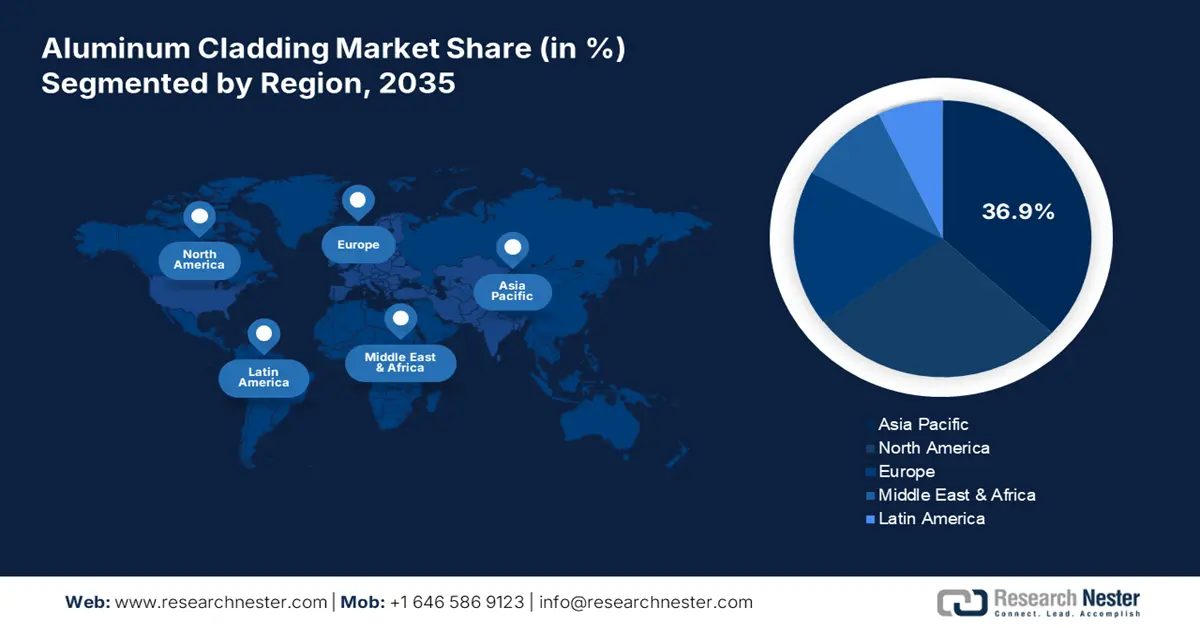

Aluminum Cladding Market Regional Analysis:

Asia Pacific Market Forecast

Asia Pacific in aluminum cladding market is anticipated to dominate over 36.9% revenue share by 2035, owing to rapid urban and industrial activities augmenting the sales of aluminum cladding products. The increasing investments in infrastructure development and upgrade projects are generating lucrative opportunities for aluminum cladding product manufacturers. India and China are estimated to offer long-term returns to aluminum cladding manufacturers, whereas the sales of aluminum cladding products are expected to increase at a healthy pace in Japan and South Korea.

In India, swift urbanization in the country necessitating investments in infrastructure development projects is generating high-earning opportunities for aluminum cladding producers. The India Brand Equity Foundation (IBEF) revealed that Infrastructure Investment Trusts (InvITs) and Real Estate Investment Trusts (REITs) have invested around US$ 15.60 billion in the past 4 years until March 2024.

China is a leading producer of aluminum across the world and holds around 60% of the global share. This factor makes China a dominating market for aluminum cladding, which can potentially influence global sales. According to a joint announcement by China’s Ministry of Finance and the State Taxation Administration (reported November 15, 2024), export tax rebates for copper and aluminum products will be canceled effective December 1. This move can tighten the global aluminum cladding market, leading to a high domestic presence of these metals. Furthermore, this underscores that the domestic market is expected to expand significantly.

North America Market Statistics

The North America aluminum cladding market is expected to increase at the fastest pace during the forecast period. The ongoing infrastructure development projects, green building regulations, sustainability trends, and technological advancements in construction materials are increasing the sales of aluminum cladding products. Both, the U.S. and Canada are off lucrative opportunities for aluminum cladding manufacturers.

In the U.S., the increasing focus on sustainability and energy efficiency is driving the use of aluminum cladding products in the construction sector. The ability to mitigate energy consumption in green buildings and high insulation properties are fueling the use of aluminum cladding in the construction sector. For instance, in August 2023, the U.S. Department of Energy announced an investment of around USD 46 million to accelerate energy efficiency and mitigate carbon emissions in residential and commercial buildings. Such investments are augmenting the sales of aluminum cladding products.

Canada is investing heavily in infrastructure development projects, which are fueling the sales of modern construction materials including, aluminum cladding products for panels and sheets. The increasing number of commercial buildings, healthcare facilities, and high-rise apartments is significantly contributing to the overall aluminum cladding market growth. For instance, the Government of Canada in its 2022 budget invested more than USD 33 billion in Infrastructure Program. Furthermore, the Government of Newfoundland and Labrador, Canada, revealed that it has invested around USD 1.1 billion for infrastructure development in 2023. To earn high profits, aluminum cladding manufacturers can focus on expanding their product offerings across Canada.