Calcium Fluoride Market Outlook:

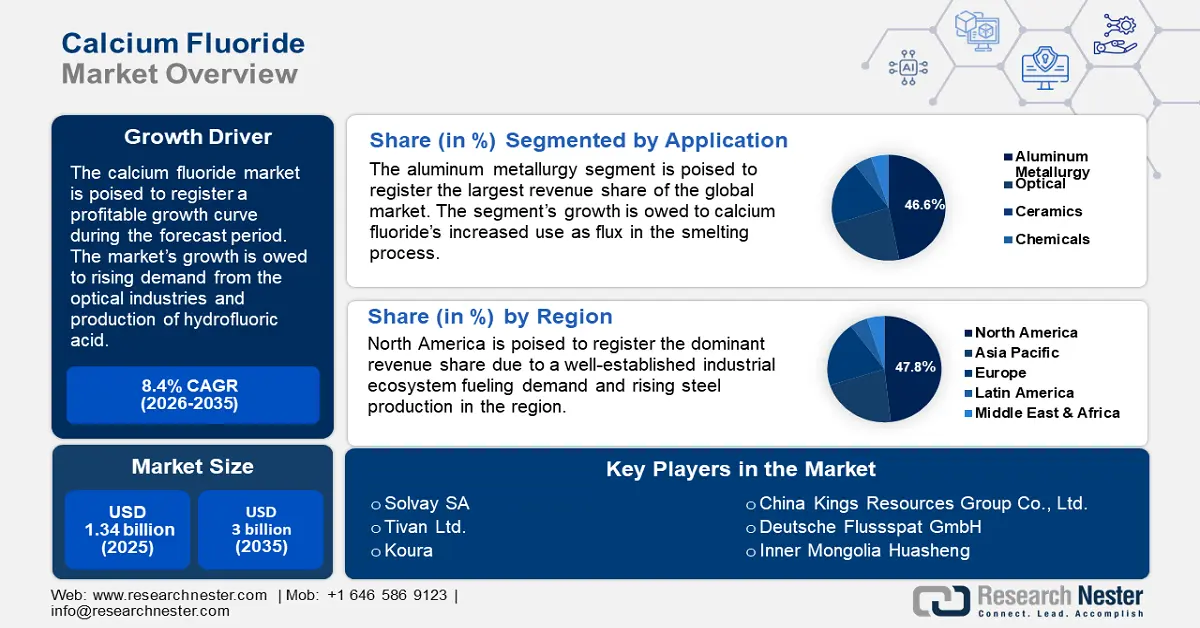

Calcium Fluoride Market size was over USD 1.34 billion in 2025 and is anticipated to cross USD 3 billion by 2035, growing at more than 8.4% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of calcium fluoride is assessed at USD 1.44 billion.

A significant driver of the calcium fluoride market’s growth is extensive applications in industries such as metallurgy and optics, as well as in the production of hydrofluoric acid. Calcium fluoride is a naturally occurring mineral that is extensively used as a flux in steelmaking, assisting reduction of melting temperatures and removing impurities. Advancements in research to apply calcium fluoride crystallization to boost potential resource recovery are poised to expand calcium fluoride uses. For instance, in April 2024, the National Center for Biotechnology Information published research indicating positive results from treating wastewater from the semiconductor industry using a calcium fluoride crystallization process through a fluidized bed reactor with silica seed material.

The calcium fluoride market is expanding owing to industries increasingly adopting the material to meet evolving technological standards. The market will benefit from advancements in mining and purification techniques, ensuring a steady supply of high-quality calcium fluoride. For instance, in April 2024, Tivan Ltd. announced a 37% growth of fluorite resource in the Speewah Fluorite Project in Australia with the project establishing itself as one of the largest high-grade fluorite resources globally. Additionally, the global shift towards renewable energy has expanded calcium fluoride applications as anti-reflective coatings on solar panels.

The calcium fluoride market’s expansion is projected to be the largest in North America, followed by APAC. Growing investments in infrastructural development in developed and emerging economies are poised to create consistent revenue streams for the sector owing to calcium fluoride’s use as a flux in construction materials. Solvay, a major player in the market, announced a 3.9% organic increase in net sales in the third quarter of the financial year 2024, indicating positive trends within the market that can be leveraged to expand revenue shares. The global calcium fluoride market is primed for substantial growth by the end of the forecast period, fueled by favorable market dynamics.

