Zero Turn Mower Market Outlook:

Zero Turn Mower Market size was valued at USD 3.3 billion in 2025 and is set to exceed USD 7.06 billion by 2035, registering over 7.9% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of zero turn mower is evaluated at USD 3.53 billion.

Residential homeowners are increasingly adopting improved and efficient zero turn mowers instead of conventional counterparts due to their convenient use. The self-owned compact zero turn movers are effective in both performance and long-term costs owing to their ability to maneuver lawn obstacles such as shrubs, flower beds, and long grass. Many countries worldwide are governed by their specific lawn management ordinance and if not obeyed can lead to legal and financial consequences.

For instance, according to the Fairfax County government’s vegetation ordinance, the height of the grass should be kept below 12 inches by residential property owners. The rules can differ based on the type of property however lack of compliance or violation of rules can lead to hefty fines. Several studies estimate that a professional lawn mowing service provider can charge thousands of dollars depending upon the project/land. To combat this financial burden, landowners find zero turn mowers a cost-effective investment option in the long-term view.

Considering this aspect as an opportunity, many zero turn mower manufacturers are concentrating on developing residential models at competitive pricing. For instance, Husqvarna Group, a leading producer of zero turn mowers offers residential mowing machines at affordable prices. The Husqvarna Group’s residential zero turn lawn mower designs range between USD 3299 to USD 6999, with multiple designs and features.

This appeals to a wider consumer base, particularly land owners seeking to mitigate high professional lawn mowing costs. For instance, the Husqvarna Group’s second quarter FY 23 interim report revealed that its net sales increased by 7% and the operating margin was 12.4%. Furthermore, in March 2023, Husqvarna revealed the launch of new wire-free technology-based residential lawn mowing solutions. The Automower 450X and 450XH EPOS movers are connected with the Automower Connect App, which eliminates the need for boundary wire. Thus, various marketing strategies including innovative residential product launches is aiding the company to earn high profits.

Key Zero Turn Mower Market Insights Summary:

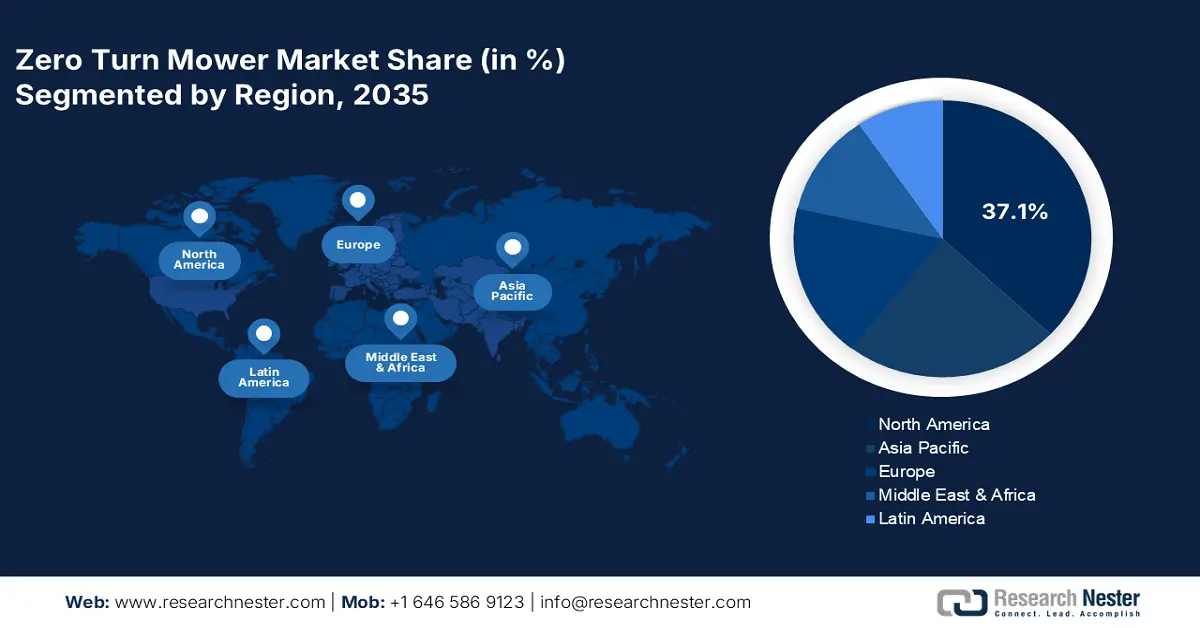

Regional Highlights:

- North America's 37.1% share in the Zero Turn Mower Market is driven by high golf course visits, strict lawn regulations, and commercial infrastructure, fostering growth through 2035.

