冷鏈物流市場展望:

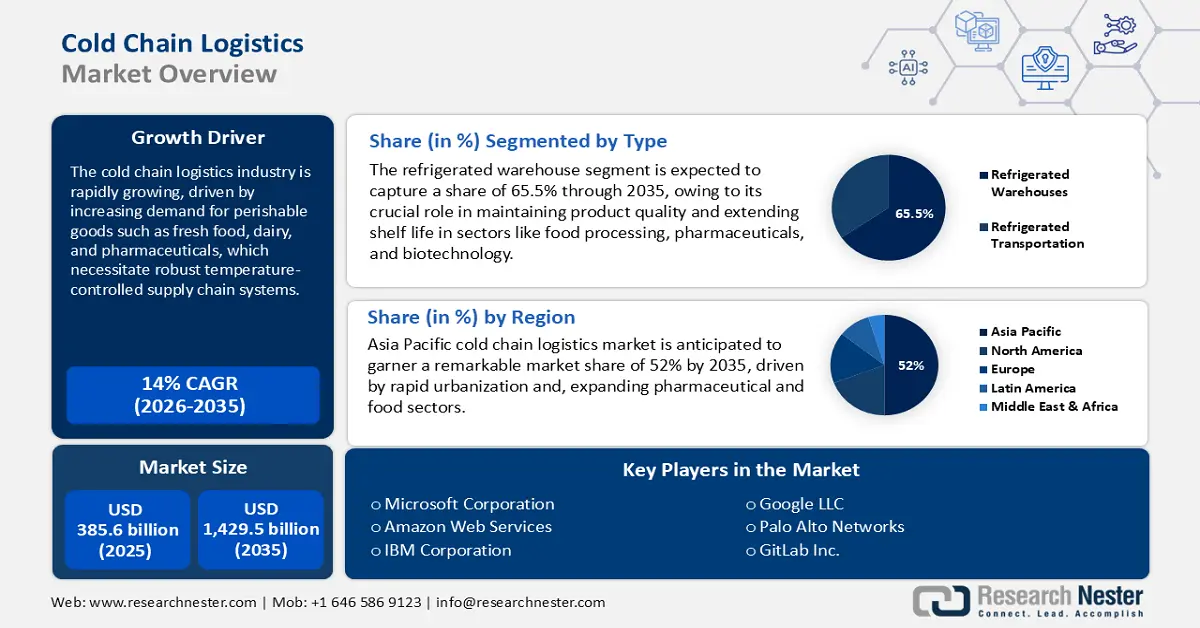

2025年,冷鏈物流市場規模為3,856億美元,預計到2035年底將達到14,295億美元,在預測期(即2026-2035年)內,複合年增長率為14%。 2026年,冷鏈物流產業規模預估為4,395億美元。

受全球對溫控商品(尤其是食品和醫藥產業)需求不斷增長的推動,冷鏈物流市場正迅速發展。冷凍技術、即時追蹤和數據分析的進步是這項擴張的基石,它們正將冷鏈物流產業重塑為一個高效透明的系統。 2025年7月,Lineage Logistics透過收購和整合魁北克省的三座新的冷庫,擴大了其在加拿大的業務版圖,並擴展了其在北美的果蔬和冷凍產品物流網絡。消費者對新鮮、優質、按需配送商品的需求日益增長,也給物流供應商帶來了新的壓力,迫使他們以最高效率運作其物流網絡。

全球各國政府機構日益認識到高效冷鏈對經濟穩定、國家安全和公共衛生至關重要。這促使政府推出大量新政策、加大投資並改善監管框架,以加強冷鏈基礎設施建設,促進易腐產品的安全可靠分銷。 2024年5月,美國白宮發布了《國家網路安全戰略實施計畫》,其中包含明確的指導方針,旨在透過制定韌性目標和跨行業標準來保障食品和藥品冷鏈的安全。政府的這些措施正使冷鏈物流業更加規範和安全,從而促進創新並刺激私部門的投資。

