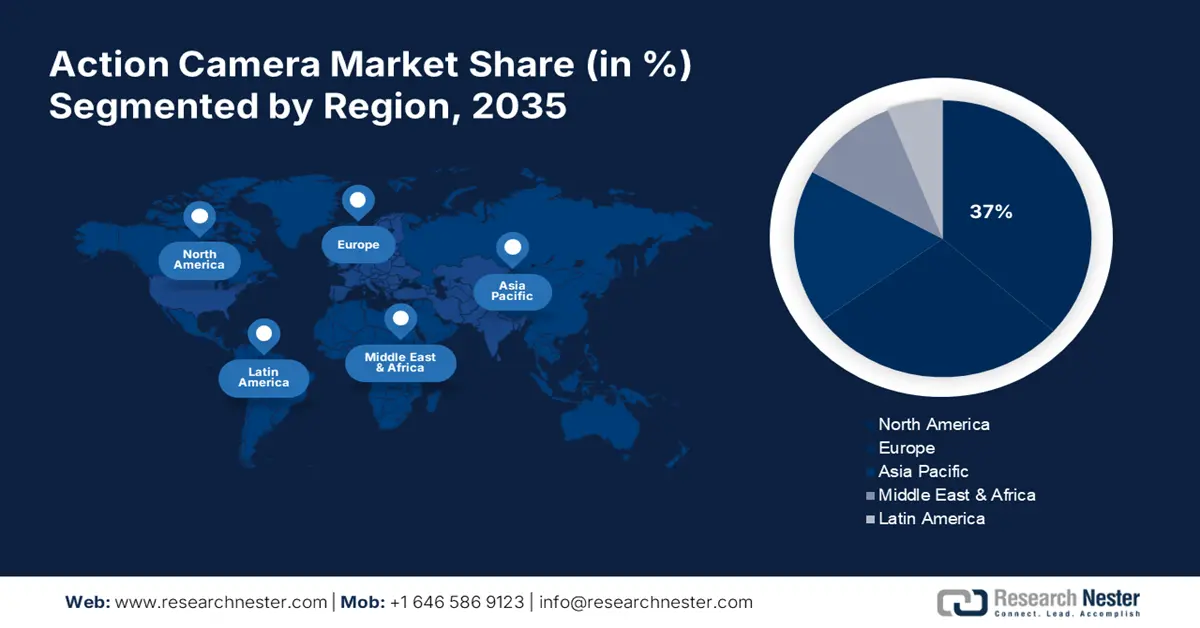

Action Camera Market Regional Analysis:

North America Market Insights

North America industry is likely to hold largest revenue share of 37% by 2035. The region's growth is promoted by the high consumer income, relatively high interest in outdoor sports activities, and wide use of various video-sharing social media. The U.S. and Canada are among the key markets due to the significant presence of content creation and sports industry uses.

The U.S. action camera market has benefited and is influenced favorably by the presence of major market players, particularly GoPro, and the wide use of social media. The partnership between GoPro and the X Games Aspen in January 2024, where GoPro served as the action camera of the X Games, further supports the relevance of action cameras in capturing live sports events requiring fast actions. The presence of the same shows the increase in demand for action cameras as durable compact high-resolution cameras for these events and, therefore, is aiding the growth of the market in the U.S.

The growth of Canada action camera market is significantly influenced by the country’s growth in the field of outdoor and adventure tourism. In 2024, Insta360 partnered with Motovan, providing a wide distribution channel for more than 50,000 riders and outdoor enthusiasts to expand its market in Canada. The market in Canada is expanding due to increasing demand in sports, particularly in outdoor tourism, where the beauty of the Canadian Rockies Coast to Coast range and the trail can be captured and recorded through these action cameras.

Europe Market Insights

Europe is expecting rapid growth in the global action camera market within the forecast period. The growth can be attributed to the rise in consumer interest in adventure sports, the increasing number of social media influencers, and the growing consideration for high-resolution and more durable cameras. Germany and France are major markets in Europe, bringing regional growth due to the presence of strong German buyers and French manufacturing and product demand accordingly.

The action camera market is thriving in Germany. This can be largely attributed to the fact that Germany has a strong, developed economy and high levels of spending on electronics. In addition, consumers prefer innovative, high-quality cameras with updated advanced technologies. In September 2022, DJI launched an innovative action camera, Osmo Action 3, which features a touch-sensitive display and voice control. Such cameras are in high demand among German customers, as they provide a high level of convenience and high performance of the camera.

The market in France is also rising steadily. The primary cause of the rise in success of this market is the high interest of the French population in various outdoor sports and growing consumer sentiment related to the creation of videos, photos, and other content. Moreover, the local government plays a large role in the development of electronics. In addition, it allows for further development in the production and manufacturing of high-quality action cameras in the country.