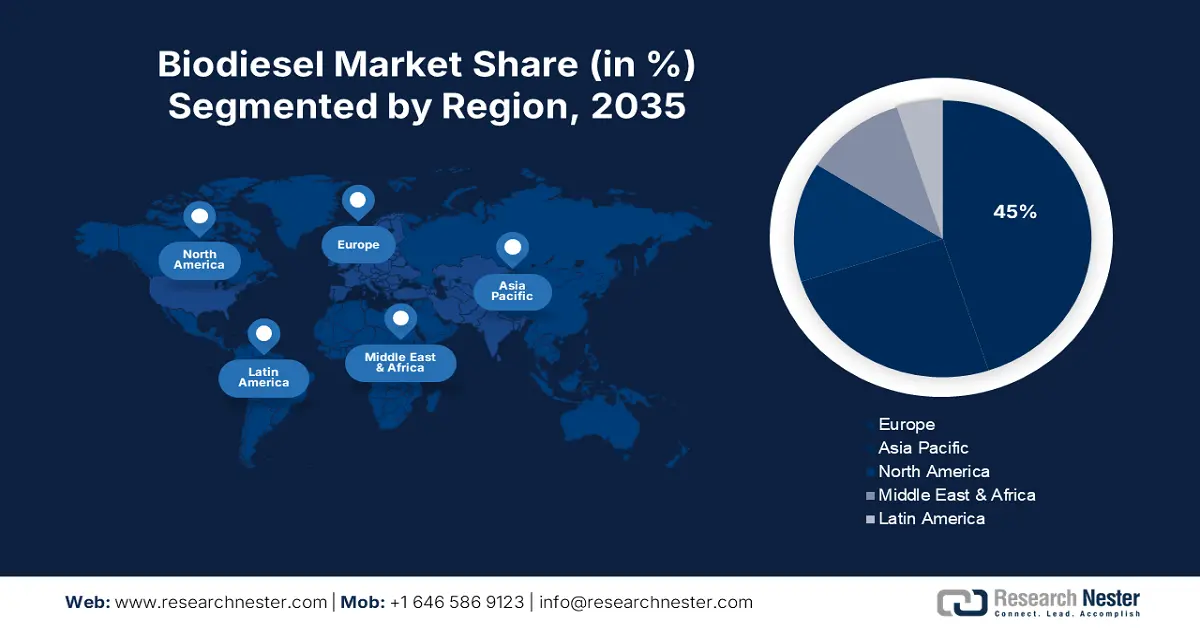

Biodiesel Market Regional Analysis:

Europe Market Insights

Europe industry is predicted to hold largest revenue share of 45% by 2035. The region's commitment to reducing carbon emissions and driving for renewable fuels plays a vital role in the adoption of biodiesel. The European Union’s Renewable Energy Directive II (RED II) requires a further step in the use of renewables in transportation, placing upward pressure on biodiesel demand. Further growth comes from Europe with its strong regulatory framework and favorable financials for renewable energy projects.

One of the major markets for biodiesel in Europe is Germany, a country with demanding environmental legislation and a strong automotive sector. With the priority of lowering greenhouse gas emissions, biodiesel demand has increased notably in transportation uses. In July 2023, German biodiesel producer Verbio AG made the enlargement and enhancement effort of production capacity as an indication that the demand for sustainable fuels continues to rise. The globally known commitment to renewable energy and environmental sustainability in Germany is another salient factor driving the market.

France is another major player in the Europe market with government measures including tax breaks for biodiesel use and subsidies from biodiesel producers. The measures led to an increase in 2022 biodiesel consumption by a rate of 7% based on figures released with the information, whose source is the principal from the French Ministry for Ecological Transition. In France, increasing focus on national targets for renewable energy and reduction in the consumption of diesel fuel will favor long-term growth.

Asia Pacific Market Insights

Asia Pacific is projected to be the fastest-growing region, fueled by rising energy needs in countries such as China and India, along with favorable regulatory assistance from governments for developing renewable power sources. To get energy security and reduce environmental pollution, countries such as India, China, and Japan are investing a lot in producing biodiesel. These countries have a large population along with rapid industrialization, which is boosting the demand for biodiesel as an alternative source of energy.

The biodiesel market is also slated to proliferate across India, owing to government backing for bio-fuel production as the demand for renewable energy climbs. The National Biofuel Policy revised in 2023 by the Indian government aims to target blending at a percentage up to 20% of biodiesel blends with diesel. The policy is prompting investments in biodiesel production and infrastructure, rendering India a key player within Asia Pacific. In September 2023, Indian Oil Corporation revealed its plans to establish a new facility for biodiesel production, which can further enhance the respective capabilities and potential to supply more demand.

The government of China intensified carbon emission control and introduced more stringent regulations, contributing to the growth of the market. China has embarked on several initiatives to encourage the growth of its biodiesel sector by offering subsidies and tax breaks for local producers. For instance, Sinopec established a newly built biodiesel production plant in June 2023 to serve its high dedication power for accelerating the global shift toward clean sources. A commitment to sustainability and energy security continues to underpin China's market, providing plenty of scope for growth downstream.