Key Calcium Fluoride Market Insights Summary:

Regional Highlights:

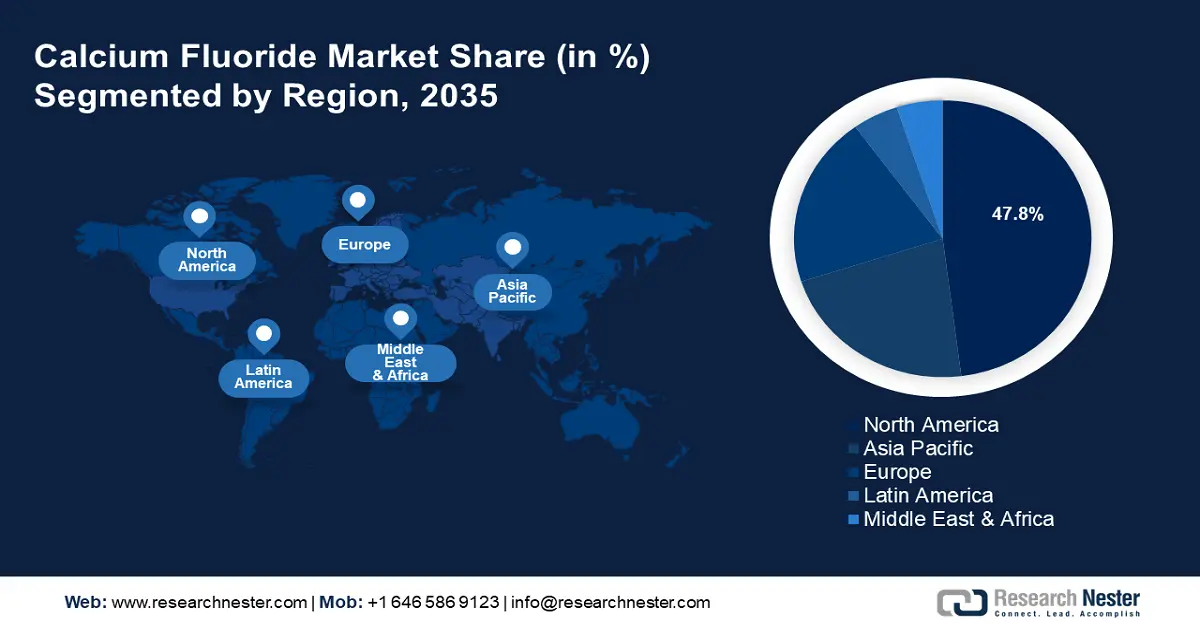

- North America's 47.8% share in the calcium fluoride market is driven by a well-established industrial base fueling demand for calcium fluoride, ensuring continued market leadership through 2035.

- The Asia Pacific Calcium Fluoride Market is forecasted to grow swiftly by 2035, fueled by demand for high-purity calcium fluoride in semiconductors and electronics.

Segment Insights:

- The Aluminum Metallurgy segment is forecasted to secure a 46.6% share by 2035, driven by its role in enhancing efficiency in the aluminum smelting process.

Key Growth Trends:

- Rising demand from the optical industry

- Expanding applications in the metallurgical sector and advancements in calcium fluoride recovery

Major Challenges:

- Volatility in end use industries

- High transportation and logistics costs

- Key Players: Merck KGaA, OCP Group, Kepai Phosphates, EuroChem, Gujarat Narmada Valley Fertilizers & Chemicals Ltd., Yara International, PhosAgro, The Mosaic Company, Nutrien.

Global Calcium Fluoride Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 1.34 billion

- 2026 Market Size: USD 1.44 billion

- Projected Market Size: USD 3 billion by 2035

- Growth Forecasts: 8.4% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (47.8% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Japan, Germany, France

- Emerging Countries: China, India, Japan, South Korea, Brazil

Last updated on : 14 August, 2025

Calcium Fluoride Market Growth Drivers and Challenges:

Growth Drivers

- Rising demand from the optical industry: The calcium fluoride market share is primed to expand by leveraging surging demand from the optical industry. The material is known for its ability to transmit infrared (IR) and ultraviolet (UV) light, making it viable for use in optics for windows, manufacturing lenses, medical imaging, astronomy, etc. For instance, in February 2021, Edmund Optics, a renowned optical solutions specialist from the U.S., launched TECHSPEC Calcium Fluoride Aspheric lenses that have high transmission from ultraviolet (UV) to IR wavelengths.

Furthermore, the rapid growth of defense & aerospace technologies benefits the demand for high-purity optical materials for thermal imaging and targeting systems. For instance, in June 2023, ZEISS announced the introduction of the DTI 1 and DTI 4 thermal imaging cameras for hunting, where calcium fluoride is utilized due to its exceptional transparency in the infrared spectrum. The expansion of applications in optical technologies for various sectors creates multiple revenue streams that key players supplying calcium fluoride can leverage. - Expanding applications in the metallurgical sector and advancements in calcium fluoride recovery: The calcium fluoride market is set to benefit from broader utilization as a flux in the metallurgical industry. Production increase in high-grade steel and alloys is a significant driver for the sector. Fluorspar, the mineral form of calcium fluoride, experiences high demand in steel mills due to its use as flux for ores. With infrastructure projects gaining worldwide momentum, led by emerging economies in APAC and Africa, the demand for calcium fluoride in cost-effective metallurgical processes is expected to rise.

