Captive Petroleum Refinery Hydrogen Generation Market Outlook:

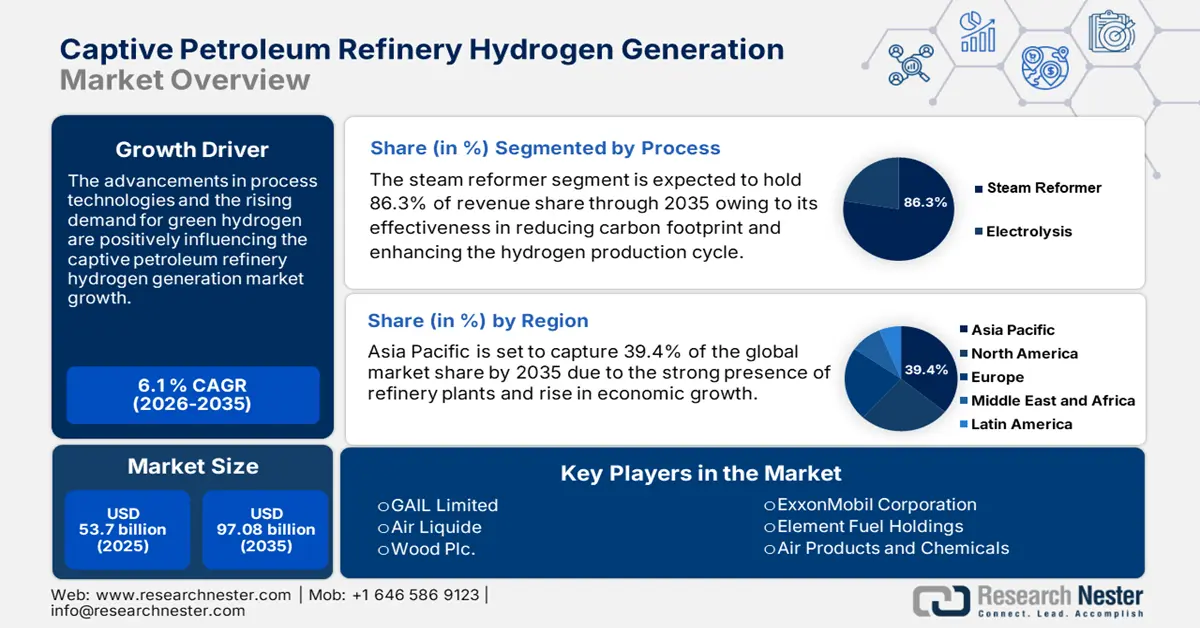

Captive Petroleum Refinery Hydrogen Generation Market size was over USD 53.7 billion in 2025 and is anticipated to cross USD 97.08 billion by 2035, witnessing more than 6.1% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of captive petroleum refinery hydrogen generation is assessed at USD 56.65 billion.

Hydrogen is a vital component used in refineries to lower the sulfur content of diesel. The rise in strict sulfur content regulations worldwide is fuelling the captive production of hydrogen in petroleum refineries. For instance, the International Maritime Organization (IMO) set a limit on sulfur use in fuel oil used by ships operating outside the designated Emission Control Areas to 0.50% m/m (mass by mass) in 2020.

The continuously evolving regulations on sulfur use are anticipated to fuel the captive production of hydrogen in the coming years. According to the Fuel Cells and Hydrogen Observatory, the total captive hydrogen production capacity was approx. 9,376t per day in 2019 in European refineries. Germany (6,534t per day) holds the top position in captive hydrogen production followed by the Netherlands (4,523t per day), Poland (3,741t per day), Spain (2,402t per day), and Italy (2,386t per day). Hydrocarbon reforming technologies are widely installed in on-site/captive generation refineries owing to their production effectiveness.