Aluminum Cladding Market Outlook:

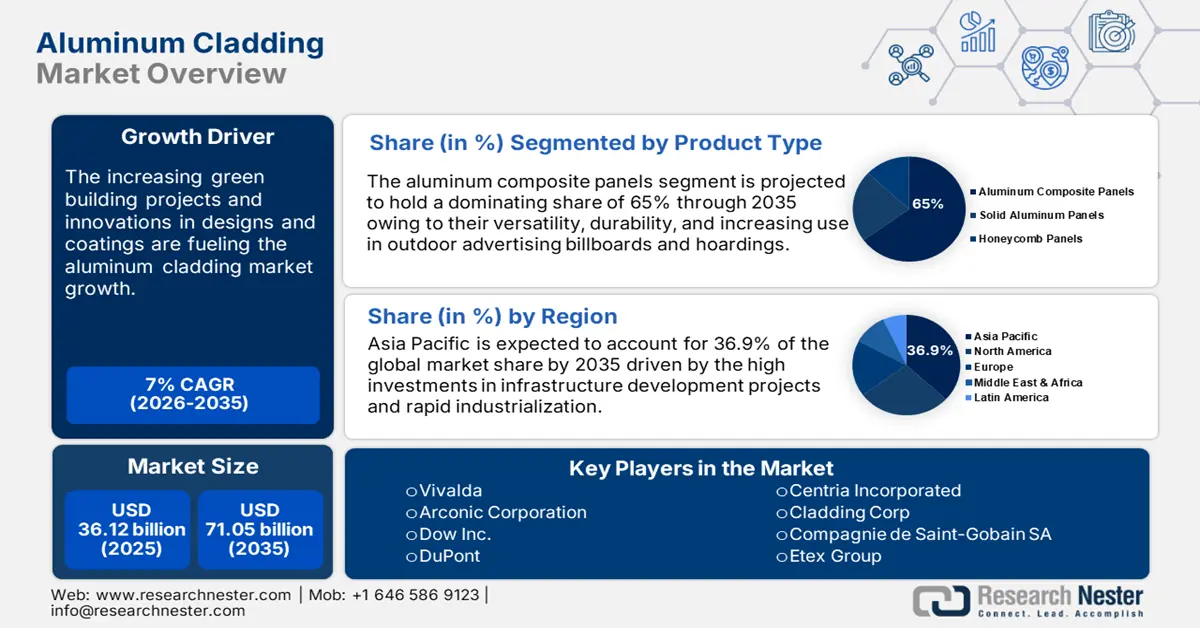

Aluminum Cladding Market size was over USD 36.12 billion in 2025 and is anticipated to cross USD 71.05 billion by 2035, growing at more than 7% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of aluminum cladding is estimated at USD 38.4 billion.

Aluminum cladding is rapidly gaining traction in the building and construction sector due to its cost-effectiveness, eco-friendly nature, durability, visual appeal, and low maintenance. The rising investments in both new infrastructure development projects and upgrades are augmenting the demand for aluminum cladding products. For instance, the Aluminum Association estimates that the rapid urban shift and increasing high-density population is set to augment 154 million LBs of aluminum usage in the construction sector between 2020 to 2025. The residential usage of aluminum grew 34% to 2.4 billion LB by 2024-end, wherein aluminum sheet and plate accounted for 1.17 billion LB usage.

According to industry estimates (Aluminum Association, IAI, and USGS data), every USD 100,000 of construction spending typically drives between 126 and 183 pounds of aluminum consumption, underscoring its growing role in residential and non-residential projects. Modern designs and low maintenance costs are set to uplift the aluminum metal roof usage to 23 to 25% by the end of 2025. This is expected to increase the demand for aluminum cladding products in the coming years.

