Banking as a service Market Outlook:

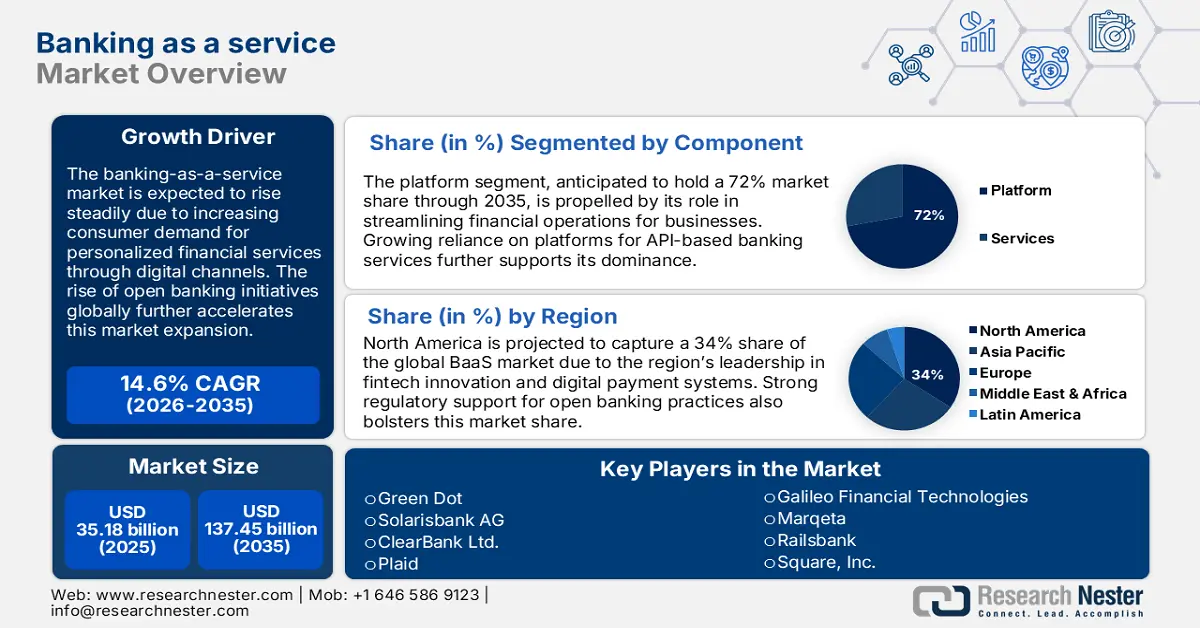

Banking as a service Market size was valued at USD 35.18 billion in 2025 and is set to exceed USD 137.45 billion by 2035, expanding at over 14.6% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of banking as a service is evaluated at USD 39.8 billion.

The banking as a service market is likely to experience steady expansion driven by the increasing digitization of financial services and the growing demand for seamless integration between banking platforms and third-party applications. BaaS enables non-bank businesses to offer financial services by embedding banking capabilities through APIs and cloud-based solutions. For example, in November 2023, Zile Money partnered with Sunrise Bank to deliver real-time monitoring and streamlined onboarding, enhancing the BaaS ecosystem. The governments in many countries promote digital banking transformation, hence boosting market opportunities for financial inclusion.

Furthermore, governments and financial regulators are also contributing to the increase in the pace of adoption by providing support policies for digital banking ecosystems. For example, the recent launch of the Saudi Central Bank's Naqd in July 2024 underlines governmental efforts toward integrating secure digital platforms for financial transactions with full transparency and efficiency. This modernizes the financial infrastructure and promotes innovation in BaaS offerings, driving banking as a service market growth.

