6G Market Outlook:

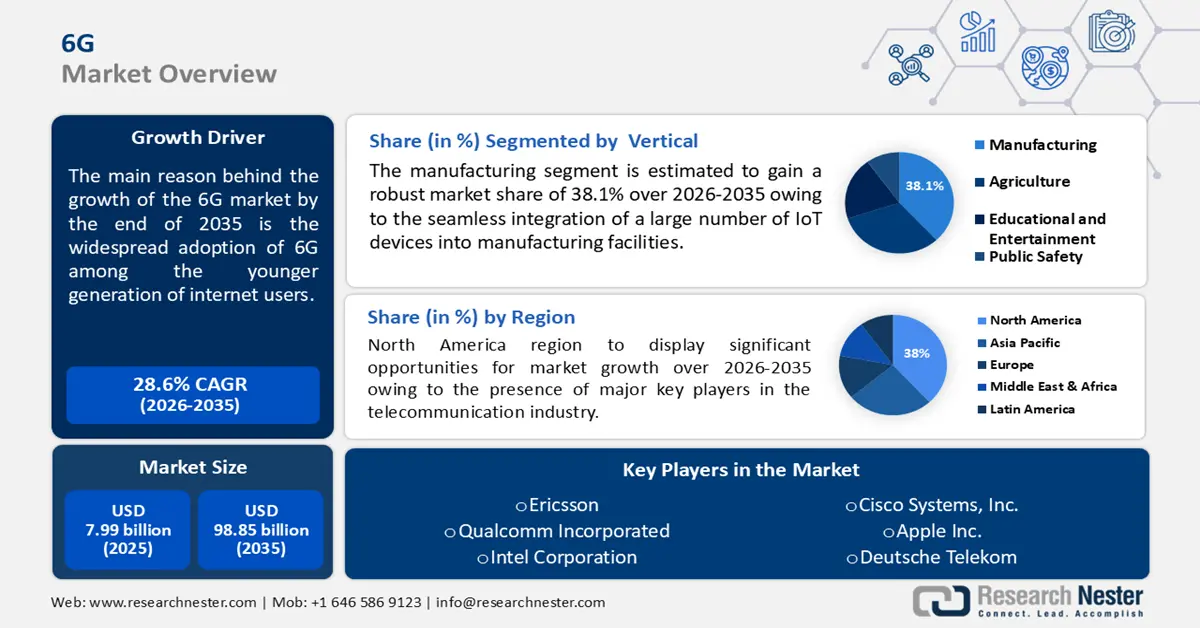

6G Market size was valued at USD 7.99 billion in 2025 and is set to exceed USD 98.85 billion by 2035, registering over 28.6% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of 6G is estimated at USD 10.05 billion.

The widespread adoption of 6G among the younger generation of internet users is expected to drive market expansion. The integration of advanced cutting-edge technologies like augmented reality, artificial intelligence, and virtual reality in the 6G network attracts users who frequently use online content and interactive media. Also, incorporating 6G across various sectors such as gaming, healthcare, and education increases its popularity among young users. A 2022 report published by the International Telecommunication Union estimated that about 71% of the young population aged 15-24 are avid Internet users, as compared to 57% of the rest of the population.

Key 6G Market Insights Summary:

Regional Highlights:

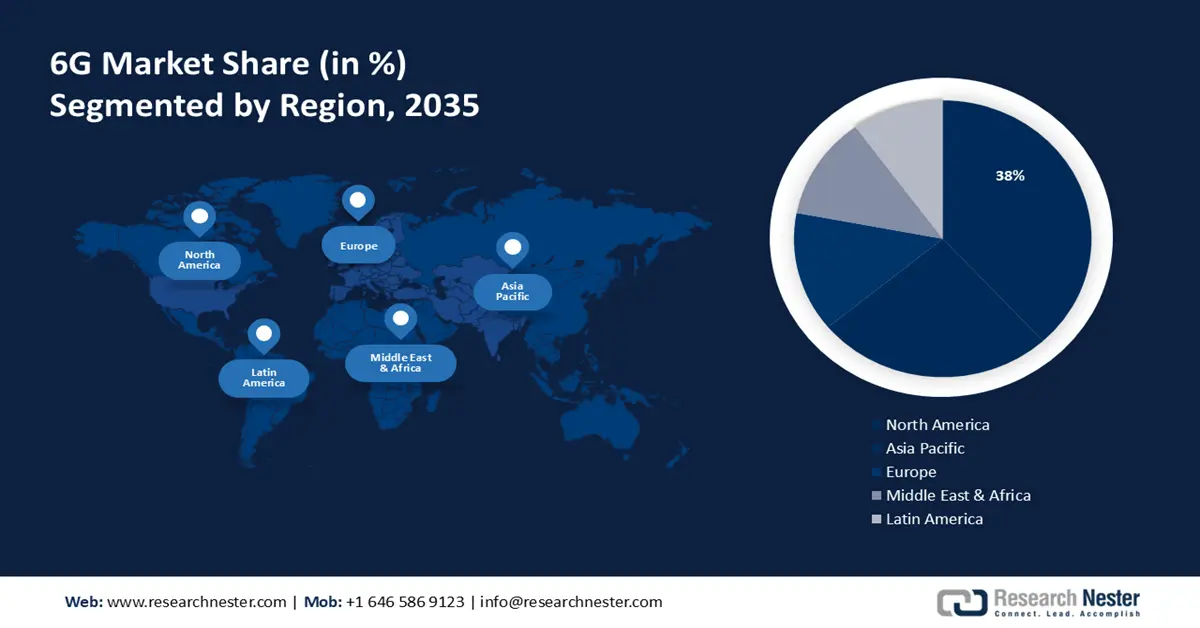

- The North America 6G market will secure over 38% share by 2035, driven by the presence of major key players in the telecommunication industry and favorable regulatory policies.

- The Asia Pacific market will register huge growth during the forecast timeline, driven by large population, strong government support, and emphasis on innovation in 6G research and deployment.

Segment Insights:

- The manufacturing segment (6g market) segment in the 6g market is expected to achieve a 38.10% share by 2035, driven by the seamless integration of a large number of IoT devices into manufacturing facilities.

- The smartphone segment in the 6g market is anticipated to achieve significant growth till 2035, driven by the widespread adoption of smartphones and growing demand for faster, more reliable connectivity.

Key Growth Trends:

- Adoption of data-driven technologies

- Increasing number of connected IoT (Internet of Things) devices

Major Challenges:

- Technical feasibility issues

- Security and privacy concerns

Key Players: Huawei Technologies Co., Ltd., Nokia Corporation, Samsung Electronics Co., Ltd., Ericsson, Qualcomm Incorporated, Intel Corporation, Cisco Systems, Inc., Apple Inc., Deutsche Telekom.

Global 6G Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 7.99 billion

- 2026 Market Size: USD 10.05 billion

- Projected Market Size: USD 98.85 billion by 2035

- Growth Forecasts: 28.6% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (38% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Japan, South Korea, Germany

- Emerging Countries: China, Japan, South Korea, India, Singapore

Last updated on : 17 September, 2025

6G Market Growth Drivers and Challenges:

Growth Drivers

- Adoption of data-driven technologies - Artificial intelligence, cloud computing, and machine learning are all data-driven technologies that can analyze massive volumes of network data in real-time. This improves network intelligence, allowing 6G networks to optimize performance, predict challenges, and flexibly allocate and manage resources based on demand.

The growing adoption of cloud computing has a profound impact on the automation, healthcare, telecom, manufacturing, and insurance industries which is accelerating the 6G market expansion. For instance, a 2023 published report estimates that since 2018 the percentage of insurers adopting cloud-based technology has risen from 72% to more than 90%. - Increasing number of connected IoT (Internet of Things) devices - There is widespread adoption of 6Gs in IoT systems owing to their affordability, compact size, and energy efficiency. It acts as a communication channel between the external environment and IoT devices. In addition, manufacturing IoT devices provides a seamless connection between systems, devices, and machines.

Furthermore, the 6G network allows real-time control, manufacturing, and monitoring options while helping to reduce downtime, optimize production efficiency, and improve overall productivity. According to Research Nester analysis, in 2022 global IoT connections showed a significant growth rate of 18.0% and achieved more than 14 billion active IoT endpoints. Thus, the growing adoption of these devices is fostering the revenue share of the 6G market. - Growing demand for ultra-reliable low latency communications (URLLC) - Many industrial real-time applications across a variety of sectors, including automotive, industrial automation, and industrial IoT necessitate extremely low end-to-end network latency, often in the range of 10 milliseconds or less. The sixth generation of cellular networks (6G) can support the required levels of network latency using the URLLC service. As per estimates, the URLLC sector is predicted to reach USD 50.0 billion by the end of 2030.

Challenges

- Technical feasibility issues - Developing and implementing cutting-edge technologies such as AI-driven networks, massive MIMO (Multiple Input Multiple Output), and terahertz frequency bands pose significant technological challenges. Addressing these issues will necessitate collaboration and innovation across different sectors to maximize the potential of 6G technology while limiting risks and providing global shared benefits.

- Security and privacy concerns - As data transmission rates and connectivity increase, maintaining strong security protocols and protecting user privacy become crucial. Safeguarding sensitive data against cyber threats outlines some future challenges and issues which can hamper deployment of 6G.

