Перспективы рынка бисмалеимидного мономера:

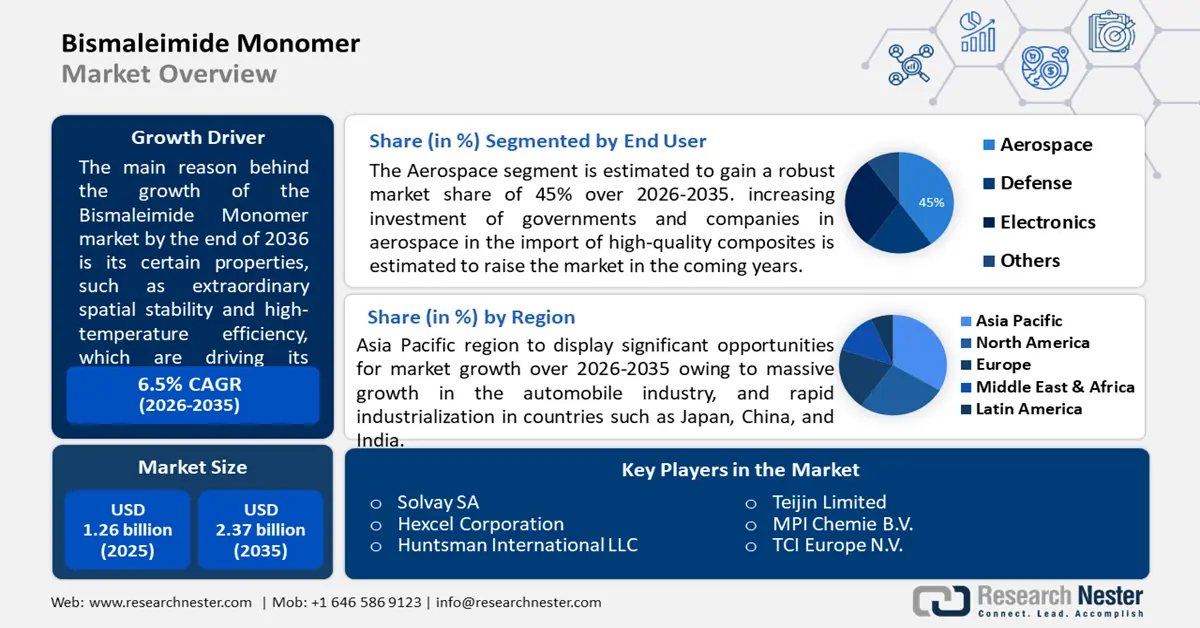

Объем рынка бисмалеимид-мономера в 2025 году превысил 1,26 млрд долларов США и, по прогнозам, достигнет 2,37 млрд долларов США к 2035 году, демонстрируя среднегодовой темп роста около 6,5% в течение прогнозируемого периода, то есть с 2026 по 2035 год. В 2026 году объем рынка бисмалеимид-мономера оценивается в 1,33 млрд долларов США.

Рост рынка в первую очередь объясняется его определенными свойствами, такими как исключительная пространственная стабильность и эффективность при высоких температурах, которые стимулируют его спрос, особенно в быстрорастущих аэрокосмической, автомобильной, электротехнической и электронной промышленности. Например, с середины 2020 года мировая электронная промышленность демонстрировала положительный рост. В рамках этой эволюции экспорт электроники в нескольких крупных центрах производства электроники Азиатско-Тихоокеанского региона продолжал уверенно расти до середины 2022 года. Экспорт ИКТ из Южной Кореи увеличился на 19% в годовом исчислении до 124 миллиардов долларов США за первые 6 месяцев 2022 года, составив 36% от общего объема экспорта Южной Кореи, в то время как общий экспорт электроники из Индии увеличился на 44% в годовом исчислении до 12 миллиардов долларов США с предыдущего финансового года 2021–2022.

Бисмалеимиды – это полиимиды аддитивного типа, используемые в высокоэффективных конструкционных композитах, требующих высокой температуры и прочности. Мономеры обычно получают путём соединения малеинового ангидрида и ароматического диамина, а образующаяся бисмалеиминовая кислота подвергается циклодегидратации с образованием бисмалеимидной смолы. Двойная связь малеимида обладает высокой реакционной способностью и может вступать в цепную реакцию. Бисмалеимиды имеют более высокую рабочую температуру, чем эпоксидные смолы. Изоляционные материалы становятся всё более популярными в растущих авиационной, компьютерной и строительной отраслях. По данным Всемирного банка, рост мировой промышленности (включая строительную отрасль) в 2021 году достиг 28,3%.

