Animation Market Outlook:

Animation Market size was valued at USD 430.01 billion in 2025 and is set to exceed USD 777.38 billion by 2035, expanding at over 6.1% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of animation is estimated at USD 453.62 billion.

AI training for character movements has gained traction in the past few years. Considering the changing landscape of animated films and television works, AI in filmmaking takes center stage. More companies in the space are seeking AI-simulated technologies and reinforcement learning models to create virtual characters with human appearance and language interaction functions. In March 2022, NVIDIA introduced an AI-driven virtual character system capable of providing animators and game developers with a wide set of virtual characters. Several other platforms offer tools to create custom AI avatars, including Deepbrain AI, Synthesia, VEED.IO, and Colossyan Creator.

With new research and advancements, redundant models and algorithms are being replaced by more efficient counterparts, including Recurrent Neural Networks (RNNs), Generative Adversarial Networks (GANs), and deep reinforcement learning. The advent of deep learning and generative adversarial networks (GANs) in 2020, introduced new possibilities for the animation market. OpenAI's GPT-3 model, can create images based on textual descriptions, demonstrating the potential for creating animated facial expressions and body movements. As AI technology continues to improve, its application in the market is estimated likely to emerge as a key trend.

Key Animation Market Insights Summary:

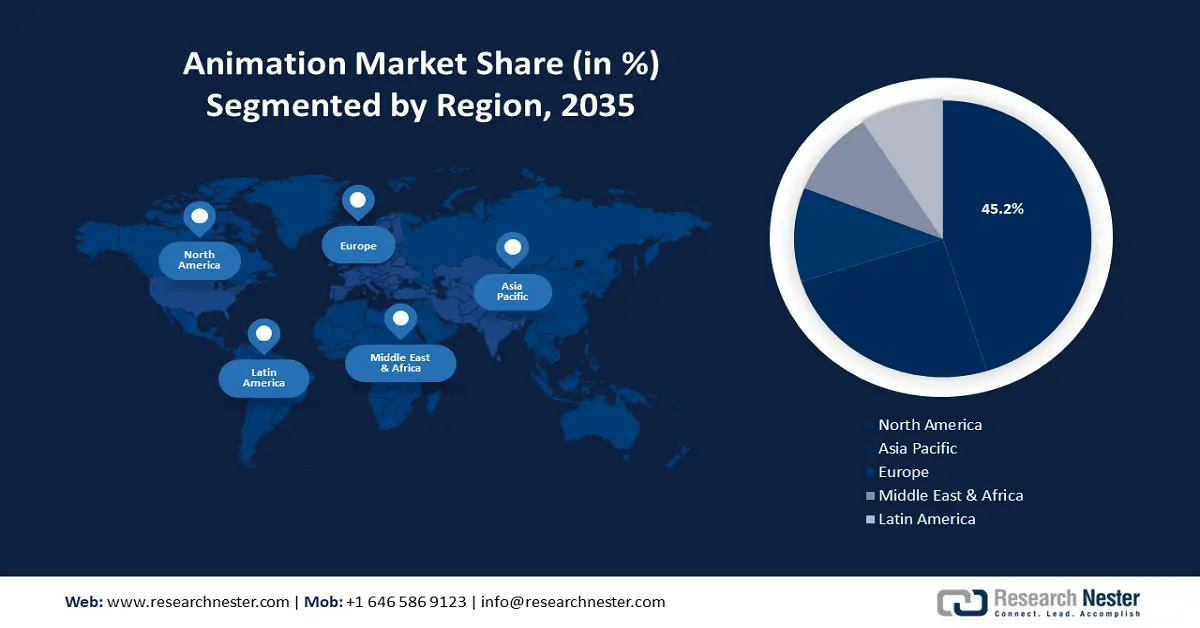

Regional Highlights:

- The North America animation market is anticipated to capture 45% share by 2035, driven by the rise in virtual animated shows and movies.

Segment Insights:

- The media and entertainment segment in the animation market is projected to hold a 45.20% share by 2035, driven by the increasing demand for animated content in films, TV shows, and online platforms, especially with the surge in adult animation content.

- The 3d animation segment in the animation market is projected to attain a 24% share by 2035, fueled by the rising demand for high-quality visual content in entertainment and industries, as well as technological advancements in animation techniques.

