編碼器積體電路市場展望:

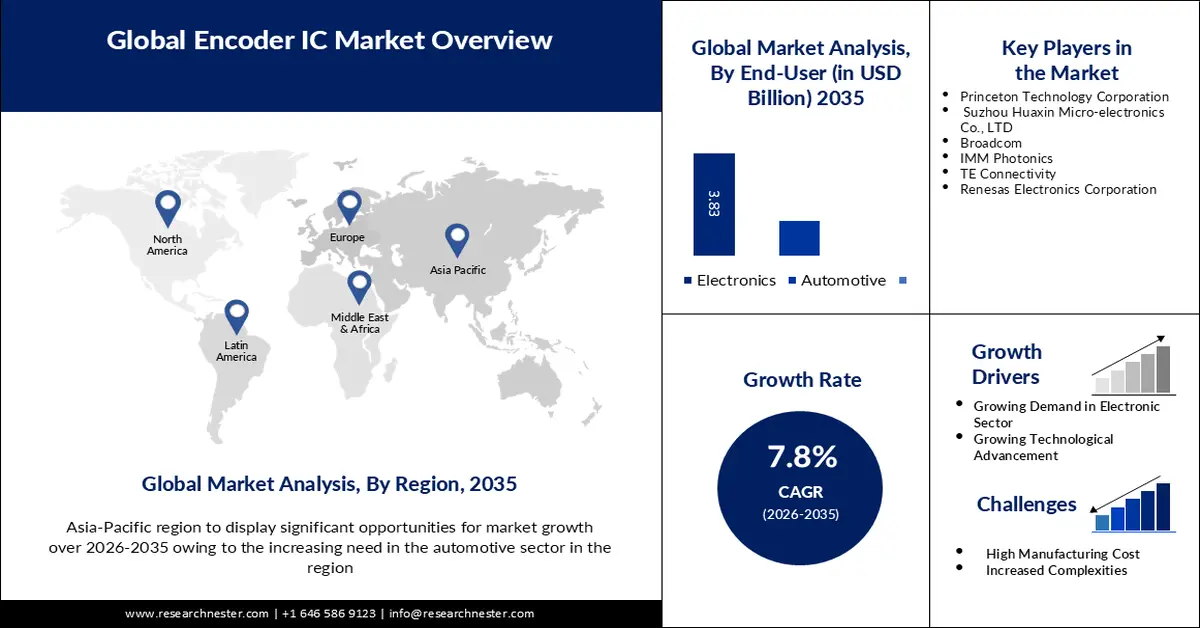

2025年編碼器IC市場規模超過33.7億美元,預計到2035年將達到71.4億美元,在預測期(即2026年至2035年)內,複合年增長率約為7.8%。 2026年,編碼器IC產業規模預估為36.1億美元。

編碼器積體電路(IC)用於電動車的電池管理系統中,以追蹤電池模組和電芯的位置和狀態。隨著汽車技術向電動車、連網和自動駕駛方向發展,對編碼器積體電路(IC)的需求預計將大幅成長。這將推動汽車電子和控制系統領域的創新和突破。電動車銷量佔新車總銷量的比例從2021年的9%上升到2022年的14%,而2020年這一比例不足5%,2021年則上升到9%。

工業領域自動化和機器人技術的日益普及推動了對編碼器積體電路的需求。這些裝置廣泛應用於機械手臂、CNC工具機、自動導引車和其他工業應用中,能夠提供精確的位置回饋,從而實現對運動的精確控制。在數控工具機中,編碼器用於在運行過程中提供位置回饋,確保工具機以最佳速度和精度完成加工。

關鍵 編碼器積體電路 市場洞察摘要:

區域亮點:

