to the equilibrium between supply and demand, geopolitical tensions, economic slowdown, and natural disasters.

- Presence of alternatives: The most popular type of blister pack is thermoformed, which employs clear PVC material provides a variety of seal options, and safeguards the goods during travel as it is strong, resilient, and impervious to tampering. Besides this, heat seal blister cards, a form of blister packing produced by applying heat, are the perfect packaging option for pharmacies to shield food items and medications from impurities, moisture, and air. All these factors may limit the adoption of cold form blister packaging.

Cold Form Blister Packaging Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

6.1% |

|

Base Year Market Size (2025) |

USD 4.82 billion |

|

Forecast Year Market Size (2035) |

USD 8.71 billion |

|

Regional Scope |

|

Cold Form Blister Packaging Market Segmentation:

Material

Aluminum segment is set to account for more than 45% cold form blister packaging market share by the end of 2035 on account of the increasing usage of aluminum for packaging. According to the International Aluminum Institute, the packaging industry's use of aluminum is expected to climb from 7.2 million tons in 2020 to 10.5 million tons in 2030, primarily led by the growing demand for canned drinks in countries such as China, Europe, and North America.

Aluminum cold form blister packaging is widely used in the pharmaceutical industry for packaging tablets, capsules, and other medications. Its ability to provide an impermeable barrier ensures that medicines are protected from contamination and degradation.

Application

The healthcare segment in the cold form blister packaging market is projected to generate significant revenue over the coming years. The healthcare industry is subject to stringent regulations to ensure product safety and integrity. Cold form blister packaging meets these requirements by offering tamper-evident features and robust protection, which helps manufacturers comply with regulatory standards. Additionally, the increasing prevalence of chronic diseases, an aging population, and advancements in pharmaceutical products contribute to higher demand for packaging that ensures drug safety and extends shelf life.

Our in-depth analysis of the cold form blister packaging market includes the following segments:

|

Material |

|

|

Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Cold Form Blister Packaging Market Regional Analysis:

APAC Market Insights

Asia Pacific industry is likely to hold largest revenue share of 35% by 2035. The booming e-commerce industry in the region is a major driver of the market, fueled by the need for secure, compliant, and efficient packaging solutions for a wide range of products. For instance, the e-commerce industry in Asia Pacific was valued at USD 2980.1 billion in 2022. As e-commerce continues to grow, the demand for advanced cold form blister packaging is expected to rise accordingly.

Also, a noticeable change in packaging trends has been observed in Japan in recent years, primarily due to increased public awareness of environmental issues, and the growing need for medicine delivery devices including autoinjectors, transdermal patches, inhalers, and prefilled syringes, which call for specific packaging options.

With over 25% of all blisters packaging machine procedures performed annually worldwide, China is the country with the greatest consumption share of blister packaging machines for pharma. Along with this, China is the world's leading producer of PVC, which may augment the market demand for cold form blister packaging.

North American Market Insights

The North America cold form blister packaging market is also predicted to have notable growth during the forecast period fueled by the increasing need for fast-moving consumer goods (FMCG), also called consumer packaged goods (CPG). For the majority of consumers in the region consumer packaged goods (CPG) are an essential component of daily living, which may boost the cold form blister packaging market share.

The existence of numerous producers of medical devices in the U.S. including Johnson & Johnson and Pfizer Inc., have converted to cold form blister packaging solutions used for over-the-counter items and prescriptions that need to be taken precisely, such as birth control pills.

In Canada, blister packaging is gaining traction as a packaging substitute due to the rising need from end-use industries including food, healthcare, consumer goods, and industrial items.

Cold Form Blister Packaging Market Players:

- Ningbo Dragon Packaging Technology Co., Ltd.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- SteriPackGroup

- Klöckner Pentaplast

- ACG

- Amcor plc

- Constantia Flexibles

- Sonoco Products Company

- WINPAK LTD.

- Bilcare Limited

- Svam Toyal Packaging Industries Pvt. Ltd.

- Tekni-Plex, Inc.

- Essentra plc

The cold form blister packaging market is dominated by key market players who are gaining traction in the market as several major companies are entering the industry by introducing improved technologies and making investments.

Recent Developments

- In July 2023, Constantia Flexibles revealed REGULA CIRC made to resist delamination increase the shelf life of pharmaceuticals and safeguard their purity and effectiveness through the supply chain.

- In September 2022, Amcor plc introduced the AmSky blister system which removes PolyVinyl Chloride (PVC) from the package by employing a thermoform blister and lidding film made of Polyethylene (PE). The system possesses the capacity to revolutionize the sustainability of pharmaceutical and healthcare packaging and enjoys a carbon footprint reduction of more than 65% when compared to current market packaging alternatives.

- Report ID: 6334

- Published Date: Sep 17, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Cold Form Blister Packaging Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.