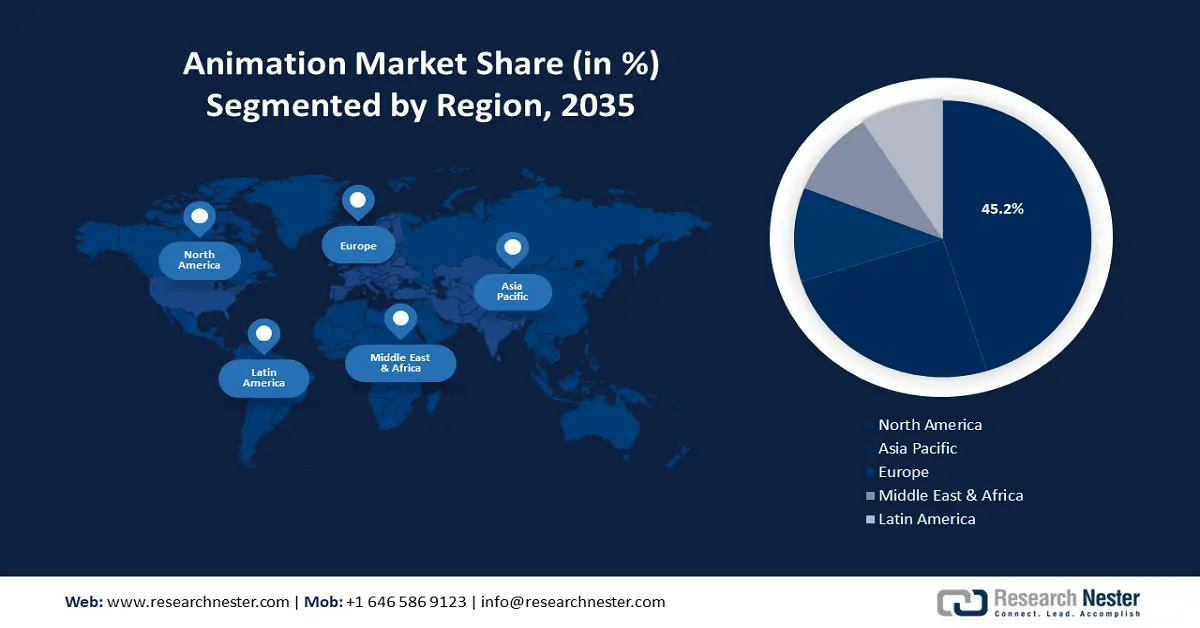

Animation Market Regional Analysis:

North America Market Insights

The animation market in North America industry is anticipated to account for largest revenue share of 45% by 2035. The growth in this region is poised due to the rise in virtual animated shows and movies. Academy of Animation Art 2024 observed that in 2022 about 50% of animated films were from North America. The gain in this sector will augment the virtual production value in the near future.

In the U.S., the prevalence of companies such as Nickelodeon, Disney, and Fox Studios acted as a growth driver for animation jobs, surpassing 25% by 2022. This will demand for skilled animators and animation studios in the forecast period. The International Trade Administration estimated in 2020 that the U.S. Media & Entertainment landscape was the largest, valued at around USD 600 million out of USD 2 trillion global revenue share.

Canada showed a slated demand for animated games along with advanced developments such as CGI. According to a report by the Entertainment Software Association of Canada in 2021, 937 video game companies such as Whimsy Games and HB Studios were registered which was an increase of 35% through 2019. This will act as a growth factor for the animation market in the coming years.

APAC Market Insights

Asia Pacific will also encounter a huge growth in the animation market value during the forecast period with a notable size. This region will account for the second position in this landscape owing to the rapid internet penetration, coupled with the demand for animated movies. The Mobile Economy Asia Pacific 2022 estimated that in 2021 internet users surpassed by 1.2 billion in APAC, which is about 45% of the APAC population.

In China, there has been an increase in OTTs owing to the high demand for entertainment platforms. A recent report by Research Nester in 2022, estimated an increase of 19% in OTT users in China in the last 3 years. This preference for OTT will propel the animation landscape during the forecast period.

Nippon Communication Foundation in 2024, stated that in Japan the box office market revenue increased by 3.9% in 2023 to USD 1.3 trillion driven by a strong performance by animated films. Moreover, the prevalence of various animation companies such as Studio Ghibli, Studio Bones, and Kyoto Animation in this country will fuel the revenue share.