Ключ Мономер бисмалеимида Сводка рыночной аналитики:

Региональные особенности:

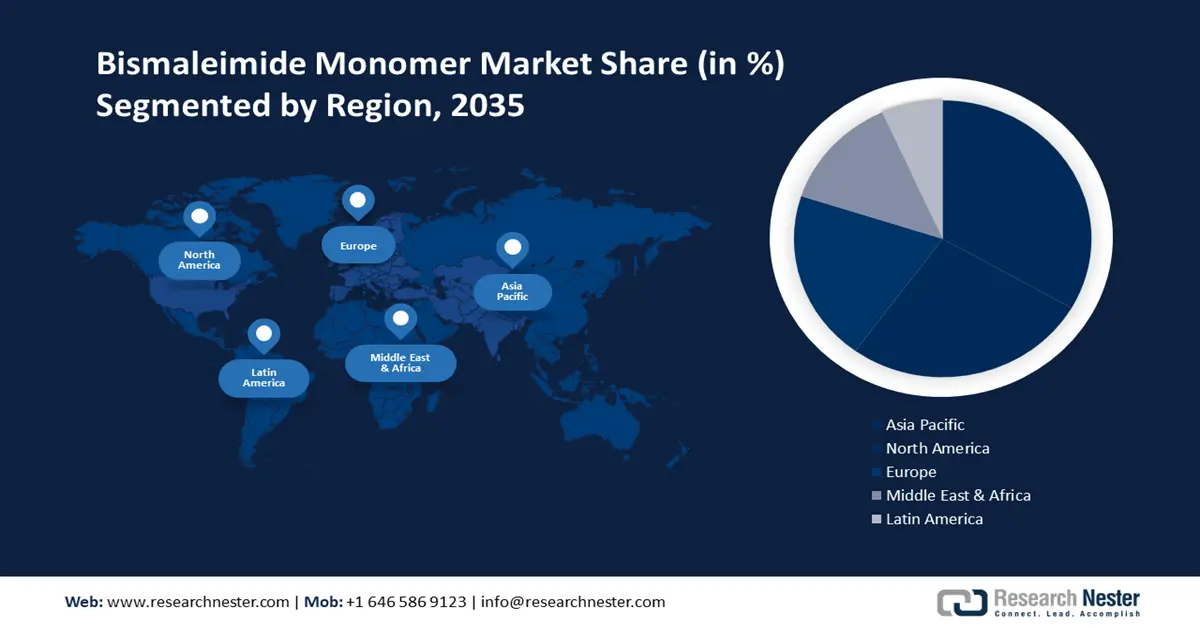

- К 2035 году доля рынка бисмалеимидного мономера в Азиатско-Тихоокеанском регионе составит около 36%, что обусловлено стремительным ростом автомобильной промышленности и быстрой индустриализацией в ключевых странах.

- Рынок Северной Америки достигнет значительного среднегодового темпа роста в период 2026–2035 годов благодаря росту производственных мощностей, внедрению различных стратегий роста и спросу аэрокосмической отрасли на лёгкие и экономичные материалы.

Обзор сегмента:

- Ожидается, что к 2035 году доля аэрокосмического сегмента на рынке бисмалеимидных мономеров составит 45%, что обусловлено ростом инвестиций в аэрокосмическую отрасль и импортом высококачественных композитов.

Основные тенденции роста:

- Рост в аэрокосмической и оборонной промышленности

- Рост производства компьютеров

Основные проблемы:

- Строгие правительственные предписания

- Ограничения, такие как высокие температуры плавления

Ключевые игроки:Evonik Industries AG, Solvay SA, Hexcel Corporation, Huntsman International LLC, Teijin Limited, MPI Chemie B.V., TCI Europe N.V., Willing New Materials Technology Co., Ltd., Honghu Shuangma Advanced Materials Tech Co., Ltd., ABR Organics Limited.

Глобальный Мономер бисмалеимида Рынок Прогноз и региональный обзор:

Прогнозы объёма рынка и роста:

- Объём рынка в 2025 году: 1,26 млрд долларов США

- Объём рынка в 2026 году: 1,33 млрд долларов США

- Прогнозируемый объём рынка: 2,37 млрд долларов США к 2035 году

- Прогнозы роста: 6,5% CAGR (2026–2035 гг.)

