Battery Electrolyte Market Outlook:

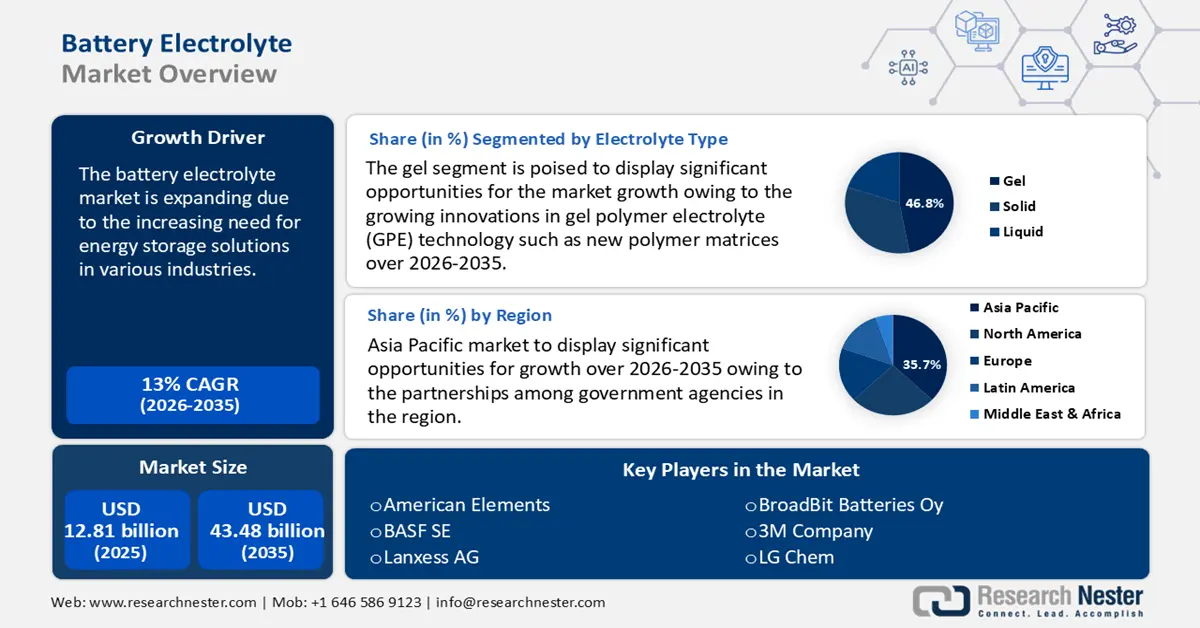

Battery Electrolyte Market size was valued at USD 12.81 billion in 2025 and is set to exceed USD 43.48 billion by 2035, expanding at over 13% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of battery electrolyte is evaluated at USD 14.31 billion.

The battery electrolyte market is witnessing tremendous growth due to the increasing need for energy storage solutions in various industries, including electronics, renewable energy, and automotive. Advanced electrolytes are becoming popular as grid-scale energy storage devices and electric vehicles are widely used. According to the International Energy Agency (IEA), by the end of 2022, the total installed grid-scale battery storage capacity was about 28 GW, most of which had been added during the preceding 6 years. Due to the addition of over 11 GW of storage capacity, installations increased by more than 75% in 2022 compared to 2021. The battery electrolyte is the most important component since it determines how effectively batteries function and contributes significantly to increased safety.

Additionally, the push toward reducing greenhouse gas emissions and growing environmental awareness has led to a significant increase in electric vehicle (EV) sales worldwide. Lithium-ion batteries, which rely on electrolytes, are the most commonly used energy storage systems in EVs, driving the need for high-quality electrolytes. According to IEA, in 2022, about 60% of lithium demand was for EV batteries. Also, governments worldwide are implementing stricter emissions regulations and providing financial incentives, such as tax rebates and subsidies, to promote EV adoption. This results in higher production and sales of EVs, further expanding the demand for battery components like electrolytes.

