Action Camera Market Outlook:

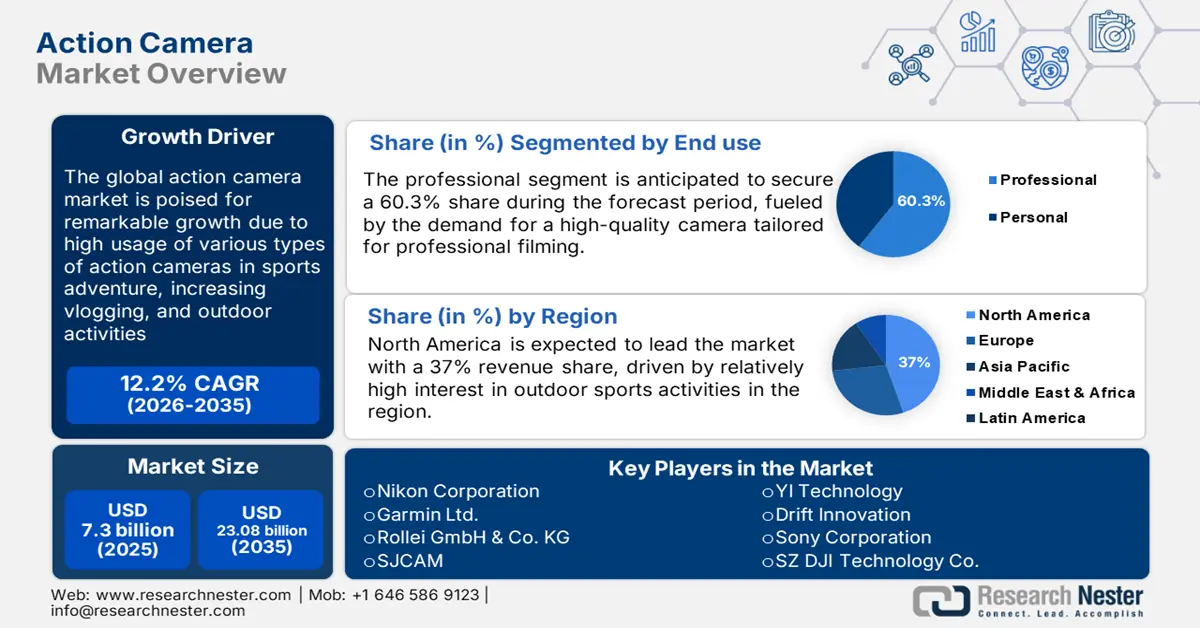

Action Camera Market size was over USD 7.3 billion in 2025 and is anticipated to cross USD 23.08 billion by 2035, witnessing more than 12.2% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of action camera is assessed at USD 8.1 billion.

The global action camera market is poised for remarkable growth due to rising trends in sports adventure, increasing vlogging, and outdoor activities. A spur in demand for portable cameras with high picture quality, capturing fast and immersive action, was triggered by the advent of social media sites and content-sharing platforms such as YouTube and Instagram, among others. Besides, technological improvements in camera resolution, durability, and battery life provide larger reasons for customers to buy action cameras. As more and more people are engaging in active lifestyles and extreme sports, the demand for action cameras has been continuously surging.

The key players in the action camera market are consistently innovating to maintain their top position in the market. For instance, GoPro launched the waterproofed small-sized waterproof action camera HERO 12 Black in October 2023, tough enough to withstand extreme conditions along with quality footage. Meanwhile, supportive government policies and initiatives are critical drivers in the action camera market. In India, for instance, the government's goal of attaining USD 300 billion in electronics manufacturing with the partnering of vital vendors is projected to expand domestic action camera production.

Key Action Camera Market Insights Summary:

Regional Highlights:

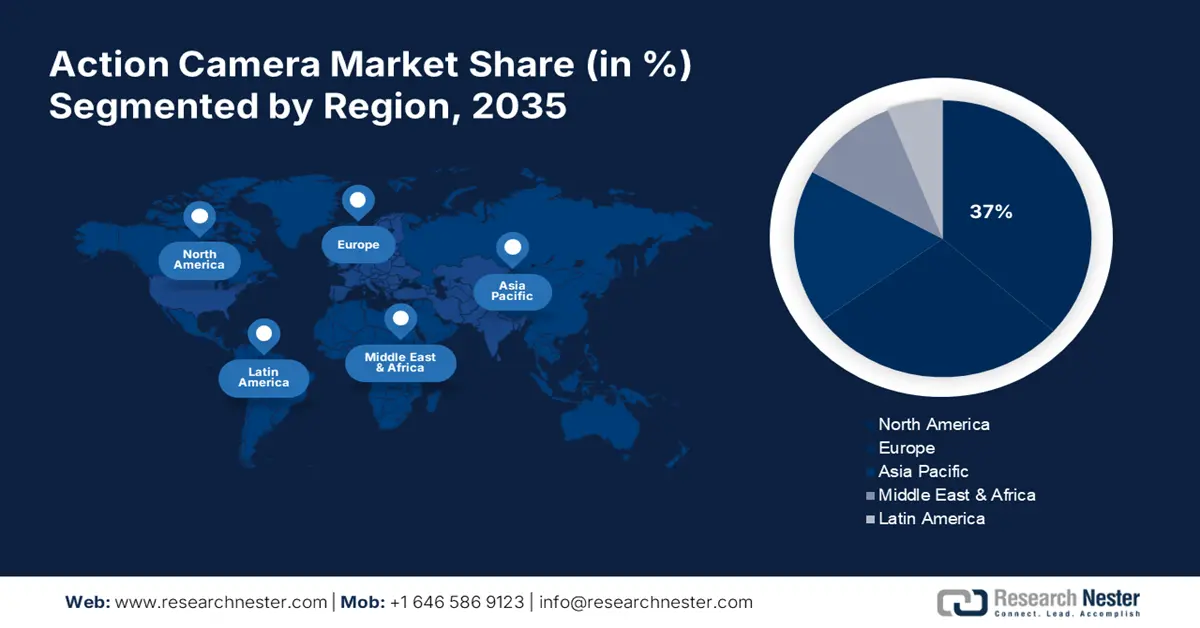

- The North America action camera market will account for 37% share by 2035, driven by strong interest in outdoor sports and content creation.

Segment Insights:

- The professional action camera segment in the action camera market is anticipated to experience robust growth till 2035, driven by demand for high-quality cameras suitable for professional filming and sports events.

- The sports segment in the action camera market is expected to hold a 47.20% share by 2035, attributed to the rising popularity of extreme sports and adventure tourism boosting demand.

Key Growth Trends:

- Integration of advanced technology

- Rising consumer interest in capturing 360-degree content

Major Challenges:

- Competitive pricing as a challenge to market entry

- Regulatory and compliance challenges

Key Players: Nikon Corporation, GoPro, Olympus Corporation, Garmin Ltd., Rollei GmbH & Co. KG, SJCAM, YI Technology, and Drift Innovation.

Global Action Camera Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 7.3 billion

- 2026 Market Size: USD 8.1 billion

- Projected Market Size: USD 23.08 billion by 2035

- Growth Forecasts: 12.2% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (37% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Japan, Germany, South Korea

- Emerging Countries: China, India, Japan, South Korea, Indonesia

Last updated on : 18 September, 2025

Action Camera Market Growth Drivers and Challenges:

Growth Drivers:

- Integration of advanced technology: One of the major growth factors for the action camera market is the integration of AI and other premium imaging technologies. One of the most recent examples is Hero Electronix's release in May 2022, the Qubo Smart Dashboard Cam Dashboard Cam with AI capabilities for easy movement detection and data storage. Thus, such technological development is increasingly popular among consumers opting for intelligent and responsive devices that serve functionality and safety.

- Rising consumer interest in capturing 360-degree content: Consumer interest in capturing 360-degree content is rising day by day, and this is perpetuated by platforms such as Facebook and YouTube that support 360-degree videos. One such trending camera is the Insta360 X3 announced in September 2022, with 5.7K 360-degree recording and AI-powered reframing. As a result of that trend in growing interest, there has been a rapid spike in month-on-month increase in 360-degree video uploads, with engagement for such videos standing higher than regular videos. These aspects have, in turn, been driven by the rise of vlogging and video content creation on YouTube.

Challenges:

- Competitive pricing as a challenge to market entry: One of the central challenges in the action camera market is the price war and competition among manufacturers. Companies that have already accessed the market have to lower their action camera prices to be competitive with other companies or new entrants who produce similar products but involve lower prices for their purchases. This step leads to the reduction of the company's profitability.

- Regulatory and compliance challenges: Another challenge is the legislative development in the use of electronics and the management of electronic waste. When an industry grows, loads of waste with electronics emerge. For the camera manufacturing industry, the problem becomes more pronounced as they produce more and more action cameras in their new models. According to a UNITAR report as of January 2024, the global e-waste produced by obsolete use and throw-away cameras and other electronic gadgets is expected to grow by 5% every year. As a result, governments introduce new regulations and frameworks to mitigate the influence of e-waste on the environment, which makes it difficult for industry players to comply.

Action Camera Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

12.2% |

|

Base Year Market Size (2025) |

USD 7.3 billion |

|

Forecast Year Market Size (2035) |

USD 23.08 billion |

|

Regional Scope |

|

Action Camera Market Segmentation:

End Use Segment Analysis

The professional segment is expected to account for 60.3% of action camera market share during the forecast period. The superiority of this segment is primarily attributed to the need for a high-quality camera tailored for professional filming, broadcasting, and relevant sports events. Professionals require filming gadgets suitable for high-resolution shooting and can withstand harsh conditions while in the field. Innovative products such as advanced models incorporated with robust features can perform highly. For instance, GoPro launched the HERO 12 Black in October 2023, which is a waterproof camera suitable for extreme conditions.

