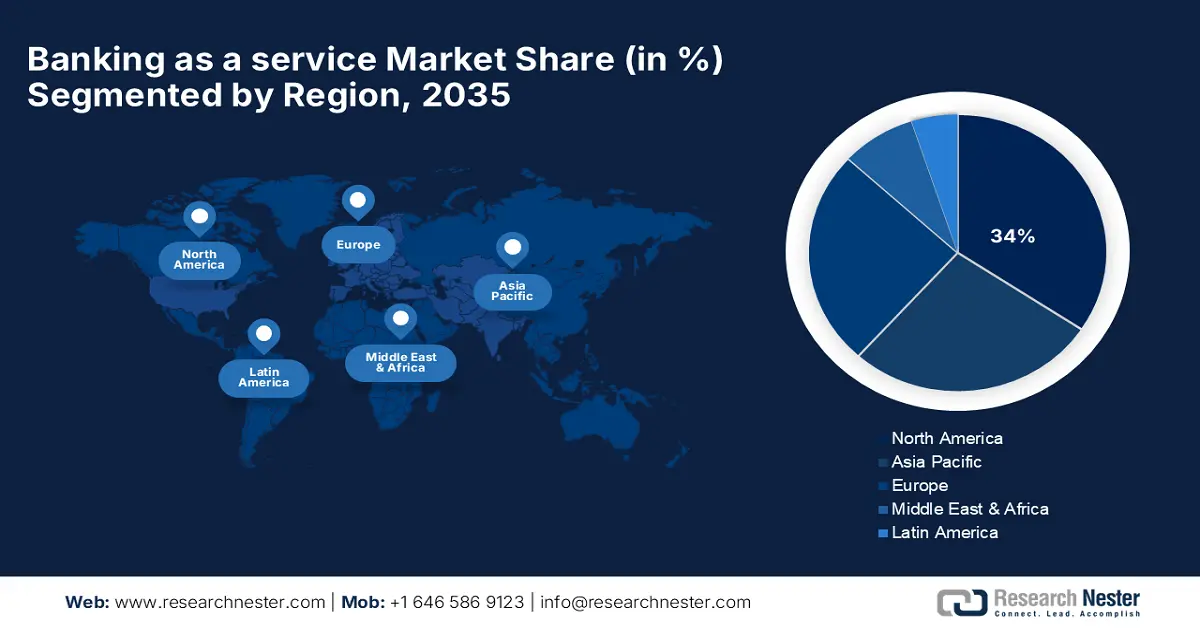

Banking as a service Market Regional Analysis:

North America Market Analysis

North America industry is anticipated to hold largest revenue share of 34% by 2035, driven by several end-to-end factors such as strong financial infrastructure and widespread adoption of digital banking technologies. Regional growth is further being supported by initiatives from the government and private sectors for better access to finance. Furthermore, traditional banks collaborating with fintech firms have been instrumental in the development of this market.

The U.S. leads the North America banking as a service (BaaS) market through its tech-driven financial innovations and strategic partnerships across different fintech companies and their traditional banks. The country records higher adoption of advanced digital solutions, hence creating a perfect hub of financial innovation. In November 2020, Moven partnered with Q2 to introduce its rapid-deployment digital solution, focusing on flexible and scalable banking services. Such partnerships improve service delivery and operational efficiency. Based on these aspects, the U.S. will continue leading the market through 2035.

The favorable regulatory frameworks and growing demand for Fintech services among industries drive the banking as a service market in Canada. The effective initiation of government policies towards the digital transformation in banking, with a strategic policy agenda to accelerate growth and development, has been the mainstay. For instance, in July 2022, Health Canada gave the green light to projects providing smooth financial transactions to the underprivileged population. This preference for access and inclusion follows the country's greater moves toward improving major services in the realm of digital banking. As the geographical coverage of fintech expands globally, so will the BaaS ecosystem in Canada, creating opportunities for both collaboration and technological advancements.

Asia Pacific Market Analysis

Asia Pacific BaaS market is anticipated to register steady growth from 2026 to 2035, owing to the surge in fintech adoption and favorable governmental policies. This digital banking transformation is led by major countries such as India, China, and Japan. Greater investments influence all such growth factors in technology infrastructure and collaborative agreements between banks and fintech firms. Furthermore, the demand by consumers for frictionless and affordable financial services significantly fosters growth in the market. This focus on digitalization in Asia Pacific places it as an important location within the global market landscape.

The banking as a service market shows rapid expansion with the robust digital revolution and growing fintech ecosystem in India. Most of the government initiatives have been viewed as promoting financial inclusions, thus creating fertile grounds for the adoption of BaaS. In March 2021, PayPal partnered with Cashfree to enable businesses in India to serve global markets with ease, hence underlining the role of BaaS in cross-border financial inclusions. This has further enhanced the appeal of the BaaS platforms in India, pushed by the integration of innovative technologies.

With its commitment to digitization in banking, China is positioned to be a leader in Asia Pacific market. Strong government support and tech-driven innovations are forcing the pace of adoption of BaaS solutions across the country. In June 2021, Bankable partnered with Global Processing Services to extend cross-border payment capabilities, reflecting the focus of China on global integration in financial matters. Investments in digital infrastructure accelerated the pace for BaaS platforms. Such initiatives underline the role of China in shaping the future of digital banking, both regionally and beyond.