Zinc Stearate Market Outlook:

Zinc Stearate Market size was over USD 1.15 billion in 2025 and is poised to exceed USD 1.91 billion by 2035, growing at over 5.2% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of zinc stearate is estimated at USD 1.2 billion.

Developing regions are expected to dominate the zinc stearate trade in the coming years owing to rapidly increasing industrial and urban activities. The expanding mining actions are leading to huge production of zinc, which directly uplifts the zinc stearate market growth. The surge in construction activities and infra-upgrade projects are uplifting the revenue growth of the zinc stearate manufacturers. The NEOM project, Grand Paris Express, HS2, the Regional Environmental Sewer Conveyance Upgrade Program (RESCU), and Brenner Base Tunnel are some of the top infrastructure development projects happening across the world. Zinc stearate is exhibiting high demand in concrete mixings owing to its superior waterproofing characteristics.

|

Zinc Oxide and Zinc Peroxide Export (2023) |

|

|

Country |

Quantity Unit (Kg) |

|

Canada |

40,957,700 |

|

Mexico |

49,520,800 |

|

U.S. |

74,334,800 |

|

Netherlands |

32,517,400 |

|

European Union |

29,581,100 |

Source: WITS

The report by the World Integrated Trade Solution (WITS) reveals that Canada, Mexico, the U.S., the Netherlands, and the European Union are some of the top exporters of zinc oxide and zinc peroxide across the world. Whereas, Nigeria, Philippines, Malaysia, Myanmar, South Africa, Singapore, Romania, Slovak Republic, and Australia are anticipated to gain a top position in this export race during the foreseeable period. The economic growth in high-potential regions is directly correlating with a rise in demand for zinc stearates. Supportive regulations on mining activities are also contributing to the production of zinc and its derivatives. Furthermore, technological advancements in the zinc stearate manufacturing process are set to enhance their efficiency and performance, contributing to the overall market growth.

Key Zinc Stearate Market Insights Summary:

Regional Highlights:

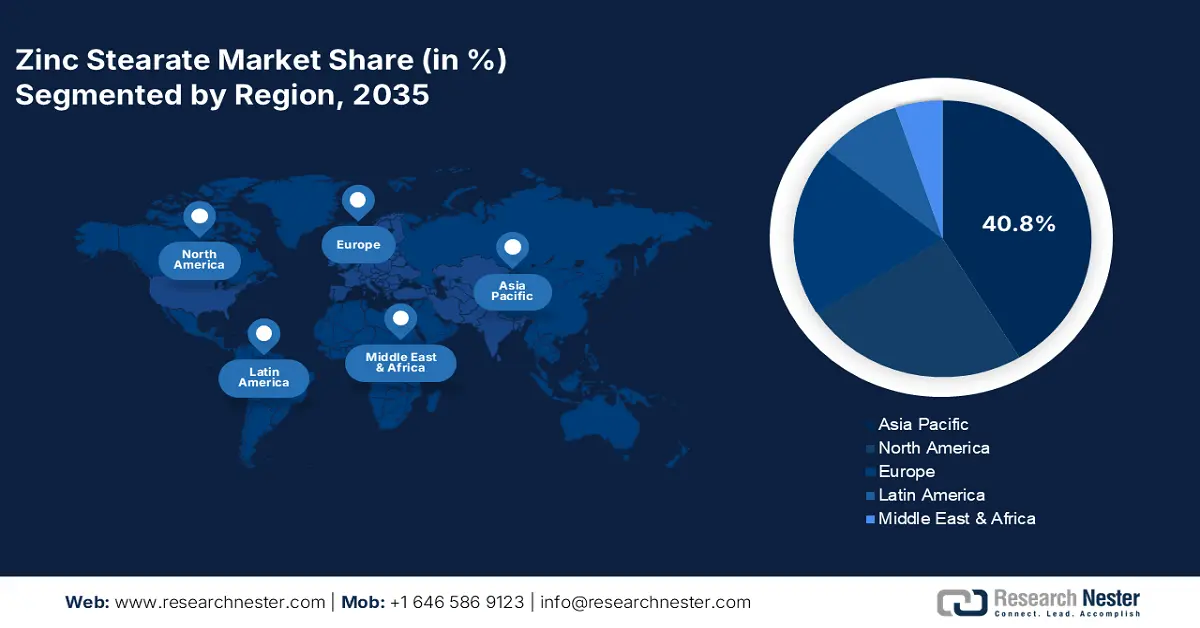

- Asia Pacific leads the Zinc Stearate Market with a 40.8% share, supported by mining activities, FDI policies, and demand from diverse industries, bolstering growth through 2035.

- The Zinc Stearate Market in North America is experiencing robust growth through 2026–2035, driven by demand in paints, coatings, and sustainable manufacturing practices.

