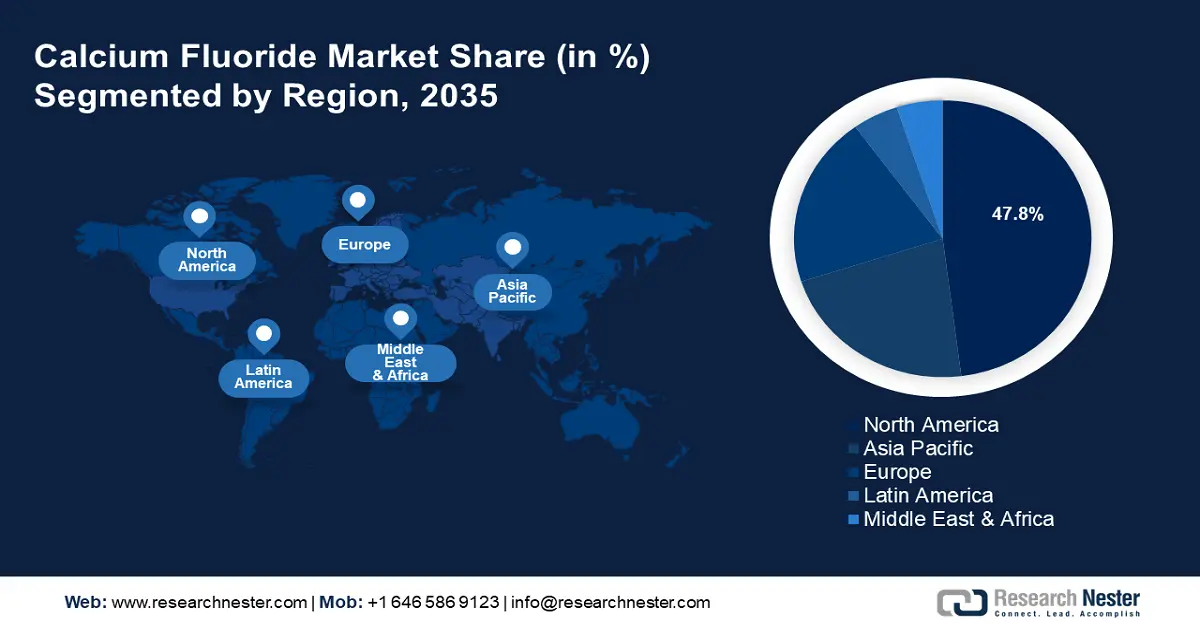

Calcium Fluoride Market Regional Analysis:

North America Market Forecast

North America in calcium fluoride market is expected to dominate around 47.8% revenue share by the end of 2035. The region’s growth is attributed to a well-established industrial base fueling demand for calcium fluoride for multiple end-user sectors. The U.S. and Canada lead the revenue share in North America. Additionally, an increase in steel production, bolstered by the rising production in the U.S. drives demand for calcium fluoride. For instance, in November 2024, the American Iron and Steel Institute reported domestic raw steel production was 1,623,000 net tons while the capability utilization rate was 73.1 percent in the month of November alone signifying the end use potential of the sector for calcium fluoride in manufacturing.

The U.S. leads the revenue share of the calcium fluoride sector in North America. A major driver of the sector’s growth in the country is rising owing to fluorspar application in iron and steel casting, and in welding rod coatings. The U.S. Geological Survey Publications Warehouse estimated 390 tons of fluorspar imports in 2023. Additionally, the U.S. remains one of the highest steel manufacturing countries globally, which is poised to create a steady demand for industrial-grade calcium fluoride.

Canada is poised to expand its revenue share in the calcium fluoride market of North America driven by its metallurgical industry. Investments in mining infrastructure boost demand for calcium fluoride as a flux in ore refining and smelting operations. For instance, in September 2024, Canada announced the Critical Minerals Infrastructure Fund, i.e., a part of the Canadian Critical Minerals Strategy to fill gaps in infrastructure. Additionally, the Critical Metals Report by the Fluoride Action Network highlighted increasing interest in fluorspar or calcium fluoride due to the lack of substitutes for its applications.

APAC Market Forecast

The Asia Pacific calcium fluoride market is poised to register the fastest revenue growth in the calcium fluoride sector. A significant driver for the sector’s rapid growth is owed to demand for high-purity calcium fluoride for advanced optical components in industries such as semiconductors and electronics. Additionally, China’s position as the world’s largest fluorspar supplier benefits the sector’s robust growth curve in APAC.

The booming steel production in China and India creates profitable opportunities for suppliers to provide calcium fluoride to be used as a flux. The rise in criticality of fluorspar is poised to boost the calcium fluoride market in APAC. For instance, in June 2024, Tivan Ltd. signed a strategic agreement with Sumitomo Corporation of Japan for a join venture for the development, financing, and operation of the Speewah Fluorite Project in Australia.

China registered the largest revenue share in the calcium fluoride sector of APAC. The country has some of the largest fluorspar reserves in the world, behind only Mexico. The Observatory of Economic Complexity estimated China to have led the global fluorspar exports in 2022 with exports worth USD 127 million. Domestic fluorspar producers are poised to benefit from growing demand from the hydrofluoric acid sector while anticipated shortage of hydrofluoric acid due to low inventories can drive an increase in fluorspar demand.

India is positioned to expand the domestic calcium fluoride sector and strengthen its standing in the APAC calcium fluoride market. A key driver of the sector is the country’s push for self-reliance in infrastructure development and domestic chemical production. Government initiatives such as Make in India boost the overall chemical sector in the country. Additionally, the country is the second largest manufacturer of steel and cement creating a steady necessity for calcium fluoride in these sectors.