Biorefinery Market Outlook:

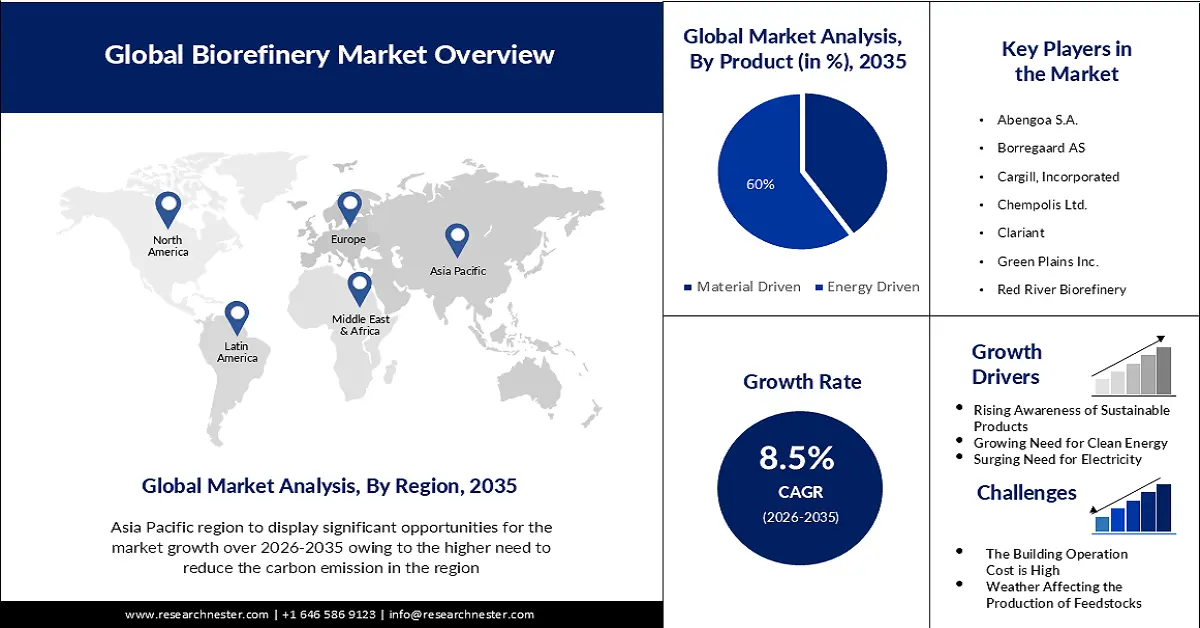

Biorefinery Market size was valued at USD 257.17 billion in 2025 and is set to exceed USD 581.46 billion by 2035, expanding at over 8.5% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of biorefinery is estimated at USD 276.84 billion.

The market growth can be attributed to increased waste conversion into energy. Biorefineries employ waste to produce biofuels, platform chemicals, and other bio-based materials, thereby reducing the environmental burden on fossil fuels. In 2021, 64 power plants in the United States created approximately 13.6 billion kilowatt-hours of electricity by burning around 28 million tons of combustible municipal solid waste (MSW) for electricity generation. Moreover, biomass materials represented approximately 61% of the combustible MSW weight and approximately 45% of the electricity generated.

The U.S. produces renewable energy harnessed from agriculture, forestlands, and other feedstocks for the transport sector on a commercial scale. The popular biofuel utilized is ethanol, usually churned out from corn, and renewable diesel prepared from vegetable oils, animal fats, and greases. According to the USDA, the U.S. ethanol production totaled 15.4 billion gallons and cumulative renewable diesel was 3.1 billion gallons in 2022. EIA estimates that the production came from 85 biodiesel plants with an annual capacity of 2.5 billion gallons, of which 72% was from the Midwest.

Biodiesel producer sales in December 2020 were 74 million gallons of pure B100 (100% biodiesel) and another 73 million gallons were biodiesel blends. 1,176 million pounds of feedstocks were used in December 2020 and soybean oil was the highest, reaching 744 million pounds. In January 2023, the country’s capacity surpassed 23 billion gallons/year (gal/y), a 6% rise from January 2022. Ethanol contributed to 78% of biofuel production capacity, while biodiesel contributed 9% and other biofuels for 13%. Between 2022 and 2023, the renewable diesel capacity spiked by 1.25 billion gallons/year, representing a 71% jump from 2022. By January 2023, Texas held a capacity of 537 million gallons/year, the second highest after Louisiana. While the Midwest dominates ethanol and biodiesel, 60% of renewable diesel and miscellaneous biofuel capacity is on the Gulf Coast.

