Captive Petroleum Refinery Hydrogen Generation Market Outlook:

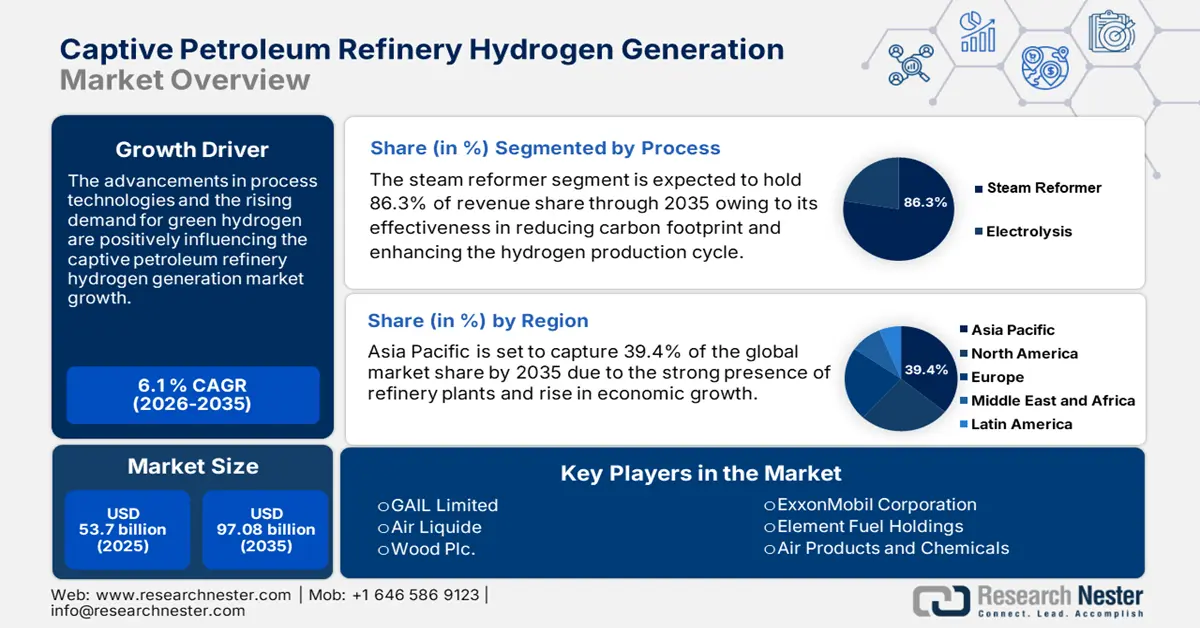

Captive Petroleum Refinery Hydrogen Generation Market size was over USD 53.7 billion in 2025 and is anticipated to cross USD 97.08 billion by 2035, witnessing more than 6.1% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of captive petroleum refinery hydrogen generation is assessed at USD 56.65 billion.

Hydrogen is a vital component used in refineries to lower the sulfur content of diesel. The rise in strict sulfur content regulations worldwide is fuelling the captive production of hydrogen in petroleum refineries. For instance, the International Maritime Organization (IMO) set a limit on sulfur use in fuel oil used by ships operating outside the designated Emission Control Areas to 0.50% m/m (mass by mass) in 2020.

The continuously evolving regulations on sulfur use are anticipated to fuel the captive production of hydrogen in the coming years. According to the Fuel Cells and Hydrogen Observatory, the total captive hydrogen production capacity was approx. 9,376t per day in 2019 in European refineries. Germany (6,534t per day) holds the top position in captive hydrogen production followed by the Netherlands (4,523t per day), Poland (3,741t per day), Spain (2,402t per day), and Italy (2,386t per day). Hydrocarbon reforming technologies are widely installed in on-site/captive generation refineries owing to their production effectiveness.

Key Captive Petroleum Refinery Hydrogen Generation Market Insights Summary:

Regional Highlights:

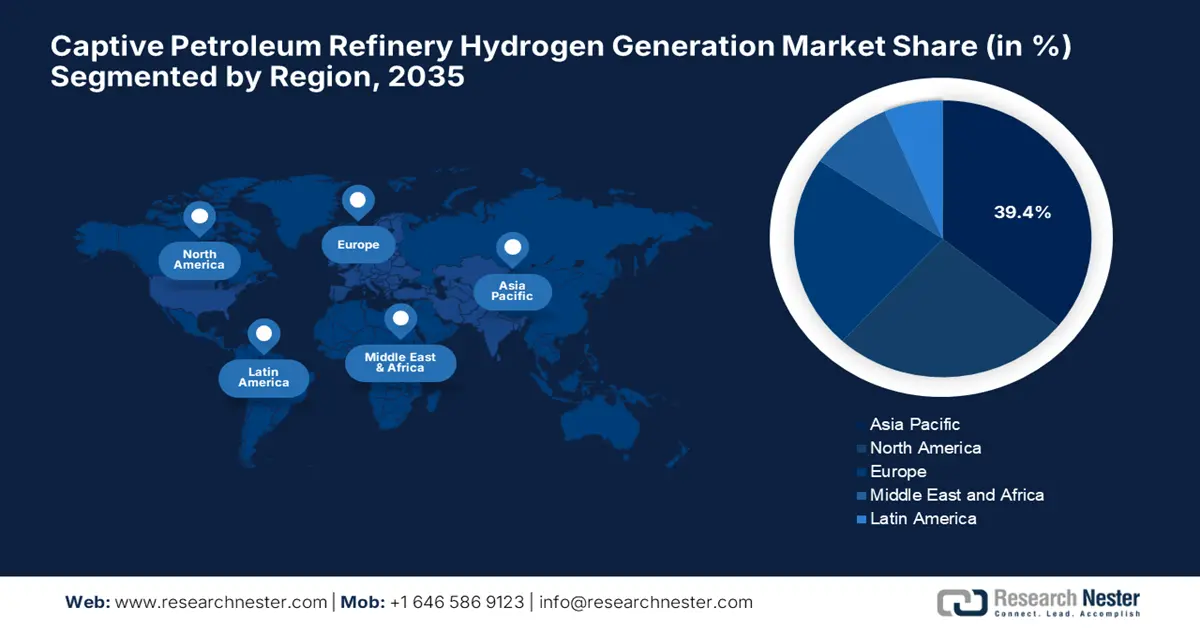

- Asia Pacific holds a 39.4% share in the Captive Petroleum Refinery Hydrogen Generation Market, driven by the strong presence of refinery plants and increasing consumption of hydrogen power in the industrial sector, including petroleum, ensuring strong growth by 2035.

Segment Insights:

- The Steam Reformer segment is anticipated to achieve an 86.3% share by 2035, fueled by advanced technologies reducing carbon emissions and promoting sustainable hydrogen production.

Key Growth Trends:

- High demand for advanced hydrogen production technologies

- Increasing popularity of green hydrogen

Major Challenges:

- High capital investments

- Poor hydrogen generation infrastructure

- Key Players: GAIL Limited, Air Liquide, Air Products and Chemicals, Emerson, Wood Plc, ExxonMobil Corporation, and Element Fuel Holdings.

Global Captive Petroleum Refinery Hydrogen Generation Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 53.7 billion

- 2026 Market Size: USD 56.65 billion

- Projected Market Size: USD 97.08 billion by 2035

- Growth Forecasts: 6.1% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (39.4% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, United States, Japan, Germany, India

- Emerging Countries: China, India, Japan, South Korea, Indonesia

Last updated on : 14 August, 2025

Captive Petroleum Refinery Hydrogen Generation Market Growth Drivers and Challenges:

Growth Drivers:

- High demand for advanced hydrogen production technologies: Innovations in the captive petroleum refinery hydrogen generation technologies such as steam reforming and electrolysis are anticipated to boost the overall market growth in the coming years. The continuous research and development activities by some of the large-capacity electrolyzers including Cummins Hylyzer and Siemens Sliyzeare set to enhance operational efficiency, mitigate the greenhouse gas emissions associated with hydrogen production, and ensure long-term operational gains.

The advanced electrolysis process method is gaining traction owing to the rising demand for green hydrogen. Several start-ups are introducing wind turbine platforms for hydrogen production through electrolysis. For instance, HiSeas Energy is a U.S.-based start-up that provides stable, low-cost & mass offshore wind turbines to energize electrolysis for hydrogen production. - Increasing popularity of green hydrogen: The rising global pressure to reduce carbon emissions is significantly driving the petroleum refining industry to invest in green hydrogen generation technologies. For green hydrogen generation, companies are integrating renewable energy sources, which aids refiners in effectively complying with regulatory demands and consumers' expectations. Integrating renewable energy sources such as wind, solar, and hydropower into the production cycle offers a pathway to introduce green hydrogen. Hydrogen is essential in various refining processes, including hydrocracking and desulfurization, using low-carbon or green hydrogen refiners can effectively reduce the carbon intensity of their operations.

Challenges

- High capital investments: The advanced process technologies for hydrogen generation are expensive due to the high upfront and installation costs. The installation of these technologies requires significant engineering and construction efforts, this adds to costs and extends project timelines. Small-scale refineries often fail to adopt modern technologies due to budget constraints, limiting new opportunities.

- Poor hydrogen generation infrastructure: The inadequate infrastructure for hydrogen storage, transport, and distribution can present significant challenges to the feasibility of captive hydrogen generation in petroleum refineries. The refinery plants require sufficient storage capacity to manage hydrogen production fluctuations and to ensure a steady supply for refining processes, limited storage options can lead to operational inefficiencies.