- The Zero Turn Mower Market in Asia Pacific is forecasted to grow rapidly through 2026–2035, driven by increasing infrastructure projects and adoption of smart gardening equipment.

Segment Insights:

- The more than 60 inches segment is set for substantial growth from 2026-2035, due to widely adopted by professional landscapers and large property owners.

- The commercial segment is projected to hold over 59.5% market share by 2035 due to the rising infrastructure developments of commercial properties.

Key Growth Trends:

- EV technology trend

- Integration of smart technologies

Major Challenges:

- Expensive advanced technology

- High repair and maintenance costs

- Key Players: Husqvarna Group, John Deere Company, MTD Products Inc., The Toro Company, Swisher Inc., and Robert Bosch GmbH.

Global Zero Turn Mower Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 3.3 billion

- 2026 Market Size: USD 3.53 billion

- Projected Market Size: USD 7.06 billion by 2035

- Growth Forecasts: 7.9% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (37.1% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Japan, Germany, United Kingdom

- Emerging Countries: China, India, Brazil, Mexico, Turkey

Last updated on : 14 August, 2025

Zero Turn Mower Market Growth Drivers and Challenges:

Growth Drivers

-

EV technology trend: The emergence of electric vehicle (EV) technology is a significant trend promoting the sales of electric zero turn mowers. Quieter operation, reduced carbon emission, and low maintenance costs are driving up its sales in comparison to gas-powered models. For instance, in October 2024, John Deere Company revealed the launch of the Z380R Electric ZTrak zero turn mower, especially for residential users. The company designed this new model with high performance and improved convenience after the success of its Z370R Electric ZTrak residential zero turn mower.

This underscores that electrification is a high-earning opportunity for new as well as established zero-turn mower manufacturers. By analyzing the financial report of John Deere, it can be understood that the company’s aim to enhance efficiency and cut operating costs of products to meet customers’ demands is aiding them to earn huge returns. In November 2024, the John Deere Company revealed that it reached a net income of USD 1.245 billion for the fourth quarter of FY 24. Customer-oriented marketing tactics are set to offer profitable opportunities for key market players in the years ahead. -

Integration of smart technologies: The integration of digital technologies such as artificial intelligence, machine learning, IoT connectivity, GPS tracking, and automation in zero turn mowers is substantially creating a high demand among residential and commercial users. Real-time monitoring, route optimization, and improved efficiency are major characteristics benefitting the robotic autonomous zero turn mower sales growth.

Electric Sheep, one of the leading producers of smart movers is continuously advancing the landscaping field by introducing next-gen electric zero turn mowers. For instance, in January 2022, Electric Sheep through its Series A Funding of USD 25.0 million started the production of vertically integrated models. In 2023 the company grew 8x and acquired 4 new companies. This highlights how AI is booming the revenue growth of the company. Furthermore, Electric Sheep estimates that landscaping is a USD 250 billion opportunistic space for embodied AI zero turn mower manufacturers in the U.S. The company also aims for 500k deployment of robots backed by ES1 a mower model by 2030.

Challenges

-

Expensive advanced technology: The advanced zero turn mowers are expensive due to the integration of digital technologies. These complex technologies drive up the overall product cost making it inaccessible, especially for residential users. Commercial businesses working on limited budgets also hesitate to invest in advanced mowers, hindering the zero turn mower market growth to some extent.

-

High repair and maintenance costs: The zero turn mowers are known for their durability, high performance, and strength but they have to go through maintenance on a regular basis such as oil changes, blade maintenance, and tire replacements. The complexity of modern mowers especially commercial models leads to high repair and maintenance costs, which acts as a major challenge for their adoption in the price sensitivity markets.

Zero Turn Mower Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

7.9% |

|

Base Year Market Size (2025) |

USD 3.3 billion |

|

Forecast Year Market Size (2035) |

USD 7.06 billion |

|

Regional Scope |

|

Zero Turn Mower Market Segmentation:

Cutting Width (Less Than 50 inches, 50 to 60 inches, More than 60 inches)

The more than 60 inches segment is set to dominate over 41.1% zero turn mower market share by 2035. These types of zero turn mowers are widely adopted by professional landscapers and large property owners. More than 60 inches cutting width zero turn mowers enable high productivity by faster operational times and mitigating labor costs. Innovations in materials and engine technology are also contributing to the performance of larger mowers.

