Bio-Butadiene Market Outlook:

Bio-Butadiene Market size was over USD 74.7 million in 2025 and is projected to reach USD 167.35 million by 2035, growing at around 8.4% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of bio-butadiene is evaluated at USD 80.35 million.

The market’s growth is driven by rising demands for sustainable materials in industries such as chemical and automotive. Bio-butadiene is used in polymerization to form larger polymer chains such as styrene-butadiene rubber (SBR), polybutadiene rubber (PBR), and acrylonitrile butadiene styrene (ABS) and is preferred because it is derived from renewable sources such as agricultural waste or biomass. With growing investments to make manufacturing supply lines sustainable, the application of bio-butadiene is poised to increase.

The market benefits from a global shift in consumer preferences for eco-friendly products and growing demands on businesses to invest in sustainable supply chains. Strict enforcement of stringent environmental regulations benefits the global bio-butadiene sector as the adoption rate increases since bio-butadiene is a greener alternative to petrochemical-based butadiene. Major market players are investing in bio-based chemicals to reduce carbon emissions and promote circular economy initiatives by various governments. For instance, in February 2022, Synthos announced a major milestone in the development of bio-butadiene technology to produce sustainable rubber and committed to building a plant with a capacity of 40,000 metric tons of bio-butadiene annually. As the demand for green tires picks steam globally, the bio-butadiene sector is positioned to benefit and increase its revenue share.

Major players in the global bio-butadiene sectors can find opportunities in regions with favorable regulatory ecosystems supporting bioplastic adoption. Advancements in fermentation processes and biotechnologies provide opportunities for scalable and cost-effective bio-butadiene production. For instance, in April 2021, the French Institute of Petroleum published a study that explored alternative solutions to butadiene produced in steam cracker units by using the Ostromislensky process of a sequence of two catalytic reaching taking place in a dedicated reactor, and the study is targeted to optimize production of bio-butadiene. Additionally, industries such as packaging, adhesives, textiles, etc., are expanding bio-based product portfolios that fuel the growth of the bio-butadiene market. The global bio-butadiene industry is positioned to leverage favorable trends and maintain a robust growth curve by the end of the forecast period.

Key Bio-Butadiene Market Insights Summary:

Regional Highlights:

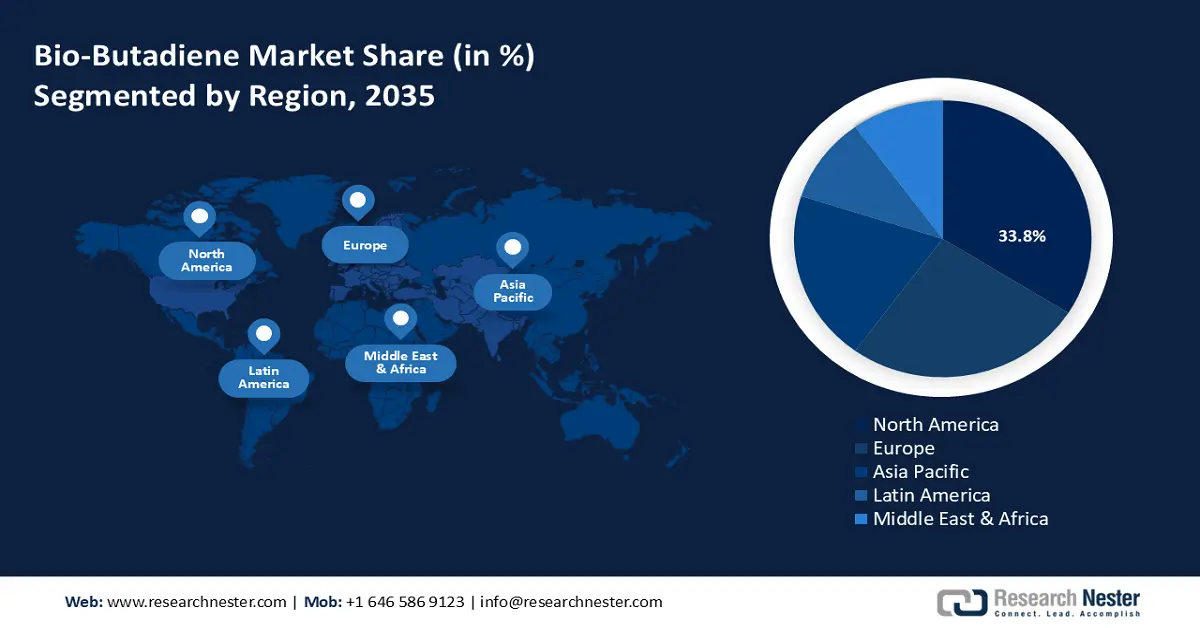

- North America bio-butadiene market will account for 33.80% share by 2035, driven by advanced bio-refinery ecosystems and investments in non-food biomass.

Segment Insights:

- The industrial grade bio-butadiene segment in the bio-butadiene market is projected to hold a 72.20% share by 2035, influenced by growing demands for sustainable materials in manufacturing for rubber, resin, and plastics.

Key Growth Trends:

- Expansion of bio-based product portfolios

- Rising demands for green tires

Major Challenges:

- Feedstock volatility and competition with food supply chains

- Competition from petrochemical butadiene

Key Players: SABIC, Evonik, Axens, Trinseo, Zeon Corporation, LG Chem, Shell, Synthos, Michelin, Biokemik, Borealis AG, and INEOS.

Global Bio-Butadiene Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 74.7 million

- 2026 Market Size: USD 80.35 million

- Projected Market Size: USD 167.35 million by 2035

- Growth Forecasts: 8.4% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (33.8% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, Japan, France

- Emerging Countries: China, India, Japan, South Korea, Thailand

Last updated on : 18 September, 2025

Bio-Butadiene Market Growth Drivers and Challenges:

Growth Drivers

- Expansion of bio-based product portfolios: Industries are investing and expanding bio-based product portfolios that are increasing the adoption rates of bio-butadiene. Companies diversifying their product offerings to include bio-based alternatives allows them to leverage the shifting consumer trends demanding sustainable supply chains and products. The younger demographics are at the forefront of demanding bio-based products. Bio-butadiene plays a crucial role in the transition by enabling the production of bio-based synthetic rubber, adhesives, and plastics. For instance, in June 2022, Dow signed an agreement with EcoSynthetetix to expand bio-based offerings for the global personal care sector. As leading market players continue to invest to improve the scalability of bio-butadiene production, the sector is projected to witness rapid growth.

- Rising demands for green tires: The growing demand from the automotive industry for green tires is a major driver of the global bio-butadiene sector. With the rising prevalence of electric vehicles (EVs) and hydrogen vehicles, the demand for low-emission, fuel-efficient green tires has surged. Bio-butadiene and acrylonitrile butadiene are crucial in the production of synthetic rubber for green tires. A demand surge of green tires benefits the bio-butadiene market as demand soars to increase production. For instance, in December 2023, Synthos and OMV signed a memorandum of understanding (MoU) to jointly produce sustainable rubber for high-performance tires.

Additionally, government incentives and tax breaks to support eco-friendly transportation solutions is projected to further boost the global bio-butadiene sector as bio-based materials are positioned to be crucial for automotive supply chains. - Growing sustainability initiatives and environmental regulations: Global sustainability initiatives to cut down greenhouse gas (GHG) emissions are a significant driver for the bio-butadiene market. Governments imposing environmental regulations make it imperative for industries to invest in sustainable solutions. For instance, in September 2020, Unilever announced plans to eliminate the use of fossil fuels in its cleaning products by 2030 with a USD 1 billion investment in this pursuit. The trends forecast more industries to shift from petrochemical-based products to bio-based alternatives. With a growing number of countries committing to net-zero emissions by 2050, the enforcement of environmental regulations is projected to become stricter, necessitating more companies to invest in building a robust sustainable supply chain.