冷鏈物流市場-成長動力與挑戰

成長驅動因素

- 對易腐品和溫控產品的需求不斷增長:全球對新鮮農產品、異國水果和溫控藥品的需求是冷鏈物流市場的主要成長動力。消費者對更健康、更多樣化飲食的需求不斷增長,推動了對可靠冷鏈能力的需求,以便將易腐品長途運輸。製藥業對生物製劑和疫苗的日益重視,需要嚴格的溫度控制,這也是另一個關鍵因素。例如,DHL於2025年7月宣布了一項20億歐元的策略性投資,用於升級其生命科學和醫療保健物流服務,例如在全球範圍內建造新鮮藥品冷藏設施。這項巨額投資表明該行業正在積極應對對專業冷鏈解決方案日益增長的需求。因此,這一發展趨勢正促使物流供應商提升運能並應用更先進的技術。

- 監控和自動化技術升級:技術創新正在改變冷鏈物流產業,使其更有效率、透明和可靠。物聯網 (IoT) 感測器、人工智慧 (AI) 和區塊鏈技術的應用,為供應鏈提供了前所未有的可視性,實現了即時溫度監控和產品追蹤。冷庫自動化也提高了營運效率,並最大限度地減少了人為錯誤的可能性。 2025 年 7 月,CtrlChain 和 NewCold 進一步加強了策略聯盟,推出了一項涵蓋冷庫、經紀和運輸的數位化整合解決方案。此解決方案可對歐洲和北美的供應鏈進行端到端協調,展現了科技在建構更有效率、更一體化的冷鏈方面的巨大潛力。這種整合正在重新定義該行業的卓越營運標準。

- 嚴格的監管標準和品質控制:對溫度敏感貨物的儲存和運輸實施更嚴格的監管是推動冷鏈物流產業發展的主要動力。對可追溯性和品質控制的重視也促使企業採用能夠完整記錄產品在供應鏈中流轉過程的解決方案。 2025年6月,英國環境、食品和農村事務部發布了關於安全冷藏、可追溯性和合規性的新建議,涵蓋家禽和加工食品行業。該建議反映了監管合規性作為冷鏈管理基本要素的重要性日益凸顯。因此,那些能夠證明其致力於達到如此高標準的企業正在獲得競爭優勢。