Ключевая региональная динамика:

- Крупнейший регион: Азиатско-Тихоокеанский регион (доля 36 % к 2035 году).

- Самый быстрорастущий регион: Азиатско-Тихоокеанский регион.

- Доминирующие страны: Китай, США, Германия, Япония, Индия.

- Развивающиеся страны: Китай, Индия, Япония, Южная Корея, Бразилия.

Last updated on : 9 September, 2025

Факторы роста и проблемы рынка бисмалеимид-мономера:

Драйверы роста

Рост в аэрокосмической и оборонной промышленности – После пандемии условия авиаперевозок заметно улучшились. Глобальная доступность вакцин от COVID-19 открывает путь к либерализации авиаперевозок. С другой стороны, для стимулирования роста оборонные компании стремятся сосредоточить свои усилия на развитии своих возможностей в области истребителей, космической устойчивости, судостроения и кибербезопасности. Такой рост в аэрокосмической и оборонной промышленности увеличивает спрос на мономеры бисмалеимида. Например, выручка мирового аэрокосмического и оборонного сектора в 2021 году составила около 715 млрд долларов США, что на 6% больше, чем в 2020 году.

Стремление к росту автомобильной промышленности. По прогнозам, к концу 2030 года потенциальный доход мировой автомобильной промышленности составит около 1,8 триллиона долларов США, увеличившись за тот же год на 31%.

Подъём производства компьютеров – бисмалеимидные мономеры широко используются в различных композитных составах для многослойных печатных плат высокопроизводительных компьютеров. Таким образом, рост производства крупногабаритных компьютеров является ещё одним важным фактором, стимулирующим спрос на бисмалеимидные мономеры. По состоянию на 2021 год по всему миру было поставлено около 344 миллионов ПК.

Масштабное развитие химической промышленности. В 2021 году предполагаемый мировой доход химической промышленности достиг самого высокого уровня за последние 16 лет, составив приблизительно 5 триллионов долларов США.

Рост расходов на исследования и разработки. По данным Всемирного банка, в 2020 году мировые расходы на исследования и разработки выросли до 2,63% от общего ВВП.

Проблемы

Строгие правительственные предписания . Первая проблема, которая возникает на этом рынке, — это строгие правила и нормы в отношении бисмалеимидных мономеров, установленные правительством.

Ограничения, такие как высокие температуры плавления

- Низкая электропроводность

Объем и прогноз рынка бисмалеимидного мономера:

| Атрибут отчёта | Детали |

|---|---|

|

Базовый год |

2025 |

|

Прогнозируемый период |

2026-2035 |

|

CAGR |

6,5% |

|

Размер рынка базового года (2025) |

1,26 млрд долларов США |

|

Прогнозируемый размер рынка на год (2035) |

2,37 млрд долларов США |

|

Региональный охват |

|

Сегментация рынка бисмалеимидного мономера:

Тип

Мировой рынок бисмалеимидного мономера сегментирован и проанализирован на предмет спроса и предложения по типу 4,4'-бисмалеимидодифенилметана, М-фениленбисмалеимида, фенилметанмалеимида, 4-метил-1,3-фениленбисмалеимида, BANI-M и других. Из которых сегмент 4,4'-бисмалеимидодифенилметана, как ожидается, значительно вырастет в течение прогнозируемого периода. На фоне его значительного использования в производстве изолированных проводов. Экспорт изолированных проводов быстро растет, что, как ожидается, приведет к росту этого сегмента. Например, экспорт изолированных проводов или кабелей из Китая увеличился до 2 451 212 долларов США в июле 2022 года по сравнению с 2 375 592 долларами США в июне 2022 года.

Конечный пользователь

Кроме того, рынок сегментирован и проанализирован с точки зрения спроса и предложения со стороны конечных потребителей, разделив его на аэрокосмическую, оборонную, электронную и другие отрасли. Ожидается, что аэрокосмический сегмент займет наибольшую долю рынка – 45%, оборонная промышленность – 25%, электроника – 20% и прочие – 10%. Рост инвестиций правительств и компаний в аэрокосмическую отрасль в импорт высококачественных композитов, по оценкам, приведет к росту рынка в ближайшие годы. Стоимость импорта правительства Испании выросла с 3811 долларов США в 2016 году до 4478 долларов США в 2019 году. Доступность сырья, удвоенная, дешевая рабочая сила и низкие издержки являются движущей силой роста этого сегмента.

