Biodiesel Market Outlook:

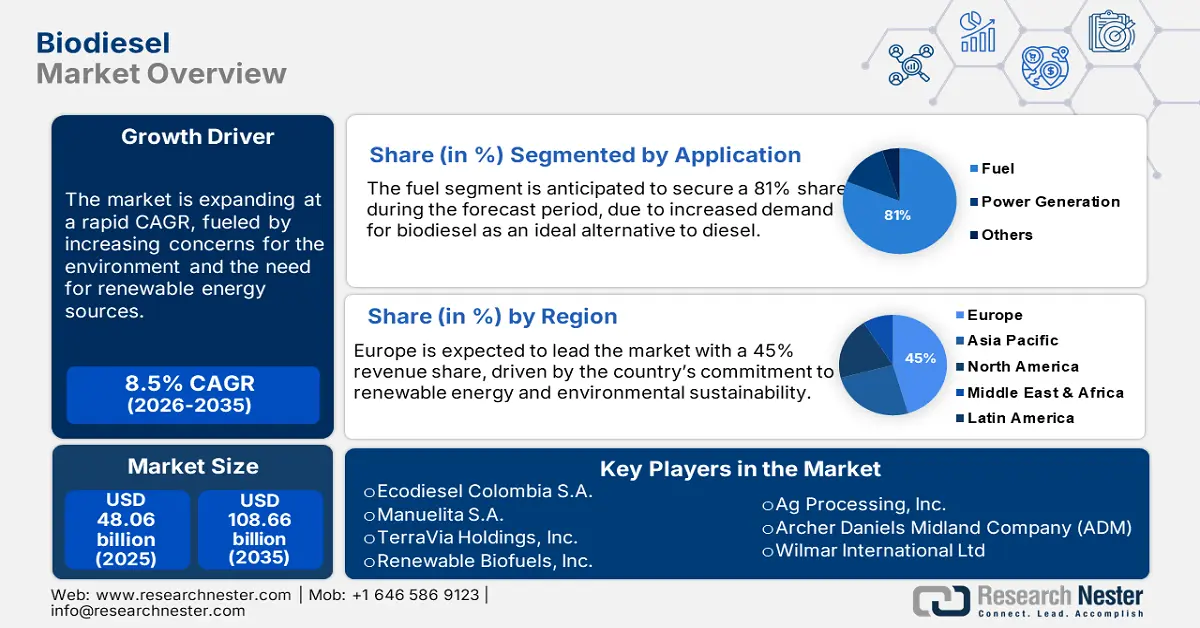

Biodiesel Market size was valued at USD 48.06 billion in 2025 and is likely to cross USD 108.66 billion by 2035, expanding at more than 8.5% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of biodiesel is assessed at USD 51.74 billion.

The market is poised to witness remarkable growth fueled by increasing concerns about the environment and the growing need for renewable energy sources. Due to global efforts to mitigate carbon emissions from human activities while swiftly moving away from fossil fuel dependence, biodiesel has slowly been put in the limelight as a durable alternative fuel. It is made from renewable raw materials such as vegetable oils and animal fats, hence tagged environment-friendly by different industries. Factors for the increase in biodiesel market movements include awareness about climate change and government incentives toward clean energy.

Companies in the biodiesel sector are scaling up production and joining forces with other companies to take full advantage of this burgeoning market. In April 2023, Neste Corporation declared a renewable diesel agreement with Marathon Petroleum to make solar-compatible fuel in California. It is expected that the joint venture will result in a substantial increase in biodiesel output to cope with surging demand for more environmentally friendly fuels. It is part of a trend toward alliances to improve market positioning and meet demand from customers for renewable power.

Key Biodiesel Market Insights Summary:

Regional Highlights:

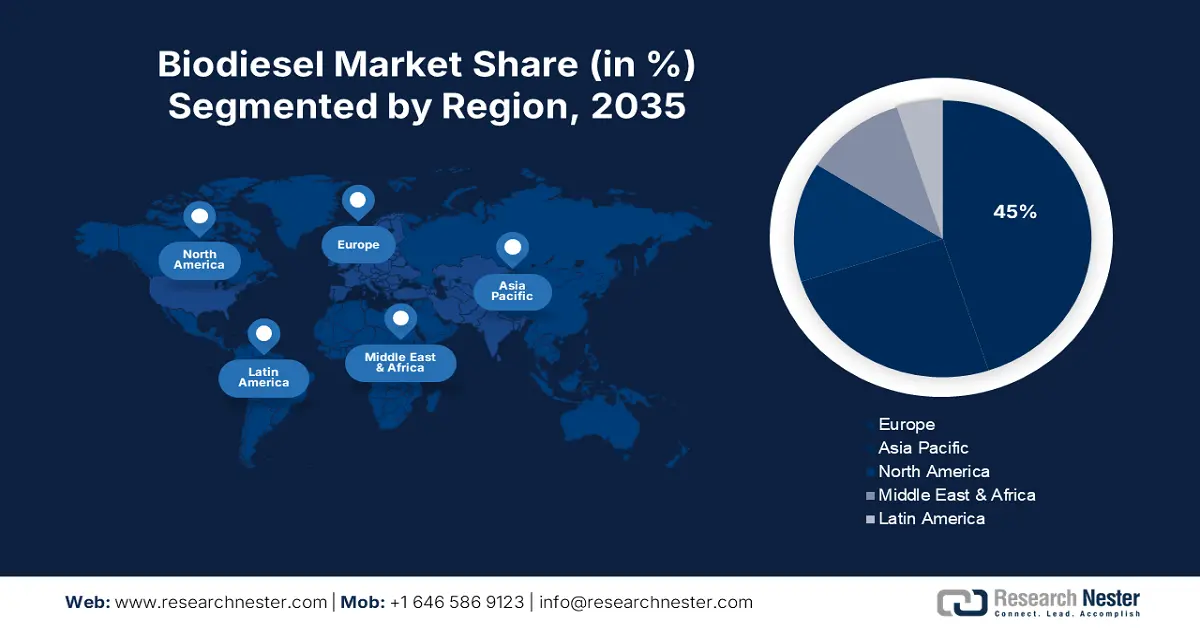

- Europe’s biodiesel market will account for 45% share by 2035, driven by the commitment to reducing carbon emissions and promoting renewable fuels.

Segment Insights:

- The vegetable oil segment in the biodiesel market is projected to achieve significant growth till 2035, driven by the high yield and availability of vegetable oil, along with the trend of reusing waste vegetable oils for biodiesel production.

- The fuel segment in the biodiesel market is forecasted to achieve an 81% share by 2035, fueled by the high demand for biodiesel as an alternative to conventional diesel in the transportation industry.

Key Growth Trends:

- Fuel innovations in production

- Growing application in the logistics sector

Major Challenges:

- Regulatory uncertainty and trade barriers

- Supply chain disruption

Key Players: Archer Daniels Midland Company (ADM), Wilmar International Ltd, Bunge Ltd., FutureFuel Corp, Ecodiesel Colombia S.A., Manuelita S.A., TerraVia Holdings, Inc., Renewable Biofuels, Inc., Ag Processing, Inc., Neste Oyj, Renewable Energy Group, Inc.

Global Biodiesel Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 48.06 billion

- 2026 Market Size: USD 51.74 billion

- Projected Market Size: USD 108.66 billion by 2035

- Growth Forecasts: 8.5% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Europe (45% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Brazil, Germany, China, Indonesia

- Emerging Countries: China, India, Indonesia, Thailand, Malaysia

Last updated on : 18 September, 2025

Biodiesel Market Growth Drivers and Challenges:

Growth Drivers

-

Fuel innovations in production: New technologies for the production of biodiesel are increasing efficiencies and driving down costs, as well as making it increasingly more economical than traditional diesel. New advanced biofuel technologies such as hydrotreating and enzymatic processes have reached a point where the yield and quality of biodiesel can be significantly enhanced. In May 2023, Chevron Corporation revealed its plans to extend the renewable diesel production site by integrating new technologies that can help in scaling them up and reducing production costs.

-

Growing application in the logistics sector: The rapid paradigm shifts towards sustainable fuels in the logistics market is a key factor in the biodiesel industry. New International Maritime Organization (IMO) rules introduced in March 2024, lowered the sulfur content allowed for ships, giving rise to demands for biodiesel as low-sulfur substitutes. This trend is also expected to continue as the transportation sector shifts to cleaner fuels.

-

Feedstock availability and sustainability: The security of feedstocks in a sustainable manner, considering socio-economic issues, is one of the primary drivers for the market. Since vegetable oils and animal fats have dual uses-food purposes and biodiesel feedstock-there will be feedstock scarcity and high feedstock prices due to competition from food industries. This gets further exacerbated by low agricultural productivity. In 2022, a 5% increase in global vegetable oils demand further heightened the pressure that raw material availability would place on biodiesel production directly.

Challenges

-

Regulatory uncertainty and trade barriers: One of the most important factors to deter the biodiesel industry growth is regulatory uncertainty, specifically with changing international regulations and trade barriers. These make competition quite indefinite and affect market stability every time there is a fluctuation in government policy on import tariffs or subsidies.

-

Supply chain disruption: In December 2023, the imposition of U.S. tariffs on imports of Argentine biodiesel heightened disruptions in the supply chain due to changing market dynamics. Such changes in regulations may bring volatility, making long-term project investments tough for producers and, hence, slowing down the overall growth in the biodiesel market.

Biodiesel Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

8.5% |

|

Base Year Market Size (2025) |

USD 48.06 billion |

|

Forecast Year Market Size (2035) |

USD 108.66 billion |

|

Regional Scope |

|

Biodiesel Market Segmentation:

By Feedstock Segment Analysis

In 2035, the vegetable oil feedstock segment will account for over 91.8% of the revenue generated in the overall biodiesel market. Its dominance in the market is very large relative to the availability and high yield of production. The reuse of waste vegetable oils in the production of biodiesel is also considered a green trend which may give a further push to this sector. In February 2024, Renewable Energy Group announced that it had expanded its vegetable oil-based biodiesel production facility in the U.S.