推動冷鏈物流市場成長的機遇

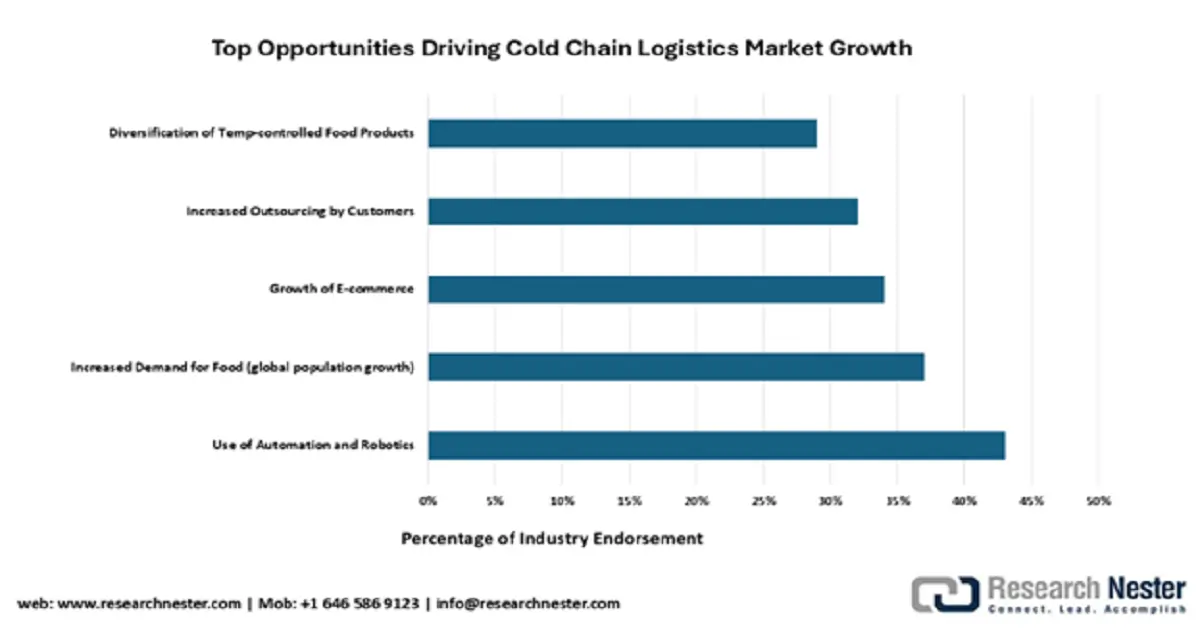

冷鏈物流市場正蓄勢待發,即將迎來重大變革。自動化和機器人技術是引領變革的關鍵,43%的業內專家認為這是提升效率、減少損耗的首要機會。全球人口成長和電子商務的蓬勃發展進一步推動了可擴展、溫控物流解決方案的需求。這些趨勢凸顯了冷鏈服務正向技術驅動型外包模式轉變,以滿足消費者和監管機構對易腐品完整性的不斷變化的需求。

來源:GCCA

挑戰

- 數位化供應鏈面臨的網路安全風險:隨著冷鏈物流市場不斷數位化,其面臨的網路安全風險也日益增加。對互聯繫統的依賴,使得供應鏈的監控與控制面臨新的風險入口。一旦網路攻擊成功,將導致業務中斷、敏感資訊洩露,甚至造成溫控產品變質,造成巨大的經濟損失。此外,產業內錯綜複雜的合作夥伴和供應商網路也加劇了這些風險。 2024年10月,加拿大網路安全中心發布了《2025-2026年國家網路威脅評估報告》,強調了在溫控供應鏈中建立新型數位化控制和可追溯性的必要性。該評估報告進一步凸顯了網路安全對冷鏈產業的重要性。

- 新興市場的基礎設施和標準化差距:隨著全球對冷鏈物流的需求不斷增長,大多數新興市場缺乏滿足現代冷鏈需求的基礎設施和標準化流程。道路系統落後、電網不穩定以及冷藏設施數量不足,都可能構成重大的物流挑戰。各地區間缺乏明確的標準化法規和最佳實踐,也會使跨境貿易複雜化,並引發合規問題。這些基礎設施缺陷可能導致營運成本增加以及產品損耗加劇。 2025年5月,印度食品加工工業部發布了新的《綜合冷鍊和加值基礎設施國家指南》。此舉旨在鼓勵公私合作投資冷藏運輸和倉儲領域的冷鏈建設,體現了對當前基礎設施差距的重視,並強調了攜手建立更強大的冷鏈生態系統的必要性。

冷鏈物流市場規模及預測:

| 報告屬性 | 詳細資訊 |

|---|---|

|

基準年 |

2025 |

|

預測年份 |

2026-2035 |

|

複合年增長率 |

14% |

|

基準年市場規模(2025 年) |

3856億美元 |

|

預測年份市場規模(2035 年) |

14295億美元 |

|

區域範圍 |

|

冷鏈物流市場細分:

類型細分分析

預計到2035年,冷藏倉庫將佔65.5%的市場份額,成為冷鏈物流產業的核心。這些倉庫對於安全儲存種類繁多的溫度敏感產品至關重要,涵蓋從新鮮水果到藥品等各類產品。對冷藏和冷凍食品需求的成長,以及現代全球供應鏈的複雜性,正推動對冷藏倉儲設施擴建和升級的大規模投資。先進的自動化技術和節能設計正成為該領域的主要差異化優勢。 2025年3月,Lineage Logistics完成了對華盛頓州貝靈厄姆冷藏公司的收購,獲得了三座新設施,並擴大了其海鮮、肉類和加工食品的儲存能力。這筆交易是冷藏倉儲產業整合和產能提升整體趨勢的一部分。