Key Growth Trends:

- Rising investments

- Growing focus on governing animated AI systems

Major Challenges:

- High production cost

- Time-consuming process

Key Players: Adobe, Lost Marble LLC, Autodesk Inc., Pixar Animation Studios, DreamWorks Animation, Sony Pictures Animation, Blue Sky Animation Studios, Paramount Animation, Cartoon Network Studios.

Global Animation Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 430.01 billion

- 2026 Market Size: USD 453.62 billion

- Projected Market Size: USD 777.38 billion by 2035

- Growth Forecasts: 6.1% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (45% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Japan, China, United Kingdom, South Korea

- Emerging Countries: China, India, South Korea, Japan, Singapore

Last updated on : 17 September, 2025

Animation Market Growth Drivers and Challenges:

Growth Drivers

- Rising investments: The market is driven by the ongoing influx of investments in developing animation technologies. Companies have identified trends including rising consumption of mainstream entertainment and the subsequent boom in OTT platforms. To gain a competitive edge, key players are strengthening their market position through investments in technology, production, and R&D. For instance, Animation UK has strategized to incentivize private sector tax investment to support the players in IP development and growth and encourage the animation sector.

In May 2024, Anton Capital Entertainment infused a financing of USD 108 million to subsidize future productions. This will help the company produce ten features annually across all commercial genres at a global scale. The funding windfall comes from a group of institutional investors and Blackrock, a 6.6% owner of The Walt Disney Company. Furthermore, Animond, a prominent market investor so far has raised a funding of USD 14 million for animation production. Scholastic Entertainment in March 2024 announced a strategic investment of USD 186 million in 9 Story Media Group, Canadian animation studio. - Growing focus on governing animated AI systems: Proposals for the governance of AI technologies in animation have proliferated in the past few years, developed by international organizations, national and subnational governments, sectoral professional associations, civil society groups, and the business community. With the release of ChatGPT in late 2022, the focus shifted to AI safety and its proponents that often presume the impending development of Artificial General Intelligence (AGI) and the need for values alignment between the interests of human stakeholders and sentient AI systems.

AGI in animation is within the ambit of existing legal and regulatory policies around intellectual property law or copyright, consumer labeling, and product liability are likely to delimit the appropriate capacities of AI technologies. For instance, in the 2023 legislative session, the District of Columbia and Puerto Rico introduced AI bills, while the U.S. National Institute of Standards and Technology underscored the urgency of crafting robust federal standards for the creation of animation using AI. - Enhanced internet accessibility: The prevalence of high-speed internet has fueled the demand for several digital and OTT (over-the-top) platforms such as Netflix, Disney+, Hulu, ESPN+, Prime Video, HBO Max, and YouTube TV. The World Economic Forum published a report in 2023, highlighting that 1/3rd of the global population had internet access in 2022 which was about 5.3 billion people, as stated by the UN’s International Telecommunication Union. To meet such demands, there is an emergence of streaming services, online platforms, and social media such as Instagram and Facebook as important distribution channels.

Challenges

- High production cost: The worldwide animation market share is restrained by exceptionally high production costs involved in producing animated content of a sophisticated animation. This requires significant financial investments in technology, skilled labor, and software licenses, particularly in 3D and CGI. Such expense factors may make it more hindered for independent animators and smaller studios to enter the sector, which could stifle diversity in the industry by concentrating production among the major players.

- Time-consuming process: The process of producing engaging animated content requires careful planning, scripting, storyboarding, and animation rendering. This is especially required for feature-length movies or intricate television shows. Such extended production schedules may make it difficult to react swiftly to shifting market demands and cause delays in the delivery of content. Credited to this, the industry is less flexible and agile than other, more rapidly growing content production industries such as virtual production worldwide.

Animation Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

6.1% |

|

Base Year Market Size (2025) |

USD 430.01 billion |

|

Forecast Year Market Size (2035) |

USD 777.38 billion |

|

Regional Scope |

|

Animation Market Segmentation:

Product Segment Analysis

3D animation segment in animation market is expected to account for more than 24% revenue share by the end of 2035. Significant growth in the revenue share is driven by its realism, depth, and fascinating visual appeal. The prevalence of 3D animation in films, TV series, and video games is evidence of its dominance. For instance, the Academy of Animation Art in 2023 stated that 3D animation generated a share of 50% in 2020 with a revenue of USD 16.6 billion. Additionally, its quality and efficiency have increased due to technological advancements in motion capture, rendering, and 3D modeling. This has boosted its application across industries and sped up the growth of this market. The need for high-quality visual content in entertainment and other industries is augmenting 3D animation's lucrative growth.