Segment Insights:

- The Paints & Coatings segment of the Zinc Stearate Market is set for significant expansion through 2035, driven by booming construction and electronics industries increasing demand for decorative coatings.

Key Growth Trends:

- Growth in beauty and personal care product demand

- Plastics augmenting zinc stearate consumption

Major Challenges:

- Excess exposure or improper handling creates health & safety concerns

- Substitutes limiting the sales of zinc stearate

Key Players: Nikunj Chemicals, Seoul Fine Chemical Industry, Allan Chemical, Barium & Chemicals, Avitar Chemicals, and VSM AG.

Global Zinc Stearate Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 1.15 billion

- 2026 Market Size: USD 1.2 billion

- Projected Market Size: USD 1.91 billion by 2035

- Growth Forecasts: 5.2% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (40.8% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, United States, Japan, Germany, India

- Emerging Countries: China, India, South Korea, Japan, Brazil

Last updated on : 13 August, 2025

Zinc Stearate Market Growth Drivers and Challenges:

Growth Drivers

- Growth in beauty and personal care product demand: Cosmetics and personal care are the most profitable marketplaces for zinc stearate manufacturers. Zinc stearate is a vital ingredient used in the production of cosmetics and personal care products and this essentiality along with the emulsifying and binding aspect is driving their sales growth. In pharmaceuticals zinc stearates act as a stabilizer and excipient, which aids in improving product quality and shelf life. The GDP growth, the rising number of beauty influencers, and e-commerce trends are collectively supporting the cosmetic, personal care, and supplement sales growth, which subsequently drives the consumption of zinc stearates.

- Plastics augmenting zinc stearate consumption: Zinc stearate is exhibiting increasing use as a release agent in the plastics industry to prevent raw materials from sticking to molding structures. High urban activities across the world fueling plastic and PVC consumption are underscoring a profitable environment for zinc stearate manufacturers.The United Nations report reveals that China is the world’s largest producer of plastics, followed by the U.S., Germany, and the Netherlands. The same source also estimates that the developing regions are net exporters of plastics and capture around 80.0% of the global plastic waste trade. This explains that the rising plastic trade is having a snowball effect on zinc stearate demand.

Challenges

- Excess exposure or improper handling creates health & safety concerns: Even though zinc stearate is considered a safe chemical, excess exposure or improper handling of it causes health issues such as respiratory problems and skin irritation. This drives strict implementation of regulations around chemical safety standards limiting the sales of certain zinc stearate formations in some regions. Thus, health and safety concerns are restraining the zinc stearate market growth to some extent.

- Substitutes limiting the sales of zinc stearate: The zinc stearate manufacturers are facing strong competition from substitute chemicals that offer similar uses. Calcium stearate, magnesium stearate, and lithium stearate are some of the alternatives to zinc stearate that offer superior performance in some applications. Thus, the availability of other components with similar functionalities is anticipated to limit the sales of zinc stearates in the coming years.

Zinc Stearate Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

5.2% |

|

Base Year Market Size (2025) |

USD 1.15 billion |

|

Forecast Year Market Size (2035) |

USD 1.91 billion |

|

Regional Scope |

|

Zinc Stearate Market Segmentation:

Application (Additives, Plasticizers, Lubricants, Emulsifiers, Protective Agents, Water Repellant Agents, Heat Stabilizers, Others)

The lubricants segment is expected to capture a dominant zinc stearate market share throughout the forecast period. Zinc stearate's dominance as a lubricant is high due to its increasing demand from the plastics, paper, and coatings industries. Plastic molding and powder metallurgy sectors are propelling the demand for zinc stearates as they offer superior efficiency in the manufacturing process. Zinc stearates owing to their lubricant characteristics lead to energy savings and shorter production times, which directly contributes to sustainable manufacturing practices and the cost-effectiveness of the final product. Thus, the growth of the above-mentioned industries is set to have a positive influence on the sales of zinc stearates.

End use Industry (Paints & Coatings, Cosmetics, Personal Care, Concrete, Paper, Rubber, Others)

The paints & coatings segment is expected to capture zinc stearate market share of over 27.5% by 2035. Zinc stearate is finding wide application in paints and coatings as a flatting and sanding agent, which boosts the coating and softening of the film. The booming construction and electronics business significantly drives the paint and coating demand, subsequently leading to high consumption of zinc stearates. For instance, the Ministry of Trade, Republic of Turkey revealed that in 2022, the global paints and coatings industry was calculated at around 40 million tons with a major share of decorative and industrial coatings. Asia Pacific is expected to dominate the sector owing to the presence of rapidly developing countries such as India and China. Robust construction and manufacturing activities in the region are significantly contributing to the sales of paints and coatings. These statistics highlight the dominance of the paints and coatings sector over the zinc stearate trade.