Captive Petroleum Refinery Hydrogen Generation Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

6.1% |

|

Base Year Market Size (2025) |

USD 53.7 billion |

|

Forecast Year Market Size (2035) |

USD 97.08 billion |

|

Regional Scope |

|

Captive Petroleum Refinery Hydrogen Generation Market Segmentation:

Process (Steam Reformer, Electrolysis)

The steam reformer segment is foreseen to account for 86.3% of the global market share by 2035. Petroleum refineries are actively adopting advanced steam reformer technologies for hydrogen production due to their effectiveness in mitigating carbon emissions and sustainable manufacturing practices. For instance, in April 2022, Wood Plc announced the launch of its new steam methane reforming technology that mitigates 95% of carbon emissions compared to conventional hydrogen plants.

Our in-depth analysis of the captive petroleum refinery hydrogen generation market includes the following segments:

|

Process

|

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Captive Petroleum Refinery Hydrogen Generation Market Regional Analysis:

Asia Pacific Market Forecast

Asia Pacific is estimated to capture 39.4% of the revenue share through 2035 owing to the strong presence of refinery plants. The rapid growth in economic activities and increasing consumption of hydrogen power in the industrial sector including, petroleum is positively influencing the overall market growth. China, India, Japan, South Korea, Indonesia, Thailand, and Australia are some of the dominant crude oil production countries in the region, driving high demand for hydrogen production technologies.

China is the top producer of crude oil in Asia Pacific and accounted for a record 14.8 million barrels per day in 2023. The huge presence of refinery capacity in the country is augmenting the demand for captive hydrogen generation technologies. The rapid expansion of the petrochemical industry is driving strategic collaborations between domestic and international companies to boost hydrogen production capabilities.

India’s rapidly increasing population and economic growth are fuelling the demand for refined fuels, prompting refineries to enhance hydrogen production for cleaner outputs. The rising investments in the refining capacities and associated hydrogen production are also pushing the market growth in India. Jamnagar Refinery is the world’s largest oil refinery and de facto petroleum hub. With more than 1.2 million barrels per day of nominal crude processing capacity Jamnagar Refinery is significantly influencing the demand for advanced hydrogen processing technologies.

North America Market Statistics

The North America market is driven by the increasing investments in natural gas infrastructure and the strong presence of regulatory organizations such as the Environmental Protection Agency and Energy Information Administration. The technological advancements in hydrogen production technologies such as steam methane reforming and autothermal reforming are enhancing operational efficiency and lowering costs.

The U.S. captive petroleum refinery hydrogen refinery generation market is expanding due to ongoing refinery upgrades to meet strict environmental regulations and rising investments in hydrogen fuel cell vehicles for transportation. For instance, according to the Energy Information Administration, the U.S. refinery hydrogen production capacity accounted for 2,913 million cubic feet per day in January 2024.

Canada’s commitment to achieve net-zero emissions by 2050 is pushing high investments in the development of advanced hydrogen production infrastructure, pushing the overall market growth. Canada is the world’s top producer of hydrogen owing to the rich availability of feedstocks and the strong presence of renewable energy sources.

Key Captive Petroleum Refinery Hydrogen Generation Market Players:

- GAIL Limited

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Air Liquide

- Air Products and Chemicals

- Emerson

- Fluor Corporation

- Next Hydrogen

- Technip Energies

- Maire Tecnimont

- ExxonMobil Corporation

- Nel Hydrogen

- Wood Plc

- Element Fuel Holdings

- Chennai Petroleum Corporation (CPCL)

Key players in the captive petroleum refinery hydrogen generation market are employing several strategies such as new technology launches, strategic partnerships, alliances, and regional expansions to earn high profits. They are partnering with other players and technology companies to innovate hydrogen generation technologies. Industry giants are also targeting high-potential regions to tap into profitable revenue streams. Some of the key players include:

Recent Developments

- In January 2024, researchers from the Technion, Israel Institute of Technology announced the introduction of new green technology for the production of hydrogen. This technology is anticipated to mitigate the operational cost and boost the use of green hydrogen as a sustainable and clean alternative.

- In June 2024, Element Fuel Holdings announced its plan to build an all-in-new oil refinery plant in Texas. The refinery is estimated to produce 50,000 to 55,000 barrels per day to cater to the demand for advanced hydrogen technologies.

- In January 2023, ExxonMobil Corporation announced its plan to produce low-carbon hydrogen at its refining and petrochemical facility in Texas. The company expects to produce up to 1 billion cubic feet per day of hydrogen from natural gas.

- Report ID: 6567

- Published Date: Aug 14, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Captive Petroleum Refinery Hydrogen Generation Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.