Industry Segment Analysis

Media and entertainment segment is set to dominate around 45.2% animation market share by the end of 2035. The demand for animated content in motion pictures, television shows, advertisements, and online platforms is set to contribute to the growth of this sector. Researchers at Research Nester published a report in 2023, that concluded that the adult animation demand in the U.S. increased by 151.6% between 2020 and 2023.

In addition, stop motion's cross-cultural appeal and storytelling adaptability make it the dominating sector. Animated films are also used in online education to produce interesting and instructive content; this trend has accelerated as e-learning has increased. Growth in this sector will augment the education technology (EdTech) share soon. Moreover, animation is used in various categories including architecture and healthcare for simulations and visualizations.

Our in-depth analysis of the global market includes the following segments:

|

Product |

|

|

Industry |

|

|

Revenue Stream |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Animation Market Regional Analysis:

North America Market Insights

The animation market in North America industry is anticipated to account for largest revenue share of 45% by 2035. The growth in this region is poised due to the rise in virtual animated shows and movies. Academy of Animation Art 2024 observed that in 2022 about 50% of animated films were from North America. The gain in this sector will augment the virtual production value in the near future.

In the U.S., the prevalence of companies such as Nickelodeon, Disney, and Fox Studios acted as a growth driver for animation jobs, surpassing 25% by 2022. This will demand for skilled animators and animation studios in the forecast period. The International Trade Administration estimated in 2020 that the U.S. Media & Entertainment landscape was the largest, valued at around USD 600 million out of USD 2 trillion global revenue share.

Canada showed a slated demand for animated games along with advanced developments such as CGI. According to a report by the Entertainment Software Association of Canada in 2021, 937 video game companies such as Whimsy Games and HB Studios were registered which was an increase of 35% through 2019. This will act as a growth factor for the animation market in the coming years.

APAC Market Insights

Asia Pacific will also encounter a huge growth in the animation market value during the forecast period with a notable size. This region will account for the second position in this landscape owing to the rapid internet penetration, coupled with the demand for animated movies. The Mobile Economy Asia Pacific 2022 estimated that in 2021 internet users surpassed by 1.2 billion in APAC, which is about 45% of the APAC population.

In China, there has been an increase in OTTs owing to the high demand for entertainment platforms. A recent report by Research Nester in 2022, estimated an increase of 19% in OTT users in China in the last 3 years. This preference for OTT will propel the animation landscape during the forecast period.

Nippon Communication Foundation in 2024, stated that in Japan the box office market revenue increased by 3.9% in 2023 to USD 1.3 trillion driven by a strong performance by animated films. Moreover, the prevalence of various animation companies such as Studio Ghibli, Studio Bones, and Kyoto Animation in this country will fuel the revenue share.

Animation Market Players:

- DeepMotion

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Adobe

- Lost Marble LLC

- Autodesk Inc.

- Pixar Animation Studios

- DreamWorks Animation

- Sony Pictures Animation

- Blue Sky Animation Studios

- Paramount Animation

- Cartoon Network Studios

Animation market growth is estimated to witness a lucrative share during the forecast period. The competitive environment is attributed to the tremendous spike in investments in animation studios globally. Animation UK published a list of various Indie Animation Funding such as Arts Council England, GLAS Animation Grant program, and ScreenSkills Bursaries: Career Progression Funding. More companies are entering this sector owing to the potential growth opportunities. In the forecast period, the market will observe emerging competitors and a growing demand for animated content around the world.

Some of the key players include:

Recent Developments

- In November 2023, DeepMotion launched MotionGPT, a cutting-edge tool that uses generative artificial intelligence (AI) to turn text prompts into various 3D animations. MotionGPT simplifies the process of creating animation, opening up 3D animation to a wider audience of producers and businesses.

- In September 2023, Adobe released enhanced storage options for Frame.io, as well as AI and 3D features for Premiere Pro and After Effects. With the help of these AI-powered features, tedious tasks are automated, allowing motion designers and video editors to quickly realize their creative visions.

- Report ID: 6331

- Published Date: Sep 17, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Animation Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.