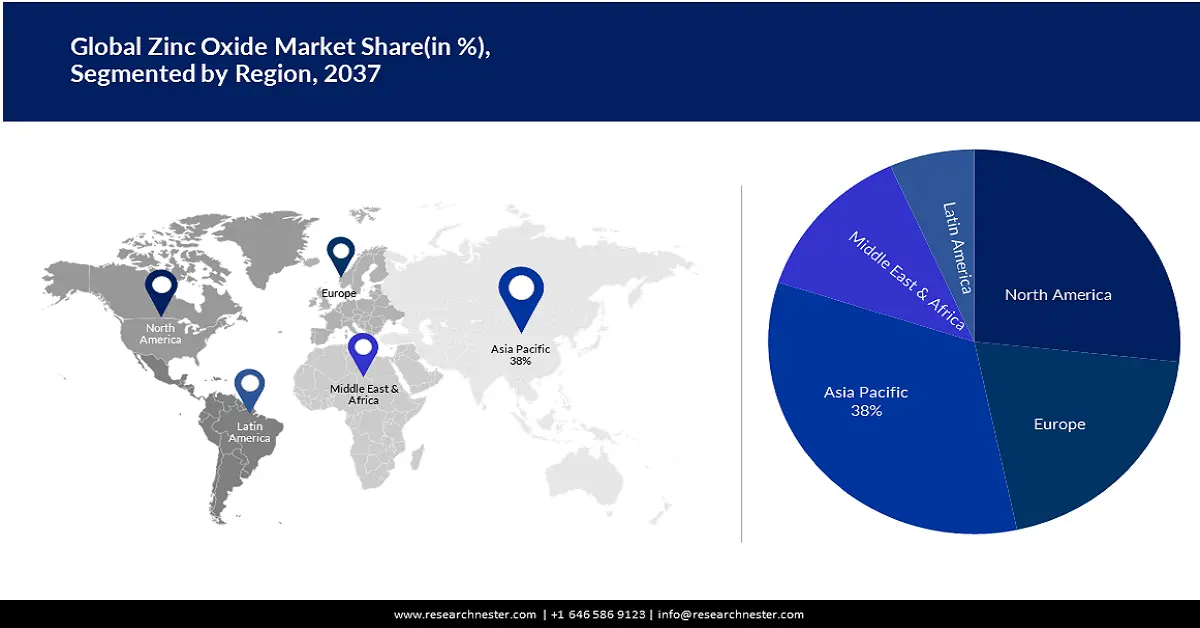

Zinc Oxide Market Regional Analysis:

APAC Market Insights

Asia Pacific zinc oxide market is likely to account for the largest revenue share of 38% by 2035, owing to the rising production of gallium and germanium. Specifically, gallium is recovered from the sodium aluminate Bayer liquor by ion exchange during bauxite ore processing and, from the residues during the zinc oxide leaching by roasting sphalerite ores. Years of sweeping industrial policies have enabled China to gain a near-total monopoly on gallium supply, widely used to manufacture microchips for the U.S.’ advanced military technologies. CSIS says that China generates 98% of the global raw gallium, resulting in a far-reaching influence on U.S. semiconductor production.

China’s export controls on germanium and gallium exemplify the demand for zinc oxide and are vital for the world’s economic development, and transition to renewable energy, and have a direct impact on U.S. GDP. According to a USGS 2024 report, China’s net exports of germanium and gallium exports can possibly slump the U.S. GDP to USD 3.1 billion (with upper and lower projections of USD 8.2 billion and USD 1.7 billion) and USD 0.4 billion (USD 0.01 billion to USD 1.1 billion), if disrupted separately, and USD 3.4 billion (USD 1.7 billion to USD 9.0 billion) in case of simultaneous disruption.

North America Market Insights

The zinc oxide market in North America is projected to hold the second-largest share during the forecast period. Both Canada and the U.S. play a pivotal role in the global mine production of zinc. Canada predominantly sources zinc in Ontario and Quebec, whereas its co-products in British Columbia, Manitoba, and the Yukon. It is being widely used in Canada in the form of zinc oxides for skin creams. Canada’s zinc and zinc product exports were USD 2.1 billion in 2023, as per the Government of Canada, which was 562,365 tons of zinc oxide, ore concentrate, unwrought zinc, and zinc metal items and cumulatively represented a 4% spike from 2022.

According to USGS estimates, the production of zinc mines in the U.S. slumped marginally in 2023 as compared to 2022. In the second half of the year, two mines that produce zinc suspended production. Due to declining zinc prices and the impact of inflation on input costs, the Middle Tennessee zinc mines temporarily suspended production in late November. Drilling would be done to identify further zinc, germanium, and gallium deposits during the closure. According to projections, domestic refined production was essentially unchanged in 2023 compared to the previous year, and apparent consumption was also essentially unchanged. Additionally, net imports of refined zinc were estimated to have decreased slightly.

Average monthly prices dipped particularly during the initial two quarters of 2024. High interest rates in the U.S. and Europe, high energy prices in Europe, the relative strength of the U.S. dollar, and concerns about a downturn in China’s real estate industry were cited by the USGS as factors leading to the price decrease. The monthly average premium to the London Metal Exchange (LME) cash price declined in 2023 but was comparatively higher than historical levels. As per the International Lead and Zinc Study Group, worldwide refined zinc in 2023 surged by 3.7% and reached 13.8 million tons, while metal consumption rose by 1.1% to 13.6 million tons, thereby leading to 248,000 tons production-to-consumption surplus.