Key Biorefinery Market Insights Summary:

Regional Highlights:

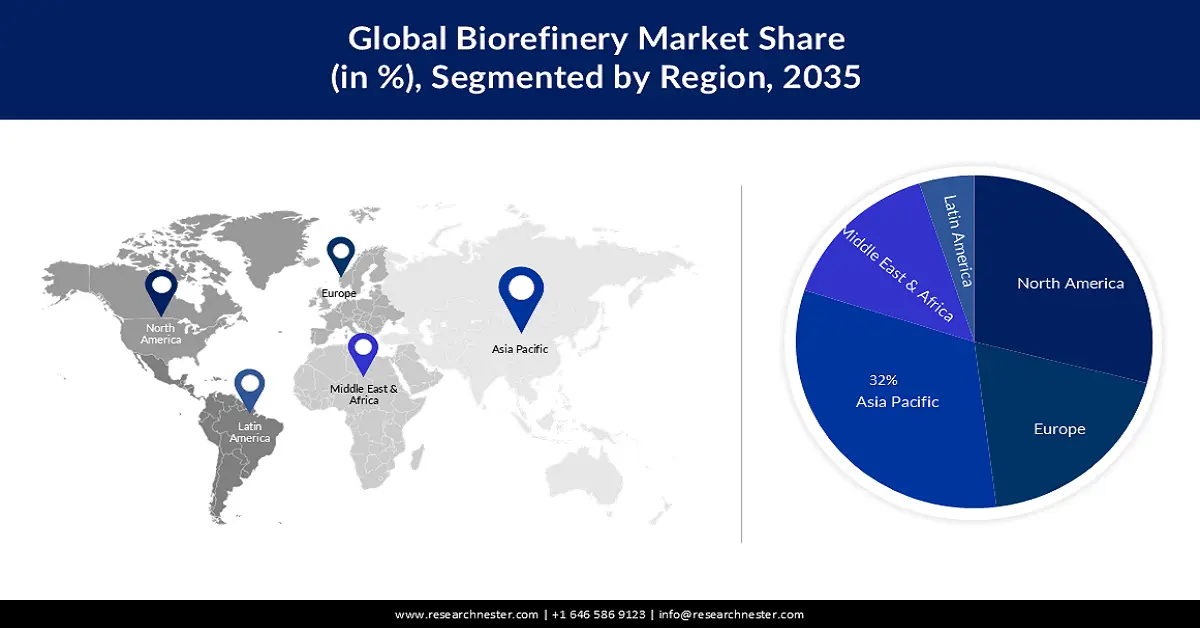

- Asia Pacific biorefinery market will secure around 32% share by 2035, driven by emission reduction initiatives and rising biofuel production.

- North America market will capture a 29% share by 2035, driven by biorefinery infrastructure investments and rising biomass utilization.

Segment Insights:

- The energy driven segment in the biorefinery market is projected to capture a 60% share by 2035, fueled by the critical role of biofuels in transportation and the need for low-carbon energy solutions.

- The energy driven segment in the biorefinery market is expected to command a 60% share by 2035, influenced by the need to achieve Net Zero Emissions targets, particularly in hard-to-decarbonize transport sectors.

Key Growth Trends:

- Technological advancement in biorefining processes

- Growing initiatives to reduce carbon emissions

Major Challenges:

- Uncertainty of feedstock availability

Key Players: Abengoa S.A., Borregaard AS, Cargill, Incorporated, Chempolis Ltd., Clariant, Green Plains Inc., Red River Biorefinery, SGP Bioenergy Holdings, LLC, Veolia Environment SA, AFYREN SAS.