Key Banking as a service Market Insights Summary:

Regional Highlights:

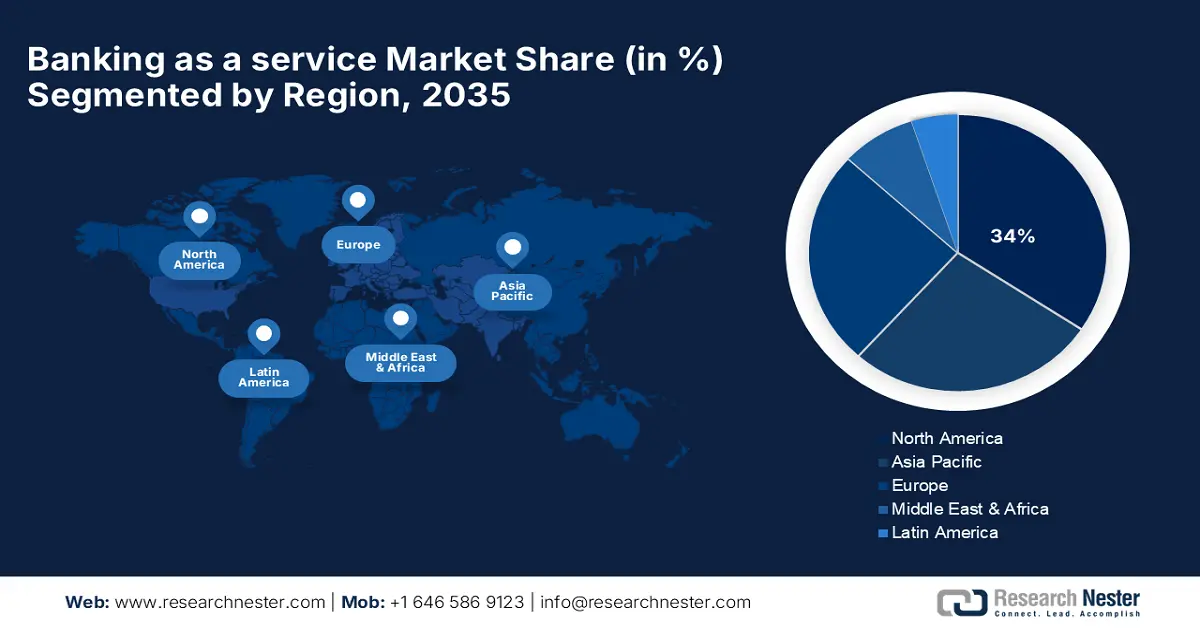

- North America leads the Banking as a Service Market with a 34% share, driven by strong financial infrastructure, digital banking adoption, and collaboration between fintech firms and traditional banks through 2026–2035.

- The Banking as a Service Market in Asia Pacific is projected to grow lucratively by 2035, fueled by the surge in fintech adoption and favorable governmental policies supporting digital banking transformation.

Segment Insights:

- The Cloud-based Banking as a Service segment is projected to dominate revenue share by 2035, fueled by its flexibility, scalability, and cost-efficiency.

- By 2035, the platform segment is projected to hold over 72% share, fueled by demand for scalable and robust digital banking infrastructures.

Key Growth Trends:

- Growing demand for embedded financial services

- Advances in API technology

Major Challenges:

- Regulatory complexity and compliance

- Cybersecurity threats

- Key Players: Green Dot, Marqeta, Railsbank, Square, Inc., Banco Bilbao Vizcaya Argentaria, Solarisbank AG, ClearBank Ltd., Plaid, Galileo Financial Technologies, and MatchMove Pay Pte Ltd.

Global Banking as a service Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 35.18 billion

- 2026 Market Size: USD 39.8 billion

- Projected Market Size: USD 137.45 billion by 2035

- Growth Forecasts: 14.6% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (34% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, United Kingdom, Germany, Singapore, Japan

- Emerging Countries: China, India, Brazil, Mexico, Singapore

Last updated on : 14 August, 2025

Banking as a service Market Growth Drivers and Challenges:

Growth Drivers

-

Growing demand for embedded financial services: The growing demand for embedded finance solutions from various corners of industry verticals like retail, e-commerce, and logistics is driving banking as a service market growth. Companies are embedding banking solutions into their platforms to up the ante of customer experiences and engagement levels. In February 2023, Oracle announced the launch of its Oracle Banking Cloud Services to enable the successful execution of demand through modular solutions by reducing complexity and improving scalability.