Furthermore, the swiftly expanding landscaping business is directly augmenting the sales of zero turn mowers with a 60 + inch cutting width. For instance, the National Association of Landscape Professionals reveals that the landscape services market was valued at USD 153 billion in 2024. Over 1 million individuals are employed in this sector and around 661,000 businesses represent landscaping services. Thus, considering the boasting landscaper business, manufacturers are concentrating on developing larger mowers with powerful engines, deck designs, and enhanced fuel efficiency.

Application (Commercial, Residential)

By the end of 2035, commercial segment is estimated to account for more than 59.5% zero turn mower market share. The rising infrastructure developments of commercial properties such as offices, schools, parks, and sports fields including golf courses are fuelling the sales of high-efficiency mowing equipment such as zero turn lawnmowers that are suited to manage large green spaces. The National Golf Foundation estimates that there are over 14,000 golf facilities in the U.S.

Our in-depth analysis of the global zero turn mower market includes the following segments:

|

Cutting Width |

|

|

Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Zero Turn Mower Market Regional Analysis:

North America Market Forecast

By 2035, North America zero turn mower market is predicted to capture over 37.1% revenue share. The high golf course visits, strict regulations on lawn maintenance, and the increasing commercial infrastructure projects are driving the sales of zero turn mowers. The strong presence of industry giants that continuously focus on the introduction zero turn mowers with advanced technologies is supporting the zero turn mower market.

In the U.S., golf’s reach is over 123 million, as of data published by the National Golf Foundation, in 2023. The rising golf activities in the country are directly fueling the constant demand for mowing services, contributing to the high sales of advanced commercial zero turn mowers. The strict ordnance on maintaining grass height is also driving the adoption of residential zero turn mowers in the country.

In Canada, the government’s strict sustainability goals are majorly pushing the sales of electric zero turn mowers. The country aims to achieve 17 sustainable goals by 2030 as per its agenda adopted in 2015 and clean energy and climate actions are few of them. The electric-powered zero turn mowers offer low carbon emissions and are quitter in comparison to conventional gas-powered models. Thus, EV technology-based zero turn mower manufacturers are anticipated to earn high revenue shares in the country.

Asia Pacific Market Statistics

Asia Pacific is a rapidly expanding marketplace for zero turn mower producers driven by the increasing infrastructure development projects such as smart cities, high investments in sports sector, and growing adoption of smart gardening equipment. The demand for zero turn mowers is estimated to increase at the fastest CAGR in India and China, whereas continuous innovations and quick adoption of new technologies are set to fuel the sales of zero turn mowers in Japan and South Korea.

In India, the development of urban green spaces such as parks, gardens, and green belts is pushing a high demand for advanced landscaping equipment such as zero turn mowers. In addition to this, government initiatives such as the National Mission for a Green India (GIM) promoting a green environment in urban and peri-urban areas are substantially augmenting the adoption of zero turn mowers to manage these spaces effectively.

The rapidly expanding construction activities in China are set to generate lucrative opportunities for zero turn mower market. For instance, in April 2023, the International Trade Administration revealed that China is the largest construction market, globally. As per the country’s 14th five-year plan, the total investments in new infrastructure development projects including energy, water systems, green building, transportation, and new urbanization are calculated at around USD 4.2 trillion. Such huge investments are anticipated to positively influence the sales of modern zero turn mowers in the coming years.

Key Zero Turn Mower Market Players:

- Bobcat Company

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Briggs & Stratton

- ARIENS

- BigDog Mower Co.

- Husqvarna Group

- John Deere Company

- MTD Products Inc.

- The Toro Company

- Swisher Inc.

- Robert Bosch GmbH

Key players in the zero turn mower market are adopting various organic and inorganic marketing tactics to earn high revenue shares. Technological advancements, new product launches, strategic collaborations & partnerships, mergers & acquisitions, and regional expansion are some of them. By strategically collaborating with tech companies and other players the industry giants are developing innovative zero turn mowers. The AI-integrated zero-turn mower highly attracts tech-savvy consumers, doubling the profits of the key market players. Regional expansion strategies are also aiding them to tap into emerging markets to grab profitable opportunities.

Some of the key players include:

Recent Developments

- In October 2023, Bobcat Company introduced the high-performance ZT5000 a zero turn mower. The design of the mover is convenient for both lawn care professionals and property owners.

- In April 2023, Husqvarna Group announced the launch of the most potent commercial zero-turn mower. This Z560LS is a productive, high-quality mover for commercial landscapers.

- Report ID: 6764

- Published Date: Aug 14, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Zero Turn Mower Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.