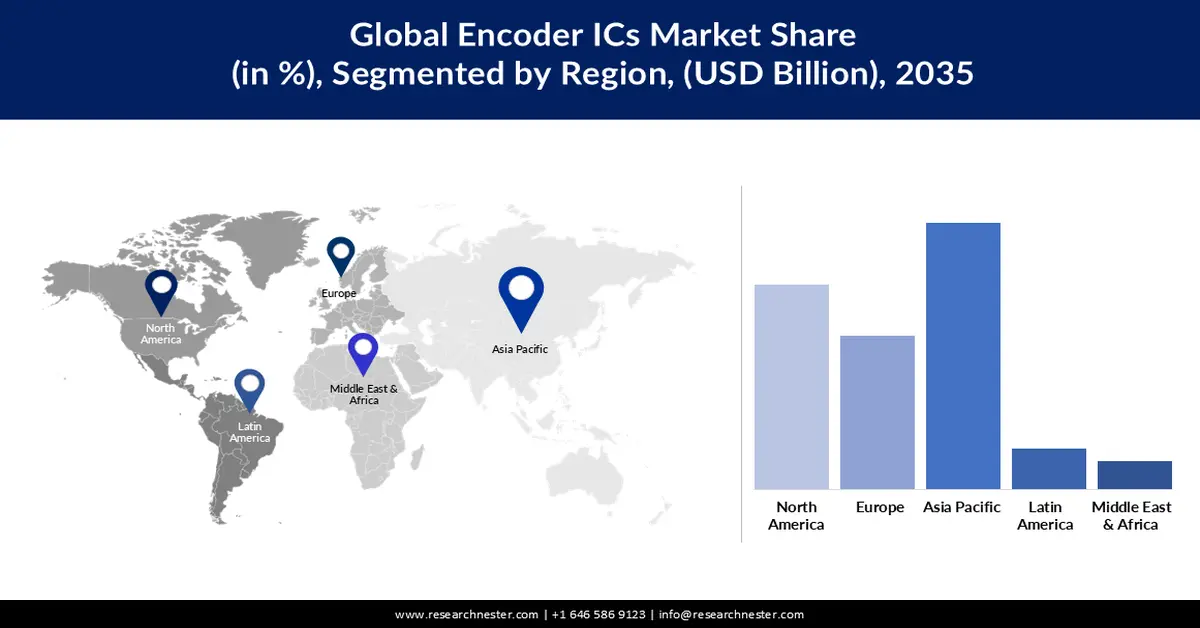

- 到 2035 年,亞太地區編碼器 IC 市場份額將達到 38%,這得益於快速的工業化、加速的城市化以及先進自動化和機器人解決方案的廣泛應用。

- 預計到 2035 年,北美市場規模將超過 23 億美元,這得益於智慧型裝置和穿戴式裝置的普及推動了印表機、無人機、數位相機和遊戲機等消費性電子產品中編碼器 IC 的廣泛應用。

細分市場洞察:

- 到 2035 年,編碼器 IC 市場的運動控制細分市場預計將達到 16.6 億美元,這主要得益於對精確位置回饋的迫切需求,以確保準確且高效的馬達和執行器控制。

- 預計到 2035 年,電子領域的市場規模將達到 38.3 億美元,這得益於編碼器在影印機、印表機、答錄機和掃描設備等辦公設備中的廣泛應用。

主要成長趨勢:

- 無線編碼器的出現

- 汽車產業的需求

主要挑戰:

- 相關複雜度增加

主要參與者:普林斯頓科技公司、蘇州華鑫微電子有限公司、博通公司、IMM Photonics公司、TE Connectivity公司、瑞薩電子公司。

全球 編碼器積體電路 市場 預測與區域展望:

市場規模及成長預測:

- 2025年市場規模: 33.7億美元

- 2026年市場規模: 36.1億美元

- 預計市場規模:到2035年將達71.4億美元

- 成長預測: 7.8%

關鍵區域動態:

- 最大區域:亞太地區(到2035年佔38%的份額)

- 成長最快的地區:亞太地區

- 主要國家:美國、中國、日本、德國、韓國

- 新興國家:印度、越南、巴西、墨西哥、印度尼西亞

Last updated on : 24 November, 2025

編碼器積體電路市場—成長驅動因素與挑戰

成長驅動因素

- 無線編碼器的出現-無線編碼器為各種應用場景提供了更大的靈活性和更便利的安裝方式,無需透過實體線連接。此外,HEV-4KW 是一款無線 HDMI 直播編碼器,其體積小巧、重量輕,能夠實現 4K 影片的全程播放。無線編碼器可與物聯網平台和雲端服務無縫集成,從而實現數據分析、快速維護以及營運效率的提升。

- 汽車產業的需求-編碼器廣泛應用於醫療領域,包括實驗室中用於處理樣本的機器人、用於調整病人床位的裝置,以及CT掃描器和手術機器人中機架的旋轉速度和位置控制。 2021年,美國進行了約64.4萬次機器人操作,預計到2028年這數字將達到100萬次。在全球範圍內,此類操作的數量已達數百萬次。

挑戰

- 編碼器的複雜性增加-編碼器通常比多工器電路更複雜,需要更多額外的元件才能運作。編碼器積體電路的設計和實現難度較大,需要專業知識和技能,這使得一些用戶在互通性至關重要的行業中不願採用編碼器。與現有系統或其他元件的兼容性問題是其應用的主要障礙,尤其是在工業領域。

- 高昂的初始投資勢必會進一步阻礙市場擴張。

- 高昂的製造成本勢必會在未來阻礙市場成長。

編碼器積體電路市場規模及預測:

| 報告屬性 | 詳細資訊 |

|---|---|

|

基準年 |

2025 |

|

預測年份 |

2026-2035 |

|

複合年增長率 |

7.8% |

|

基準年市場規模(2025 年) |

33.7億美元 |

|

預測年份市場規模(2035 年) |

71.4億美元 |

|

區域範圍 |

|

編碼器積體電路市場細分:

應用細分市場分析

預計到 2035 年底,編碼器 IC 市場中的運動控制細分市場規模將達到 16.6 億美元。編碼器 IC 在運動控制系統中發揮基礎性作用,它提供有關馬達或執行器位置和運動的關鍵回饋,從而實現精確控制和高效運行所需的必要精度。

製造業、物流業及其他行業自動化程度的不斷提高是推動這一趨勢的主要因素。為了有效率地運行,機器人、自動駕駛車輛等設備必須能夠精確控制其運動,因此需要編碼器積體電路。到2025年,全球五分之四的倉庫將實現電腦化。在物流領域應用機器人技術,可望降低40%的成本。

最終用戶細分分析

到 2035 年底,編碼器 IC 市場電子領域預計將達到 38.3 億美元。編碼器廣泛應用於辦公設備,包括影印機、印表機、答錄機、基於 PC 的掃描器和掃描器等。

此外,由於新技術的快速普及以及蘋果、三星電子和惠普公司等眾多消費性電子巨頭的存在,亞太和北美地區消費性電子應用中編碼器的使用量明顯增加。

我們對全球編碼器積體電路市場的深入分析涵蓋以下幾個方面:

應用 |

|

最終用戶 |

|

Vishnu Nair

全球業務發展主管根據您的需求自訂本報告 — 與我們的顧問聯繫,獲得個人化的洞察與選項。

編碼器積體電路市場—區域分析

亞太市場洞察

由於快速的工業化、城市化和技術進步,亞太地區的工業預計在2035年佔據全球38%的收入份額,這推動了該地區各行各業的廣泛應用。此外,隨著工業4.0的普及和先進自動化及機器人解決方案的實施,製造業正在改變。例如,根據國際機器人聯合會的數據,亞洲佔全球新部署機器人總數的73%。

龐大的人口基數帶來的龐大供需是印度經濟快速成長的最重要因素。為了促進印度的經濟穩定,供需雙方正在協同運作。印度市場充滿機遇,未來幾年對編碼器積體電路的需求將持續快速成長。

該地區市場的成長可歸因於中國消費性電子產業的快速發展。智慧型手機、印表機、平板電腦等設備都需要編碼器積體電路才能更好地有效運作。

市場成長可歸因於汽車產業對編碼器積體電路需求的不斷增長,以及日本電動車銷售的成長。

北美市場洞察

預計到2035年底,北美地區的編碼器積體電路市場規模將超過23億美元。編碼器積體電路廣泛應用於該地區的消費性電子產品中,例如數位相機、印表機、無人機和遊戲機,以增強設備的功能和性能。智慧型設備和穿戴式裝置的普及也推動了消費性電子領域對編碼器積體電路需求的成長。預計到2025年,大多數美國家庭將擁有約20台連網電子設備。

這一增長可歸因於其高使用率和美國製造商數量的不斷增長。

由於編碼器積體電路在工業自動化領域的應用日益廣泛,預計加拿大市場將持續成長。

編碼器積體電路市場參與者:

- 安華高科技

- 公司概況

- 商業策略

- 主要產品

- 財務業績

- 關鍵績效指標

- 風險分析

- 最新進展

- 區域影響力

- SWOT分析

- 上海麥格泰克微電子有限公司

- 射頻解決方案

- RLS doo

- 普林斯頓科技公司

- 蘇州華鑫微電子有限公司

- 博通

- IMM光子學

- TE Connectivity

- 瑞薩電子公司

最新動態

- 安華高科技公司發布了一款高解析度絕對式光學編碼器,適用於高性能伺服和馬達回饋應用。這款名為AEAT9000的全新超精密絕對式編碼器在平穩的功率驅動性能方面提供了最高的精度。

- 針對下一代汽車攝影機應用,瑞薩電子公司推出了一款創新的汽車電源管理IC—RAA271082。 RAA271082是多路電源IC,包含一個主高壓同步降壓穩壓器、兩個次級低壓同步降壓穩壓器和一個低壓LDO穩壓器。該IC符合ISO 26262標準。

- Report ID: 4527

- Published Date: Nov 24, 2025

- Report Format: PDF, PPT

- 探索关键市场趋势和洞察的预览

- 查看样本数据表和细分分析

- 体验我们可视化数据呈现的质量

- 评估我们的报告结构和研究方法

- 一窥竞争格局分析

- 了解区域预测的呈现方式

- 评估公司概况与基准分析的深度

- 预览可执行洞察如何支持您的战略

探索真实数据和分析

常见问题 (FAQ)

編碼器積體電路 市场报告范围

版权所有 © 2026 Research Nester。保留所有权利。