- Advances in API technology: API-driven banking solutions have been revolutionizing financial services, making integrations with third-party applications seamless and effortless. For example, in October 2022, Treasury Prime partnered with First Internet Bank, offering sophisticated API connections for extended scalability of service. Innovation with API-based platforms lets businesses embed financial services without developing complex core banking systems.

- Increased focus on financial inclusion: The banking as a service (BaaS) market is also being propelled by governments and financial regulating bodies, which promote financial inclusions through BaaS solutions for extending banking services to unbanked populations. For instance, in March 2023, ICICI Bank launched bespoke digital solutions for capital market players, which is a perfect example of how BaaS improves access to banking services for a wide range of customers. This inclusiveness is one of the major factors contributing to market growth.

Challenges

-

Regulatory complexity and compliance: One of the main challenges faced by any BaaS provider is to survive in the complex regulatory ecosystem. Financial institutions need to comply with strict regulatory requirements, sometimes extremely divergent across diverse jurisdictions. These regulations demand huge investments in legal competencies, compliance frameworks, and reporting systems. Non-compliance with regulations draws severe penalties and reputational loss. Furthermore, the evolving nature of regulations adds more complexity to compliance for a BaaS provider.

- Cybersecurity threats: With increased digitalization on BaaS platforms, cybersecurity threats have also grown more severe. The imperative for the security of sensitive financial data against theft, hacking, and fraud has emerged as a key concern for businesses. Installation of security measures like encryption, multi-factor authentication, and real-time monitoring involves expensive modalities. This will continue to be a significant challenge for BaaS providers as the threat landscape continuously evolves.

Banking as a service Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

14.6% |

|

Base Year Market Size (2025) |

USD 35.18 billion |

|

Forecast Year Market Size (2035) |

USD 137.45 billion |

|

Regional Scope |

|

Banking as a service Market Segmentation:

Component (Platform, Services)

Platform segment is expected to account for banking as a service market share of more than 72% by the end of 2035, owing to the demand being generated for scalable and robust digital banking infrastructures. This dominance defines the vital role taken up by the platforms in effectively enabling seamless integrations and efficient operations of financial services. In February 2024, Wealthify announced its partnership with ClearBank to embed banking services into its investment platform, representing the rising dependency on platforms within the market. This is but an example of such partnerships, driving home the critical role that a platform plays in facilitating smoother financial management and value addition in service delivery.

Type (API-based Banking as a service, Cloud-based Banking as a service)

In banking as a service market, cloud-based baas solutions segment is set to account for revenue share of around 75% by 2035, owing to their flexibility, scalability, and cost-efficiency. This enables Financial Institutions to quickly adapt to market demand while easing their infrastructure costs. Fiserv's strategic acquisition of Finxact in February 2022 underscored the rise in demand experienced within cloud-native banking technology. These developments underpin digital transformation and scalability as one of the most crucial factors driving the momentum of cloud-based solutions in the market.

Our in-depth analysis of the banking as a service market includes the following segments

|

Component |

|

|

Type |

|

|

Enterprise Size |

|

|

End use |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Banking as a service Market Regional Analysis:

North America Market Analysis

North America industry is anticipated to hold largest revenue share of 34% by 2035, driven by several end-to-end factors such as strong financial infrastructure and widespread adoption of digital banking technologies. Regional growth is further being supported by initiatives from the government and private sectors for better access to finance. Furthermore, traditional banks collaborating with fintech firms have been instrumental in the development of this market.

The U.S. leads the North America banking as a service (BaaS) market through its tech-driven financial innovations and strategic partnerships across different fintech companies and their traditional banks. The country records higher adoption of advanced digital solutions, hence creating a perfect hub of financial innovation. In November 2020, Moven partnered with Q2 to introduce its rapid-deployment digital solution, focusing on flexible and scalable banking services. Such partnerships improve service delivery and operational efficiency. Based on these aspects, the U.S. will continue leading the market through 2035.

