Airborne Surveillance Market Outlook:

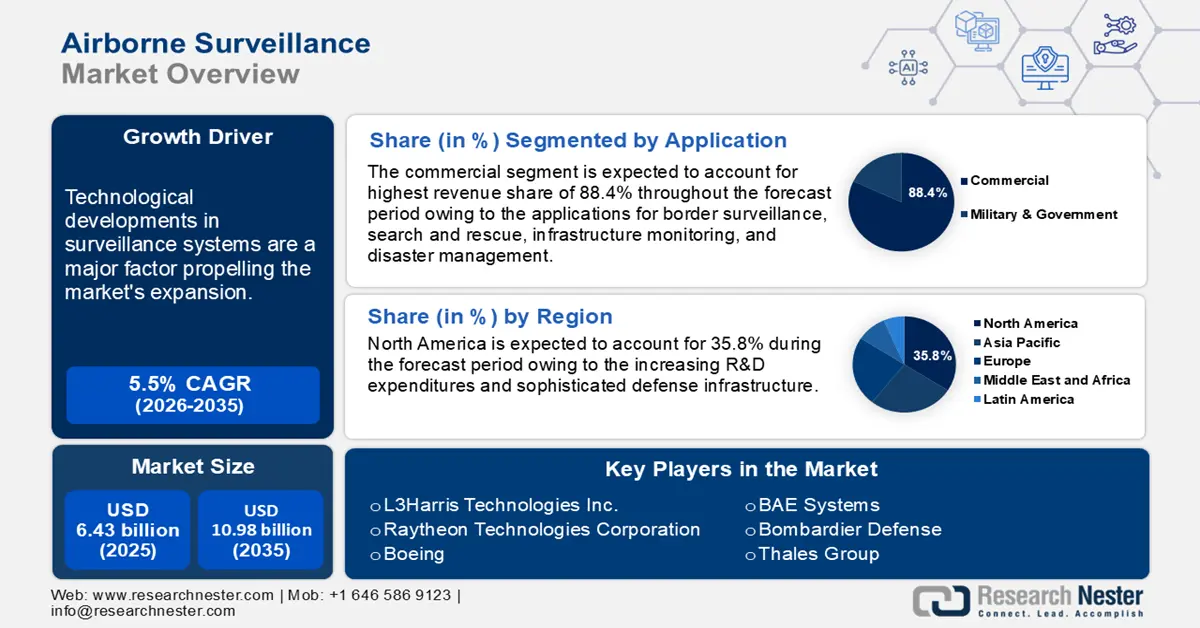

Airborne Surveillance Market size was over USD 6.43 billion in 2025 and is projected to reach USD 10.98 billion by 2035, witnessing around 5.5% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of airborne surveillance is evaluated at USD 6.75 billion.

Technological developments in surveillance systems are a major factor propelling the airborne surveillance market's expansion. Advances in radar systems, infrared sensors, and high-definition imagery have improved the capabilities of aerial surveillance aircraft. Improved object tracking, identification, and detection are made possible by these technologies and are essential for military, law enforcement, and commercial uses. For example, in September 2024, HENSOLDT a leading manufacturer of defense and security electronics worldwide HENSOLDT announced the debut of the ARGOS-15, a next-generation aerial imaging system, at the Africa Aerospace and Defence (AAD) Expo. This eagerly awaited system is expected to become the standard for contemporary intelligence, surveillance, and reconnaissance (ISR) missions. It is a major leap in multispectral sensor technology.

Another important factor is the growing need for maritime and border security. Countries are putting more and more effort into fortifying their borders against illicit operations including human trafficking, smuggling, and illegal immigration. Massive border areas and marine regions are being monitored by airborne surveillance platforms, which include drones and manned planes fitted with advanced monitoring gear. The increased emphasis on safeguarding the country and averting international dangers is driving up demand for aerial surveillance systems.

Key Airborne Surveillance Market Insights Summary:

Regional Highlights:

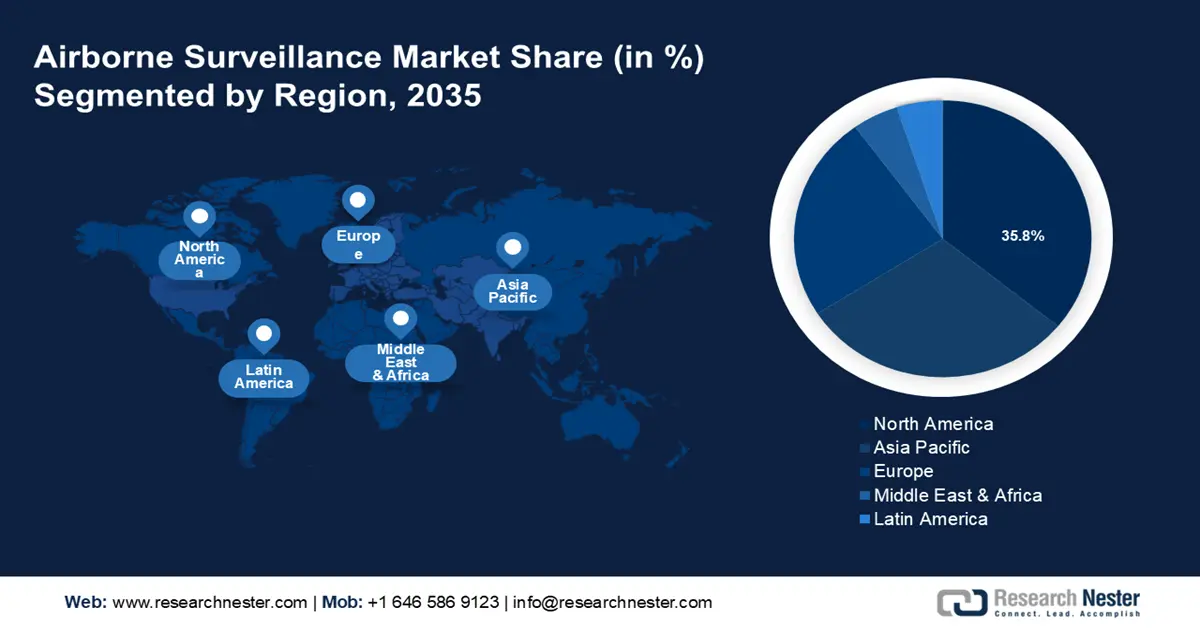

- North America airborne surveillance market will account for 35.80% share by 2035, driven by substantial R&D expenditures and sophisticated defense infrastructure.

- Asia Pacific market will register stable CAGR during 2026-2035, driven by the rise in demand for UAVs and the growing need for aerial investigation from the military and defense sectors of nations like China and India.

Segment Insights:

- The commercial segment in the airborne surveillance market is projected to hold an 88.40% share by 2035, driven by demand for sensors, imaging systems, and investments in advanced radars and cameras.

- The manned system segment in the airborne surveillance market is projected to hold a significant share by 2035, influenced by preference for larger payloads, longer missions, and human decision-makers on board.

Key Growth Trends:

- Integration of artificial intelligence (AI), machine learning, and IoT

- Increased usage of Unmanned Aerial Systems (UAS) in military

Major Challenges:

- High expense associated with airborne surveillance system deployment

- Scarce supply of expert drone operators

Key Players: Lockheed Martin Corporation, Northrop Grumman Corporation, L3Harris Technologies Inc., Raytheon Technologies Corporation, Boeing, Thales Group, BAE Systems, Bombardier Defense Thales.

Global Airborne Surveillance Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 6.43 billion

- 2026 Market Size: USD 6.75 billion

- Projected Market Size: USD 10.98 billion by 2035

- Growth Forecasts: 5.5% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (35.8% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Russia, Germany, United Kingdom

- Emerging Countries: China, India, Japan, South Korea, Thailand

Last updated on : 18 September, 2025

Airborne Surveillance Market Growth Drivers and Challenges:

Growth Drivers

- Integration of artificial intelligence (AI), machine learning, and IoT: Drones and other industry innovations are receiving more attention from a variety of sectors for use in surveillance activities. The drone product line has improved due to technological developments in cameras, microcontrollers, sensors, CPUs, etc. The businesses are creating integrated measurement and annotation tools with volume, area, and distance calculations. The IoT, AI, and machine learning enable the UAVs to store and process vast amounts of data. Because AI-powered surveillance systems can identify airborne activities more accurately than traditional aerial surveillance systems, there will likely be an increasing demand for the integration of IoT and AI-powered surveillance systems.

- Increased usage of Unmanned Aerial Systems (UAS) in military: Using their real-time intelligence, surveillance, and reconnaissance (ISR) capabilities, military drones collect data regarding combat operations. Increased UAV purchases to improve defense capabilities are anticipated to support the growth of the airborne surveillance industry. Furthermore, because there is a growing need for sophisticated intelligence collection and analysis capabilities, the growing defense budget is anticipated to support airborne surveillance market expansion. For instance, the Canadian government granted a contract for USD 72 million to General Dynamics Mission Systems and Voyager Aviation Corporation in May 2021 for the in-service support and maintenance of the three King Air 350ER aircraft. To enhance situational awareness, the aircraft will be equipped with sophisticated sensors and other military-grade hardware. It is anticipated that the three aircraft would be delivered to the Canadian government by 2022.

