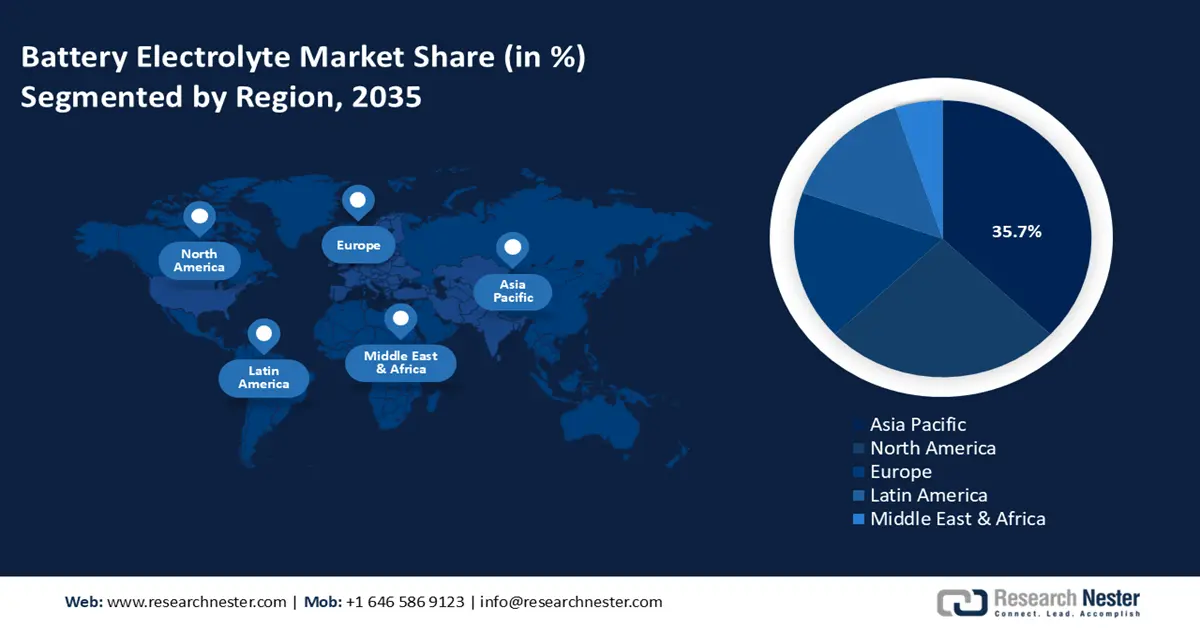

Battery Electrolyte Market Regional Analysis:

APAC Market Statistics

Asia Pacific industry is expected to hold largest revenue share of 35.7% by 2035. The market is growing in the region owing to the increasing energy storage demand and technological innovation. Furthermore, the region is witnessing large R&D investments, resulting in improvements in battery technologies and electrolyte compositions. Partnerships among government agencies, academic institutions, and business leaders further spur innovation in this industry.

China leads in producing and using battery electrolytes because it has major manufacturers and consumers, and many industries that use them. According to the Center for Strategic and International Studies (CSIS), 90% of anodes and lithium electrolyte solutions were made in China as of 2022. The country is also investing more in research and development to improve battery technologies and create new types of electrolytes and batteries. These advancements make China's battery electrolyte market more competitive.

Furthermore, the need for dependable and sustainable energy solutions has increased due to India’s rapid urbanization, industrialization, and population growth. The demand for high-performance batteries and electrolytes is also being boosted by the country’s strong economic growth and rising levels of disposable income, which are propelling sales of EVs and portable electronics. India Brand Equity Foundation (IBEF) reported that electric vehicle sales in India increased by 49.25% to 1.52 million units in 2023.

North America Market Analysis

North America will witness huge growth in the battery electrolyte market during the forecast period. The market is escalating in the region due to the presence of major players and manufacturers. Furthermore, growing research and development activities have led to the continual formulation and performance advancements in electrolyte technology. Solid-state electrolytes are becoming popular in various applications as they provide superior energy density and safety over conventional liquid electrolytes.

Moreover, rising sales of electric vehicles in the U.S. are anticipated to fuel the demand for batteries in the country due to supportive governmental regulations and the presence of players in the battery electrolyte market. For instance, to help make EVs available to all Americans for both short and long-distance travel, the Federal Government has set a target of having half of all new cars sold in the United States by 2030 be zero-emission vehicles. Additionally, it wants to construct a fair and convenient network of 500,000 chargers. Moreover, the installation of renewable energy systems and the growing demand for infrastructure for vehicle charging are driving the growth of the battery electrolyte market in Canada.