Key Battery Electrolyte Market Insights Summary:

Regional Highlights:

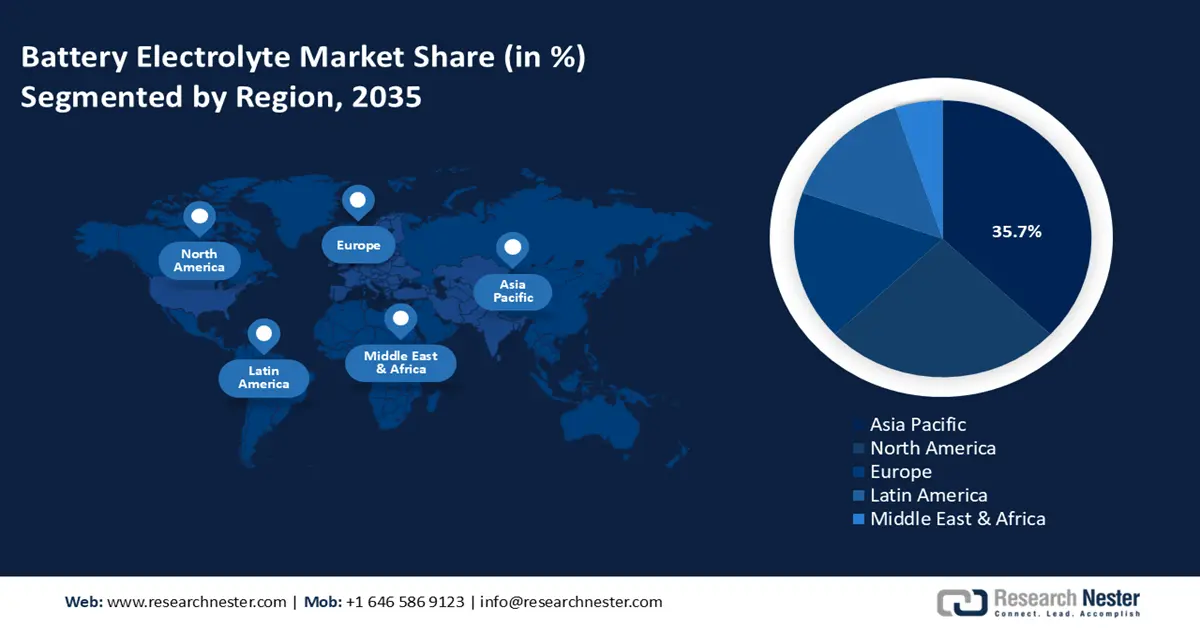

- Asia Pacific leads the battery electrolyte market with a 35.7% share, driven by increasing energy storage demand and technological innovation, fostering growth through 2026–2035.

- North America’s battery electrolyte market is anticipated to experience substantial growth by 2035, driven by the presence of major players and advancements in electrolyte technology.

Segment Insights:

- The Gel segment is forecasted to achieve significant growth by 2035, propelled by innovations in gel polymer electrolyte technology and enhanced thermal stability.

- The Lead Acid segment is anticipated to secure a 36.7% share by 2035, fueled by the affordability, dependability, and reusability of lead acid batteries in stationary and automotive applications.

Key Growth Trends:

- Increasing use in renewable energy systems

- Surge in research activities to develop advanced and sustainable electrolytes

Major Challenges:

- Fluctuating raw material prices

- Lack of government initiatives and subsidies for lithium-ion battery producers

- Key Players: BASF SE, 3M Company, LG Chem, GS Yuasa International Ltd., Central Glass Co., Ltd., American Elements, Lanxess AG, BroadBit Batteries Oy, Mitsui & Co., Ltd., Shenzhen Capchem Technology Co. Ltd.

Global Battery Electrolyte Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 12.81 billion

- 2026 Market Size: USD 14.31 billion

- Projected Market Size: USD 43.48 billion by 2035

- Growth Forecasts: 13% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (35.7% Share by 2035)

- Fastest Growing Region: North America

- Dominating Countries: China, Japan, South Korea, United States, Germany

- Emerging Countries: China, India, Japan, South Korea, Taiwan

Last updated on : 14 August, 2025

Battery Electrolyte Market Growth Drivers and Challenges:

Growth Drivers

- Increasing use in renewable energy systems: Batteries with cutting-edge electrolytes are a huge asset to renewable energy sources like solar and wind power. These batteries facilitate the smooth integration of intermittent energy sources into the grid and enable effective energy storage. Electrolytes are also essential for grid-level energy storage, which allows extra energy to be stored during off-peak hours and released during peak demand.