Challenges

- Feedstock volatility and competition with food supply chains: A major challenge of the bio-butadiene sector is the reliance on bio-based feedstocks such as biomass and agricultural waste. Feedstocks are susceptible to price volatility and supply fluctuations due to factors such as weather conditions. This can cause bottlenecks in bio-butadiene production, stifling the market’s growth. Additionally, livestock for bio-butadiene directly competes with food supply chains which can lead to increased prices, eventually increasing costs of production.

- Competition from petrochemical butadiene: The market faces challenges owing to competition with petrochemical butadiene and the latter has greater market penetration and adoption. Additionally, manufacturers face challenges in matching the quality of petrochemical-based butadiene. For industries, sustainability alone cannot be a viable feature for large-scale adoption of bio-butadiene. The global bio-butadiene market is poised to answer this challenge by achieving performance parity with petrochemical butadiene which is projected to hasten adoption.

Bio-Butadiene Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

8.4% |

|

Base Year Market Size (2025) |

USD 74.7 million |

|

Forecast Year Market Size (2035) |

USD 167.35 million |

|

Regional Scope |

|

Bio-Butadiene Market Segmentation:

Grade Segment Analysis

Industrial grade segment is projected to account for more than 72.2% bio-butadiene market share by the end of 2035 owing to growing demands for sustainable materials in manufacturing applications for rubber, resin, plastic, etc. Industrial-grade bio-butadiene is estimated to witness larger commercial applications by industries seeking to curb carbon footprints without compromising on the quality of raw materials for manufacturing. For instance, in Additionally, the shift in demands for renewable materials in manufacturing marks a burgeoning trend of industrial decarbonization that is set to assist the robust growth of this segment.

Laboratory grade bio-butadiene is poised to increase its share in the global bio-butadiene market by the end of the forecast period. The growth of the segment is attributed to demands in specialized applications and small-scale chemical synthesis. Laboratory grade bio-butadiene is used in academic and industrial research institutions. The increasing research and development activities on bio-butadiene benefit the robust growth of this segment. For instance, in April 2021, Trinseo and ETB signed a letter of intent to collaborate on the development of purified bio-based 1,3-butadiene.

Source Segment Analysis

By source, the biomass-based segment held the largest revenue share in the global bio-butadiene market. The robust growth of the segment is owed to advancements in biomass conversion technologies, allowing greater production of bio-butadiene from renewable sources. The rising demand for sustainable end-products as well as calls to invest in sustainable supply chains is poised to maintain the growth curve of the biomass-based segment. Additionally, biomass-based bio butadiene offers an eco-friendly alternative to petrochemical butadiene. For instance, in December 2021, Riken published a study on using genetically engineered bacteria, i.e., Escherichia coli to convert glucose to bio-butadiene.

Our in-depth analysis of the market includes the following segments:

|

Grade |

|

|

Source |

|

|

End use Industry |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Bio-Butadiene Market Regional Analysis:

North America Market Insights

North America industry is likely to account for largest revenue share of 33.8% by 2035. The growth is attributed to the region’s advanced bio-refinery ecosystem and investments in sourcing feedstock from non-food biomass such as agricultural residue. The robust biotechnological infrastructure in the region benefits the scalability of bio-butadiene production and advancements in fermentation improve yield efficiency. The U.S. and Canada are leading the revenue surge in North America and the market is poised to maintain its robust growth curve by the end of the forecast period.