Our in-depth analysis of the global market includes the following segments:

|

Application |

|

|

End use Industry |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Zinc Stearate Market Regional Analysis:

Asia Pacific Market Forecast

By 2035, Asia Pacific zinc stearate market is predicted to dominate over 40.8% revenue share. The high mining activities and supportive foreign direct investment (FDI) policies are augmenting the production of zinc stearate. The swiftly expanding businesses such as construction, consumer electronics, cosmetics, pharma, and personal care are directly fueling the consumption of zinc stearates for the production of byproducts. Furthermore, supportive government policies supporting chemical production are aiding zinc stearate manufacturers in revenue growth. China, India, Japan, and South Korea are some of the opportunistic marketplaces driving the overall trade of zinc stearates.

The booming manufacturing activities in China are anticipated to create profitable opportunities for zinc stearate manufacturers in the coming years. In January 2024, the Centre for Economic Policy Research (CEPR) revealed that China contributes to 35% of global production. Thus, the country’s increasing dominance in the manufacturing sector is set to create a profitable environment for zinc stearate trade. The country being a significant producer of plastic is also augmenting the consumption of zinc stearates. For instance, in February 2022, the International Pollutants Elimination Network (IPEN) disclosed that China’s plastic production has surpassed 95.741 million tons, amounting to 1/3rd of the world's plastic output.

In India, the growth in mining activities is set to double the profits of zinc stearate market players in the coming years. Supportive government policies and increasing international demand are propelling mining projects in the country. The India Brand Equity Foundation (IBEF) study reveals that in the next 5 to 10 years, the zinc demand is estimated to double owing to increasing investments in infrastructure development initiatives. The same source also states that around 1319 reporting mines were active in 2022. The Aatmanirbhar Initiative of India is further anticipated to support the market growth in the years ahead.

North America Market Statistics

The North America zinc stearate market is foreseen to expand at a robust CAGR between 2026 to 2035. The presence of specialized chemical producers and dominant end use industries such as paints and coatings, construction, manufacturing, and electronics are augmenting the overall market growth. The ongoing innovations in cosmetics and personal care products are propelling the sales of zinc stearate in the region. Supportive government policies and sustainable manufacturing practices are anticipated to further drive the market growth in both the U.S. and Canada.

In the U.S., the increasing construction and infrastructure development activities are fueling the consumption of zinc stearates. For instance, the U.S. Census Bureau disclosed that in November 2024 the construction spending totaled USD 2152.6 billion. During the same period, the spending on private construction was calculated at USD 1650.7 billion and on public construction was USD 501.9 billion. This robust spending in the construction field explains the zinc stearate sales growth in the country.

Canada’s boasting automotive and manufacturing sectors are propelling the demand for zinc stearates. The zinc stearate compound is widely used in the production of rubbers, plastics, and other materials vital in vehicle production. The electric vehicle (EV) trend and increasing adoption of sustainable manufacturing practices are fueling the market growth. For instance, the Statistics Canada study reveals that in Q4 2023 the registration of new zero-emission vehicles totaled 52,685, in Q1’24 (48,411), Q2’24 (65,733), and Q3’24 (75,636). Thus, the continuous innovations in the automotive sector are poised to promote the usage of zinc stearates in the coming years.

Key Zinc Stearate Market Players:

- Dover Chemical Corporation

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Jiangxi Hongyuan Chemical & Industrial Co., Ltd.

- Faci S.p.A.

- Baerlocher GmbH

- Shaoyang Tiantang Additives Chemical Co., Ltd

- Peter Greven GmBH & Co. KG

- Valtris Speciality Chemicals

- Norac Additives

- Nikunj Chemicals

- Seoul Fine Chemical Industry

- Allan Chemical

- Barium & Chemicals

- Avitar Chemicals

- VSM AG

The zinc stearate market is characterized by the presence of industry giants and the increasing emergence of new companies. The adoption of organic and inorganic marketing strategies is primarily aiding the leading companies to earn high profits and reach a wider consumer base. Technological innovations, new product launches, strategic collaborations & partnerships, global expansion, and mergers & acquisitions are some of the tactics employed by market players. The zinc stearate market is highly dependent on the growth of the end use industries such as automotive, manufacturing, construction, concrete, paper, pharmaceuticals, and cosmetics. Strategic partnerships with these companies are predicted to propel the profits shares of zinc stearate manufacturers.

Some of the key players include:

Recent Developments

- In November 2023, VSM AG announced the successor of the VSM STEARATE and STEARATE Plus series, ALU-X. The latest product offers x-treme performance and clean grinding of materials.

- In March 2022, the Federal Register revealed that the Environmental Protection Agency (EPA) regulation establishes an exemption from the requirement of a tolerance for residues of zinc stearate in pesticide formulations. This applies to no more than 6 percent by weight of the formulation in pre- and post-harvest applications to crops.

- Report ID: 7099

- Published Date: Aug 13, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Zinc Stearate Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.