Key Aluminum Cladding Market Insights Summary:

Regional Highlights:

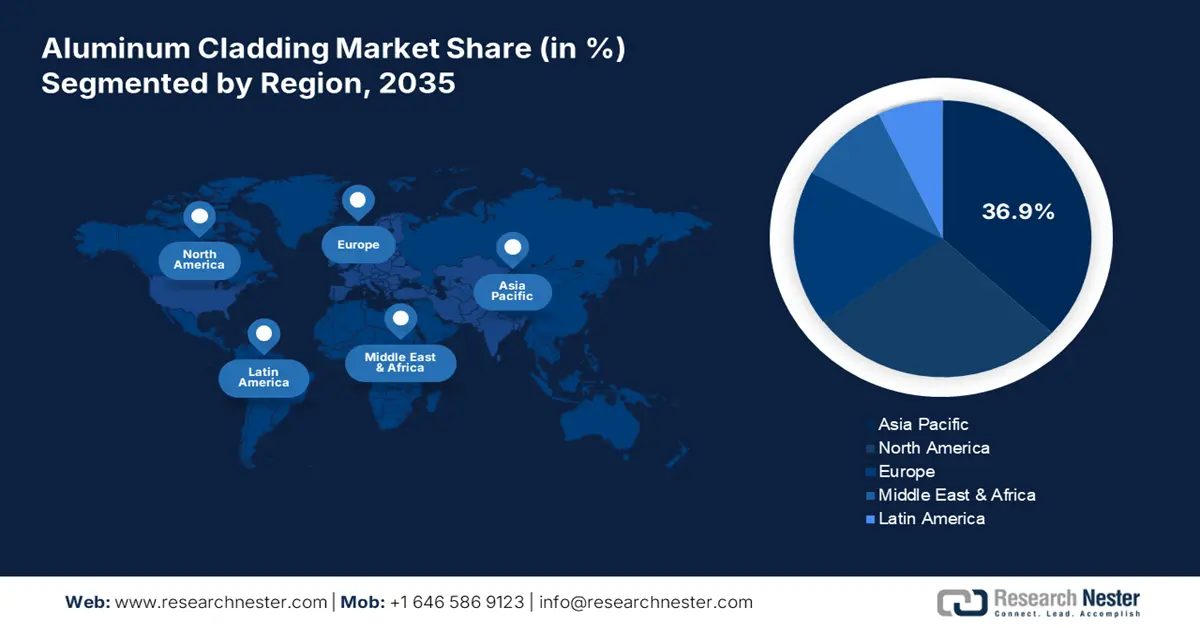

- Asia Pacific's 36.9% share in the aluminum cladding market is fueled by rapid urban and industrial activities augmenting the sales of aluminum cladding products, driving sustained growth through 2035.

- North America is anticipated to experience the fastest growth in the Aluminum Cladding Market from 2026 to 2035, driven by ongoing infrastructure projects, green building regulations, and sustainability trends.

Segment Insights:

- The Non-fire-rated ACP Sheet segment is expected to exceed 57.5% market share by 2035, fueled by the lower cost of non-fire-rated sheets and their growing use in budget-conscious construction projects.

- Aluminum Composite Panels segment are projected to capture over 65% market share by 2035, driven by high demand in architectural applications and digital outdoor advertising.

Key Growth Trends:

- Increasing use in green building

- Technological innovations

Major Challenges:

- Rising preference for cost-effective alternatives

- Supply chain disruptions

- Key Players: Vivalda, Arconic Corporation, Dow Inc., DuPont, and Boral Limited.

Global Aluminum Cladding Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 36.12 billion

- 2026 Market Size: USD 38.4 billion

- Projected Market Size: USD 71.05 billion by 2035

- Growth Forecasts: 7% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (36.9% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, United States, Germany, Japan, South Korea

- Emerging Countries: China, India, Japan, South Korea, Singapore

Last updated on : 14 August, 2025

Aluminum Cladding Market Growth Drivers and Challenges:

Growth Drivers

- Increasing use in green building: The sustainability and green building trend is positively influencing the demand for aluminum cladding in construction. Compared to other materials such as plastic and wood, aluminum is recyclable, lightweight, and effectively aids in mitigating carbon footprint. Recycling of aluminum cuts costs up to 92% associated with the primary production of aluminum. Leadership in Energy and Environmental Design (LEED), Green Globe, and International Green Construction Code (IgCC) are some of the green building certifications fueling the use of sustainable construction materials such as aluminum sheets and panels.

