Aquafeed Additives Market Outlook:

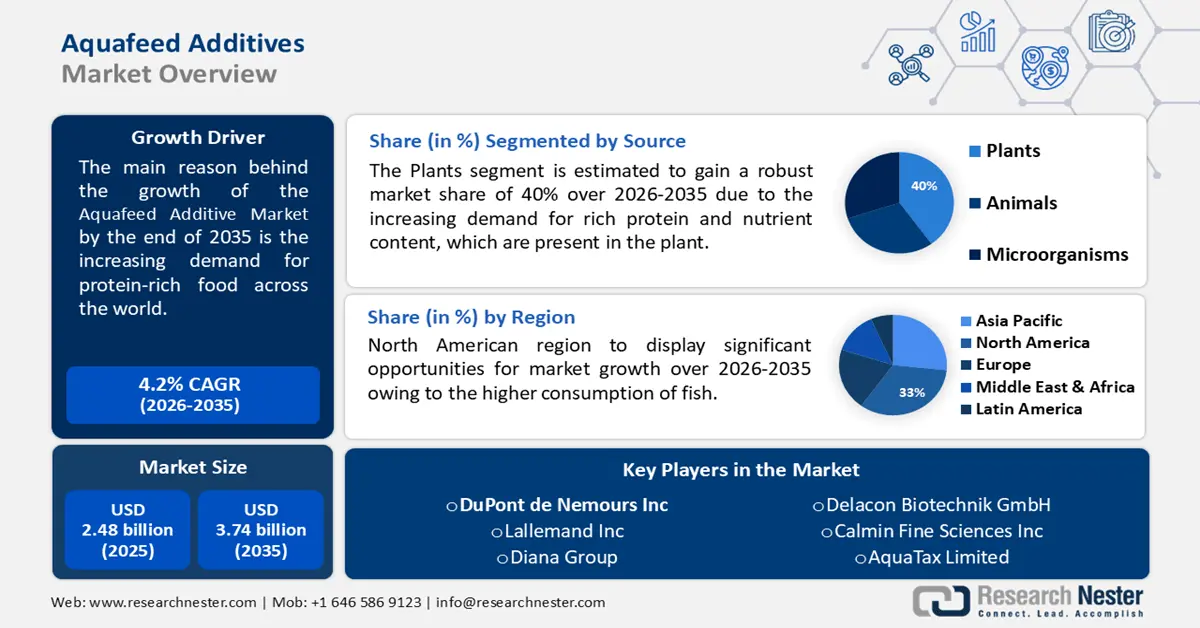

Aquafeed Additives Market size was over USD 2.48 billion in 2025 and is anticipated to cross USD 3.74 billion by 2035, witnessing more than 4.2% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of aquafeed additives is assessed at USD 2.57 billion.

The global sales of complex feed and feed supplements are driven by the rise of aquaculture and nutritional awareness among fish farmers.

The seafood industry has observed a boom with the growing consumption of crabs, salmon, tilapia, and catfish mainly due to their high protein content. For instance, the Global Seafood Alliance in March 2024 estimated that India’s fish consumption will reach 26.5 metric tons by 2048. Furthermore, the rising urban population and increased fish trade in Asian countries, particularly in eastern and southeastern Asia, have influenced fish consumption, expanding the global market. As per the Food and Agriculture Organization, world trade in fish and fisheries products is estimated to reach 65.0 million tons in 2023. Thus, the growing seafood consumption is fueling the demand for aquafeed additives.

Key Aquafeed Additives Market Insights Summary:

Regional Highlights:

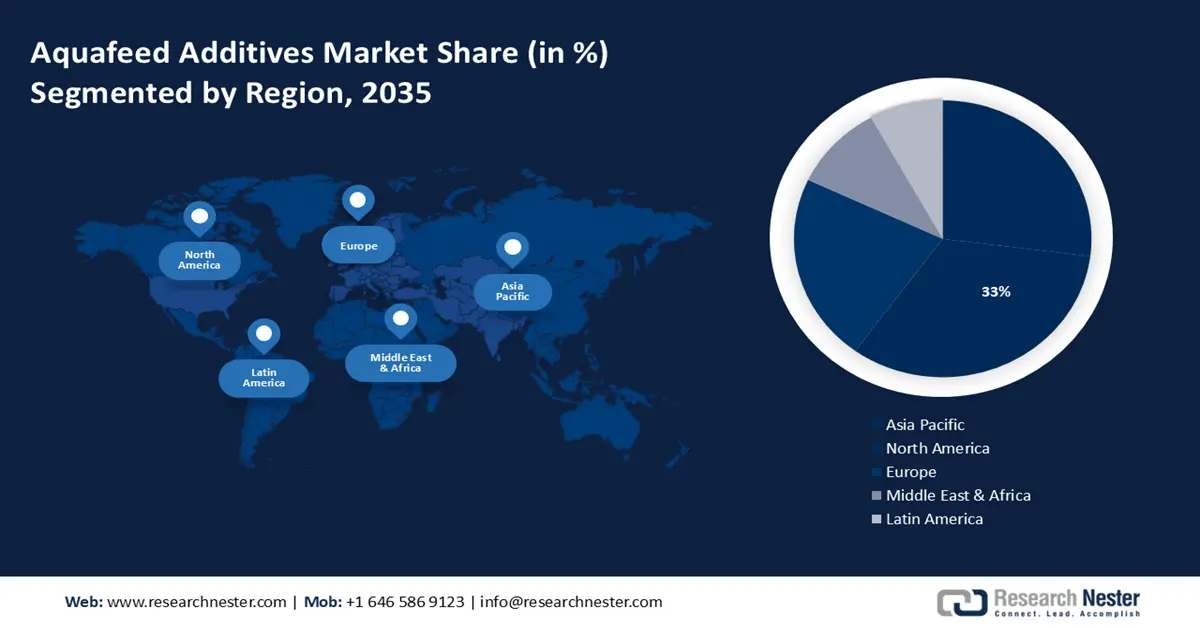

- The North America aquafeed additives market will account for 33% share by 2035, driven by the growing consumption of salmonids, hard clams, oysters, and mussels.

Segment Insights:

- The plants segment in the aquafeed additives market is expected to secure a 40% share by 2035, fueled by the rising preference for nutrient-rich, plant-based additives over animal-based alternatives.

- The catfish segment in the aquafeed additives market is expected to hold the largest share by 2035, attributed to catfish’s sustainability, adaptability, and nutritional value boosting demand for aquafeed additives.

Key Growth Trends:

- Use of additives to mitigate mercury poisoning

- New product development

Major Challenges:

- Fluctuating prices of raw materials

- Growing adoption of a vegan lifestyle

Key Players: AquaTax Limited, Calmin Fine Sciences Inc., Delacon Biotechnik GmbH, Diana Group, Lallemand Inc., DuPont de Nemours Inc.

Global Aquafeed Additives Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 2.48 billion

- 2026 Market Size: USD 2.57 billion

- Projected Market Size: USD 3.74 billion by 2035

- Growth Forecasts: 4.2% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (33% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, United States, Norway, Japan, Chile

- Emerging Countries: China, India, Japan, South Korea, Brazil

Last updated on : 17 September, 2025

Aquafeed Additives Market Growth Drivers and Challenges:

Growth Drivers

- Use of additives to mitigate mercury poisoning - A June 2024 study by the U.S. Food & Drug Administration (FDA) discusses the risks associated with the intake of contaminated seafood, particularly among Asian and Native American children. The Environmental Protection Agency (EPA) and the FDA issued a joint advisory on fish consumption as a part of the Closer to Zero campaign to foster awareness about mercury and other toxins. Several products are available in the market to improve seafood quality. For instance, Orffa has a lineup of products including phytogenic feed additives to improve aquaculture and fillet quality.

- New product development - The aquafeed additives market is set to be driven by product innovation using sustainable bio-ingredients and would be well received by consumers. For example, TilaFeed provides circular nutrient management with bioeconomy-based approach for aquaponics. Aquafeed additives that are more environmentally friendly are anticipated to increase customer demand and draw in new competitors. However, because current players enjoy economies of scale, newcomers will have to contend with fierce competition from them.

- High demand for protein-rich food - Aquafeed additives are an excellent source of proteins and omega-3 fatty acids. They boost the meal's nutritional content and provide several advantages, such as better protein digestion, faster development, higher feed conversion, less aquatic species die-off, and strengthened immune systems. Therefore, it is projected that growing awareness among aquafeed makers of the nutritional advantages of high-protein aquafeed additives would spur market expansion.

Challenges

- Fluctuating prices of raw materials - Aquafeed production relies heavily on additives like fishmeal and fish oil. The increased desire for plant-based meat in aquafeed is a consequence of changing fish meal costs caused by a shortage of caught fish. These changes are anticipated to affect the aquafeed additives industry because fishmeal is a necessary raw ingredient for making these additives.

- Growing adoption of a vegan lifestyle - The emergence of alternative protein and veganism advocate for quantifying the upstream impact on the environment and ethical concerns about cultured meat. Fishmeal and fish oil are the main raw materials for aquafeed additives, and the increasing popularity of veganism worldwide is hindering market growth. The shortage of fishmeal is leading to decreased production of additives. Moreover, as more people adopt a plant-based diet, the consumption of plant-based additives is on the rise, negatively affecting the demand for aquafeed additives and restricting market growth.

