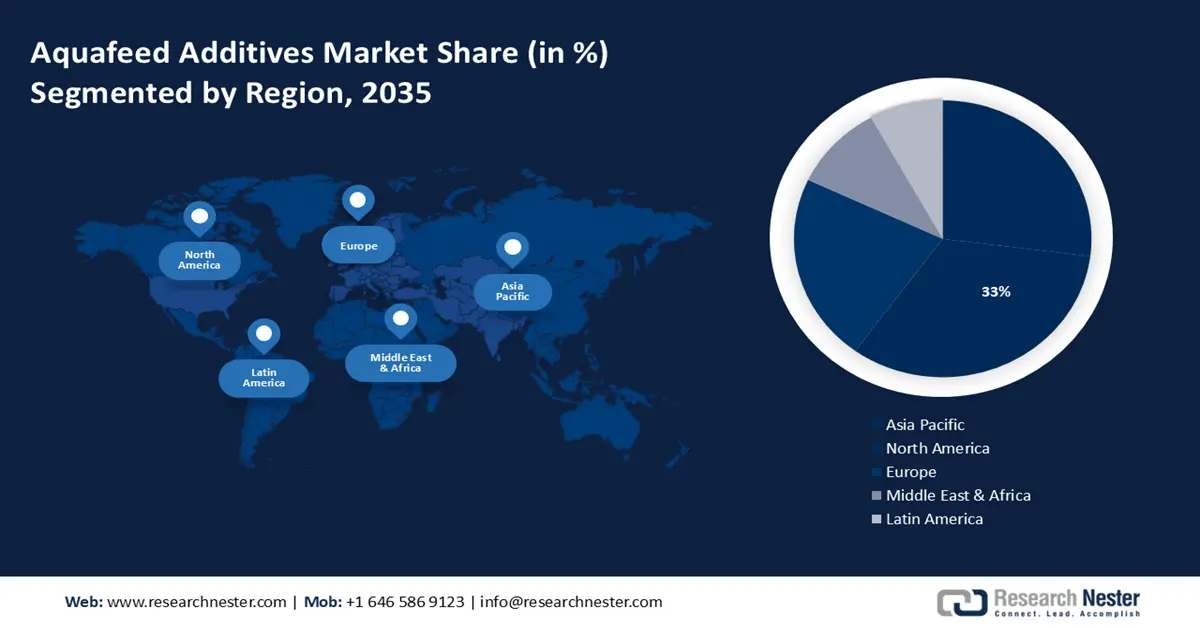

Aquafeed Additives Market Regional Analysis:

North American Market Insights

North America industry is set to account for largest revenue share of 33% by 2035. The industry's expansion is largely driven by the growing consumption of salmonids, hard clams, oysters, and mussels. Additionally, the increasing desire for aquaculture-sourced seafood can be linked to the reduction in wild fishery production and the higher daily intake of seafood in the area. The region's climatic conditions favor the development of various aquaculture species, including crustaceans and catfish. In terms of value, bivalve mollusks like oysters, clams, and mussels make up over 80% of marine aquaculture production in the U.S.

U.S. - The extensive farming of these species in the country is predicted to support the expansion of the aquaculture sector.

Canada - The growing demand for seafood resulting from population growth is expected to boost the progress of the aquaculture industry, consequently driving the growth of the market.

APAC Market Insights

Aquafeed additives market size for Asia Pacific region is likely to cross USD 6.1 Billion by the end of 2035. The significant expansion of the aquaculture sector is driven by factors such as the availability of inexpensive labor, the facilitation of controlled conditions for aquaculture, and the presence of natural resources in the area.

China led aquaculture production in the Asia Pacific region in 2021, reaching almost 73 million metric tons. Moreover, the favorable weather conditions in these nations contribute to overall aquaculture production, consequently boosting the aquafeed industry and, by extension, the aquafeed additives.

India - Individuals opt for fish and various other seafood options to fulfill their dietary protein requirements. This heightened consciousness has led to an escalated interest in aquafeed products in India.

China - The robust aquaculture production in the area, particularly in China, as well as factors indicating the simplicity of fish farming, resilience of species, and improved water quality in enclosed farming systems, are anticipated to stimulate the demand for aquafeed additives in the forthcoming years.

Japan - Among global per capita fish consumers, Japan ranks as one of the top nations. Due to the high demand for marine products, especially fish and shellfish, sustainable and efficient aquaculture operations require the use of aquafeed additives.