應用細分市場分析

基於強勁的消費者需求和產品極易腐爛的特性,預計到2035年,乳製品和冷凍甜點市場將佔據38%的收入份額。供應鏈中溫度的均勻性對於保障乳製品和冷凍甜點產品的品質和安全至關重要。此外,高端和手工產品需求的不斷增長也推動了該市場的成長,因為這類產品往往需要更嚴格的溫度控制。該市場的複雜性要求採用高科技物流和嚴格的品質控制。例如,Americold Logistics於2025年3月以2,400萬美元收購了位於新澤西州維內蘭的Safeway Freezers公司。此舉增強了該公司在美國東海岸的乳製品、冷凍甜點、烘焙食品和藥品儲存能力,體現了其為服務於這一重要應用領域而持續投資基礎設施的決心。

流程段分析

預計到2035年,預冷設施將佔據36%的市場份額,在延長易腐品的保質期方面發揮著至關重要的作用。預冷是指在儲存或運送前,快速去除剛採摘農作物的熱量。這是降低水果和蔬菜呼吸速率和酶分解的必要步驟,從而保持其品質和新鮮度。對新鮮優質農產品日益增長的需求以及國際貿易的擴張,催生了對先進預冷技術的需求。作為全球領先的建築技術公司,江森自控在2025年ACREX展會上展示了其最新的預冷創新技術,其中包括專為農業冷庫量身定制的人工智慧驅動智慧控制系統。這項進展凸顯了人工智慧和智慧控制系統在提高預冷作業的能源效率和產品品質方面的關鍵作用,使其成為該領域的重要成長推動力。

我們對冷鏈物流市場的深入分析涵蓋以下幾個面向:

部分 | 子段 |

類型 |

|

溫度類型 |

|

科技 |

|

過程 |

|

應用 |

|

Vishnu Nair

全球業務發展主管根據您的需求自訂本報告 — 與我們的顧問聯繫,獲得個人化的洞察與選項。

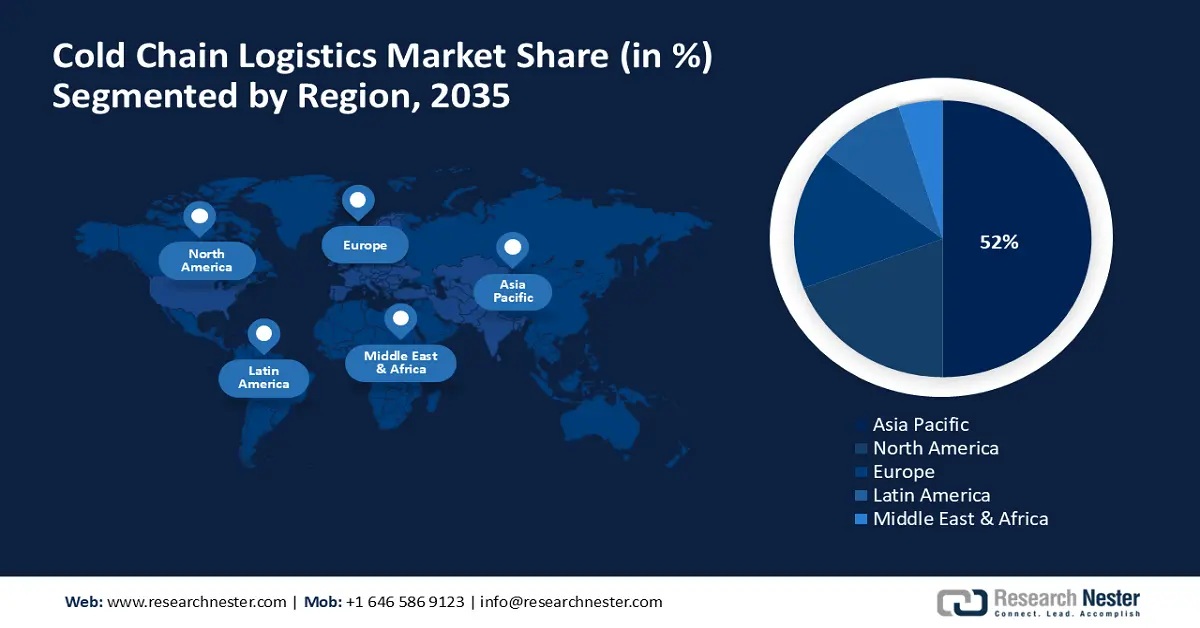

冷鏈物流市場-區域分析

亞太市場洞察

預計到2035年,亞太地區冷鏈物流市場將佔據全球52%的市場份額,成為全球規模最大、成長最快的地區。這主要得益於該地區經濟的快速增長、可支配收入的增加以及不斷壯大的中產階級對新鮮優質食品的巨大需求。然而,該地區大部分地區缺乏完善的冷鏈設施,這不僅是發展機遇,也是挑戰。巨大的市場潛力正吸引著大量的國際投資。

中國擁有龐大的人口基數和蓬勃發展的經濟,是領先的市場。政府已將建設新型冷鏈物流網絡列為國家重點目標。國務院在2025年1月發布的「十四五」現代物流規劃中,將冷鏈物流列為優先發展領域,旨在促進冷藏鐵路、多式聯運走廊和末端溫控網絡的發展。這種自上而下的推進方式正在加速建構世界一流的冷鏈基礎設施。

印度是亞太地區一個極具潛力的市場,擁有龐大的農業經濟,對加工食品和藥品的需求也日益增長。印度政府正積極推動國內冷鏈基礎設施建設,以最大限度地減少食品浪費,並提高安全優質產品的供應。該市場格局較為分散,既有大型企業,也有小型區域營運商。 2025年7月,Snowman Logistics Limited在德里首都區昆德利的新倉庫正式營運。該倉庫以長期租賃的方式取得,使公司新增3,576個托盤位,使其在21個城市的44個倉庫的總托盤位容量達到154,330個。除了龐大的倉儲網路外,Snowman還擁有296輛自有冷藏車和325輛租賃冷藏車,為全國提供全面的冷鏈連接。

北美市場洞察

北美冷鏈物流市場在2026年至2035年間將以14.8%的強勁複合年增長率增長,主要受消費者對新鮮和冷凍農產品的高需求以及龐大且先進的製藥行業的推動。該地區擁有全球最大的冷鏈物流公司之一,也是冷鏈技術創新中心。電子商務和線上生鮮配送的日益普及也推動了對末端冷鏈解決方案的需求。市場動態持續發展,以適應消費者和企業不斷變化的需求。

美國是北美的重要市場,擁有高度先進的冷鏈基礎設施和健全的監管體系。政府也積極透過撥款和研究經費扶持該行業。 2025年7月,美國農業部發布了最新的《食品供應鏈基礎設施支出報告》,其中概述了用於提升肉類、乳製品和農產品冷鏈能力的撥款計畫。這顯示美國政府致力於加強本國的食品供應鏈。

加拿大的冷鏈物流產業也在穩步發展,這得益於其龐大的農業和食品加工業。加拿大政府正大力投資興建國內冷鏈基礎設施,以保障食品供應並擴大海外市場。加拿大幅員遼闊,這不僅帶來了特殊的物流挑戰,也帶來了機會。 2025年3月,加拿大政府重申了對國家級冷藏設施的戰略投資承諾,這些設施用於醫療衛生和緊急應變。這其中包括為符合公共衛生標準的疫苗分發設施提供撥款。

歐洲市場洞察

預計到2035年,歐洲冷鏈物流市場將持續成長,這主要得益於對食品安全、永續性和技術的高度重視。該地區擁有先進的冷鏈基礎設施和嚴格的監管環境,能夠確保溫度敏感型產品的品質和完整性。對有機食品和本地食品需求的成長也推動了對更有效率、更透明的冷鏈解決方案的需求。歐洲消費者是全球最挑剔的消費者之一,這促使業界朝著前所未有的品質和服務水準邁進。

