Cannabis Testing Market Outlook:

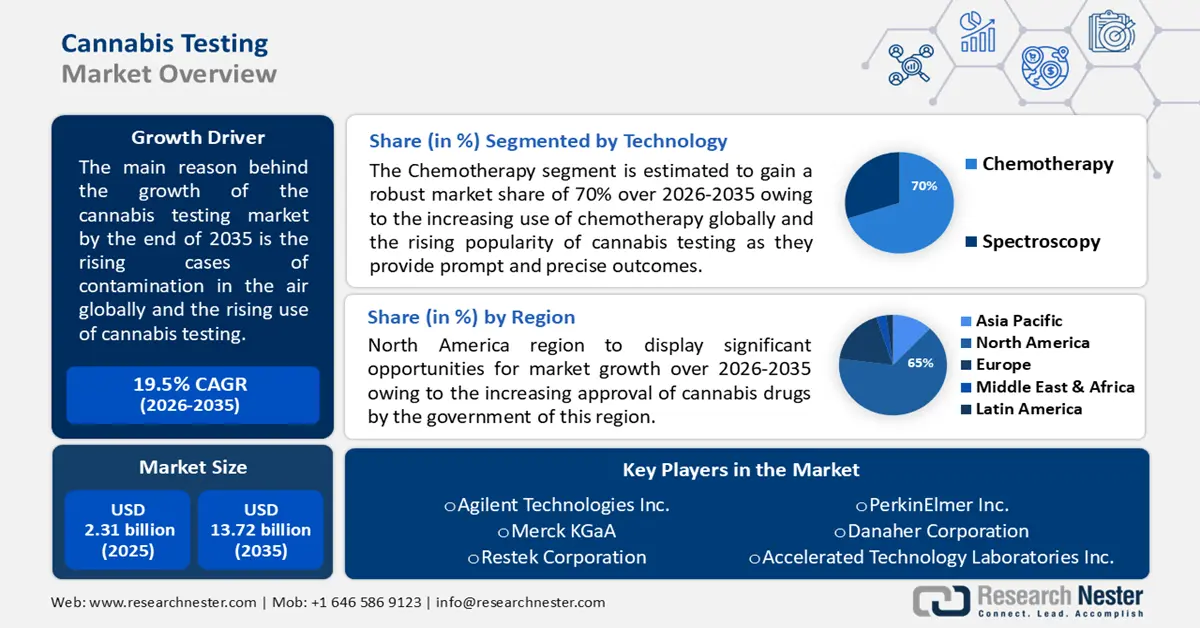

Cannabis Testing Market size was over USD 2.31 billion in 2025 and is anticipated to cross USD 13.72 billion by 2035, growing at more than 19.5% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of cannabis testing is assessed at USD 2.72 billion.

The reason behind the growth is the rising cases of contamination in the air globally and the rising use of cannabis testing. According to the World Health Organization, many regions of the world still have dangerously high levels of air pollution. In 2023, 9 out of 10 individuals breathe air that contains high levels of contaminants, according to new statistics from the WHO. According to updated estimates, indoor and outdoor air pollution claim the lives of an astounding 7 million people annually.

Key Sets Cannabis Testing Market Insights Summary:

Regional Highlights:

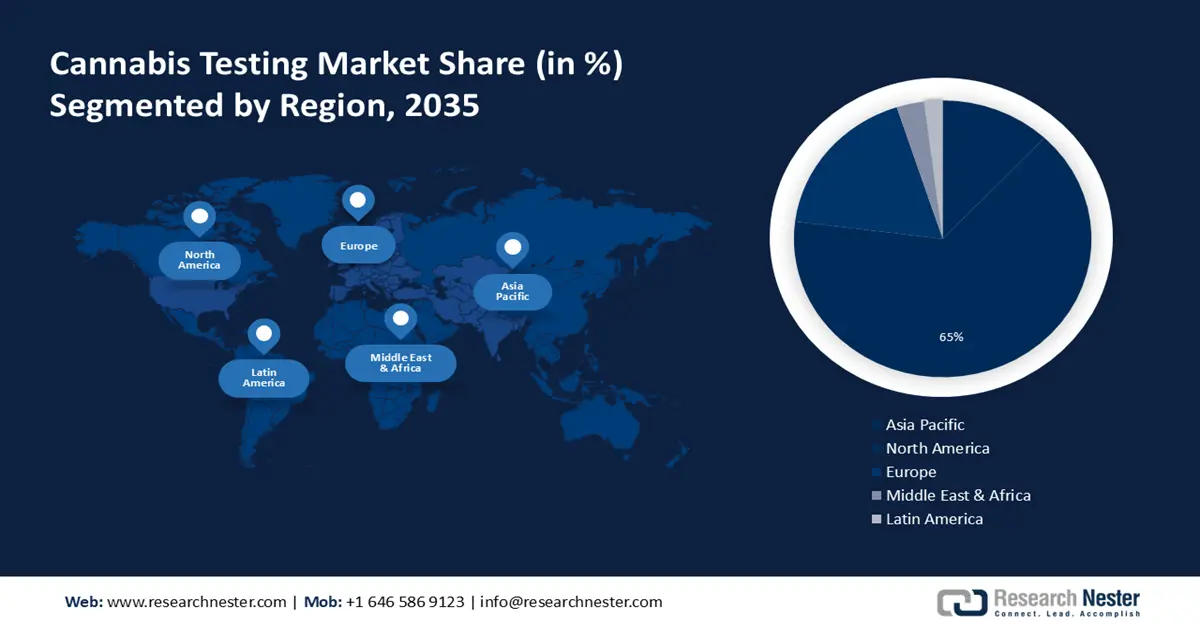

- North America cannabis testing market achieves a 65% share by 2035, driven by increasing approval of cannabis drugs by the government.

Segment Insights:

- The chemotherapy segment in the cannabis testing market is projected to hold a 70% share by 2035, influenced by the increasing global use of chemotherapy and demand for precise cannabis testing.

- The pesticide screening segment in the cannabis testing market is expected to hold a 23% share by 2035, driven by health concerns and government restrictions around pesticide use in cannabis.

Key Growth Trends:

- Rising legalization of therapeutic and recreational use of cannabis

- The growing LIMS use in cannabis testing facilities

Major Challenges:

- Fluctuation in therapeutic standardization of cannabis

- Lack of research on the use of cannabis

Key Players: Agilent Technologies Inc., Merck KGaA, Restek Corporation, PerkinElmer Inc., Danaher Corporation, Accelerated Technology Laboratories Inc., Steep Hill Halent Laboratories Inc., Digipath Inc., SC Labs, GreenLeaf Lab, Shimadzu Scientific Instruments, CBD LAB GROUP, Alps Electric Co., LTD. EMC Test Lab, Anritsu Customer Support Co. Ltd. EMC Center.

Global Sets Cannabis Testing Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 2.31 billion

- 2026 Market Size: USD 2.72 billion

- Projected Market Size: USD 13.72 billion by 2035

- Growth Forecasts: 19.5% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (65% Share by 2035)

- Fastest Growing Region: North America

- Dominating Countries: United States, Canada, Germany, United Kingdom, Netherlands

- Emerging Countries: United States, Canada, Mexico, United Kingdom, Germany

Last updated on : 17 September, 2025

Cannabis Testing Market Growth Drivers and Challenges:

Growth Drivers

- Rising legalization of therapeutic and recreational use of cannabis - Many nations have legalized cannabis usage for medical purposes as well as recreational drugs and adult use in the past few years. This is explained by the recently recognized medicinal potential of cannabis and items infused with it. Research has demonstrated that cannabis can offer significant relief from side effects, including nausea brought on by chemotherapy and multiple sclerosis-related chronic pain.

