X-ray Detector Market Outlook:

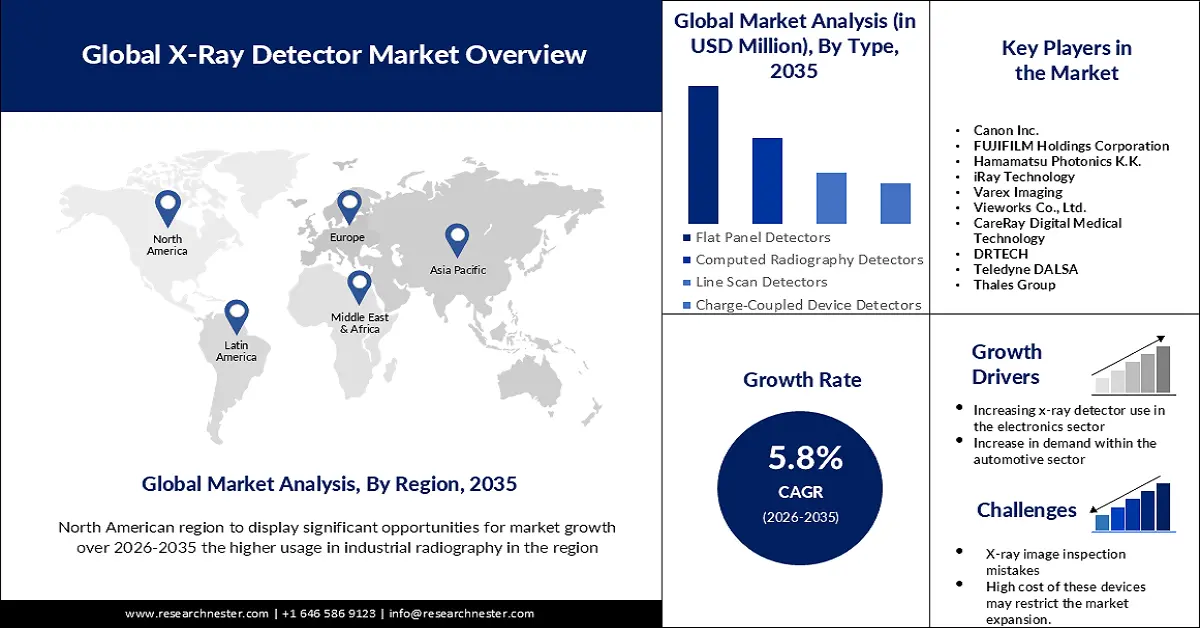

X-ray Detector Market size was valued at USD 3.77 billion in 2025 and is expected to reach USD 6.63 billion by 2035, expanding at around 5.8% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of x-ray detector is evaluated at USD 3.97 billion.

The market's expansion is thought to be due to X-ray detectors due to ongoing technological advancements and rising demand for improved imaging in the anticipated timeframes. An estimated 3.6 billion diagnostic medical exams, including X-rays, are carried out annually throughout the world. The figure is still rising as more people seek out medical attention. Of these, 350 million are carried out on minors younger than 15 years old.

In addition to these, due to its large-area, flat-panel detectors made of a thin-film transistor array, the most recent generation of X-ray detectors can offer quick access to digital images. Radiologists should have easier access to a wealth of information regarding a wide variety of large-area and flat-panel electronic detectors due to the rapid technological advancements in digital radiography. This discovery has forced the creation of extremely sensitive X-ray detectors that will reduce radiation exposure for numerous key stakeholders. X-ray photon energy is a crucial component of X-ray detectors since the various components of the system primarily depend on it for their X-ray absorption coefficients. Therefore, properly generated X-ray photon energy utilizing the novel technology would enhance penetration capabilities. This discovery has forced several major competitors to develop extremely sensitive and low-dose radiation X-ray detectors in order to keep up with the anticipated increase of the X-ray detector market.

Key X-ray Detector Market Insights Summary:

Regional Highlights:

