Agriculture Equipment Market Outlook:

Agriculture Equipment Market size was over USD 173.58 billion in 2025 and is anticipated to cross USD 325.83 billion by 2035, witnessing more than 6.5% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of agriculture equipment is assessed at USD 183.73 billion.

The agriculture equipment market expansion is anticipated by the slated growth in the demand for better management of crops to improve the quality and quantity of food as there is a high demand for food worldwide. According to a 2023 published report by the Organization for Economic Co-Operation and Development (OECD), it is estimated that agricultural commodities would gain a growth share of about 1.3% per year for the next 10 years.

Key Agriculture Equipment Market Insights Summary:

Regional Highlights:

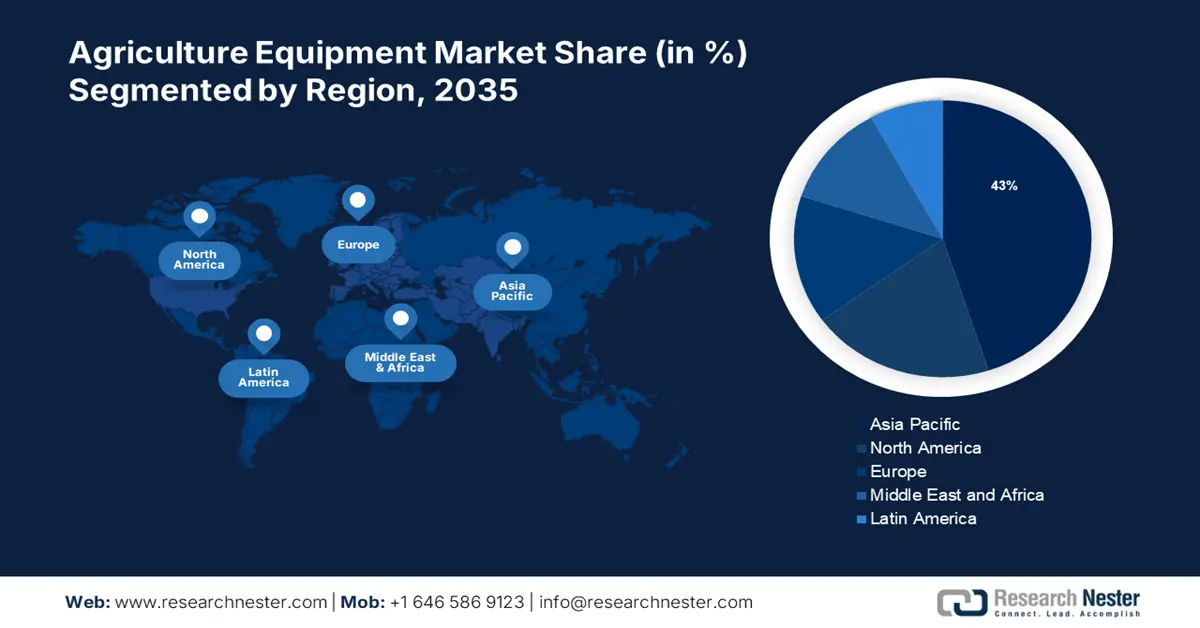

- Asia Pacific agriculture equipment market is anticipated to capture 43% share by 2035, driven by rising labor costs and poor working conditions driving demand for automation.

- North America market will achieve huge CAGR during 2026-2035, driven by large farmland availability and supportive government loan programs.

Segment Insights:

- The tractors segment in the agriculture equipment market is forecasted to show substantial growth till 2035, driven by the lack of human resources and the need to meet nutritional demands.

- The land development & seedbed preparation segment in the agriculture equipment market is projected to see lucrative growth till 2035, driven by fewer agricultural laborers and increased equipment needs.

Key Growth Trends:

- Declining areas for agriculture

- Government support in agriculture

Major Challenges:

- Low purchasing power with high cost

- Decreasing farmland for agriculture

Key Players: Alamo Group, Mahindra, AGCO Corporation, FlieglAgro-Center GmbH, APV GmbH, Bellota Agrisolutions, CLAAS KGaAmbH, CNH Industrial N.V., MaterMacc S.p.A, Morris Equipment Ltd.

Global Agriculture Equipment Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 173.58 billion

- 2026 Market Size: USD 183.73 billion

- Projected Market Size: USD 325.83 billion by 2035

- Growth Forecasts: 6.5% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (43% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, Japan, India

- Emerging Countries: China, India, Thailand, Indonesia, Brazil

Last updated on : 17 September, 2025

Agriculture Equipment Market Growth Drivers and Challenges:

Growth Drivers

-

Declining areas for agriculture - As the labor force surges, the areas of arable land are decreasing globally, and this demand for several agriculture mechanisms and machinery, such as robots, along with a slated increase in large-scale farming. According to a report by Our World in Data in 2023, globally, in most of the countries, the land dedicated to cropland is observed to be lower than 20%, while several countries dedicate less than 10%.

- Government support in agriculture - The government has introduced several schemes, plans, and initiatives to promote agricultural activities and increase the usage of farm machinery and mechanized farming methods. According to a report published by the OECD in 2022, total agricultural support worldwide surpassed 817 billion every year from 2019 to 2021 in about 54 countries, which is an increase of about 13% from 720 billion in 2018 to 2020.

- Increase in automation - The use of fully automated machinery has boosted the production of the agricultural sector, and the amount of automation in these machines has increased as well. The agriculture equipment market growth has resulted tremendously from the use of tools with higher levels of automation. According to Research Nester analysis, in 2024, it was witnessed that automation has been adopted by more than 75% of companies that have registered a lucrative gain of about 10-12% in their productivity.