Many aluminum cladding product manufacturers earn high profits by aligning with the sustainability trend. For instance, in July 2024, Compagnie de Saint-Gobain SA one of the leaders in sustainable construction materials revealed that it captured a record operating margin of 11% in the first of FY 24. Through its 3 strategic acquisitions (Bailey, CSR, and FOSROC) it added USD 2.09 billion to the annual sales and around 441.5 million in EBITDA. - Technological innovations: The ongoing innovations in aluminum cladding in terms of improving its durability, weather resistance, and customizations are expected to boost global aluminum cladding market growth during the forecast period. Furthermore, the growing trend of smart buildings integrated with advanced materials and systems is augmenting the demand for aluminum cladding for use in solar panels, smart lighting, and walling. The rising construction of high-rise buildings such as skyscrapers is also driving the demand for lightweight aluminum cladding products such as panels and sheets.

For instance, the New York State government invested around USD 50 million in the Empire Building Challenge (EBC) to establish different ways to achieve carbon neutrality in tall buildings. This investment move is expected to align with the Climate Leadership and Community Protection Act’s goal of mitigating 85% of greenhouse gas emissions by 2050. Such investments are set to drive the use of sustainable materials such as aluminum claddings in the coming years.

Challenges

- Rising preference for cost-effective alternatives: The aluminum cladding market growth can be hampered due to the growing preference for alternative materials. Materials such as cement, fiber, and PVC are cost-effective and more durable in certain conditions compared to aluminum. Cement, for instance, can withstand adverse weather conditions, including fire. These features can appeal to end users to employ alternative construction materials, limiting the sales of aluminum cladding panels and sheets.

- Supply chain disruptions: Fluctuations in the supply chain due to factors such as raw material costs and trade restrictions can hinder the aluminum cladding market growth to some extent. Supply chain disruptions often lead to delays in final product availability, which can make aluminum a less attractive option in the construction sector.

Aluminum Cladding Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

7% |

|

Base Year Market Size (2025) |

USD 36.12 billion |

|

Forecast Year Market Size (2035) |

USD 71.05 billion |

|

Regional Scope |

|

Aluminum Cladding Market Segmentation:

Product Type (Aluminum Composite Panels, Solid Aluminum Panels, Honeycomb Panels)

Aluminum composite panels segment is projected to account for aluminum cladding market share of more than 65% by the end of 2035, owing to its high usage in architectural claddings, facades, and interior designing for ceiling panels, partitions, and decorative signage. Outdoor advertising one of the oldest and most effective ways of marketing, significantly contributes to the sales of aluminum composite panels. These panels integrated with digital technologies are used to display ads on billboards, hoardings, and advanced posters.

Sheet Type (Non-fire-rated ACP Sheet, Fire-rated Grade)

In aluminum cladding market, non-fire-rated ACP sheet segment is expected to hold revenue share of over 57.5% by the end of 2035. The low cost of non-fire-rated ACP sheets compared to fire-rated variants is increasing their use in budget-conscious construction projects. The ongoing advancements in manufacturing and material technologies are improving the performance of non-fire-rated ACP sheets. Advanced coatings and surface treatments are enhancing their resistance to UV degradation, corrosion, and other environmental factors. Thus, advanced non-fire-rated ACP sheets are finding high applications in commercial and residential buildings to enhance their aesthetics and functionalities.

Our in-depth analysis of the global aluminum cladding market includes the following segments:

|

Product Type |

|

|

Sheet Type |

|

|

Price Range |

|

|

Category |

|

|

Application |

|

|

End use |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Aluminum Cladding Market Regional Analysis:

Asia Pacific Market Forecast

Asia Pacific in aluminum cladding market is anticipated to dominate over 36.9% revenue share by 2035, owing to rapid urban and industrial activities augmenting the sales of aluminum cladding products. The increasing investments in infrastructure development and upgrade projects are generating lucrative opportunities for aluminum cladding product manufacturers. India and China are estimated to offer long-term returns to aluminum cladding manufacturers, whereas the sales of aluminum cladding products are expected to increase at a healthy pace in Japan and South Korea.

