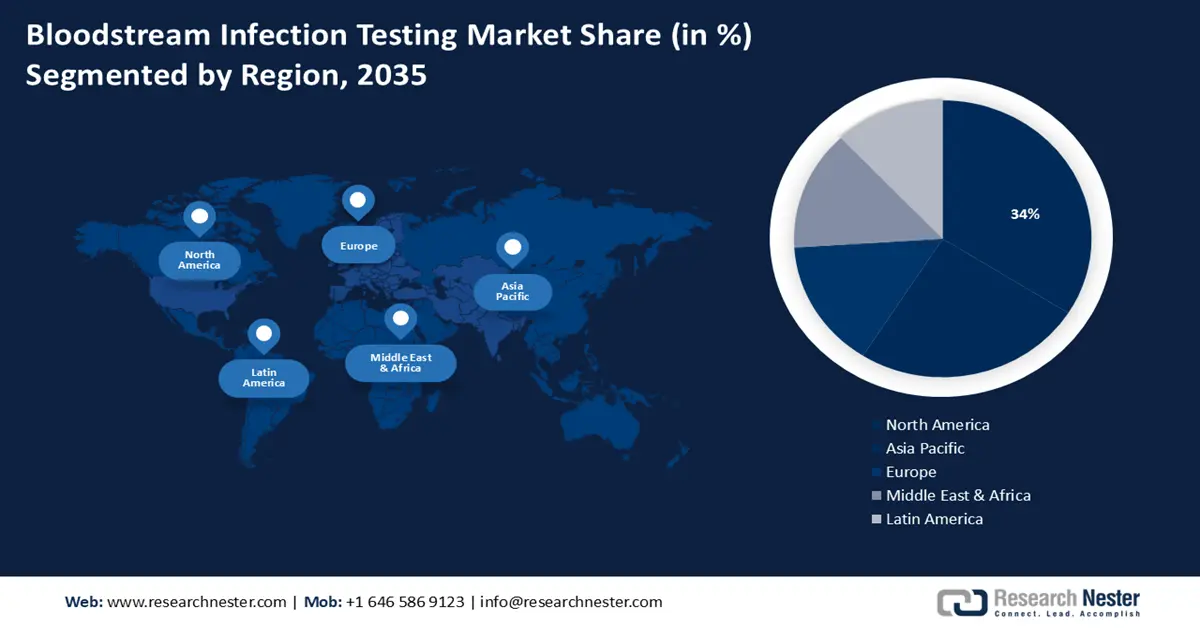

Bloodstream Infection Testing Market Regional Analysis:

North American Market Insights

North America region in bloodstream infection testing market is expected to dominate revenue share of over 34% by 2035. This growth can be impelled by the rapid growth in the geriatric population with a large number of healthcare facilities available.

According to the United States Census Bureau, the geriatric population reached 55.8 million, or 16.8% of the population of the United States in 2020. The blood disorders reported in the population are non-cancerous blood disease which makes it easier to treat them.

The presence of major key players in the US who started investing more in the research and development of bloodstream infection testing devices, is evaluated to create opportunities in the market share through 2035. As per a recent report, medical device startups raised in the US to USD 8.8 billion in venture capital in 2023, falling nearly 62% since 2020.

Healthcare-associated infections (HAIs) create a significant risk to the safety and quality of care of the patient. For instance, The Canadian Nosocomial Infection Surveillance Program (CNISP) conducts national surveillance of HAIs at sentinel acute-care hospitals across Canada and recorded that around 4,300 device-associated blood infections were reported in 2020.

APAC Market Insights

The Asia Pacific region will also encounter huge growth for the bloodstream infection testing market between 2024 and 2035, and will hold the second position owing to the high rate of bloodstream infections in the region. Rapid economic growth in various parts of Asia has increased investments in medical technologies and healthcare spending. This has resulted in easier adoption of the latest technologies made in bloodstream infection testing tools. According to a recent study, a multicenter investigation of 2,773 cases of bloodstream infections was reported based on the China Antimicrobial Surveillance Network (CHINET).

Infectious illness control due to the presence of blood donors has become a major concern due to the high population density and mobility of China. As per a recent report, in 2021, the blood donation rate in China was 12 donations per 1000 individuals which is not enough to satisfy the nation's essential blood demand. The demand for blood continues to grow with the rapid growth of healthcare service requirements among the geriatric population of the region.

According to Annals of Laboratory Medicine, ESBL-EC (extended-spectrum β-lactamase-producing Escherichia coli) causes the majority of the bloodstream infections in Korea and around, 27% of community-onset E. coli bloodstream infections were caused by ESBL producers.