The World Drug Report 2022 from the UN Office on Drugs and Crime (UNODC) states that 284 million individuals between the ages of 15 and 64 took drugs globally in 2020, a 26% rise over the preceding ten years. Drug usage among youth has increased; in many nations, current drug use rates are greater than those of earlier generations. - Initiation of new medical testing technologies - The public can benefit from improved healthcare accessibility and flexibility through the use of digital medical technologies. It includes publicly available data about health, medical conditions, treatments, side effects, and current advancements in biomedical research. These days, medical and diagnostic services are become easier to get, especially in low-income nations.

For instance, Abbot Laboratories alone invested over 3 billion dollars in research and development in 2023. Moreover, cannabis testing is the process of analyzing a single sample of cannabis to find out its levels of THC, CBD, and terpenes as well as any pollutants or impurities like bugs, mildew, illness, residual solvents, or pesticide residue. These technological advancements helping in the huge implementation of cannabis testing. - The growing LIMS use in cannabis testing facilities - Since many states have legalized cannabis for recreational and medicinal purposes in adults, thorough and trustworthy analytical testing is required to guarantee product potency and customer safety. To address this void, an increasing number of laboratories focused on testing cannabis and cannabis-derived products are springing up.

Challenges

- Fluctuation in therapeutic standardization of cannabis - The debate surrounding the therapeutic efficacy of cannabis remains unresolved, despite widespread support for the safety of currently available cannabis products. Several participants have noted that the classification of cannabis as a Schedule I drug in the US impedes research efforts regarding this important issue.

- Lack of research on the use of cannabis - There has been little study conducted in the US on the health consequences of cannabis and cannabinoids, which prevents individuals, medical professionals, and policymakers from having access to the information they need to make informed decisions about using cannabis and cannabinoids. There is a risk to public health since there is a dearth of evidence-based knowledge on how cannabis and cannabinoids affect health.

Cannabis Testing Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

19.5% |

|

Base Year Market Size (2025) |

USD 2.31 billion |

|

Forecast Year Market Size (2035) |

USD 13.72 billion |

|

Regional Scope |

|

Cannabis Testing Market Segmentation:

Test Segment Analysis

Pesticide screening segment is estimated to hold more than 23% cannabis testing market share by 2035. Because of the significant health problems related to pesticide users, many governments allow the implementation of specific pesticides with limitations. These pesticides are directed for use on a cannabis plant for cannabis testing in many countries.

As stated by the European Environment Agency, at 25% of all monitoring locations in rivers and lakes throughout Europe in 2021, one or more pesticides were found to be above limits of concern. A 2019 research that analyzed agricultural soils found pesticide residues in 84% of the samples.

Technology Segment Analysis

By 2035, chemotherapy segment is expected to hold more than 70% cannabis testing market share. This expansion will be noticed due to the increasing use of chemotherapy globally and the rising popularity of cannabis testing as they provide prompt and precise outcomes.

According to a recent study, there will be a 53% increase in the number of people worldwide who require chemotherapy between 2018 and 2040, from 9.8 million to 15 million. Cancer patients are becoming more and more interested in the possible benefits of using the age-old plant in their treatment plans as more states allow medicinal marijuana.

Our in-depth analysis of the global cannabis testing market includes the following segments:

|

Test |

|

|

Technology |

|

|

End-Use |

|

|

Product & Software |

|

|

Portability |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Cannabis Testing Market Regional Analysis:

North American Market Insights

North America cannabis testing market is poised to dominate over 65% revenue share by 2035. This growth will be noticed mainly due to the increasing approval of cannabis drugs by the government of this region. For instance, the FDA has authorized Epidiolex, a medication that includes cannabidiol (CBD) in a pure form, to treat seizures in kids two years of age and older that are linked to Lennox-Gastaut syndrome or Dravet syndrome. In other words, the FDA has determined that this specific medication is both safe and effective for the purpose for which it was designed.