The rise of Energy Storage Systems (ESS), which are critical for balancing supply and demand in renewable energy systems, further drives electrolyte demand. These systems require high-performance batteries with advanced electrolytes for efficient storage and energy release. ESS is used in various applications including homes, businesses, and utility-scale projects, contributing to the growth of the battery electrolyte market. according to the American Clean Power Association (ACP), between 2017 and 2022, U.S. energy storage deployments increased more than 18 times, from 645 MWh to 12,191 MWh1.. - Adoption of Artificial Intelligence (AI) and Machine Learning (ML) for developing electrolytes: Traditionally, developing an electrolyte is usually a trial-and-error procedure that includes preparing the electrolyte, characterizing battery performance through electrochemical tests, repeating these steps to optimize the formula, and finally arriving at an ideal electrolyte formula. Therefore, by statistically connecting large volumes of data (salts, solvents, additives, and their formulas), AI and ML are used to forecast novel solvent molecules, additives, formulas, and solvation structures, which ultimately lead to the best electrolyte design.

Furthermore, researchers are focusing on developing workable AI models for electrolyte development. For instance, in June 2024, scientists from Northwestern Engineering collaborated with researchers at the University of Texas in Austin to create MolSets, a specialized ML model for molecular mixtures. The AI model predicts the properties of electrolyte combinations using machine learning, completing in seconds what would take years in the lab. - Surge in research activities to develop advanced and sustainable electrolytes: Numerous institutions and leading businesses are conducting several research and development initiatives to enhance the properties of lithium battery electrolytes. These initiatives aim to improve electrolyte characteristics to raise cost-competitiveness and battery capacity. Certain research initiatives are especially focused on novel types of electrolytes, like solid electrolytes, to increase their efficiency, which raises the total efficiency of the battery.

Moreover, the need for electrolytes made from renewable resources or those with minimal environmental impact is rising as environmental concerns and the drive towards a low-carbon economy gain traction. Manufacturers can develop and battery electrolyte market recycled and bio-based electrolytes, or electrolytes derived from plentiful, non-toxic resources.

Challenges

- Fluctuating raw material prices: Certain raw elements, such as lithium, cobalt, and nickel, crucial parts of lithium-ion batteries, are needed to produce improved electrolytes. Supply chain vulnerabilities stem from the extraction and processing of essential resources, often concentrated in different nations. Purchasing raw materials is also difficult due to environmentally sustainable practices and ethical sourcing, as stakeholders demand greater accountability and transparency across the supply chain. Therefore, the volatile prices of raw materials may hinder the growth of the battery electrolyte market.

- Lack of government initiatives and subsidies for lithium-ion battery producers: The governments of several nations are concentrating on providing incentives and subsidies to stimulate the development of lithium-ion batteries to promote the use of renewable energy sources. However, the governments of several regions, including Africa, do not contribute to the production of lithium-ion batteries. This is impeding the development of these batteries, hampering the battery electrolytes market.

Battery Electrolyte Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

13% |

|

Base Year Market Size (2025) |

USD 12.81 billion |

|

Forecast Year Market Size (2035) |

USD 43.48 billion |

|

Regional Scope |

|

Battery Electrolyte Market Segmentation:

Electrolyte Type (Liquid, Solid, Gel)

Gel segment is likely to account for battery electrolyte market share of more than 46.8% by the end of 2035. The segment growth can be attributed to the growing innovations in gel polymer electrolyte (GPE) technology such as new polymer matrices, improved ionic conductors, and enhanced thermal stability, increasing their demand in aerospace and industrial energy storage applications. GPEs minimize the dangers of flammability and leakage while delivering effective ion transport, making them appropriate for various applications, including electric vehicles and portable devices. Gel polymer electrolytes are a promising way to advance battery technology due to their adaptability and capacity to be customized for certain needs.

Battery Type (Lithium-ion, Lead Acid, Flow Battery, Others)

In battery electrolyte market, lead acid segment is projected to capture revenue share of over 36.7% by 2035. Lead acid batteries are extensively used in stationary energy storage applications, automobiles, and industries, fueling battery electrolyte market demand. They are essential for many industries due to their affordability, dependability, and capacity to supply large surge currents. Additionally, lead acid batteries are reusable, contributing to their ecological credentials. The lead acid segment remains dominant despite developments in other battery chemistries, like lithium-ion. This is because lead acid has a well-established infrastructure, is reasonably priced, and has demonstrated performance in numerous applications.

Lead acid batteries are predominantly used in vehicles, accounting for nearly 60% of the total automotive battery sector. This sustained demand is driven by their effectiveness for starting, lighting, and ignition (SLI) applications in vehicles. The continued production of conventional vehicles will support electrolyte demand, thus driving battery electrolyte market growth.