- Accessible low-cost drones: Fixed-wing and rotary-wing aircraft are used in traditional aerial surveillance techniques. These are expensive and time-consuming procedures. Drones are affordable and require less time to operate than conventional types of aircraft. Because drones are inexpensive and provide effective results, there has been an increase in their use for surveillance purposes. Drone production costs have also dropped as a result of the manufacturing sector's fast industrialization and automation. As a result, drones are widely accessible and reasonably priced, which is anticipated to support airborne surveillance market expansion.

Challenges

- High expense associated with airborne surveillance system deployment: Aerial surveillance equipment includes cameras, radars, sensors, and other parts. The sophisticated sensors can deliver precise data. However, due to their intricate design, the sensors are costly to develop. As the components are subjected to harsh climatic conditions, the design is intricate and therefore more expensive. The extraordinary investigative capabilities of Light Detecting and Ranging (LiDAR) sensors have led to their widespread adoption. Nevertheless, the sensors' development is expensive.

- Scarce supply of expert drone operators: Drones must be operated by qualified and experienced drone pilots to scan offshore and onshore structures, hence the industry is anticipated to grow slowly due to a lack of these pilots. Federal policies and regulations in the United States stipulate that drone operators need to possess a certified long-range pilot certificate that has been authorized by the Federal Aviation Administration (FAA). Furthermore, stringent government laws governing drone use are anticipated to impede airborne surveillance market expansion.

Airborne Surveillance Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

5.5% |

|

Base Year Market Size (2025) |

USD 6.43 billion |

|

Forecast Year Market Size (2035) |

USD 10.98 billion |

|

Regional Scope |

|

Airborne Surveillance Market Segmentation:

Application Segment Analysis

Commercial segment is predicted to hold airborne surveillance market share of over 88.4% by the end of 2035. Border surveillance, search and rescue, infrastructure monitoring, environmental observation, and disaster management are all applications in the commercial section of the market. The need for sensors and imaging systems is being driven by commercial drones. Additionally, it is anticipated that growing investments in the development of sophisticated radars, sensors, and cameras will support airborne surveillance market expansion. For instance, in November 2020, the Joint Artificial Intelligence Center (JAIC) has granted a USD 93.3 million contract to General Atomics Aeronautical Systems, Inc. (GA-ASI) to improve unmanned aircraft's autonomous sensing capabilities.

Businesses operating in the energy, agricultural, and logistics sectors depend more and more on cutting-edge aerial surveillance systems to maximize resource management, guarantee operational safety, and improve operational efficiency. Drones with LiDAR, high-resolution cameras, and other sensors are frequently employed for aerial mapping, crop monitoring, and pipeline inspection. The commercial sector is adopting airborne surveillance systems due to the growing need for real-time data and the ability to cover broad areas rapidly and economically. Furthermore, factors driving this segment's growth are developments in sensor technology, data analytics, and regulatory frameworks.

Product Type Segment Analysis

In airborne surveillance market, manned system segment is expected to dominate revenue share of around 63.9% by the end of 2035. Helicopters and fixed-wing aircraft fitted with cutting-edge surveillance gear are examples of conventional aircraft used in manned airborne surveillance systems. Pilots and crew members use these technologies to carry out surveillance missions for both government and private clients. As they can carry larger payloads and last longer, manned systems are favored for some activities. Additionally, having human decision-makers on board can be quite important in dynamic scenarios. Airborne Warning and Control System (AWACS) aircraft and P-8 Poseidon maritime patrol aircraft are two examples. The manned systems component is still essential, especially for missions involving a large amount of human participation and for nations with developed infrastructure and experience with piloting these kinds of aircraft.

Our in-depth analysis of the global airborne surveillance market includes the following segments:

|

Component |

|

|

Product Type |

|

|

Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Airborne Surveillance Market Regional Analysis:

North America Market Insights

North America industry is poised to account for largest revenue share of 35.8% by 2035, owing to its substantial R&D expenditures and sophisticated defense infrastructure. To maintain military superiority around the world, the U.S. Department of Defense allows significant expenditures for the purchase and modernization of surveillance equipment. In addition, there is a thriving commercial UAV sector in the area, with uses in public safety, construction, energy, and agriculture. For instance, the Federal Aviation Administration (FAA) stated that there were 863,728 registered drones in the U.S. as of January 2024. 352,222 of these are intended for business usage, and 506,635 are for personal use. By 2026, the FAA predicts that there will be 858,000 commercial drones in use.

