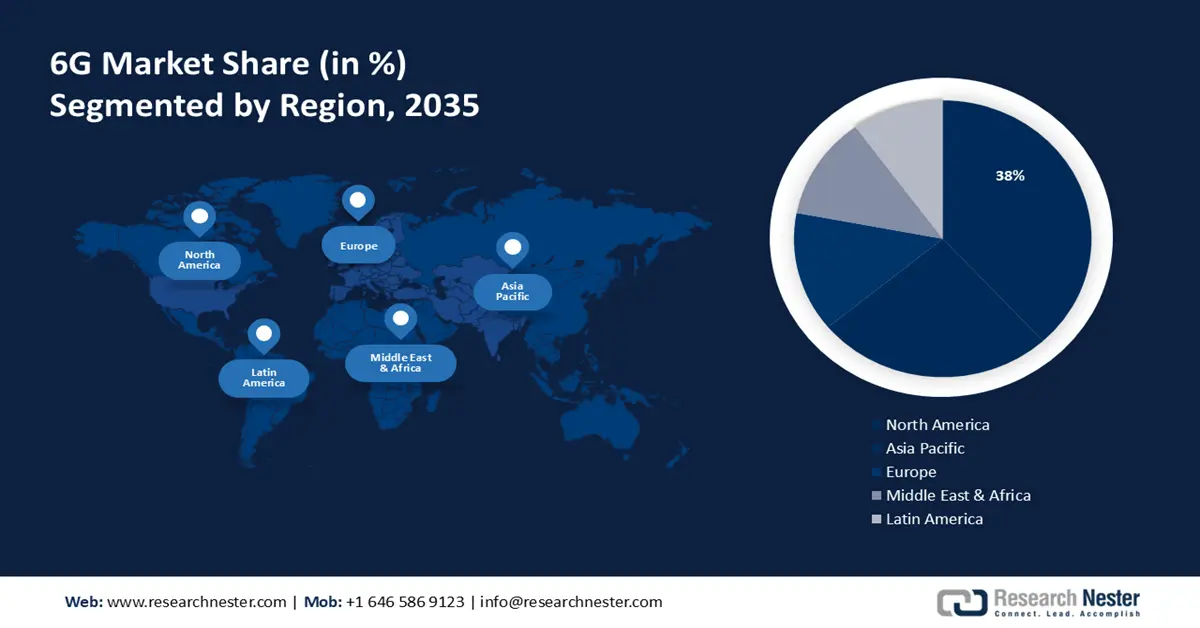

6G Market Regional Analysis:

North America Market Insights

North America industry is estimated to dominate majority revenue share of 38% by 2035. The substantial growth of the landscape is led by the presence of major key players in the telecommunication industry. These organizations are making progress in 6G research, development, and deployment, driving growth and advancements in the market. Additionally, favorable regulatory policies help to drive the growth of the 6G market in North America.

The United States is expected to dominate the regional 6G market in terms of investment, adoption and applications. Telecom companies in the country such as AT&T, T-Mobile and Verizon have signed billion-dollar agreements with network equipment providers such as Samsung, Nokia and Ericsson to expand its US 6G network infrastructure. Additionally, the National Science Foundation of the United States granted USD 7 million in extra funding for the Platforms for Advanced Wireless Research (PAWR) initiative, which will increase the capacity of the PAWR testbeds for testing and validating Open Radio Access Network (O-RAN) systems and subsystems.

In Canada 6G is still in the development phase and is predicted to be available before 2030. Major players like Bell, Telus and Rogers are expected to be first providers to deploy 6G in the country.

APAC Market Insights

The Asia Pacific region will also encounter huge growth in the 6G market during the forecast period. The APAC 6G market offers enormous opportunities for economic growth and technical improvement. With its large population, electronics and semiconductor industries, strong government support, and emphasis on innovation, the region is ideally positioned to become a global leader in 6G research and deployment.

China is expected to dominate the 6G market in the coming years owing to the unwavering support of the Chinese government and local companies in the 6G race. Large telecom giants like ZTE, Huawei, and Xiaomi are aggressively investing in advancing 6G networks and are actively involved in research and development. These companies can conduct large-scale trials and develop new technologies because they have the necessary expertise, scale, and resources. For instance, in January 2022, Purple Mountain Laboratories, a facility backed by the Chinese government, declared that it had successfully accomplished a record breaking 6G level wireless transmission up to 206.25 gigabits per second.

In South Korea, the Ministry of Science and ICT reports that under the K-Network 2030 plan, the Korean government will secure world-class 6G technologies, innovate the software-based next-generation mobile network, and strengthen the network supply chain.