Global Biorefinery Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 257.17 billion

- 2026 Market Size: USD 276.84 billion

- Projected Market Size: USD 581.46 billion by 2035

- Growth Forecasts: 8.5% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (32% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, China, Brazil, India

- Emerging Countries: China, Japan, India, South Korea, Thailand

Last updated on : 10 September, 2025

Biorefinery Market Growth Drivers and Challenges:

Growth Drivers

- Technological advancement in biorefining processes: Next-generation biorefinery processes hold the potential to convert plant biomass to alternative fuels. Companies are leveraging technology to advance their process and gain better results. The DOE’s Center for Bioenergy Innovation Research startup, Terragia Biofuel received USD 6 million from Energy Impact Partners (EIP) and Engine Ventures in March 2024. The funding will allow Terragia to commercialize its biology-based technology to convert cellulosic biomass into ethanol, initiate partnerships with biofuel producers, and expand its workforce.

The University of California, Riverside (UCR) in a February 2024 report, discussed its CELF technology for generating sustainable aviation fuel with an anticipatory break-even cost as low as USD 3.15/gallon of gasoline-equivalent. The present average price of jet fuel is USD 5.96/gallon in the U.S. The government provides renewable identification number credits or subsidies for biofuel production, to strengthen domestic biofuel manufacturing.

The credits are rendered to second-generation biofuels and the D3 tier is priced typically at USD 1/per gallon. At this price per credit, one can expect a rate of return of more than 20%. The DOE’s Bioenergy Technology Office, in light of the UCR’s recent accomplishments, has awarded a USD 2 million grant for a small-scale CELF pilot plant at UCR. The institution aims at securing larger-scale investment to boost the technology’s footprint globally and harness sustainable fuels. - Growing initiatives to reduce carbon emissions: Several studies have highlighted the relevance of biorefineries as a focal point in the carbon-neutral ecosystem of technologies associated with the circular economy paradigm. According to the International Trade Administration, Vietnam's Prime Minister made various promises at the UN Climate Change Conference in Glasgow in November 2021 (COP26), including an ambitious objective of decreasing emissions to Net Zero by 2050.

Challenge

- Uncertainty of feedstock availability: The production and availability of feedstock, such as forestry residue, and agricultural waste, are uncertain. As their production is dependent on crop yield, land use, and weather. This variability can affect the productivity and profitability of biorefineries and it is likely to hamper the biorefinery market growth.

Biorefinery Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

8.5% |

|

Base Year Market Size (2025) |

USD 257.17 billion |

|

Forecast Year Market Size (2035) |

USD 581.46 billion |

|

Regional Scope |

|

Biorefinery Market Segmentation:

Product Segment Analysis

The energy driven segment is estimated to gain the largest biorefinery market share of about 60% in the year 2035. With few alternative low-carbon technological options, biofuels are especially crucial for trucking, shipping, and aircraft. Moreover, according to the International Energy Agency, to achieve Net Zero Emissions by 2050 necessitates 14% annual growth until 2030. Biofuels produced from feedstocks will meet 45% of total global demand by 2030; however, only an estimated 7% of biofuels were produced from wastes and leftovers in 2020.

Feedstock Segment Analysis

The starch & sugar crops segment in biorefinery market is expected to garner a significant share of around 40% in 2035. These feedstocks are relatively much affordable in comparison to others, including woody biomass or algae. The world trade of starch residue comprising bagasse, beet-pulp and miscellaneous waste of sugar manufacture, distilling or brewing dregs, whether or not in pellets form was USD 7.15 billion in 2023. The adoption of sugar crops has increased as they are a cost-effective choice for biorefinery operations. Moreover, these feedstocks have high carbohydrate content, which can be converted into different valuable products, such as bioplastics, biochemicals, and biofuels.

Our in-depth analysis of the global biorefinery market includes the following segments:

|

Type |

|

|

Technology |

|

|

Feedstock |

|

|

Product |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Biorefinery Market Regional Analysis:

APAC Market Insights

The Asia Pacific biorefinery market is projected to be the largest with a share of about 32% in the forthcoming years and is attributed majorly to the increasing demand for limiting carbon emissions. India’s Union Cabinet has accepted the revised Nationally Determined Contribution (NDC), which will be reported to the U.S. Framework Convention on Climate Change (UNFCCC). India has now pledged to lower its GDP's emissions intensity by 45% by 2030. Furthermore, it is a step towards India's long-term objective of reaching net-zero emissions by 2070. On the other hand, the growing production of biofuels is also expected to drive market growth in the region. Owing to increased exports, China's biodiesel output is expected to reach 1.7 billion liters in 2021, up more than 54% from 2020.