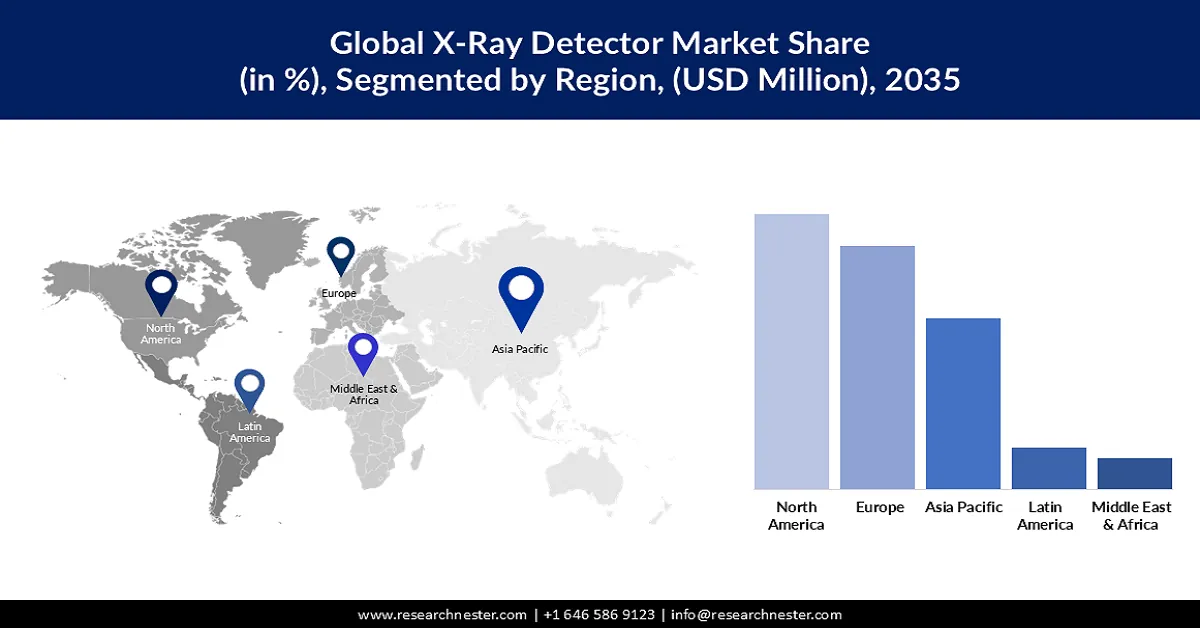

- North America’s x-ray detector market attains a 35% share by 2035, driven by increasing utilization of industrial radiography to examine material integrity and structure.

- Europe’s market will achieve a 30% share by 2035, fueled by the crucial role of European technology in digitization of mechanical and automotive engineering, increasing demand for industrial radiography.

Segment Insights:

- The flat panel detectors segment in the x-ray detector market is expected to achieve a 43% share by 2035, fueled by increased use in non-destructive testing and industrial quality control.

- The oil & gas segment in the x-ray detector market is projected to achieve a 24% share by 2035, driven by strict safety standards demanding extensive inspections using x-ray detectors.

Key Growth Trends:

- Increase in Demand within the Automotive Sector

- Increasing X-ray Detector Use in The Electronics Sector

Major Challenges:

- Inspection of Vehicles Is A Difficult Task.

- The High Cost of These Devices May Restrict the X-ray Detector Market.

Key Players: Canon Inc., FUJIFILM Holdings Corporation, Hamamatsu Photonics K.K., iRay Technology, Varex Imaging, Vieworks Co., Ltd., CareRay Digital Medical Technology, DRTECH, Teledyne DALSA, Thales Group.

Global X-ray Detector Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 3.77 billion

- 2026 Market Size: USD 3.97 billion

- Projected Market Size: USD 6.63 billion by 2035

- Growth Forecasts: 5.8% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (35% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, Japan, China, United Kingdom

- Emerging Countries: China, India, Japan, South Korea, Malaysia

Last updated on : 11 September, 2025

X-ray Detector Market Growth Drivers and Challenges:

Growth Drivers

- Increase in Demand within the Automotive Sector- Because engineered materials can allow X-ray radiation to pass through them, inspection devices can measure and photograph hidden features. The automotive sector uses this technology to meet the growing demand for quality assurance and product traceability, which lowers liability and improves product quality. An X-ray scan can often eliminate the need for inspection stations since it can provide a last quality check after packaging instead of at key points during the production process. The best way to inspect automotive castings for faults like cracks and welding issues is with an X-ray detector. However, a wide range of applications, such as suspension parts, braking systems, suspension parts, coolant hoses, engine mounts, intercoolers, coatings, heat exchangers, and features within catalytic converters, exhaust systems, fuel injection systems, suspension assemblies, complex assemblies, and micro-electromechanical systems, are also served by 2D and 3D X-ray inspection in the automotive industry. In 2021, there was a 3% year-over-year growth in the production of motor cars, with around 80 million vehicles produced worldwide.

- Increasing X-ray Detector Use in The Electronics Sector- X-ray inspection of electronic components is now standard practice for all companies in the electronics industry. The most widely used applications are process verification, quality assurance, and failure analysis. Because X-ray examination is so versatile, the user can complete all of these activities with just one equipment. Destructive testing is very beneficial for many applications, but it takes time, effort, and expensive equipment. Because electronic components are often so small, any destructive inspection method will damage the objects that need to be examined. Non-destructive testing, or NDT, is any inspection carried out on a part without causing harm. X-rays should be used by everybody working in the NDT sector. They enable customers to visually assess goods that are hidden, enclosed, or otherwise out of reach for other kinds of examination.

- Increasing Requirements in the Gas and Oil Sector- Lower-than-expected production from oil and gas wells is frequently caused by well debris or broken downhole equipment. Because most well fluids are opaque, oil companies don't have a reliable way to see the physical condition of a well. Moreover, owing to the creative X-ray technology of the X-ray detector equipment, precise downhole images can be taken regardless of the type of fluid in the well. Applications such as personnel or luggage screening and vehicle or container inspection usually use backscatter imaging in security scenarios when it is desirable to examine anything hidden behind an opaque barrier without physically removing it.