The U.S. dominates the world airborne surveillance market owing to its large defense budget and commitment to preserving its technological dominance. The U.S. military widely uses UAVs, manned aircraft, and satellites for intelligence, surveillance, and reconnaissance (ISR) purposes. The nation is home to a flourishing commercial drone industry, which uses drones for everything from environmental monitoring to emergency response and agriculture & infrastructure inspection. To safely integrate unmanned aerial vehicles (UAVs) into the national airspace and assist airborne surveillance market growth, the Federal Aviation Administration (FAA) is a key player in this regard.

Canada's emphasis on border security and environmental monitoring is also helping the sector flourish. The region's technological prowess and well-suited legislative environments facilitate the widespread uptake and development of aerial surveillance technologies.

Asia Pacific Market Insights

Asia Pacific is expected to experience a stable CAGR during the forecast period due to rise in demand for UAVs as more people become aware of their advantages. Furthermore, the airborne surveillance market in the area is anticipated to be driven by the growing need for aerial investigation from the military and defense sectors of nations like China and India. For example, the High Speed Expendable Aerial Target (HEAT) called ABHYAS, with an enhanced booster configuration has completed six consecutive developmental trials from the Integrated Test Range (ITR), Chandipur, Odisha, according to the Defence Research and Development Organization (DRDO). By doing this, ABHYAS has effectively finished ten developmental trials that show the system's dependability.

Driven by its ambitious defense modernization plans and growing demand for commercial UAV uses, China is quickly boosting its capabilities for airborne surveillance. The government is making significant investments in the creation and implementation of cutting-edge military, border, and maritime surveillance systems. With widespread applications in logistics, construction, and agriculture, China's booming commercial drone sector is also boosting the airborne surveillance market. A wide range of surveillance platforms and components are produced and exported by the nation thanks to its robust industrial base and technical breakthroughs.

Growing as a major player in the aerial surveillance business, South Korea is concentrating on strengthening its defenses and utilizing UAV technology for a range of purposes. To defend against regional threats and maintain national security, the South Korea government is investing in cutting-edge ISR systems. The nation is also investigating the use of unmanned aerial vehicles (UAVs) for environmental monitoring, infrastructure inspection, and disaster management. Modern airborne surveillance solutions are developed and implemented thanks to South Korea's dedication to innovation and cooperative efforts with foreign partners.

Airborne Surveillance Market Players:

- Saab

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Lockheed Martin Corporation

- Northrop Grumman Corporation

- L3Harris Technologies Inc.

- Raytheon Technologies Corporation

- Boeing

- BAE Systems

- Bombardier Defense

- Thales Group

The following is a list of the leading companies in the airborne surveillance market. Collectively, these companies command the majority of the market and shape the course of industry trends. The strategy maps, goods, and financials of these airborne surveillance companies are analyzed to map the supply network. In the airborne surveillance market, Lockheed Martin Corporation and Northrop Grumman Corporation are major players. Lockheed Martin Corporation's vast experience, cutting-edge technological skills, and wide range of products have allowed them to hold a substantial market share in the airborne surveillance sector. For many years, the corporation has led the defense and aerospace sectors. It provides a variety of airborne surveillance systems, such as the cutting-edge F-35 Lightning II and the well-known U-2 Dragon Lady.

Here are some leading players in the airborne surveillance market:

Recent Developments

- In June 2024, Thales, Spire Global, and European Satellite Services Provider (ESSP) inked a Memorandum of Cooperation to provide the air traffic management (ATM) sector and the larger aviation market with a variety of cutting-edge worldwide satellite-based surveillance services. A dedicated constellation of more than 100 satellites will power these services by gathering Automatic Dependent Surveillance-Broadcast (ADS-B) communications sent by airplanes and sending the information back to Earth in real-time.

- In November 2023, Bombardier Defense informed that Saab, a defense and security business, has received its seventh Global aircraft, which is prepared to be converted into Saab's Airborne Early Warning and Control (AEW&C) system, known as GlobalEye. This new supply coincides with the two businesses' attendance at the Dubai Air Show 2023, where Saab will be showcasing GlobalEye's leading capabilities and Bombardier will be introducing its adaptable Global and Challenger business jets to the Middle East market.

- Report ID: 6486

- Published Date: Sep 18, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Airborne Surveillance Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.