Aquafeed Additives Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

4.2% |

|

Base Year Market Size (2025) |

USD 2.48 billion |

|

Forecast Year Market Size (2035) |

USD 3.74 billion |

|

Regional Scope |

|

Aquafeed Additives Market Segmentation:

Ingredient Segment Analysis

Feed acidifier segment in the aquafeed additives market is estimated to exhibit substantial CAGR till 2035. Feed acidifiers are created using organic acids and their salts. They play a vital role in controlling gastric acid levels in aquatic animals leading to improved food digestion, and absorption. The use of feed acidifiers as additives is predicted to experience significant expansion because they can help prevent diseases caused by E. coli and Salmonella. They are being seen as a substitute for antibiotics in protecting against diseases.

Application Segment Analysis

In terms of application, the catfish segment in aquafeed additives market is set to witness the largest size by the end of 2035. Catfish, as a sustainable fish species, are raised in freshwater ponds using corn, rice, and soybeans as aquafeed. Catfish are the preferred group of farmed aquaculture species because of their ability to be farmed in less-than-ideal climatic conditions. The increasing consumer demand for catfish, induced by its high vitamin D and omega-6 fatty acid content, is set to boost the demand for aquafeed additives in the upcoming years.

Source Segment Analysis

Plants segment is predicted to dominate aquafeed additives market share of around 40% by the end of 2035. Additives derived from corn, soybean, sunflower seed, peas, cottonseed, and other natural sources are in high demand due to their nutrient content, and rich protein. This makes them increasingly popular in the aquafeed additives industry as they offer a viable alternative to animal-based supplements, and are easily digestible.

Our in-depth analysis of the global market includes the following segments:

|

Ingredient |

|

|

Application |

|

|

Source |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Aquafeed Additives Market Regional Analysis:

North American Market Insights

North America industry is set to account for largest revenue share of 33% by 2035. The industry's expansion is largely driven by the growing consumption of salmonids, hard clams, oysters, and mussels. Additionally, the increasing desire for aquaculture-sourced seafood can be linked to the reduction in wild fishery production and the higher daily intake of seafood in the area. The region's climatic conditions favor the development of various aquaculture species, including crustaceans and catfish. In terms of value, bivalve mollusks like oysters, clams, and mussels make up over 80% of marine aquaculture production in the U.S.

U.S. - The extensive farming of these species in the country is predicted to support the expansion of the aquaculture sector.

Canada - The growing demand for seafood resulting from population growth is expected to boost the progress of the aquaculture industry, consequently driving the growth of the market.

APAC Market Insights

Aquafeed additives market size for Asia Pacific region is likely to cross USD 6.1 Billion by the end of 2035. The significant expansion of the aquaculture sector is driven by factors such as the availability of inexpensive labor, the facilitation of controlled conditions for aquaculture, and the presence of natural resources in the area.

China led aquaculture production in the Asia Pacific region in 2021, reaching almost 73 million metric tons. Moreover, the favorable weather conditions in these nations contribute to overall aquaculture production, consequently boosting the aquafeed industry and, by extension, the aquafeed additives.

India - Individuals opt for fish and various other seafood options to fulfill their dietary protein requirements. This heightened consciousness has led to an escalated interest in aquafeed products in India.

China - The robust aquaculture production in the area, particularly in China, as well as factors indicating the simplicity of fish farming, resilience of species, and improved water quality in enclosed farming systems, are anticipated to stimulate the demand for aquafeed additives in the forthcoming years.

Japan - Among global per capita fish consumers, Japan ranks as one of the top nations. Due to the high demand for marine products, especially fish and shellfish, sustainable and efficient aquaculture operations require the use of aquafeed additives.

Aquafeed Additives Market Players:

- Biorigin

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- AquaTax Limited

- Calmin Fine Sciences Inc.

- Delacon Biotechnik GmbH

- Diana Group

- Lallemand Inc.

- DuPont de Nemours Inc.

- BiomEdit

The aquafeed additives sector experiences intense competition, as numerous companies provide diverse products for various aquatic animals. These companies have extensive global reach and supply a broad selection of aquafeed additives, including amino acids, vitamins, minerals, and enzymes. To maintain competitiveness in the industry, companies need to offer top-notch products supported by research and compliant with industry regulations.

Recent Developments

- BiomEdit, the pioneering microbiome biotech firm in animal health, received investment from Nutreco in 2023, establishing a minority position. This collaboration marks the first strategic research and commercial relationship for BiomEdit and aims to deliver innovative feed additives based on microbiome technology to livestock and aquaculture producers.

- In June 2022, ADM AquaTax introduced AquaTax, a product utilizing novel yeasts to provide physiological support to aqua species and improve the efficiency of aquaculture farmers.

- Report ID: 6255

- Published Date: Sep 17, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Aquafeed Additives Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.