Additionally, advancements in mining operations of fluorspar are poised to boost the calcium fluoride supply chain for various industries. For instance, in November 2024, TOMRA Mining announced contract to supply TOMRA XRT sorters to Koura in removing waste from a feed in operations at the Las Cuevas fluorspar mine in Mexico. Furthermore, advancements in calcium fluoride recovery will boost supply and reduce environmental impact, benefiting the sector’s continued growth. For instance, in July 2024, research in the International Water Association Publications indicated positive results from using an icy lime solution to recover highly pure calcium fluoride from fluorine-containing wastewater. - Increasing demand in cement industries and rising industrialization: Rising demand from cement manufacturing industries represents a major driver for the calcium fluoride sector. As a mineralizer, calcium fluoride reduces the clinkerization temperature and improves clinker quality. The rise in global construction activities, led by developing regions, is projected to create a burgeoning demand for cement and glass products. In June 2024, the World Economic Forum (WEF) indicated that the green building revolution can create a USD 1.8 trillion global calcium fluoride market opportunity where cement demand will experience exponential growth.

In addition, rapid industrialization in APAC and Latin America is positioned to bolster calcium fluoride requirements.

The expansion of cement plants in countries such as Brazil, China, and India is a testament to the favorable trends that will create a sustained necessity for calcium fluoride in cement manufacturing during the forecast period. For instance, in October 2024, Dalmia Cement announced a decision to set up a new cement plant in Madhya Pradesh, India, with a capacity of 4 million tons and an investment of USD 375 million.

Challenges

- Volatility in end use industries: The calcium fluoride market is reliant on end use industries such as optical, steel, cement, glass, etc., and volatility in these sectors can negatively impact the market growth. The economic downtown period led to slowdown of construction activities, wherein demand for calcium fluoride may be adversely impacted. Additionally, geopolitical tensions and inflation can cause further fluctuation in demand from end-use industries.

- High transportation and logistics costs: The cost of transportation of calcium fluoride from mines in specific regions, such as Mexico, can incur significant costs. The rising fuel prices globally can add to higher shipping expenses. Furthermore, port congestions can delay international shipping disrupting supply chains. The rising costs and logistical challenges can curb the sector’s growth curve.

Calcium Fluoride Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

8.4% |

|

Base Year Market Size (2025) |

USD 1.34 billion |

|

Forecast Year Market Size (2035) |

USD 3 billion |

|

Regional Scope |

|

Calcium Fluoride Market Segmentation:

Application (Aluminum Metallurgy, Optical, Ceramics, Chemicals, Others)

By application, the aluminum metallurgy segment is poised to account for calcium fluoride market share of around 46.6% by 2035. The segment’s dominant share is attributed to application of calcium fluoride in improving the efficiency of the smelting process. Its usage as a flux facilitates a reduction in the melting temperature of aluminum and its alloys, leading to lower energy consumption and improvements in operational efficiency. In September 2023, ABx group was awarded a contract by Adbri to supply 90,000-120,000t of bauxite to its cement plant in Australia, and the mining project began in October 2023. The trends boost aluminum production from bauxite benefiting the application of calcium fluoride in the Hall-Héroult smelting process to extract pure aluminum.

Sectors such as aerospace and automotive drive demand for drive demand for high-purity aluminum. For instance, in October 2023, Airbus extended its agreement with Novelis for the latter to continue to supply innovative aluminum products and solutions for the commercial aerospace industry.

The optical segment of the calcium fluoride market is projected to boost application of calcium fluoride and contribute significantly to its expansion during the forecast period. Calcium fluoride remains a critical component in manufacturing of high-precision optical components. Features such as ability to transmit ultraviolet (UV) and infrared (IR) with minimal distortion make it indispensable in camera lenses, telescopes, lasers, etc.

The optical segment expands applications in end user industries such as semiconductors, diagnostic imaging, and defense for equipment such as photolithography, thermal imaging, and high-energy laser beams. New contracts from the defense sector for advanced thermal imaging equipment are poised to create sustained revenue channels for the calcium fluoride market. For instance, in September 2024, LightPath Technologies Inc., announced receiving a contract from a tier-1 defense customer for thermal imaging assemblies.

Type (>97% Calcium Fluoride, <97% Calcium Fluoride)

The high-purity of >97% calcium fluoride assists the segment registering the largest revenue share by type in the calcium fluoride market. >97% calcium fluoride segment benefits from its export quality and application in the manufacturing of high-precision optical components. The Observatory of Economic Complexity estimated global trade worth of USD 384 million of <97% calcium fluoride in 2022. Additionally, rising demand for materials with superior purity and performance positions the segment for sustained growth.