Challenges

-

Low purchasing power with high cost - The machinery used in farming and agriculture is very expensive. Large capital investments are needed for equipment including cultivators, tractors, harvesters, crop sprayers, and trailers. Due to their limited purchasing power, many farmers-especially those from developing nations like Brazil, Indonesia, India, and South Africa—cannot afford such costly machinery. Because of this, rising agriculture equipment market like the Middle East and Latin America have less need for these machines. Therefore, it is anticipated that these factors will limit market expansion throughout the projected time.

- Decreasing farmland for agriculture- Farmlands have been converted into commercial buildings over time as a result of global urbanization trends. These farmlands are being utilized for commercial projects like shopping malls, hotels, and residences. The usage of farm equipment and agriculture is indirectly impacted by this. Driven by the small size of farmlands and the lengthy return on investment period, it has become difficult for individual farmers to acquire heavy equipment. Therefore, it is anticipated that these issues will impede the growth of global agriculture equipment market revenue in the near future.

Agriculture Equipment Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

6.5% |

|

Base Year Market Size (2025) |

USD 173.58 billion |

|

Forecast Year Market Size (2035) |

USD 325.83 billion |

|

Regional Scope |

|

Agriculture Equipment Market Segmentation:

Product Segment Analysis

Tractors segment is expected to hold more than 35% agriculture equipment market share by 2035. The segment's tremendous growth rate can be augmented by the lack of human resources and the need for population growth to meet the world's nutritional requirements. Tractors are now essential for the agriculture sector to become more productive. According to the OECD in 2023, there is an expected fall in the employment landscape of Europe in the next decade of about 13%, with a huge decline for low-skilled workers. Moreover, over the coming years, advancements in automated material handling equipment should support the segment's expansion.

The agriculture equipment market value is expanding as a result of the growing acceptance of smart combine harvesters and the incorporation of smart actuators into already-existing harvesters. Farmers can better regulate harvesting applications and monitor grain flow with smart combine harvesters.

Application Segment Analysis

Land development & seedbed preparation segment in the agriculture equipment market is poised to register lucrative growth till 2035. since there are fewer agricultural laborers in the world, and this shortage causes the country's development process to require more equipment. According to a report by the OECD in 2023, in Australia, the percentage of working people on farms was reduced by 5.5%, along with a reduction of about 20% in the number of farm managers.

Regarding developed nations, labor has become much less available, which has increased the need for this equipment, which is projected to grow rapidly over the next several years. In addition, more tractors will be used to develop the land. The advantages of using tractors include higher productivity and shorter processing times for these tasks. Throughout the slated period, the segments for threshing and harvesting will likewise expand strongly.

Our in-depth analysis of the global agriculture equipment market includes the following segments:

|

Product |

|

|

Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Agriculture Equipment Market Regional Analysis:

APAC Market Insights

Asia Pacific industry is predicted to account for largest revenue share of 43% by 2035. The landscape's substantial growth in the region is expected to be credited to the surge in labor costs in the agriculture industry coupled with poor working conditions in this region. According to a report by the International Labor Organization in 2022, only 7% of the total employed workers in agriculture were salaried in 2021, and this is an increase of about 0.1% since 2011. Furthermore, the majority of the workers were unpaid or in own-account work.

According to Chinese agriculture equipment market analysis, the number of large and medium tractors was valued at about 5 million in 2022, and this is an increase from 2021, which had a count of about 4 million.

According to a report published by OECD in 2020, there is about 11.8% of total agricultural land in Japan, owing to the country's mountainous topography.

North American Market Insights

The North American region will also encounter a huge influence on agriculture equipment market demand during the forecast period and will account for the second position attributed to the presence of large farmlands, which fuel the demand for farm machinery. According to the United States Department of Agriculture's (USDA) National Agricultural Statistics Service, the average farm size increased from 444 acres in 2020 to 445 acres in 2021.

Through the United States Department of Agriculture Direct Operating Loans, Operating Microloans, and Guaranteed Operating Loans, the US government offers loans for farm equipment. Due to almost double easy loans and their desire to increase productivity, farmers are becoming more tech-savvy, which has led to gains for a variety of machinery.

To help farmers enhance farm management and their financial performance, the Canadian Ministry of Agriculture and Agri-Food announced in 2022 that SomaDetect Inc. and Vivid Machines Inc. received over USD 1 million in funding through the AgriScience Program.

Agriculture Equipment Market Players:

- Alamo Group

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Mahindra

- AGCO Corporation

- FlieglAgro-Center GmbH

- APV GmbH

- Bellota Agrisolutions

- CLAAS KGaAmbH

- CNH Industrial N.V.

- MaterMacc S.p.A

- Morris Equipment Ltd

Most of the companies are continuously collaborating, expanding, making agreements, and joining ventures for the growth of this sector and are estimated to be the major key players in this landscape.

Recent Developments

- Alamo Group- New Holland Agriculture and the Agricultural Division of the Alamo Group, a top provider of tools and accessories that fit the range of New Holland compact and mid-range tractors, have formed a strategic alliance.

- Mahindra- The National Farm Machinery Show attended the initiation of two new compact and sub-compact tractor models by Mahindra. With improved power comfort and functions, the new "Powered by OJA" tractors aim to improve user experience.

- Report ID: 6226

- Published Date: Sep 17, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Agriculture Equipment Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.