6G Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

28.6% |

|

Base Year Market Size (2025) |

USD 7.99 billion |

|

Forecast Year Market Size (2035) |

USD 98.85 billion |

|

Regional Scope |

|

6G Market Segmentation:

Vertical Segment Analysis

Manufacturing segment is set to account for more than 38.1% 6G market share by the end of 2035. The segment growth is attributed to the seamless integration of a large number of IoT devices into manufacturing facilities. This includes smart devices, sensors, and actuators that collect and transmit data in real-time, enabling predictive maintenance, asset tracking and inventory management. A 2023 survey findings revealed that more than three out of five manufacturers (60%) integrated IoT technologies in their manufacturing processes.

Application Segment Analysis

The multisensory extended reality segment is estimated to be the highest-growing segment with a notable CAGR in the coming years. The multi-sensory extended segment of the 6G market refers to the integration of advanced sensory technologies into wireless communication systems, allowing for immersive and interactive experiences that go beyond conventional audio and visual capabilities. This includes applications such as feedback mechanisms, sensory stimulation (such as taste augmentation), and spatial awareness, resulting in a truly multidimensional communication environment.

Deployment Segment Analysis

The smartphone segment is set to garner a significant market share propelled by the widespread adoption of smartphones across the world. Smartphones have become important for communication, internet access, and a variety of applications, making them a crucial driver of the 6G market. With the growing demand for faster and more reliable connectivity, 6G technology intends to transform smartphone capabilities by delivering faster data rates, lower latency, and increased network capacity. According to 2024 statistics shared by the Per Research Center, in 2023, about 90% of U.S. adults owned a smartphone.

Our in-depth analysis of the global market includes the following segments:

|

Vertical |

|

|

Application |

|

|

Deployment |

|

|

Communication Infrastructure |

|

|

Component |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

6G Market Regional Analysis:

North America Market Insights

North America industry is estimated to dominate majority revenue share of 38% by 2035. The substantial growth of the landscape is led by the presence of major key players in the telecommunication industry. These organizations are making progress in 6G research, development, and deployment, driving growth and advancements in the market. Additionally, favorable regulatory policies help to drive the growth of the 6G market in North America.

The United States is expected to dominate the regional 6G market in terms of investment, adoption and applications. Telecom companies in the country such as AT&T, T-Mobile and Verizon have signed billion-dollar agreements with network equipment providers such as Samsung, Nokia and Ericsson to expand its US 6G network infrastructure. Additionally, the National Science Foundation of the United States granted USD 7 million in extra funding for the Platforms for Advanced Wireless Research (PAWR) initiative, which will increase the capacity of the PAWR testbeds for testing and validating Open Radio Access Network (O-RAN) systems and subsystems.

In Canada 6G is still in the development phase and is predicted to be available before 2030. Major players like Bell, Telus and Rogers are expected to be first providers to deploy 6G in the country.

APAC Market Insights

The Asia Pacific region will also encounter huge growth in the 6G market during the forecast period. The APAC 6G market offers enormous opportunities for economic growth and technical improvement. With its large population, electronics and semiconductor industries, strong government support, and emphasis on innovation, the region is ideally positioned to become a global leader in 6G research and deployment.

China is expected to dominate the 6G market in the coming years owing to the unwavering support of the Chinese government and local companies in the 6G race. Large telecom giants like ZTE, Huawei, and Xiaomi are aggressively investing in advancing 6G networks and are actively involved in research and development. These companies can conduct large-scale trials and develop new technologies because they have the necessary expertise, scale, and resources. For instance, in January 2022, Purple Mountain Laboratories, a facility backed by the Chinese government, declared that it had successfully accomplished a record breaking 6G level wireless transmission up to 206.25 gigabits per second.

In South Korea, the Ministry of Science and ICT reports that under the K-Network 2030 plan, the Korean government will secure world-class 6G technologies, innovate the software-based next-generation mobile network, and strengthen the network supply chain.

6G Market Players:

- ZTE Corporation

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Huawei Technologies Co., Ltd.

- Nokia Corporation

- Samsung Electronics Co., Ltd.

- Ericsson

- Qualcomm Incorporated

- Intel Corporation

- Cisco Systems, Inc.

- Apple Inc.

- Deutsche Telekom

The 6G market is driven by prominent companies that are well-established and provide innovative solutions and services in the telecommunications industry. Most of these companies are continuously expanding, collaborating, and adopting joint venture strategies to strengthen their position in the market.

Some of the key players include:

Recent Developments

- In February 2024, the White House released a statement jointly by the United States, Australia, Canada, the Czech Republic, Finland, France, Japan, South Korea, Sweden, and the United Kingdom endorsing a set of common 6G principles that are open, free, global, interoperable, dependable, resilient, and secure connectivity.

- In July 2022, Deutsche Telekom took the lead for the 6G-TakeOff research project funded by the German Federal Ministry of Education and Research. To create a standard 6G architecture for communication networks made up of satellites, flying infrastructure platforms, and ground stations, Deutsche Telekom is assembling a consortium.

- Report ID: 6269

- Published Date: Sep 17, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

6G Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.