China had 46 biodiesel biorefineries in 2022, with a total capacity of 3,500 million liters and a capacity utilization of 43%. Renewable diesel (HDRD) biorefineries were 11, with a capacity of 2,000 million liters and 47% utilized. According to the OEC, in 2023, China emerged as the top five exporters of biodiesel and mixtures, recording USD 2.74 billion in exports out of USD 27.9 billion in world trade.

Production Capacity of China’s Top Fuel Ethanol Licensed producers in 2022

|

Producers |

Production Capacity (in million liters) |

Feedstocks |

|

SDIC Jilin Alcohol |

887 |

Corn |

|

Henan Tianguan |

887 |

Wheat, Corn, Cassava |

|

COFCO Biochemical (Anhui) |

798 |

Corn, Cassava |

|

COFCO Bioenergy (Zhaodong) |

507 |

Corn, Cellulosic |

|

Jilin Boda Biochemistry |

507 |

Corn |

Source: USDA

North America Market Insights

The North America biorefinery market is estimated to be the second largest, registering a share of about 29% by the end of 2035. Total power end-use consumption in the United States in 2022 was around 3% higher than in 2021. Retail electricity sales to the residential sector were approximately 4% higher in 2022 than in 2021, while retail power sales to the commercial sector were approximately 3% higher in 2022 than in 2021. This has led to investments in biorefinery infrastructure in North America. The Government of Canada is also focused on facilitating the development of sustainable resources for biodiesel. As per a government report from May 2023, seven new renewable diesel plants are under construction or planned, in Newfoundland, British Columbia, Alberta, Quebec, and Labrador. These would collectively add up 70,000 barrels per day (Mb/d) and 4.07 billion liters per year (BL/yr) by 2027, up from zero in 2020.

The U.S. has a prominent wealth of sustainable biomass capable of building a robust bioeconomy. Yearly, these renewable carbon waste resources can be utilized to generate 50 billion gallons of low-carbon biofuels for ships, aviation, and heavy-duty automobiles, says a U.S. DOE 2023 report. Furthermore, this biomass can be converted to 17 billion pounds of bio-based products and 75 billion kilowatt-hours of renewable power. The Bioenergy Technologies Office (BETO), under the DOE, has reserved research, development, and demonstration (RD&D) capabilities to mobilize carbon waste to sustainable alternative commodities.

Biorefinery Market Players:

-

The biorefinery market has a presence of several players with large production capacities. The companies are engaged in numerous strategic initiatives such as the launch of new facilities, collaborations, partnerships, and mergers and acquisitions. They are capitalizing on the shift toward alternative processes of generating electricity and transportation fuels. Some of them include:

- Abengoa S.A.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Borregaard AS

- Cargill, Incorporated

- Chempolis Ltd.

- Clariant

- Green Plains Inc.

- Red River Biorefinery

- SGP Bioenergy Holdings, LLC

- Veolia Environment SA

- AFYREN SAS

Recent Developments

- In November 2024, Caldwell Parish announced the launch of a new biorefinery plant to expand its customer base in Los Angeles and San Francisco. The project is set to cost USD 4.5 million and is projected to double the current amount of the company’s tax base to USD 10 million.

- In September 2024, the U.S. Department of Energy (DOE), the U.S. Department of Energy (DOE), and the U.S. Department of Transportation’s (DOT’s) Federal Aviation Administration (FAA) disclosed a USD 12 million to develop advanced integrated biorefinery technologies. The initiative will aid the production processes of Sustainable Aviation Fuel (SAF) and boost the country’s bioeconomy.

- In August 2024, Verbio inaugurated biorefinery facility in Nevada, Iowa to support ethanol production. The company has installed an overall 60 million gallons production capacity of corn-based ethanol annually and 2.3 million MMbtu of RNG.

- Report ID: 4883

- Published Date: Sep 10, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Biorefinery Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.