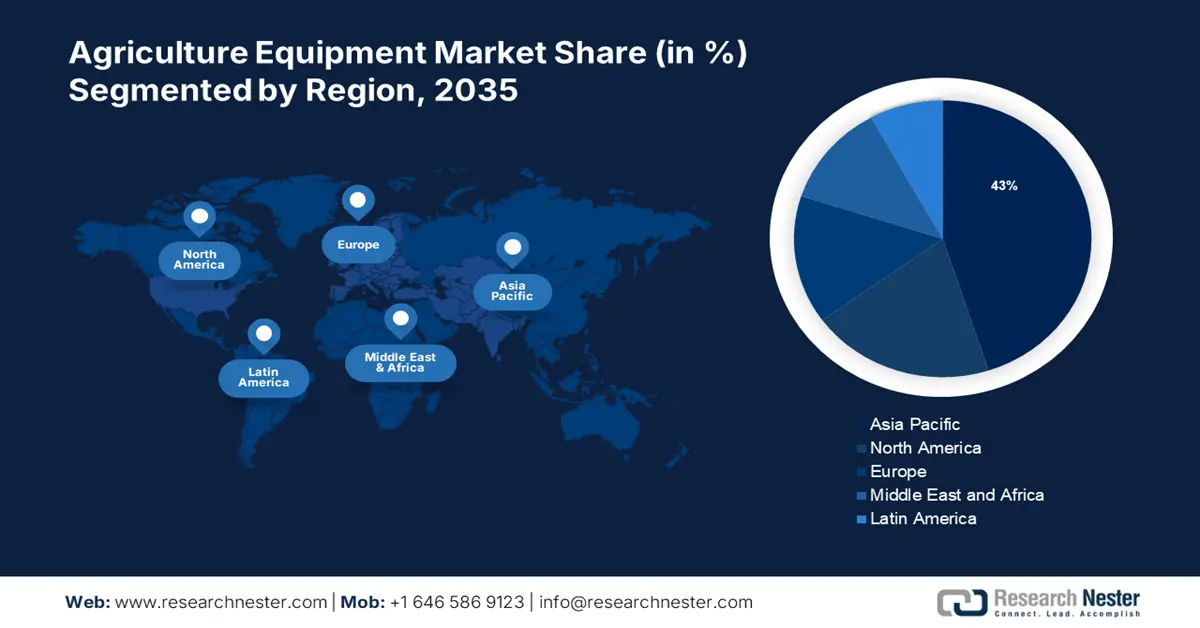

Agriculture Equipment Market Regional Analysis:

APAC Market Insights

Asia Pacific industry is predicted to account for largest revenue share of 43% by 2035. The landscape's substantial growth in the region is expected to be credited to the surge in labor costs in the agriculture industry coupled with poor working conditions in this region. According to a report by the International Labor Organization in 2022, only 7% of the total employed workers in agriculture were salaried in 2021, and this is an increase of about 0.1% since 2011. Furthermore, the majority of the workers were unpaid or in own-account work.

According to Chinese agriculture equipment market analysis, the number of large and medium tractors was valued at about 5 million in 2022, and this is an increase from 2021, which had a count of about 4 million.

According to a report published by OECD in 2020, there is about 11.8% of total agricultural land in Japan, owing to the country's mountainous topography.

North American Market Insights

The North American region will also encounter a huge influence on agriculture equipment market demand during the forecast period and will account for the second position attributed to the presence of large farmlands, which fuel the demand for farm machinery. According to the United States Department of Agriculture's (USDA) National Agricultural Statistics Service, the average farm size increased from 444 acres in 2020 to 445 acres in 2021.

Through the United States Department of Agriculture Direct Operating Loans, Operating Microloans, and Guaranteed Operating Loans, the US government offers loans for farm equipment. Due to almost double easy loans and their desire to increase productivity, farmers are becoming more tech-savvy, which has led to gains for a variety of machinery.

To help farmers enhance farm management and their financial performance, the Canadian Ministry of Agriculture and Agri-Food announced in 2022 that SomaDetect Inc. and Vivid Machines Inc. received over USD 1 million in funding through the AgriScience Program.