The favorable regulatory frameworks and growing demand for Fintech services among industries drive the banking as a service market in Canada. The effective initiation of government policies towards the digital transformation in banking, with a strategic policy agenda to accelerate growth and development, has been the mainstay. For instance, in July 2022, Health Canada gave the green light to projects providing smooth financial transactions to the underprivileged population. This preference for access and inclusion follows the country's greater moves toward improving major services in the realm of digital banking. As the geographical coverage of fintech expands globally, so will the BaaS ecosystem in Canada, creating opportunities for both collaboration and technological advancements.

Asia Pacific Market Analysis

Asia Pacific BaaS market is anticipated to register steady growth from 2026 to 2035, owing to the surge in fintech adoption and favorable governmental policies. This digital banking transformation is led by major countries such as India, China, and Japan. Greater investments influence all such growth factors in technology infrastructure and collaborative agreements between banks and fintech firms. Furthermore, the demand by consumers for frictionless and affordable financial services significantly fosters growth in the market. This focus on digitalization in Asia Pacific places it as an important location within the global market landscape.

The banking as a service market shows rapid expansion with the robust digital revolution and growing fintech ecosystem in India. Most of the government initiatives have been viewed as promoting financial inclusions, thus creating fertile grounds for the adoption of BaaS. In March 2021, PayPal partnered with Cashfree to enable businesses in India to serve global markets with ease, hence underlining the role of BaaS in cross-border financial inclusions. This has further enhanced the appeal of the BaaS platforms in India, pushed by the integration of innovative technologies.

With its commitment to digitization in banking, China is positioned to be a leader in Asia Pacific market. Strong government support and tech-driven innovations are forcing the pace of adoption of BaaS solutions across the country. In June 2021, Bankable partnered with Global Processing Services to extend cross-border payment capabilities, reflecting the focus of China on global integration in financial matters. Investments in digital infrastructure accelerated the pace for BaaS platforms. Such initiatives underline the role of China in shaping the future of digital banking, both regionally and beyond.

Key Banking as a service Market Players:

- Green Dot

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Solarisbank AG

- ClearBank Ltd.

- Plaid

- Galileo Financial Technologies

- Marqeta

- Railsbank

- Square, Inc.

- Banco Bilbao Vizcaya Argentaria

- MatchMove Pay Pte Ltd

The market is fiercely competitive in nature, and some of the key players involved are Green Dot, Marqeta, Railsbank, Square, Inc., Banco Bilbao Vizcaya Argentaria, Solarisbank AG, ClearBank Ltd., Plaid, Galileo Financial Technologies, and MatchMove Pay Pte Ltd. Each of these companies is now working on innovations in technology to make the BaaS solutions broad, scalable, and secure, thus allowing seamless integration into their clients' businesses.

Strategic acquisitions and partnerships further develop players' market presence. In March 2022, Green Dot partnered with Plaid to bring secure open finance solutions to GO2bank users. This collaboration offers API-based, token-secure connectivity, enhancing digital access for underserved banking consumers. Such partnerships drive the competitive landscape with seamless satisfaction of customers' needs as a key focus. Furthermore, this also highlights the ongoing innovation in the BaaS market as companies strive to expand their offerings and deliver enhanced financial services.

Here are some leading players in the banking as a service market:

Recent Developments

- In July 2024, Avidia Bank partnered with Q2 Software Inc. to upgrade its digital banking platform. Through this collaboration, Avidia will integrate AI-powered engagement tools to provide real-time insights and automated saving plans, enhancing customer experience.

- In October 2023, Hitachi Payment Services launched the HPX program in India to foster long-term partnerships with fintech startups. This initiative aims to revolutionize the payments industry by supporting innovative solutions that enhance business and consumer payment experiences.

- Report ID: 6706

- Published Date: Aug 14, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Banking as a service Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.