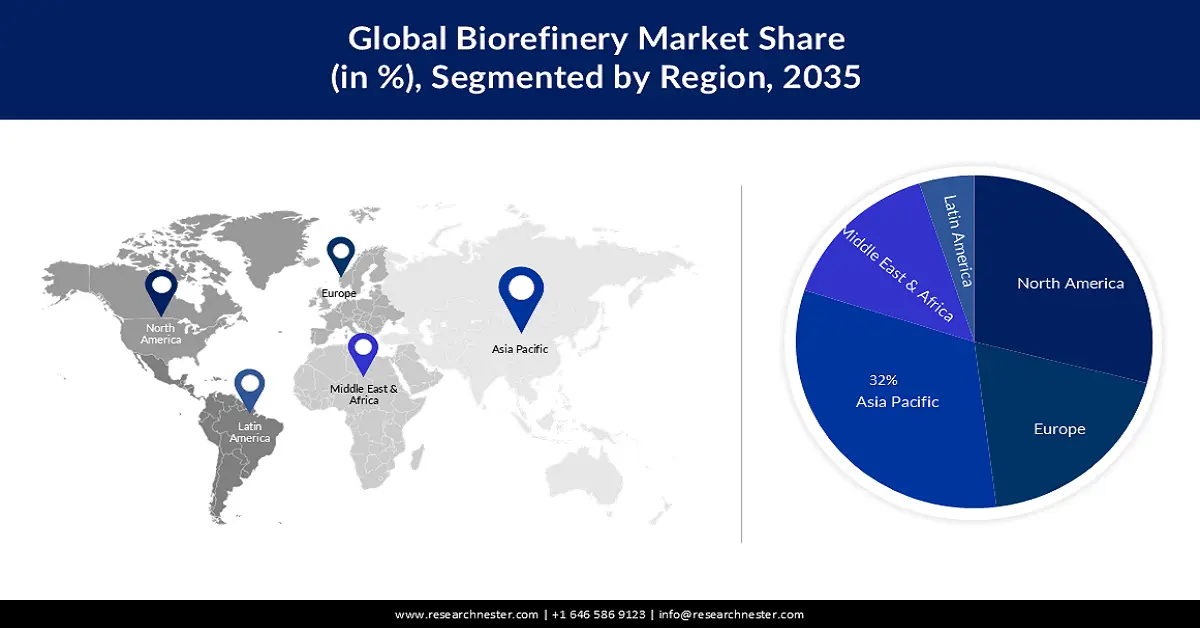

Biorefinery Market Regional Analysis:

APAC Market Insights

The Asia Pacific biorefinery market is projected to be the largest with a share of about 32% in the forthcoming years and is attributed majorly to the increasing demand for limiting carbon emissions. India’s Union Cabinet has accepted the revised Nationally Determined Contribution (NDC), which will be reported to the U.S. Framework Convention on Climate Change (UNFCCC). India has now pledged to lower its GDP's emissions intensity by 45% by 2030. Furthermore, it is a step towards India's long-term objective of reaching net-zero emissions by 2070. On the other hand, the growing production of biofuels is also expected to drive market growth in the region. Owing to increased exports, China's biodiesel output is expected to reach 1.7 billion liters in 2021, up more than 54% from 2020.

China had 46 biodiesel biorefineries in 2022, with a total capacity of 3,500 million liters and a capacity utilization of 43%. Renewable diesel (HDRD) biorefineries were 11, with a capacity of 2,000 million liters and 47% utilized. According to the OEC, in 2023, China emerged as the top five exporters of biodiesel and mixtures, recording USD 2.74 billion in exports out of USD 27.9 billion in world trade.

Production Capacity of China’s Top Fuel Ethanol Licensed producers in 2022

|

Producers |

Production Capacity (in million liters) |

Feedstocks |

|

SDIC Jilin Alcohol |

887 |

Corn |

|

Henan Tianguan |

887 |

Wheat, Corn, Cassava |

|

COFCO Biochemical (Anhui) |

798 |

Corn, Cassava |

|

COFCO Bioenergy (Zhaodong) |

507 |

Corn, Cellulosic |

|

Jilin Boda Biochemistry |

507 |

Corn |

Source: USDA

North America Market Insights

The North America biorefinery market is estimated to be the second largest, registering a share of about 29% by the end of 2035. Total power end-use consumption in the United States in 2022 was around 3% higher than in 2021. Retail electricity sales to the residential sector were approximately 4% higher in 2022 than in 2021, while retail power sales to the commercial sector were approximately 3% higher in 2022 than in 2021. This has led to investments in biorefinery infrastructure in North America. The Government of Canada is also focused on facilitating the development of sustainable resources for biodiesel. As per a government report from May 2023, seven new renewable diesel plants are under construction or planned, in Newfoundland, British Columbia, Alberta, Quebec, and Labrador. These would collectively add up 70,000 barrels per day (Mb/d) and 4.07 billion liters per year (BL/yr) by 2027, up from zero in 2020.

The U.S. has a prominent wealth of sustainable biomass capable of building a robust bioeconomy. Yearly, these renewable carbon waste resources can be utilized to generate 50 billion gallons of low-carbon biofuels for ships, aviation, and heavy-duty automobiles, says a U.S. DOE 2023 report. Furthermore, this biomass can be converted to 17 billion pounds of bio-based products and 75 billion kilowatt-hours of renewable power. The Bioenergy Technologies Office (BETO), under the DOE, has reserved research, development, and demonstration (RD&D) capabilities to mobilize carbon waste to sustainable alternative commodities.