Cell & Gene Therapy Manufacturing Services Market Outlook:

Cell & Gene Therapy Manufacturing Services Market size was over USD 7.94 billion in 2025 and is anticipated to cross USD 40.86 billion by 2035, witnessing more than 17.8% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of cell & gene therapy manufacturing services is estimated at USD 9.21 billion.

The growth is majorly due to the rising demand for advanced therapies fueled by the increasing prevalence of conditions such as cancer, neurological disorders, and inherited diseases. Furthermore, automation, AI, and closed-system manufacturing processes are being adopted to enhance capabilities.

Governments worldwide are also providing regulatory support for faster approvals, and funding several research programs. This is encouraging biotech and pharma companies to develop cell and gene therapies. For instance, in October 2024, the 57th Governor of New York State funded USD 430 million, for New York BioGenesis Park which is a Cell and Gene Therapy Innovation Hub, in Long Island. As the therapies progress for clinical trials and toward commercialization, there’s a greater need for specialized manufacturing services to support their production.

Key Cell & Gene Therapy Manufacturing Services Market Insights Summary:

Regional Highlights:

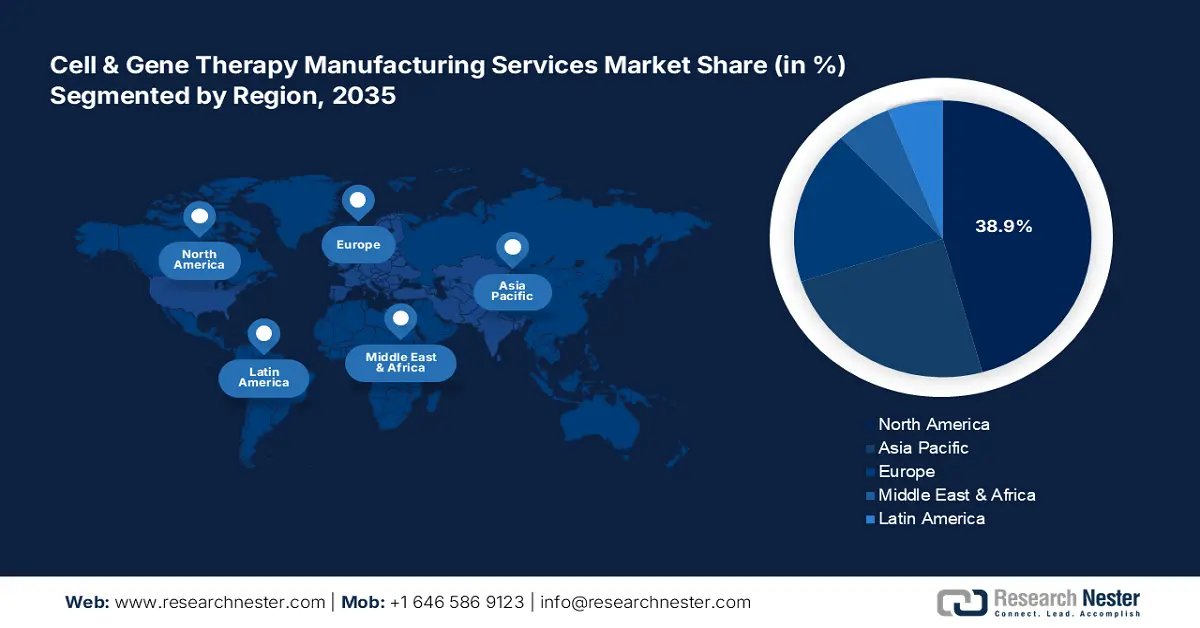

- North America's 38.9% share in the Cell & Gene Therapy Manufacturing Services Market is bolstered by scalable CDMO networks and strong biotech funding, ensuring dominance through 2035.

Segment Insights:

- The gene therapy segment is forecasted to experience considerable growth from 2026 to 2035, driven by increasing clinical trials and manufacturing improvements.

- Contract Manufacturing segment is anticipated to capture over an 87.8% share by 2035, fueled by companies’ rising outsourcing of manufacturing activities.

