Cannabis Testing Market Regional Analysis:

North American Market Insights

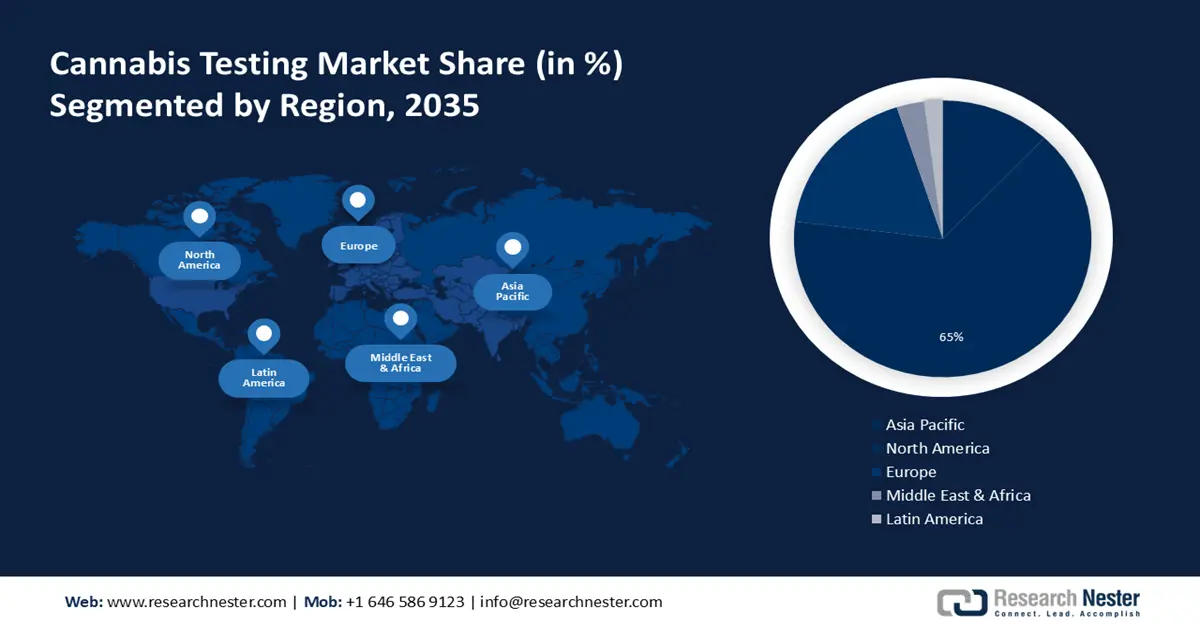

North America cannabis testing market is poised to dominate over 65% revenue share by 2035. This growth will be noticed mainly due to the increasing approval of cannabis drugs by the government of this region. For instance, the FDA has authorized Epidiolex, a medication that includes cannabidiol (CBD) in a pure form, to treat seizures in kids two years of age and older that are linked to Lennox-Gastaut syndrome or Dravet syndrome. In other words, the FDA has determined that this specific medication is both safe and effective for the purpose for which it was designed.

The cannabis testing market has seen massive growth in the U.S. as a result of the increasing collaboration between the major companies and rising initiatives on research. For instance, Agricor, Botanacor, and Can-Lab were merged into one firm, SC Labs, in August 2022. This new company provides easy-to-use cannabis testing services in different cities in the U.S., along with hemp laboratory services across the country. Throughout the projected period, such activities are anticipated to accelerate cannabis testing market expansion.

The Canadian cannabis testing development mainly lies in rising consent and legalization of cannabis testing by the Canadian government. Moreover, Canada was the first country that authorize cannabis testing all over the country. On October 17, 2019, Canada modified its Cannabis Regulations to include guidelines for the legal manufacturing and distribution of three additional cannabis classes: edibles, extracts, and topicals.

European Market Insights

Europe cannabis testing market size is estimated to witness significant growth through 2035. The rising presence of labs and the rising cannabis-dependent research in this region will raise the expansion of cannabis testing in Europe. The strength of cannabis products has significantly increased, according to recent research done in 2021. Between 2011 and 2021, the average strength of herbal cannabis in the EU climbed by around 57%, whilst the average potency of cannabis resin increased by over 200% within the same time frame, creating further health risks for users.

Cannabis testing is especially in actual demand in the U.K., driven by the rising cases of Alzheimer's in this country. According to the National Library of Medicine’s estimation published in the year 2023, it is estimated that 800,000 persons in the UK, or 1.3% of the population, suffer from dementia. Dementia prevalence in those over 65 is 1 in 14; in those over 80, it is 1 in 6. The age group in the UK with the fastest growth is above 65 therefore the demand for dementia care products is also rising in this country.

In Germany, cannabis testing will encounter massive growth because of the rising adoption of LIMS in cannabis testing laboratories in the country. Furthermore, Germany has been the cannabis testing market leader in Europe for LIMS systems in recent years. The use of LIMS in Germany is a result of the growing need for lab automation.

The cannabis testing sector will also be huge in France due to the increasing awareness in people about the benefits of cannabis. Moreover, In France, everyday usage is rising among older generations: for 35–44-year-olds, it went from 1.4% in 2017 to 2.0% in 2021, while for 45–54-year-olds, it went from 0.6% to 1.2%.