Application Segment Analysis

In 2023, the sports segment by application captured the largest action camera market share of 47.2%. The demand for action cameras has been significantly boosted by the growing popularity of extreme sports, coupled with the rise of adventure tourism, which is the primary driver for this segment. Moreover, sports broadcasting and content creation are increasingly utilizing action cameras, which also drives the growth of this segment. For instance, in August 2023, GoPro announced that it became an official wearable action camera of MotoGPTM. Hence, the importance of the highest quality of footage in sports will continue to boost market growth.

Our in-depth analysis of the action camera market includes the following segments:

|

End use |

|

|

Size |

|

|

Application |

|

|

Resolution |

|

|

Distribution Channel |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Action Camera Market Regional Analysis:

North America Market Insights

North America industry is likely to hold largest revenue share of 37% by 2035. The region's growth is promoted by the high consumer income, relatively high interest in outdoor sports activities, and wide use of various video-sharing social media. The U.S. and Canada are among the key markets due to the significant presence of content creation and sports industry uses.

The U.S. action camera market has benefited and is influenced favorably by the presence of major market players, particularly GoPro, and the wide use of social media. The partnership between GoPro and the X Games Aspen in January 2024, where GoPro served as the action camera of the X Games, further supports the relevance of action cameras in capturing live sports events requiring fast actions. The presence of the same shows the increase in demand for action cameras as durable compact high-resolution cameras for these events and, therefore, is aiding the growth of the market in the U.S.

The growth of Canada action camera market is significantly influenced by the country’s growth in the field of outdoor and adventure tourism. In 2024, Insta360 partnered with Motovan, providing a wide distribution channel for more than 50,000 riders and outdoor enthusiasts to expand its market in Canada. The market in Canada is expanding due to increasing demand in sports, particularly in outdoor tourism, where the beauty of the Canadian Rockies Coast to Coast range and the trail can be captured and recorded through these action cameras.

Europe Market Insights

Europe is expecting rapid growth in the global action camera market within the forecast period. The growth can be attributed to the rise in consumer interest in adventure sports, the increasing number of social media influencers, and the growing consideration for high-resolution and more durable cameras. Germany and France are major markets in Europe, bringing regional growth due to the presence of strong German buyers and French manufacturing and product demand accordingly.

The action camera market is thriving in Germany. This can be largely attributed to the fact that Germany has a strong, developed economy and high levels of spending on electronics. In addition, consumers prefer innovative, high-quality cameras with updated advanced technologies. In September 2022, DJI launched an innovative action camera, Osmo Action 3, which features a touch-sensitive display and voice control. Such cameras are in high demand among German customers, as they provide a high level of convenience and high performance of the camera.

The market in France is also rising steadily. The primary cause of the rise in success of this market is the high interest of the French population in various outdoor sports and growing consumer sentiment related to the creation of videos, photos, and other content. Moreover, the local government plays a large role in the development of electronics. In addition, it allows for further development in the production and manufacturing of high-quality action cameras in the country.

Action Camera Market Players:

- Nikon Corporation

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Garmin Ltd.

- Rollei GmbH & Co. KG

- SJCAM

- YI Technology

- Drift Innovation

The competitive landscape of the action camera market is shaped by multiple key players who continue to lead the market due to innovation, technology advancements, and partnerships. GoPro, DJI, Insta360, and Sony dominate the market, introducing multiple products to meet the needs of unsophisticated general users and professional athletes. These companies are leaders by introducing new technologies, innovations, and effective partnerships. New entrants may act as a threat as some of the start-ups may manage to develop good and relatively cheaper products. On the other hand, small players can be considered safe as they work for some niche customers seeking cheaper products. Thus, the niche market is not capable of exhausting the demand for professional or premium action cameras.

Here are some leading players in the action camera market:

Recent Developments

- In October 2023, the Pro Xtreme Cam was launched, targeting thrill-seekers who prioritize sharing experiences. This action camera is designed for extreme conditions, offering robust performance and ease of use.

- In November 2022, Caddx launched the Walnut, a small action camera designed for FPV drones. The camera features 4K60 resolution and Gyroflow stabilization support, making it ideal for drone enthusiasts seeking high-quality, stable footage.

- In September 2022, GoPro announced the global distribution of the HERO 11 Black series. The series includes three models: HERO 11 Black, HERO 11 Black Creator Edition, and HERO 11 Black Mini, catering to various user needs.

- Report ID: 6377

- Published Date: Sep 18, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Action Camera Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.