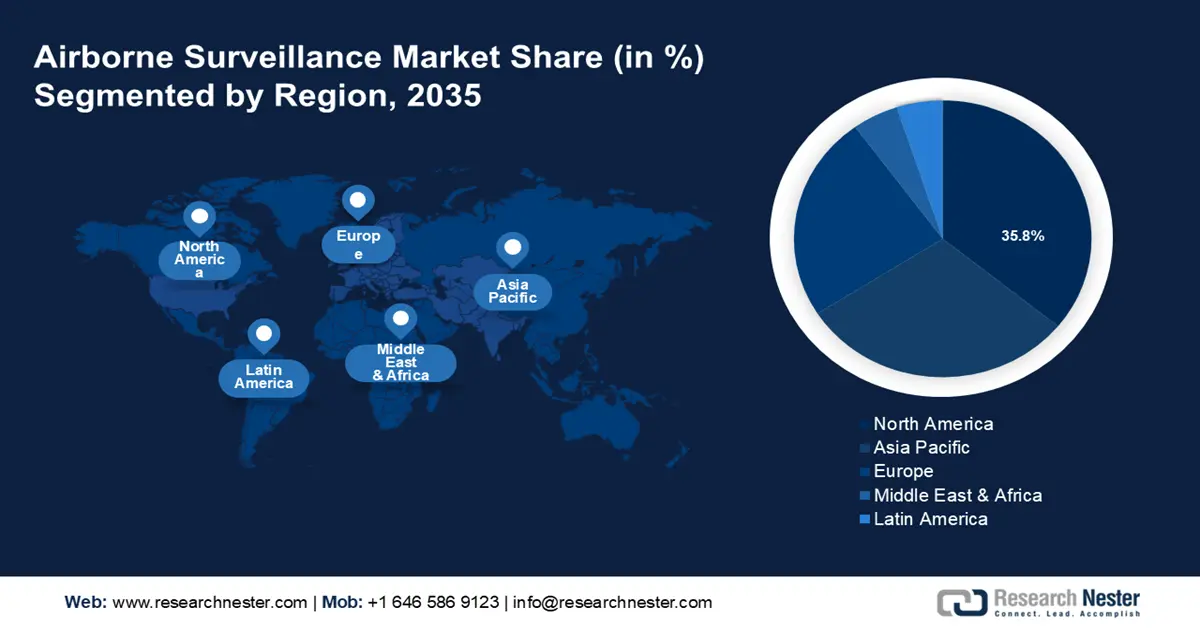

Airborne Surveillance Market Regional Analysis:

North America Market Insights

North America industry is poised to account for largest revenue share of 35.8% by 2035, owing to its substantial R&D expenditures and sophisticated defense infrastructure. To maintain military superiority around the world, the U.S. Department of Defense allows significant expenditures for the purchase and modernization of surveillance equipment. In addition, there is a thriving commercial UAV sector in the area, with uses in public safety, construction, energy, and agriculture. For instance, the Federal Aviation Administration (FAA) stated that there were 863,728 registered drones in the U.S. as of January 2024. 352,222 of these are intended for business usage, and 506,635 are for personal use. By 2026, the FAA predicts that there will be 858,000 commercial drones in use.

The U.S. dominates the world airborne surveillance market owing to its large defense budget and commitment to preserving its technological dominance. The U.S. military widely uses UAVs, manned aircraft, and satellites for intelligence, surveillance, and reconnaissance (ISR) purposes. The nation is home to a flourishing commercial drone industry, which uses drones for everything from environmental monitoring to emergency response and agriculture & infrastructure inspection. To safely integrate unmanned aerial vehicles (UAVs) into the national airspace and assist airborne surveillance market growth, the Federal Aviation Administration (FAA) is a key player in this regard.

Canada's emphasis on border security and environmental monitoring is also helping the sector flourish. The region's technological prowess and well-suited legislative environments facilitate the widespread uptake and development of aerial surveillance technologies.

Asia Pacific Market Insights

Asia Pacific is expected to experience a stable CAGR during the forecast period due to rise in demand for UAVs as more people become aware of their advantages. Furthermore, the airborne surveillance market in the area is anticipated to be driven by the growing need for aerial investigation from the military and defense sectors of nations like China and India. For example, the High Speed Expendable Aerial Target (HEAT) called ABHYAS, with an enhanced booster configuration has completed six consecutive developmental trials from the Integrated Test Range (ITR), Chandipur, Odisha, according to the Defence Research and Development Organization (DRDO). By doing this, ABHYAS has effectively finished ten developmental trials that show the system's dependability.

Driven by its ambitious defense modernization plans and growing demand for commercial UAV uses, China is quickly boosting its capabilities for airborne surveillance. The government is making significant investments in the creation and implementation of cutting-edge military, border, and maritime surveillance systems. With widespread applications in logistics, construction, and agriculture, China's booming commercial drone sector is also boosting the airborne surveillance market. A wide range of surveillance platforms and components are produced and exported by the nation thanks to its robust industrial base and technical breakthroughs.

Growing as a major player in the aerial surveillance business, South Korea is concentrating on strengthening its defenses and utilizing UAV technology for a range of purposes. To defend against regional threats and maintain national security, the South Korea government is investing in cutting-edge ISR systems. The nation is also investigating the use of unmanned aerial vehicles (UAVs) for environmental monitoring, infrastructure inspection, and disaster management. Modern airborne surveillance solutions are developed and implemented thanks to South Korea's dedication to innovation and cooperative efforts with foreign partners.