Application Segment Analysis

The fuel application segment is expected to remain dominant in the global biodiesel market, with a share of approximately 81% during the forecast period owing to high demand for biodiesel as an alternative to conventional diesel in the transportation industry. In 2020, Neste Corporation declared that it was expanding the production of its renewable diesel to cater to the increased demand for road transport fuels, which further strengthened this share.

Our in-depth analysis of the global market includes the following segments:

|

By Feedstock |

|

|

Application |

|

|

Production Process |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Biodiesel Market Regional Analysis:

Europe Market Insights

Europe industry is predicted to hold largest revenue share of 45% by 2035. The region's commitment to reducing carbon emissions and driving for renewable fuels plays a vital role in the adoption of biodiesel. The European Union’s Renewable Energy Directive II (RED II) requires a further step in the use of renewables in transportation, placing upward pressure on biodiesel demand. Further growth comes from Europe with its strong regulatory framework and favorable financials for renewable energy projects.

One of the major markets for biodiesel in Europe is Germany, a country with demanding environmental legislation and a strong automotive sector. With the priority of lowering greenhouse gas emissions, biodiesel demand has increased notably in transportation uses. In July 2023, German biodiesel producer Verbio AG made the enlargement and enhancement effort of production capacity as an indication that the demand for sustainable fuels continues to rise. The globally known commitment to renewable energy and environmental sustainability in Germany is another salient factor driving the market.

France is another major player in the Europe market with government measures including tax breaks for biodiesel use and subsidies from biodiesel producers. The measures led to an increase in 2022 biodiesel consumption by a rate of 7% based on figures released with the information, whose source is the principal from the French Ministry for Ecological Transition. In France, increasing focus on national targets for renewable energy and reduction in the consumption of diesel fuel will favor long-term growth.

Asia Pacific Market Insights

Asia Pacific is projected to be the fastest-growing region, fueled by rising energy needs in countries such as China and India, along with favorable regulatory assistance from governments for developing renewable power sources. To get energy security and reduce environmental pollution, countries such as India, China, and Japan are investing a lot in producing biodiesel. These countries have a large population along with rapid industrialization, which is boosting the demand for biodiesel as an alternative source of energy.

The biodiesel market is also slated to proliferate across India, owing to government backing for bio-fuel production as the demand for renewable energy climbs. The National Biofuel Policy revised in 2023 by the Indian government aims to target blending at a percentage up to 20% of biodiesel blends with diesel. The policy is prompting investments in biodiesel production and infrastructure, rendering India a key player within Asia Pacific. In September 2023, Indian Oil Corporation revealed its plans to establish a new facility for biodiesel production, which can further enhance the respective capabilities and potential to supply more demand.

The government of China intensified carbon emission control and introduced more stringent regulations, contributing to the growth of the market. China has embarked on several initiatives to encourage the growth of its biodiesel sector by offering subsidies and tax breaks for local producers. For instance, Sinopec established a newly built biodiesel production plant in June 2023 to serve its high dedication power for accelerating the global shift toward clean sources. A commitment to sustainability and energy security continues to underpin China's market, providing plenty of scope for growth downstream.

Biodiesel Market Players:

- FutureFuel Corp

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Ecodiesel Colombia S.A.

- Manuelita S.A.

- TerraVia Holdings, Inc.

- Renewable Biofuels, Inc.

- Ag Processing, Inc.

- Archer Daniels Midland Company (ADM)

- Wilmar International Ltd

- Bunge Ltd.

- Cargill, Inc.

- Louis Dreyfus Company

- Biox Corp

- Munzer Bioindustrie GmbH

- Neste Oyj

- Renewable Energy Group, Inc.

The biodiesel market is highly competitive and fragmented, with several key players competing to increase their shares in the market by introducing new innovative products and strategic partnerships. Companies including Neste Corporation, Renewable Energy Group (REG), and Archer Daniels Midland Company are among the leading players in the industry due to their significant manufacturing capacity as well as presence across multiple regions. As a result, these companies are increasing their R&D activities to improve biodiesel productivity and develop new products — thereby enabling them to stay competitive in the changing market landscape.

Here are some leading players in the market:

Recent Developments

- In July 2024, Benson Hill expanded its innovation pipeline to include advanced traits for soybean oil and biofuel, contributing to the biodiesel market by improving feedstock efficiency and sustainability.

- In January 2024, Scania initiated a biodiesel pilot program in Côte d'Ivoire, testing the viability of biodiesel production and usage in local transportation.

- In October 2023, Yang Ming Marine Transport Corporation launched a sustainable biofuel initiative, focusing on biodiesel to reduce the environmental impact of shipping operations.

- In October 2023, Vitol announced the upcoming launch of specialized biofuel bunker barges by early 2024, enhancing the availability of biodiesel for maritime fuel applications.

- Report ID: 6380

- Published Date: Sep 18, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Biodiesel Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.