In India, swift urbanization in the country necessitating investments in infrastructure development projects is generating high-earning opportunities for aluminum cladding producers. The India Brand Equity Foundation (IBEF) revealed that Infrastructure Investment Trusts (InvITs) and Real Estate Investment Trusts (REITs) have invested around US$ 15.60 billion in the past 4 years until March 2024.

China is a leading producer of aluminum across the world and holds around 60% of the global share. This factor makes China a dominating market for aluminum cladding, which can potentially influence global sales. According to a joint announcement by China’s Ministry of Finance and the State Taxation Administration (reported November 15, 2024), export tax rebates for copper and aluminum products will be canceled effective December 1. This move can tighten the global aluminum cladding market, leading to a high domestic presence of these metals. Furthermore, this underscores that the domestic market is expected to expand significantly.

North America Market Statistics

The North America aluminum cladding market is expected to increase at the fastest pace during the forecast period. The ongoing infrastructure development projects, green building regulations, sustainability trends, and technological advancements in construction materials are increasing the sales of aluminum cladding products. Both, the U.S. and Canada are off lucrative opportunities for aluminum cladding manufacturers.

In the U.S., the increasing focus on sustainability and energy efficiency is driving the use of aluminum cladding products in the construction sector. The ability to mitigate energy consumption in green buildings and high insulation properties are fueling the use of aluminum cladding in the construction sector. For instance, in August 2023, the U.S. Department of Energy announced an investment of around USD 46 million to accelerate energy efficiency and mitigate carbon emissions in residential and commercial buildings. Such investments are augmenting the sales of aluminum cladding products.

Canada is investing heavily in infrastructure development projects, which are fueling the sales of modern construction materials including, aluminum cladding products for panels and sheets. The increasing number of commercial buildings, healthcare facilities, and high-rise apartments is significantly contributing to the overall aluminum cladding market growth. For instance, the Government of Canada in its 2022 budget invested more than USD 33 billion in Infrastructure Program. Furthermore, the Government of Newfoundland and Labrador, Canada, revealed that it has invested around USD 1.1 billion for infrastructure development in 2023. To earn high profits, aluminum cladding manufacturers can focus on expanding their product offerings across Canada.

Key Aluminum Cladding Market Players:

- Vivalda

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Arconic Corporation

- Dow Inc.

- DuPont

- Boral Limited

- Cembrit Holding AS

- Centria Incorporated

- Cladding Corp

- Compagnie de Saint-Gobain SA

- Etex Group

- James Hardie Industries PLC

- Kingspan Group

- Middle East Insulation LLC

- Cortizo

- OmniMax International, Inc.

- Tata Steel Ltd

- Trespa International B.V.

Key players in the aluminum cladding market are increasing their revenue streams and gaining a competitive edge by adopting a combination of organic and inorganic strategies such as technological innovations, strategic partnerships, regional expansion, mergers & acquisitions, and a strong emphasis on sustainability trends. For instance, in November 2024, DuPont announced its net sales of USD 3.2 billion raised by 4% and the organic sales surpassed 3% compared to previous years.

Industry giants are introducing a wide range of aluminum cladding products tailored to different aluminum cladding market segments such as residential, commercial, and, industrial buildings, meeting consumer's specific demands is boosting their revenue streams. Furthermore, by forming strategic collaborations they are introducing innovative aluminum cladding products, attracting a wider consumer base.

Some of the key players include:

Recent Developments

- In September 2024, Cortizo and AIC Equip signed an Infinity Partner agreement to use 100% post-consumer recycled aluminum. This move by the companies is to align with the sustainability trend and mitigate the carbon footprint.

- In December 2023, Vivalda a leading producer of aluminum composite panels announced the launch of a new fire-rated architectural infill panel available in 28mm to 150mm thickness. With this move, the company is accelerating its sales in the U.K.

- Report ID: 6770

- Published Date: Aug 14, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Aluminum Cladding Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.