The U.S. leads the revenue share in the bio-butadiene sector of North America. The sector’s profitable growth is attributed to a favorable regulatory ecosystem that supports renewable chemicals. The government has actively supported the plans to build a bioeconomy in the U.S. For instance, in March 2024, the U.S. Department of Agriculture release an action plan for building a resilient biomass supply in the country. The plan is poised to increase biomass availability and build a robust supply chain, that is projected to increase commercial production of bio-butadiene. The Department of Energy (DOE) released the 2023-billion-ton report that highlights the country’s ability to sustainably triple biomass production to more than 1 billion tons annually, which will be vital to completely decarbonize sectors such as aviation. The bio-butadiene sector in the U.S. is poised to leverage the favorable trends to increase its profit share by the end of 2035.

Canada is projected to increase its revenue share in the bio-butadiene market by the end of the forecast period. The market in Canada benefits from the commitment to fostering a circular economy and curbing greenhouse gas emissions. Additionally, the government is investing to strengthen the bioeconomy and benefit the agricultural sector by boosting biomass production. For instance, in August 2023, the government investments worth USD 5.3 million in BioFuelNet in a bid to boost the country’s bioeconomy. As the nation strives to increase biomass production, the trends are favorable to boost the production of bio-butadiene and open new avenues for adoption in various sectors that are seeking to decarbonize.

Europe Market Insights

Europe is projected to register the fastest market growth during the forecast period profiting from the stringent environmental regulations of the region. For instance, in 2020, the European Green Deal was approved to make the European Union carbon-neutral by 2050. In 2021, the European Climate Law mandated greenhouse gas emissions to be 55% lower by 2030 in comparison to 1990. Additionally, the market in Europe benefits from the robust bioeconomy framework and increasing investments in research and development.

France holds a profitable revenue share in the bio-butadiene sector in Europe. The domestic market in France is projected to increase its revenue share by the end of the forecast period. The market’s growth is owed to increasing investments in the use of biomass. For instance, in April 2024, the European Commission approved approximately USD 984.5 million for the French biomass scheme. Additionally, a favorable regulatory environment in the country, such as the National Low-Carbon National Strategy boosts production of bio-butadiene, by creating short-term carbon budgets that must not be exceeded over 5 years. Companies in France are investing in a portfolio of circular-based chemicals benefiting the bio-butadiene sector. For instance, in June 2022, Borealis introduced Borvida, a range of sustainable base chemicals comprising Borvida B, from non-food waste biomass, and Borvida C, from chemically-recycled waste.

Germany accounts for a large share of the bio-butadiene sector of Europe. The surge in the profit share of the market in Germany is attributed to the presence of an advanced automotive manufacturing hub in the country that is leading in demand for bio-based synthetic rubber. Research Nester estimated Germany to be a leading market for green tires driving the demand for bio-butadiene production and adoption in manufacturing. Additionally, the National Bioeconomy Strategy of 2020 provides a favorable ecosystem in the country to foster a sustainable bio-based economy. For instance, in June 2021, Siemens announced that it will electrify its biorefinery in Germany and the industrial-scale facility will produce green biochemicals without the use of raw materials from fossil fuels. The trends bode well for the production of bio-butadiene in the country at an industrial scale boosting the sector’s growth curve.

Bio-Butadiene Market Players:

- SABIC

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Evonik

- Axens

- Trinseo

- Zeon Corporation

- LG Chem

- Shell

- Synthos

- Michelin

- Biokemik

- Borealis AG

- INEOS

The global bio-butadiene market is poised to register a profitable growth curve by the end of the forecast period. Key players are investing in research and development to increase scalability and develop advanced catalysts to increase yield.

Here are some key players in the market:

Recent Developments

- In January 2023, Braskem announced a project to evaluate the production of bio-based polypropylene. The project would utilize Braskem's proven, proprietary technology to convert bioethanol into physically segregated bio-based polypropylene.

- In April 2023, Bridgestone announced the development of a tire using 75% recycled and renewable materials. The tire included synthetic rubber made with recycled plastics and natural rubber that was harvested from desert shrubs in the Arizona desert. The company announced that it had completed production of 200 demonstration tires.

- Report ID: 6635

- Published Date: Sep 18, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Bio-Butadiene Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.