Key Growth Trends:

- Increasing prevalence of genetic disorders and other rare diseases

- Growth in partnerships between biotech companies

Major Challenges:

- High cost and scalability issues

- Quality control and standardization difficulties

- Key Players: Bluebird Bio, Inc., Catalent, Inc., Charles River Laboratories International, Inc., Merck KGaA, Miltenyi Bioindustry (Miltenyi Biotec).

Global Cell & Gene Therapy Manufacturing Services Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 7.94 billion

- 2026 Market Size: USD 9.21 billion

- Projected Market Size: USD 40.86 billion by 2035

- Growth Forecasts: 17.8% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (38.9% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, China, Japan, UK

- Emerging Countries: China, India, Japan, South Korea, Singapore

Last updated on : 14 August, 2025

Cell & Gene Therapy Manufacturing Services Market Growth Drivers and Challenges:

Growth Drivers

- Increasing prevalence of genetic disorders and other rare diseases: The rising number of genetic disease cases is driving the cell & gene therapy manufacturing services market, as it boosts demand for targeted treatments, that can address the root cause of these diseases. Genetic disorders such as muscular dystrophy, cystic fibrosis, and various cancers lack effective treatments, creating a need for treatment therapies. This rising global burden is influencing biotech and pharmaceutical companies to accelerate development efforts for cell and gene therapies. This, in turn, drives the demand for specialized manufacturing services, supporting complex production and regulatory needs.

- Growth in partnerships between biotech companies: These partnerships allow the firms to leverage the specialized expertise and facilities of CMOs, avoiding the need to build costly infrastructure in-house. Through these collaborations, the companies can accelerate production, maintain high-quality standards, and focus more resources on research and development. For instance, in July MaxCyte, Inc. and Vittoria Biotherapeutics announced collaboration for a strategic platform license (SPL) of MaxCyte’s Flow Electroporation technology and ExPERT platform to Vittoria Biotherapeutics. In this collaboration, Vittoria will attain non-exclusive clinical and commercial rights to use MaxCyte’s platforms.

Challenges

- High cost and scalability issues: These services require highly specialized facilities, equipment, and materials, making the initial setup and operational expenses substantial. Additionally, since these treatments are often personalized, scaling production to serve larger populations while maintaining affordability is a complex challenge. The customization required for each patient can limit batch sizes, further driving up costs, and requiring innovative approaches to reduce expenses without compromising quality.

- Quality control and standardization difficulties: These complications occur due to the intricate nature of cell and gene therapies, which are often derived from live cells or complex genetic materials. Ensuring consistency in potency, purity, and safety across different batches is a major challenge, especially given the variability of biological materials. Standardizing protocols that comply with regulatory requirements while accommodating the unique aspects of each therapy is difficult. This makes it essential to develop rigorous quality control systems that can detect and manage variability efficiently.

Cell & Gene Therapy Manufacturing Services Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

17.8% |

|

Base Year Market Size (2025) |

USD 7.94 billion |

|

Forecast Year Market Size (2035) |

USD 40.86 billion |

|

Regional Scope |

|

Cell & Gene Therapy Manufacturing Services Market Segmentation:

Mode (Contract manufacturing, In-house manufacturing)

The contract manufacturing segment is poised to hold over 87.8% cell & gene therapy manufacturing services market share by the end of 2035. Companies’ rising outsourcing of manufacturing activities to streamline production procedures and fast-track time-to-market for their therapies is majorly driving the segment’s growth. The dynamic regulatory landscape, in addition to the requirement for flexibility in manufacturing capacity, is driving the growth further. In January 2024, Israeli cell technology company Pluri announced the expansion of the contract development and manufacturing division, PluriCDMO. The company intends to share its knowledge base, technology, and facilities to develop stem cells, induced pluripotent stem cells, exosomes, and Immunotherapeutics, with other businesses.

Type (Cell therapy, Gene therapy)

Based on type, gene therapy is projected to expand at a considerable CAGR during the forecast period in the cell & gene therapy manufacturing services market. A wide range of products are currently up for clinical trials, and manufacturing process improvement has become a significant need in the market. As per an article on gene therapy by Wiley, over 3,900 gene therapy trials were undertaken in 46 countries as per the March 2023 update. Furthermore, prominent companies are increasingly focusing on manufacturing and commercialization owing to rising funding and the clinical success of more products. Companies are undertaking several initiatives to enhance their presence in the manufacturing market.

