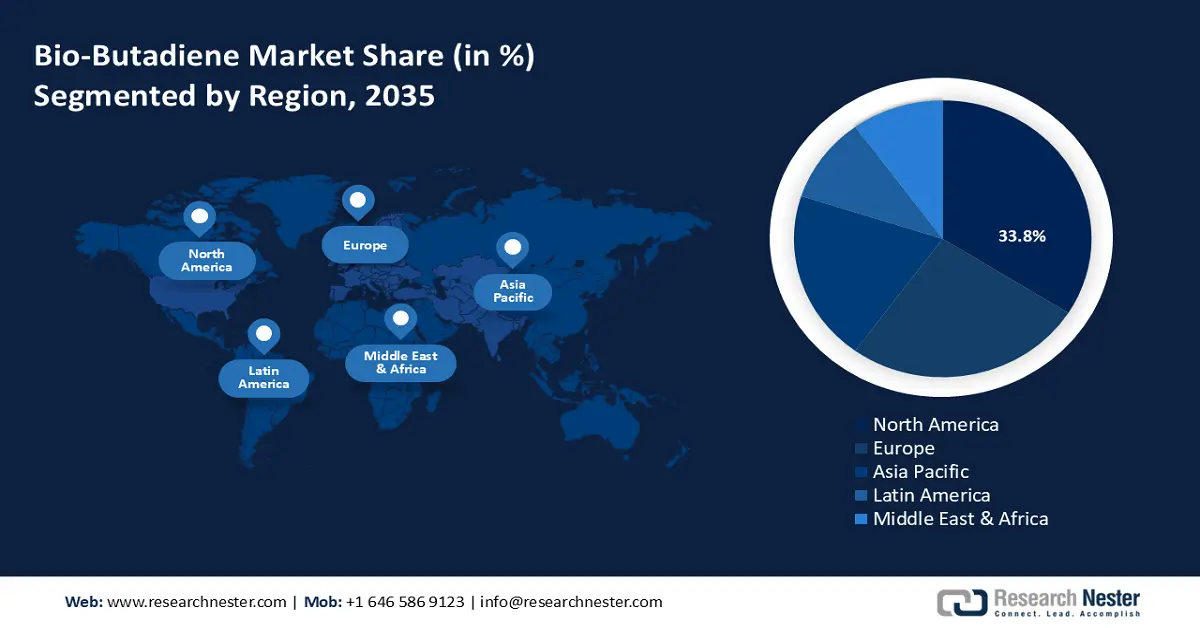

Bio-Butadiene Market Regional Analysis:

North America Market Insights

North America industry is likely to account for largest revenue share of 33.8% by 2035. The growth is attributed to the region’s advanced bio-refinery ecosystem and investments in sourcing feedstock from non-food biomass such as agricultural residue. The robust biotechnological infrastructure in the region benefits the scalability of bio-butadiene production and advancements in fermentation improve yield efficiency. The U.S. and Canada are leading the revenue surge in North America and the market is poised to maintain its robust growth curve by the end of the forecast period.

The U.S. leads the revenue share in the bio-butadiene sector of North America. The sector’s profitable growth is attributed to a favorable regulatory ecosystem that supports renewable chemicals. The government has actively supported the plans to build a bioeconomy in the U.S. For instance, in March 2024, the U.S. Department of Agriculture release an action plan for building a resilient biomass supply in the country. The plan is poised to increase biomass availability and build a robust supply chain, that is projected to increase commercial production of bio-butadiene. The Department of Energy (DOE) released the 2023-billion-ton report that highlights the country’s ability to sustainably triple biomass production to more than 1 billion tons annually, which will be vital to completely decarbonize sectors such as aviation. The bio-butadiene sector in the U.S. is poised to leverage the favorable trends to increase its profit share by the end of 2035.

Canada is projected to increase its revenue share in the bio-butadiene market by the end of the forecast period. The market in Canada benefits from the commitment to fostering a circular economy and curbing greenhouse gas emissions. Additionally, the government is investing to strengthen the bioeconomy and benefit the agricultural sector by boosting biomass production. For instance, in August 2023, the government investments worth USD 5.3 million in BioFuelNet in a bid to boost the country’s bioeconomy. As the nation strives to increase biomass production, the trends are favorable to boost the production of bio-butadiene and open new avenues for adoption in various sectors that are seeking to decarbonize.

Europe Market Insights

Europe is projected to register the fastest market growth during the forecast period profiting from the stringent environmental regulations of the region. For instance, in 2020, the European Green Deal was approved to make the European Union carbon-neutral by 2050. In 2021, the European Climate Law mandated greenhouse gas emissions to be 55% lower by 2030 in comparison to 1990. Additionally, the market in Europe benefits from the robust bioeconomy framework and increasing investments in research and development.

France holds a profitable revenue share in the bio-butadiene sector in Europe. The domestic market in France is projected to increase its revenue share by the end of the forecast period. The market’s growth is owed to increasing investments in the use of biomass. For instance, in April 2024, the European Commission approved approximately USD 984.5 million for the French biomass scheme. Additionally, a favorable regulatory environment in the country, such as the National Low-Carbon National Strategy boosts production of bio-butadiene, by creating short-term carbon budgets that must not be exceeded over 5 years. Companies in France are investing in a portfolio of circular-based chemicals benefiting the bio-butadiene sector. For instance, in June 2022, Borealis introduced Borvida, a range of sustainable base chemicals comprising Borvida B, from non-food waste biomass, and Borvida C, from chemically-recycled waste.

Germany accounts for a large share of the bio-butadiene sector of Europe. The surge in the profit share of the market in Germany is attributed to the presence of an advanced automotive manufacturing hub in the country that is leading in demand for bio-based synthetic rubber. Research Nester estimated Germany to be a leading market for green tires driving the demand for bio-butadiene production and adoption in manufacturing. Additionally, the National Bioeconomy Strategy of 2020 provides a favorable ecosystem in the country to foster a sustainable bio-based economy. For instance, in June 2021, Siemens announced that it will electrify its biorefinery in Germany and the industrial-scale facility will produce green biochemicals without the use of raw materials from fossil fuels. The trends bode well for the production of bio-butadiene in the country at an industrial scale boosting the sector’s growth curve.