德國是歐洲的主導市場,擁有強勁的經濟和高效率的物流產業。德國政府鼓勵在冷鏈領域使用永續和節能技術。 2024年9月,德國聯邦數位與交通部啟動了冷藏倉庫節能改造以及農產品供應鏈中綠色鐵路物流的資助計畫。這不僅體現了經濟效益,也體現了對環境的重視。

英國是另一個重要的市場,擁有發達且規模龐大的食品和製藥產業。英國政府致力於提升國家食品安全,並增強供應鏈韌性。 2025年6月,英國國家網路安全中心推出了一項行業保障計劃,旨在提升食品和藥品冷鏈的韌性,例如在可追溯性、安全性和倉儲自動化等方面開展合作。此舉旨在英國脫歐後打造更強大、更安全的冷鏈產業。

冷鏈物流市場主要參與者:

- 美國冷鏈物流

- 公司概況

- 商業策略

- 主要產品

- 財務業績

- 關鍵績效指標

- 風險分析

- 最新進展

- 區域影響力

- SWOT分析

- Lineage Logistics Holding LLC

- 德迅

- DHL供應鏈

- 日本通運

- 德迅國際股份公司

- 敏捷物流

- CEVA物流

- DSV A/S

- 新冷先進冷物流

- 雪人物流

- CJ物流

- Linfox物流

- 中南物流控股有限公司

- VersaCold物流服務

冷鏈物流產業是一個競爭激烈且充滿活力的領域,既有大型跨國營運商,也有規模較小的專業服務商。 Americold Logistics、Lineage Logistics 和 DHL Supply Chain 等主要企業憑藉其強大的全球網路和廣泛的服務組合,在市場中佔據主導地位。為了保持競爭力並滿足不斷變化的客戶需求,各公司都在基礎設施和技術方面投入大量資金。此外,市場上的併購活動也十分活躍,企業力求拓展地域覆蓋範圍並增強自身能力。

多家公司正在投資包括自動化、物聯網和人工智慧的新技術,以提高效率、增強視覺性並減少環境足跡。綠色物流的需求也不斷增長,包括節能冷氣、替代燃料和環保包裝。邁向永續發展不僅是企業社會責任的問題,也是一項重要的競爭優勢。例如,DSV A/S 於 2025 年 4 月完成了對 DB Schenker 的收購,交易金額達 143 億歐元,此次收購將全球最大的冷鏈物流平台之一納入麾下,並擴展了其多式聯運先進溫控解決方案。此次收購體現了產業整合和形成更全面、更一體化服務產品的趨勢。

最新動態

- 2025 年 5 月, DHL 供應鏈在其位於德國弗洛爾施塔特的健康物流園區開設了第四個冷藏倉庫,這是其到 2030 年投資 22 億美元用於醫療和製藥物流的一部分。該設施設有多個溫度區、深冷室,並支援細胞/基因治療供應鏈。

- 2025年4月, Lineage Logistics宣布以2.47億美元收購泰森食品位於賓州、堪薩斯州、伊利諾州和亞利桑那州的四座冷庫,並簽署多年協議開發兩座自動化冷庫。此舉擴大了Lineage在美國的冷鏈能力,並提升了自動化和技術應用水準。

- 2025年3月, Americold Logistics宣布以1.27億美元收購位於德州休士頓的一座最先進的冷藏設施,其中包括計畫中的擴建項目。此次交易將為Americold的倉庫組合增加35,700個托盤位,並支持一項新的食品零售商合約。

- Report ID: 4557

- Published Date: Sep 26, 2025

- Report Format: PDF, PPT

- 探索关键市场趋势和洞察的预览

- 查看样本数据表和细分分析

- 体验我们可视化数据呈现的质量

- 评估我们的报告结构和研究方法

- 一窥竞争格局分析

- 了解区域预测的呈现方式

- 评估公司概况与基准分析的深度

- 预览可执行洞察如何支持您的战略