The cannabis testing market has seen massive growth in the U.S. as a result of the increasing collaboration between the major companies and rising initiatives on research. For instance, Agricor, Botanacor, and Can-Lab were merged into one firm, SC Labs, in August 2022. This new company provides easy-to-use cannabis testing services in different cities in the U.S., along with hemp laboratory services across the country. Throughout the projected period, such activities are anticipated to accelerate cannabis testing market expansion.

The Canadian cannabis testing development mainly lies in rising consent and legalization of cannabis testing by the Canadian government. Moreover, Canada was the first country that authorize cannabis testing all over the country. On October 17, 2019, Canada modified its Cannabis Regulations to include guidelines for the legal manufacturing and distribution of three additional cannabis classes: edibles, extracts, and topicals.

European Market Insights

Europe cannabis testing market size is estimated to witness significant growth through 2035. The rising presence of labs and the rising cannabis-dependent research in this region will raise the expansion of cannabis testing in Europe. The strength of cannabis products has significantly increased, according to recent research done in 2021. Between 2011 and 2021, the average strength of herbal cannabis in the EU climbed by around 57%, whilst the average potency of cannabis resin increased by over 200% within the same time frame, creating further health risks for users.

Cannabis testing is especially in actual demand in the U.K., driven by the rising cases of Alzheimer's in this country. According to the National Library of Medicine’s estimation published in the year 2023, it is estimated that 800,000 persons in the UK, or 1.3% of the population, suffer from dementia. Dementia prevalence in those over 65 is 1 in 14; in those over 80, it is 1 in 6. The age group in the UK with the fastest growth is above 65 therefore the demand for dementia care products is also rising in this country.

In Germany, cannabis testing will encounter massive growth because of the rising adoption of LIMS in cannabis testing laboratories in the country. Furthermore, Germany has been the cannabis testing market leader in Europe for LIMS systems in recent years. The use of LIMS in Germany is a result of the growing need for lab automation.

The cannabis testing sector will also be huge in France due to the increasing awareness in people about the benefits of cannabis. Moreover, In France, everyday usage is rising among older generations: for 35–44-year-olds, it went from 1.4% in 2017 to 2.0% in 2021, while for 45–54-year-olds, it went from 0.6% to 1.2%.

Cannabis Testing Market Players:

- Strategic Materials Inc.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Agilent Technologies Inc.

- Merck KGaA

- Restek Corporation

- PerkinElmer Inc.

- Danaher Corporation

- Accelerated Technology Laboratories Inc.

- Steep Hill Halent Laboratories Inc.

- Digipath Inc.

- SC Labs

- GreenLeaf Lab

There are a few key companies in the somewhat concentrated cannabis testing sector. In order to enhance the value of their services, these businesses are concentrating on expanding their geographic reach and obtaining significant certifications. A few major key players that are dominating the cannabis testing market now are:

Recent Developments

- SC Labs doubled its testing capacity across five states (Arizona, Colorado, Michigan, California, and Colorado) in April 2023 after acquiring C4 Laboratories, a well-known cannabis testing business in Arizona. Leading laboratory C4 Laboratories in Arizona provides state-of-the-art testing capabilities, scientifically grounded consumer safety, and operational excellence. Clients of SC Labs looking for excellence and increased international reach will gain from the purchase.

- Agilent Technologies Inc. will launch two new products on June 3, 2024, during the 72nd ASMS Conference on Mass Spectrometry and Associated Topics. Targeting the food and environmental industries, the Agilent 7010D Triple Quadrupole GC/MS System provides accuracy and sensitivity in gas chromatography-mass spectrometry. Additionally, the biopharma industry and life science research are served by the Agilent ExD Cell, which is designed to be used with the 6545XT AdvanceBio LC/Q-TOF system.

- Report ID: 6206

- Published Date: Sep 17, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Sets Cannabis Testing Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.