Challenges

- X-ray image inspection mistakes- Manufacturers utilize industrial radiography to ensure that parts are safe to use before being damaged. Similar to how medical X-rays are used to identify fractures or breaks in bones, industrial radiography frequently uses gamma rays, or X-rays, to take photographs of materials since they can reveal issues that are not visible to the unaided eye. Furthermore, images captured from within can be utilized to confirm that an item is free of invisible defects. Radiography is an important tool because it doesn't change or damage the object being tested. It can also be used when accessing the material for examination is difficult or inconvenient.

- Inspection of Vehicles Is A Difficult Task.

- The High Cost of These Devices May Restrict the X-ray Detector Market.

X-ray Detector Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

5.8% |

|

Base Year Market Size (2025) |

USD 3.77 billion |

|

Forecast Year Market Size (2035) |

USD 6.63 billion |

|

Regional Scope |

|

X-ray Detector Market Segmentation:

Type Segment Analysis

X-ray detector market share from the flat panel detectors segment is expected to cross 43% by 2035. The use of flat panel detectors for non-destructive testing (NDT) applications has increased significantly in the industrial sector. They usually have benefits like improved sensitivity to identify material faults, real-time data collecting, and high-resolution imaging. Flat panel detectors are widely used in quality control applications such as manufacturing, aerospace, and automotive to guarantee the integrity of components and materials. During the fiscal year 2022, the manufacturing industry's yearly production growth rate was 11.4%. Flat panel detectors are predicted to continue growing in popularity in the industrial sectors as long as technology progresses and more people become aware of their advantages.

End-Use Application Segment Analysis

The oil & gas segment share in the X-ray detector market is expected to reach 24% by 2035. In fact, the oil and gas sector is seeing a sharp increase in the need for X-ray detectors. One of the main factors propelling the rise of X-ray detectors in the oil and gas industry is the strict safety standards that demand extensive inspections of infrastructure and equipment. The finest quality in construction and maintenance is ensured by these detectors, which aid in permitting exact inspection of welds, pipes, and componentry. This is vital for preventing failures and guaranteeing the longevity of assets.

Our in-depth analysis of the global X-ray detector market includes the following segments:

|

Type |

|

|

Portability |

|

|

End-Use Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

X-ray Detector Market Regional Analysis:

North American Market Insights

The X-ray detector market in North America is projected to be the largest with the largest revenue share of 35% by 2035. There has been an increasing utilization of industrial radiography to examine the integrity, and structure of the material in the North America region. The expansion of X-ray detectors in the industrial sector is anticipated by the demand for this industry in the region. Between 2018 and 2019, the United States aircraft manufacturing sector shrank by roughly 12.7%. Just 135.3 billion dollars in total output were produced by this subsector in 2019.

European Market Insights

The Europe X-ray detector market share is expected to surpass 30% by the end of 2035. For example, European technology is now crucial to the digitization of mechanical and automotive engineering and has greatly benefited many other industries in the region. Industrial radiography is essential to these industries because it may spot minute flaws that are unseen to the naked eye. The two primary uses of industrial radiography are as follows: Manufacturers utilize industrial radiography as a tool to find defects in the materials they use. Inspectors utilize industrial radiography to find defects in industrial assets to ensure that they are safe for use and satisfy regulatory inspection requirements. These days, there is a lot of interest in the X-ray detector market, which is in great demand in the region.

Key X-ray Detector Market Players:

- Baker Hughes Company

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Canon Inc.

- FUJIFILM Holdings Corporation

- Hamamatsu Photonics K.K.

- iRay Technology

- Varex Imaging

- Vieworks Co., Ltd.

- CareRay Digital Medical Technology

- DRTECH

- Teledyne DALSA

- Thales Group

Recent Developments

- FUJIFILM Cellular Dynamics, Inc. announced a non-exclusive license agreement with global healthcare company Novo Nordisk A/S to use FUJIFILM Cellular Dynamics' iPSC platform for the development and commercialization of iPSC-derived cell therapies with a focus on serious chronic diseases. Novo Nordisk will have a non-exclusive license to use the iPSC cell lines for research and development, as well as to use GMP-grade cell lines for clinical and commercial manufacture and commercialization of iPSC-derived cell therapies, under the terms of the agreement.

- Thales engaged in an exclusive negotiation to acquire Cobham Aerospace Communications, a leading supplier of advanced, ultra-reliable novel safety cockpit communication systems, for USD 1.1 billion. Thales intends to pursue its objective of strengthening its Avionics portfolio with this acquisition. Avionics employs 690 people, including 190 engineers, throughout a well-invested footprint in France, South Africa, the United States/Canada, and Denmark. It is estimated to earn USD 200 million in revenue by 2023.

- Report ID: 5453

- Published Date: Sep 11, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

X-ray Detector Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.