Bloodstream Infection Testing Market Outlook:

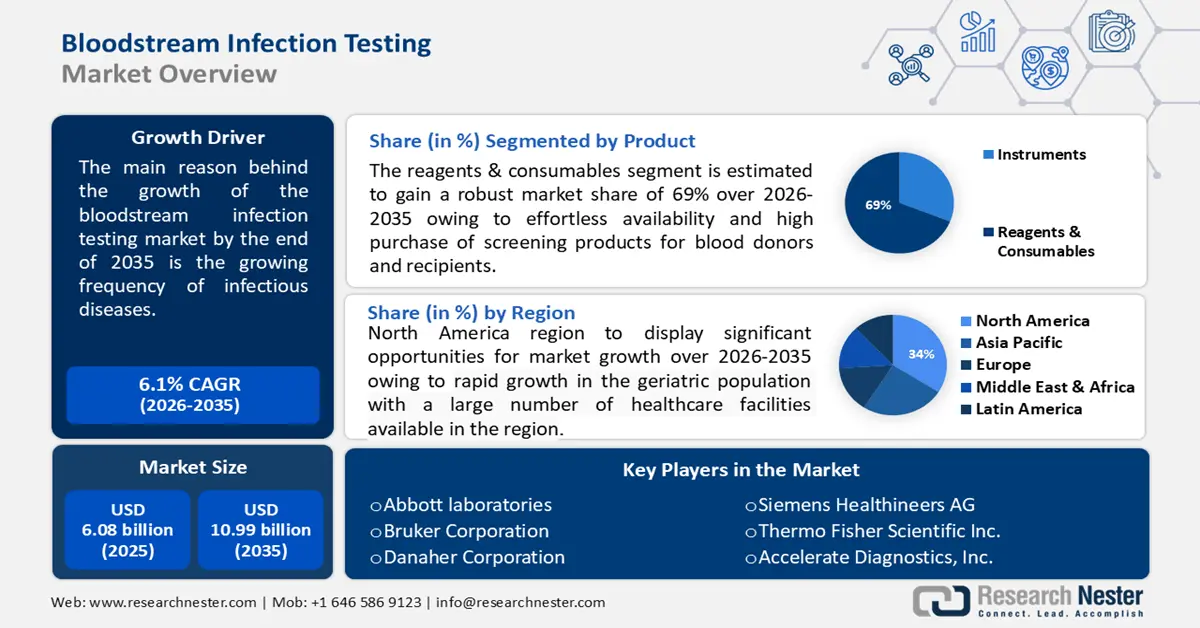

Bloodstream Infection Testing Market size was over USD 6.08 billion in 2025 and is poised to exceed USD 10.99 billion by 2035, witnessing over 6.1% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of bloodstream infection testing is estimated at USD 6.41 billion.

The growing frequency of infectious diseases is the key factor driving the market growth of bloodstream infection testing. The increasing population and limited constancy to hygiene practices increase the possibility of infectious diseases. According to the World Health Organization, in 2020, there were around 48.9 million cases and 11 million deaths caused due to sepsis worldwide, representing 20% of all global deaths.

Key Bloodstream Infection Testing Market Insights Summary:

Regional Highlights:

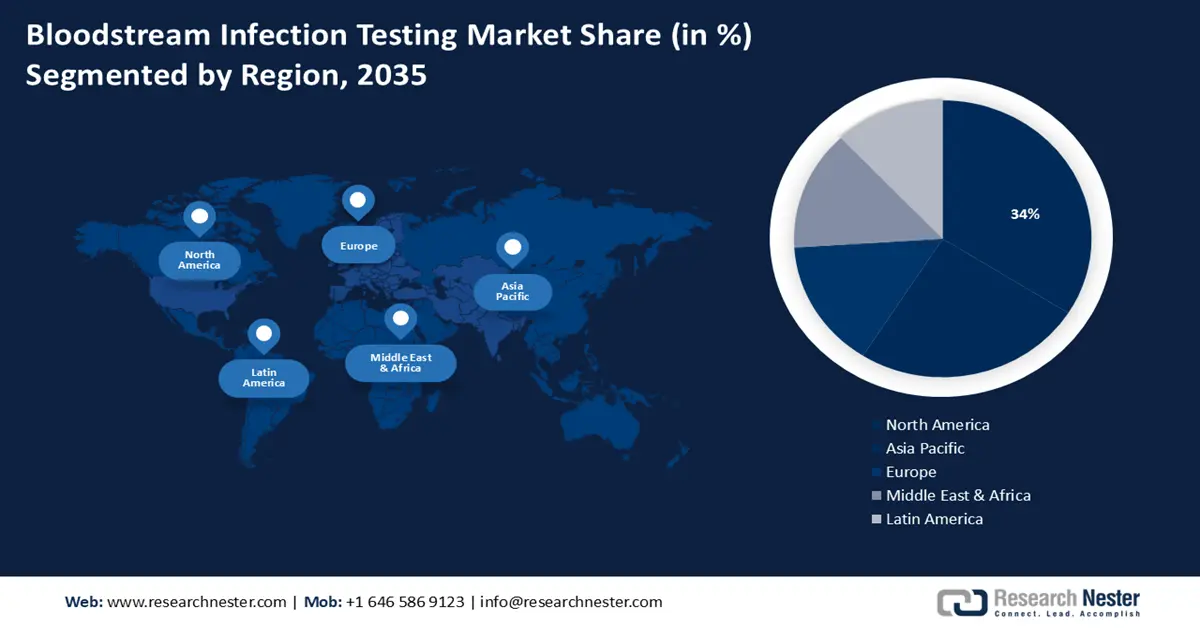

- North America bloodstream infection testing market will secure over 34% share by 2035, driven by the rapid growth in the geriatric population and the presence of major key players investing in bloodstream infection testing devices.

- Asia Pacific market will register huge growth from 2026 to 2035, fueled by high rates of bloodstream infections and increased investments in medical technologies and healthcare spending.

Segment Insights:

- The reagents & consumables segment in the bloodstream infection testing market is projected to hold a 69% share by 2035, influenced by the easy availability and high purchase rates of screening products for blood donors and recipients.

- The bacterial segment in the bloodstream infection testing market is expected to hold a 65% share by 2035, driven by the increasing incidence of bacterial infections, including pneumonia and meningitis.

Key Growth Trends:

- Growing government initiatives and increasing awareness about blood donation

- Creating awareness about healthcare-associated infections (HAIs)

Major Challenges:

- Restricted access to advanced healthcare facilities

- High maintenance and initial setup costs

Key Players: Abbott Laboratories, biomerieux SA, Bruker Corporation, Danaher Corporation, DiaSorin S.p.A, Siemens Healthineers AG, Thermo Fisher Scientific Inc., T2 Biosystems, Inc., Accelerate Diagnostics, Inc., F. Hoffmann-La Roche Ltd.

Global Bloodstream Infection Testing Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 6.08 billion

- 2026 Market Size: USD 6.41 billion

- Projected Market Size: USD 10.99 billion by 2035

- Growth Forecasts: 6.1% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (34% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Japan, Germany, France

- Emerging Countries: China, India, Brazil, Mexico, South Korea

Last updated on : 17 September, 2025

Bloodstream Infection Testing Market Growth Drivers and Challenges:

Growth Drivers

- Growing government initiatives and increasing awareness about blood donation - Regular blood donation by a sufficient number of healthy people can save a life, or even several if the blood is separated into its components. According to WHO, around 118.5 million blood donations are collected across the world, and 40% of these are collected in high-income countries, home to 16% of the world’s population.

WHO strongly recommended that it should be compulsory to screen all blood donations for various infections before using them. This screening includes HIV, hepatitis B, and syphilis and should stick to the need for a quality system. Moreover, there is a growing demand for advanced screening technologies and solutions to effectively identify potential infections in donated blood. - Creating awareness about healthcare-associated infections (HAIs) - The growing cases of healthcare-associated BSI (HA-BSI) have been recorded in the last few years and the major cause of this disease is the use of intravascular catheters.

As per a recent report, developed countries have shown that hospital-acquired blood infections (HA-BSIs) are one of the most serious nosocomial infections and constitute 20%–60% of hospitalization-related deaths. These infections have profound health implications for affected individuals. Hospitals and clinical diagnostics laboratories have a high demand for advanced products to detect these infections more precisely.

Challenges

- Restricted access to advanced healthcare facilities - People living in remote or rural locations majorly lack access to proper medical facilities, such as labs with advanced diagnostic equipment. Due to the physical distance to these facilities, it becomes very difficult for patients to get fast and accurate bloodstream infections.

Various factors such as insufficient roads - High maintenance and initial setup costs - A notable amount is needed to set up an advanced bloodstream infection testing infrastructure and equipment. The cost linked with these technologies restricts small healthcare facilities and areas from setting up such laboratories.

Moreover, the expenses required for operation and maintenance including staff, equipment calibration, and training healthcare professionals create pressure on healthcare providers' finances after the initial setup, which hinders the market growth of bloodstream infection testing.

Bloodstream Infection Testing Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

6.1% |

|

Base Year Market Size (2025) |

USD 6.08 billion |

|

Forecast Year Market Size (2035) |

USD 10.99 billion |

|

Regional Scope |

|

Bloodstream Infection Testing Market Segmentation:

Product Segment Analysis

Reagents & consumables segment is expected to dominate bloodstream infection testing market share of over 69% by 2035. The segment growth can be attributed to the effortless availability and high purchase of screening products for blood donors and recipients.

Moreover, the broad range of blood grouping, typing, and donor screening reagents, kits, and assays which are offered by global and local manufacturers drive the growth of consumables segment. According to the United Nations Children’s Fund (UNICEF), the number of AD syringes UNICEF procured grew from 11 million in 1997 to around 600-800 million per year. It is also the world’s largest buyer of AD syringes, procuring 40% of the global market.