Наш углубленный анализ мирового рынка включает следующие сегменты:

По типу |

|

По применению |

|

Конечным пользователем |

|

Vishnu Nair

Руководитель глобального бизнес-развитияНастройте этот отчет в соответствии с вашими требованиями — свяжитесь с нашим консультантом для получения персонализированных рекомендаций и вариантов.

Региональный анализ рынка бисмалеимидного мономера:

Анализ рынка Азиатско-Тихоокеанского региона

Ожидается, что к 2035 году доля выручки в Азиатско-Тихоокеанском регионе составит 36%. Этому способствуют стремительный рост автомобильной промышленности и быстрая индустриализация в таких странах, как Япония, Китай и Индия. Например, в 2021 году автомобильный сектор Китая произвел около 22 миллионов легковых автомобилей, тогда как Япония заняла второе место по этому показателю, произведя почти 7 миллионов легковых автомобилей в том же году. Азиатско-Тихоокеанский регион считается крупнейшим промышленным центром мира и включает в себя такие отрасли, как автомобилестроение, аэрокосмическая промышленность, электроника и электротехника. Низкие затраты, дешевая рабочая сила и доступность сырья являются ключевым фактором, который доступен в Азиатско-Тихоокеанском регионе и стимулирует рост этого рынка.

Обзор рынка Северной Америки

Кроме того, существенную долю рынка занимает Североамериканский регион. Ожидается, что увеличение производственных мощностей и внедрение различных стратегий роста в органическом и неорганическом производстве приведут к расширению бизнеса и портфеля продукции. Ожидается, что этот фактор будет способствовать росту рынка бисмалеимидмономера в регионе в прогнозируемый период. Кроме того, ожидается, что развитие аэрокосмической промышленности в этом регионе будет способствовать росту рынка бисмалеимидмономера в прогнозируемый период. Бисмалеимидмономеры способствуют снижению веса самолетов и снижению стоимости производства, одновременно повышая требования к ним в аэрокосмическом секторе.

Участники рынка бисмалеимидного мономера:

- Эвоник Индастриз АГ

- Обзор компании

- Бизнес-стратегия

- Основные предложения продуктов

- Финансовые показатели

- Ключевые показатели эффективности

- Анализ рисков

- Недавнее развитие

- Региональное присутствие

- SWOT-анализ

- Solvay SA

- Корпорация Hexcel

- Хантсман Интернешнл ООО

- Тейджин Лимитед

- MPI Chemie BV

- TCI Europe NV

- Willing New Materials Technology Co., Ltd.

- Honghu Shuangma Advanced Materials Tech Co., Ltd.

- ABR Organics Limited

Последние события

Компании Huntsman Corporation и KPX Chemical создали совместное предприятие под названием KPX HUNTSMAN POLYURETHANES AUTOMOTIVE CO., LTD. (KHPUA) для поставки корейским автопроизводителям инновационных полиуретановых систем.

Корпорация Hexcel присоединилась к британскому проекту ASCEND (Aerospace and Automotive Supply Chain Enabled Development), целью которого является разработка высокоскоростных технологий производства и обработки для создания новых легких современных композитных материалов.

- Report ID: 4313

- Published Date: Sep 09, 2025

- Report Format: PDF, PPT

- Ознакомьтесь с предварительным обзором ключевых рыночных тенденций и инсайтов

- Ознакомьтесь с примерами таблиц данных и разбивками по сегментам

- Оцените качество наших визуальных представлений данных

- Оцените структуру нашего отчёта и методологию исследования

- Получите представление об анализе конкурентной среды

- Поймите, как представлены региональные прогнозы

- Оцените глубину профилирования компаний и бенчмаркинга

- Предварительный просмотр того, как практические инсайты могут поддержать вашу стратегию

Изучите реальные данные и анализ

Часто задаваемые вопросы (FAQ)

Мономер бисмалеимида Объем рыночного отчета

Бесплатный образец включает текущий и исторический объем рынка, тенденции роста, региональные графики и таблицы, профили компаний, прогнозы по сегментам и многое другое.

Связаться с нашим экспертом

Авторские права © 2026 Research Nester. Все права защищены.