Our in-depth analysis of the global calcium fluoride market includes the following segments:

|

Application |

|

|

Type |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Calcium Fluoride Market Regional Analysis:

North America Market Forecast

North America in calcium fluoride market is expected to dominate around 47.8% revenue share by the end of 2035. The region’s growth is attributed to a well-established industrial base fueling demand for calcium fluoride for multiple end-user sectors. The U.S. and Canada lead the revenue share in North America. Additionally, an increase in steel production, bolstered by the rising production in the U.S. drives demand for calcium fluoride. For instance, in November 2024, the American Iron and Steel Institute reported domestic raw steel production was 1,623,000 net tons while the capability utilization rate was 73.1 percent in the month of November alone signifying the end use potential of the sector for calcium fluoride in manufacturing.

The U.S. leads the revenue share of the calcium fluoride sector in North America. A major driver of the sector’s growth in the country is rising owing to fluorspar application in iron and steel casting, and in welding rod coatings. The U.S. Geological Survey Publications Warehouse estimated 390 tons of fluorspar imports in 2023. Additionally, the U.S. remains one of the highest steel manufacturing countries globally, which is poised to create a steady demand for industrial-grade calcium fluoride.

Canada is poised to expand its revenue share in the calcium fluoride market of North America driven by its metallurgical industry. Investments in mining infrastructure boost demand for calcium fluoride as a flux in ore refining and smelting operations. For instance, in September 2024, Canada announced the Critical Minerals Infrastructure Fund, i.e., a part of the Canadian Critical Minerals Strategy to fill gaps in infrastructure. Additionally, the Critical Metals Report by the Fluoride Action Network highlighted increasing interest in fluorspar or calcium fluoride due to the lack of substitutes for its applications.

APAC Market Forecast

The Asia Pacific calcium fluoride market is poised to register the fastest revenue growth in the calcium fluoride sector. A significant driver for the sector’s rapid growth is owed to demand for high-purity calcium fluoride for advanced optical components in industries such as semiconductors and electronics. Additionally, China’s position as the world’s largest fluorspar supplier benefits the sector’s robust growth curve in APAC.

The booming steel production in China and India creates profitable opportunities for suppliers to provide calcium fluoride to be used as a flux. The rise in criticality of fluorspar is poised to boost the calcium fluoride market in APAC. For instance, in June 2024, Tivan Ltd. signed a strategic agreement with Sumitomo Corporation of Japan for a join venture for the development, financing, and operation of the Speewah Fluorite Project in Australia.

China registered the largest revenue share in the calcium fluoride sector of APAC. The country has some of the largest fluorspar reserves in the world, behind only Mexico. The Observatory of Economic Complexity estimated China to have led the global fluorspar exports in 2022 with exports worth USD 127 million. Domestic fluorspar producers are poised to benefit from growing demand from the hydrofluoric acid sector while anticipated shortage of hydrofluoric acid due to low inventories can drive an increase in fluorspar demand.

India is positioned to expand the domestic calcium fluoride sector and strengthen its standing in the APAC calcium fluoride market. A key driver of the sector is the country’s push for self-reliance in infrastructure development and domestic chemical production. Government initiatives such as Make in India boost the overall chemical sector in the country. Additionally, the country is the second largest manufacturer of steel and cement creating a steady necessity for calcium fluoride in these sectors.

Key Calcium Fluoride Market Players:

- Solvay SA

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Hunan Nonferrous Chenzhou Fluoride

- Inner Mongolia Huasheng

- Koura Global

- Deutsche Flussspat

- ARES strategic mining

- Ax Group

- Tivan Ltd.

- Canada Fluorspar Ltd.

- Soy Fluorspar Ltd.

- China Kings Resources Group Co., Ltd.

- Vizag Chemicals

The calcium fluoride sector is projected to have a profitable expansion during the forecast period. Key players are investing to increase the production of fluorspar to boost presence in the domestic and global supply chains.

Here are some key players in the calcium fluoride market:

Recent Developments

- In July 2024, Nui Phao Mining announced the signing of a memorandum of understanding (MoU) with Fluorine Korea and Traxys North America LLC to ensure a stable supply of acid-grade fluorspar to Fluorine Korea’s AHF plant in Ulsan, South Korea that is poised to be operational from 2026. Traxys North America LLC will be the exclusive international distributor of Nui Phao’s fluorspar.

- In June 2024, Soy Fluorspar Ltd., Fujax East Africa, and Fujax UK signed a three-party agreement worth USD 35 million with the government of Kenya for a 25-year lease to occupy the government-owned land and restart operations at the fluorspar mine at Kimwarer, Kenya.

- Report ID: 6796

- Published Date: Aug 14, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Calcium Fluoride Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.