Application Segment Analysis

In bloodstream infection testing market, bacterial segment is set to account for revenue share of around 65% by 2035. The segment growth can be attributed to the increasing cases of bacterial infections such as pneumonia or meningitis. Bacteria can enter the bloodstream of the human body as a severe side effect of other infections during surgery or due to catheters.

Moreover, bacterial infections in the blood can have several serious health effects. According to WHO, around half (20 million) of all predicted sepsis cases recorded across the world occurred in children under 5 years of age, and for every 1000 hospitalized patients, around 15 patients will develop sepsis as a complication of receiving health care. Furthermore, increasing cases of sepsis are foreseen to be the major driving factor for the market.

End-User Segment Analysis

By 2035, hospital segment is estimated to capture bloodstream infection testing market share of over 55%. The reason behind segment growth is the increasing number of hospitals as these are the primary place for diagnosis of bloodstream infection. The patient with symptoms of bloodstream infection first gets in touch with the hospital, as these places are equipped with advanced technologies including diagnostic laboratories, equipment, and experienced healthcare professionals.

They frequently perform a high volume of bloodstream infection tests on both inpatients and outpatients, making them a key player in the market. As per the latest report, more than 317,705 hospital admissions took place due to sepsis during the period from 2008 to 2021. Around 222,832 of the patients were admitted to hospital for the first time due to sepsis. Moreover, the improving healthcare facilities in developing countries along with the growing number of independent laboratories with hospital beds and supporting equipment is the main factor driving the bloodstream infection testing market.

Our in-depth analysis of the global market includes the following segments:

|

Product |

|

|

Sample |

|

|

Technology |

|

|

Application |

|

|

End-User |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Bloodstream Infection Testing Market Regional Analysis:

North American Market Insights

North America region in bloodstream infection testing market is expected to dominate revenue share of over 34% by 2035. This growth can be impelled by the rapid growth in the geriatric population with a large number of healthcare facilities available.

According to the United States Census Bureau, the geriatric population reached 55.8 million, or 16.8% of the population of the United States in 2020. The blood disorders reported in the population are non-cancerous blood disease which makes it easier to treat them.

The presence of major key players in the US who started investing more in the research and development of bloodstream infection testing devices, is evaluated to create opportunities in the market share through 2035. As per a recent report, medical device startups raised in the US to USD 8.8 billion in venture capital in 2023, falling nearly 62% since 2020.

Healthcare-associated infections (HAIs) create a significant risk to the safety and quality of care of the patient. For instance, The Canadian Nosocomial Infection Surveillance Program (CNISP) conducts national surveillance of HAIs at sentinel acute-care hospitals across Canada and recorded that around 4,300 device-associated blood infections were reported in 2020.

APAC Market Insights

The Asia Pacific region will also encounter huge growth for the bloodstream infection testing market between 2024 and 2035, and will hold the second position owing to the high rate of bloodstream infections in the region. Rapid economic growth in various parts of Asia has increased investments in medical technologies and healthcare spending. This has resulted in easier adoption of the latest technologies made in bloodstream infection testing tools. According to a recent study, a multicenter investigation of 2,773 cases of bloodstream infections was reported based on the China Antimicrobial Surveillance Network (CHINET).

Infectious illness control due to the presence of blood donors has become a major concern due to the high population density and mobility of China. As per a recent report, in 2021, the blood donation rate in China was 12 donations per 1000 individuals which is not enough to satisfy the nation's essential blood demand. The demand for blood continues to grow with the rapid growth of healthcare service requirements among the geriatric population of the region.

According to Annals of Laboratory Medicine, ESBL-EC (extended-spectrum β-lactamase-producing Escherichia coli) causes the majority of the bloodstream infections in Korea and around, 27% of community-onset E. coli bloodstream infections were caused by ESBL producers.

Bloodstream Infection Testing Market Players:

- Abbott Laboratories

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- biomerieux SA

- Bruker Corporation

- Danaher Corporation

- DiaSorin S.p.A

- Siemens Healthineers AG

- Thermo Fisher Scientific Inc.

- T2 Biosystems, Inc.

- Accelerate Diagnostics, Inc.

- F. Hoffmann-La Roche Ltd

The major players in the bloodstream infection testing market are offering a detailed portfolio of blood test-related products. These companies introduced advanced technologies that enable detailed visualization of blood test procedures.

Recent Developments

- Abbott Laboratories announced that the U.S. Food and Drug Administration (FDA) has approved the Esprit BTK Everolimus Eluting Resorbable Scaffold System (Esprit BTK System) which is a breakthrough innovation for people who are suffering from chronic limb-threatening ischemia (CLTI) below-the-knee (BTK). The System is designed in such a way as to keep arteries open and deliver a drug (Everolimus) to support vessel healing prior to completely dissolving.

- Danaher Corporation launched a collaboration with Johns Hopkins University aiming to develop new methods for diagnosing mild traumatic brain injury (TBI). Under this program, researchers at Johns Hopkins University will leverage technology from Beckman Coulter Diagnostics which is a Danaher subsidiary and leader in clinical diagnostics, to potentially establish correlations between a new biomarker panel and clinical outcomes.

- Report ID: 6043

- Published Date: Sep 17, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.