Application (Automotive, Consumer Electronics, Energy Storage, Others)

By the end of 2035, automotive segment is estimated to hold battery electrolyte market share of over 34.4%. The demand for batteries to power EVs and hybrid electric vehicles (HEVs) is rising due to the global transition towards electric mobility. According to the IEA, 14 million electric cars were sold in 2023, and their percentage of all sales rose from roughly 4% in 2020 to 18% in 2023.

Automakers are highly investing in battery technology to improve vehicle performance and increase driving range. Furthermore, the increasing awareness of environmental sustainability and government rules requiring emissions reductions are propelling the use of electric vehicles. As a result, the automobile industry continues to dominate the battery business, influencing the electrification of transportation in the future.

Our in-depth analysis of the battery electrolyte market includes the following segments:

|

Electrolyte Type |

|

|

Battery Type |

|

|

Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Battery Electrolyte Market Regional Analysis:

APAC Market Statistics

Asia Pacific industry is expected to hold largest revenue share of 35.7% by 2035. The market is growing in the region owing to the increasing energy storage demand and technological innovation. Furthermore, the region is witnessing large R&D investments, resulting in improvements in battery technologies and electrolyte compositions. Partnerships among government agencies, academic institutions, and business leaders further spur innovation in this industry.

China leads in producing and using battery electrolytes because it has major manufacturers and consumers, and many industries that use them. According to the Center for Strategic and International Studies (CSIS), 90% of anodes and lithium electrolyte solutions were made in China as of 2022. The country is also investing more in research and development to improve battery technologies and create new types of electrolytes and batteries. These advancements make China's battery electrolyte market more competitive.

Furthermore, the need for dependable and sustainable energy solutions has increased due to India’s rapid urbanization, industrialization, and population growth. The demand for high-performance batteries and electrolytes is also being boosted by the country’s strong economic growth and rising levels of disposable income, which are propelling sales of EVs and portable electronics. India Brand Equity Foundation (IBEF) reported that electric vehicle sales in India increased by 49.25% to 1.52 million units in 2023.

North America Market Analysis

North America will witness huge growth in the battery electrolyte market during the forecast period. The market is escalating in the region due to the presence of major players and manufacturers. Furthermore, growing research and development activities have led to the continual formulation and performance advancements in electrolyte technology. Solid-state electrolytes are becoming popular in various applications as they provide superior energy density and safety over conventional liquid electrolytes.

Moreover, rising sales of electric vehicles in the U.S. are anticipated to fuel the demand for batteries in the country due to supportive governmental regulations and the presence of players in the battery electrolyte market. For instance, to help make EVs available to all Americans for both short and long-distance travel, the Federal Government has set a target of having half of all new cars sold in the United States by 2030 be zero-emission vehicles. Additionally, it wants to construct a fair and convenient network of 500,000 chargers. Moreover, the installation of renewable energy systems and the growing demand for infrastructure for vehicle charging are driving the growth of the battery electrolyte market in Canada.

Key Battery Electrolyte Market Players:

- BASF SE

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- 3M Company

- LG Chem

- GS Yuasa International Ltd.

- Central Glass Co., Ltd.

- American Elements

- Lanxess AG

- BroadBit Batteries Oy

- Mitsui & Co., Ltd.

- Shenzhen Capchem Technology Co. Ltd

To increase their customer base, the major players in the battery electrolyte market are concentrating on increasing the productivity and quality of their products. Leading players are engaged in research and development to determine the optimal composition of the material used in manufacturing. Some of the major businesses' other expansion methods include joint ventures, mergers and acquisitions, and intensive R&D.

Recent Developments

- In March 2021, LANXESS entered the realm of battery chemistry by collaborating with Guangzhou Tinci Materials Technology Co., a prominent global manufacturer of lithium-ion battery materials. LANXESS will create electrolyte compositions for lithium-ion batteries under the Chinese company's authorization.

- In August 2020, BroadBit Batteries launched ProLion-001, a new high-performance electrolyte for Li-ion batteries. This novel Li-ion electrolyte addresses the fundamental performance limits of current Li-ion electrolytes, allowing for higher temperature functioning, enhanced safety, longer cycle life, faster charging, and increased power (especially at low temperatures).

- Report ID: 6592

- Published Date: Aug 14, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Battery Electrolyte Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.