Our in-depth analysis of the market includes the following segments:

|

Type |

|

|

Mode |

|

|

Indication |

|

|

End user |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Cell & Gene Therapy Manufacturing Services Market Regional Analysis:

North America Market Analysis

North America industry is anticipated to account for largest revenue share of 38.9% by 2035, Domestic companies in North America have amplified their manufacturing operations in the cell & gene therapy manufacturing services market. Moreover, a strong network of CDMOs enables scalable production of the therapies in the region. In March 2023, Thermo Fisher Scientific Inc., in collaboration with the University of California, San Francisco (UCSF) announced the acceleration of advanced cell therapies for difficult-to-treat conditions. This includes cancer, rare diseases, and other illnesses.

As per the National Cancer Institute, in 2024, an estimated 2,001,140 new cases of cancer were diagnosed in the U.S., leading to nearly 611,720 people dying from the disease. The country dominates the North America region, driven by a mixture of strong technological infrastructure, substantial funding in biotechnology, and an exceedingly skilled workforce. Moreover, supportive regulations have enhanced R&D activities, leading to a flow in the number of clinical trials and approvals of advanced groundbreaking therapies in the market.

Canada market is growing steadily, supported by the government, a strong academic research environment, and collaborative industry partnerships. The country’s focus on innovation and regulatory advancements, such as the Pathway to Licensing advanced therapies is strengthening the cell & gene therapy manufacturing services market in the country. Scaling domestic production is enhancing the supply chain in the country, and accelerating cross-border partnerships.

APAC Market Statistics

APAC region houses a large and assorted population, including a substantial patient number from diseases which can be treated potentially through cell and gene therapies. This grants a considerable market prospect for establishments providing manufacturing services in the region, further driving market growth. The region is also progressively identifying the capabilities of the life sciences segment. These factors are boosting the region’s market.

South Korea market is particularly supported by a robust biotech industry. Regulatory reforms and financial support for biopharmaceuticals have spurred the establishment of cutting-edge production facilities, aiming to position South Korea as a regional hub for cell and gene therapy. For instance, in October 2024, Samsung Biologics launched a new high-concentration formulation platform, S-HiCon, to boost high-dose biopharmaceutical development and manufacturing.

China cell & gene therapy manufacturing services market is driven by a large patient base with unmet medical needs. The government’s commitment to supporting biotech innovation, combined with favorable regulatory adjustments for faster approvals, has fostered an environment where biotech companies can rapidly advance cell and gene therapies from research to commercialization. Hence, the country’s market is anticipated to witness considerable growth during the forecast period.

Key Cell & Gene Therapy Manufacturing Services Market Players:

- Boehringer Ingelheim International GmbH

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Bluebird Bio, Inc.

- Catalent, Inc.

- Charles River Laboratories International, Inc.

- Merck KGaA

- Miltenyi Bioindustry (Miltenyi Biotec)

- Samsung Biologics

- Thermo Fisher Scientific Inc

- WuXi AppTec Co., Ltd.

One of the key strategies adopted by the companies in the cell & gene therapy manufacturing services market is investing in capacity expansion. This is majorly done through building new facilities or upgrading existing ones to accommodate high-demand gene and cell therapy projects. In January 2023, FUJIFILM Irvine Scientific, Inc. launched the BalanCD HEK293 Viral Feed, which is intended to enhance AAV production for gene therapy applications and viral vector-based vaccines. These launches, in addition to other strategic activities, including geographical expansion, and partnerships between firms are projected to influence positive significant market activities, maintaining healthy competition between the players. Some of the prominent players are:

Recent Developments

- In September 2024, Samsung Biologics announced the launch of innovative development platforms named S-AfuCHO, and S-OptiCharge, at BioProcess International 2024.

- In December 2023, FUJIFILM Corporation invested USD 200 million in two subsidiaries to expand its capability of global cell therapy contract development and manufacturing (CDMO). The investment will fund the new 175,000 sq. ft headquarters of FUJIFILM Cellular Dynamics’ in the U.S.

- Report ID: 6699

- Published Date: Aug 14, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Cell & Gene Therapy Manufacturing Services Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.