Digital Wound Measurement Devices Market Outlook:

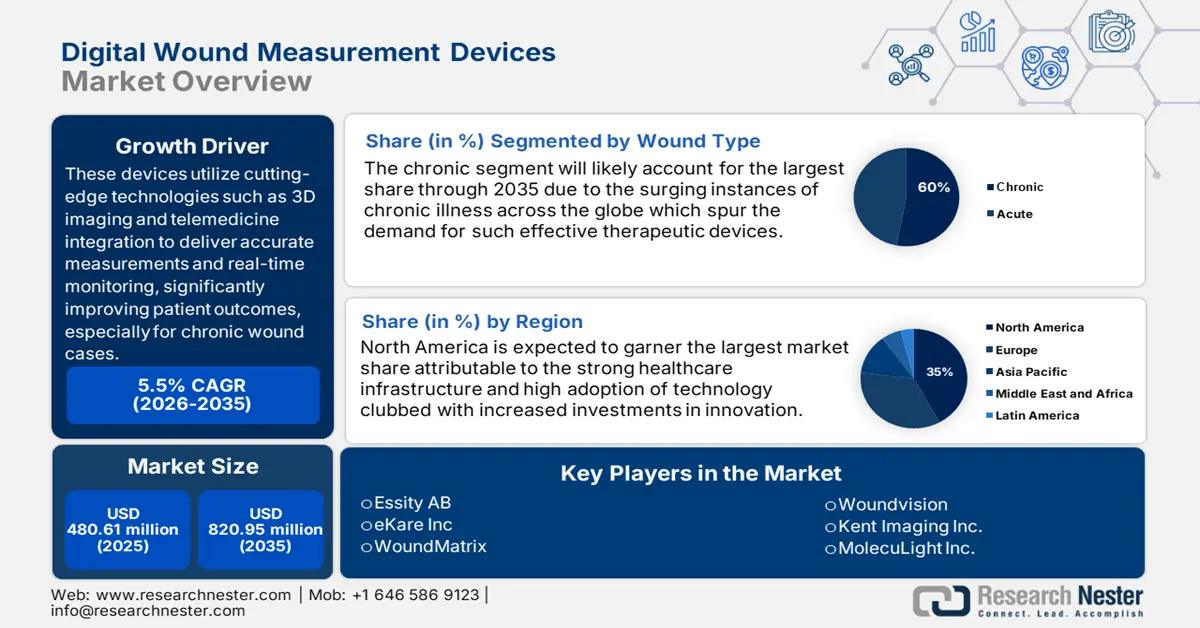

Digital Wound Measurement Devices Market size was over USD 480.61 million in 2025 and is anticipated to cross USD 820.95 million by 2035, witnessing more than 5.5% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of digital wound measurement devices is assessed at USD 504.4 million.

The market is growing owing to the increase in the burden of chronic wounds, including ischemic wounds and ulcers, as a result of fast-paced lifestyles. According to recent data from the National Institute of Health, 1–2% of people are predicted to sustain a chronic wound at some point in their lives in developed nations.

Key Digital Wound Measurement Devices Market Insights Summary:

Regional Highlights:

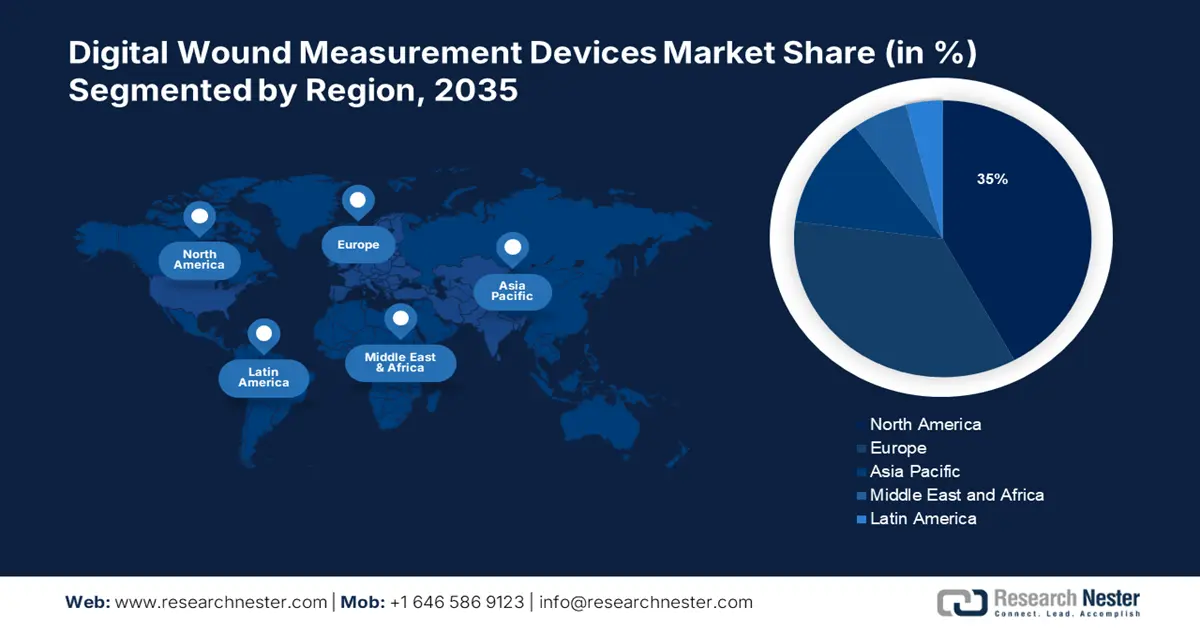

- North America digital wound measurement devices market will secure over 35% share by 2035, fueled by the growing adoption of advanced wound dressing solutions and increasing prevalence of chronic wounds.

- Asia Pacific market will exhibit significant CAGR during 2026-2035, attributed to increasing healthcare awareness, improved healthcare infrastructure, and rising demand for advanced medical facilities.

Segment Insights:

- The chronic segment in the digital wound measurement devices market is expected to capture a significant share by 2035, attributed to the rising prevalence of chronic diseases leading to increased chronic wounds.

Key Growth Trends:

- Growing adoption of advanced wound treatment

- Surge in the adoption of telemedicine

Major Challenges:

- Absence of centralized framework

- High investment

Key Players: MolecuLight Inc., Kent Imaging Inc., Essity AB, Woundvision, Parable Health, eKare Inc, ARANZ Medical Limited, TISSUE ANALYTICS, Swift Medical Inc., WoundMatrix.

Global Digital Wound Measurement Devices Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 480.61 million

- 2026 Market Size: USD 504.4 million

- Projected Market Size: USD 820.95 million by 2035

- Growth Forecasts: 5.5% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (35% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, Japan, United Kingdom, China

- Emerging Countries: China, India, Brazil, Mexico, South Korea

Last updated on : 17 September, 2025

Digital Wound Measurement Devices Market Growth Drivers and Challenges:

Growth Drivers

- Growing adoption of advanced wound treatment - The demand for digital wound measurement devices is increasing as more and more consumers become aware of the severity of these types of wounds such as loss of infection areas or limbs; they are also becoming increasingly inclined to take up Advanced Wound Management and Therapy.

For instance, in January 2023, Convatec announced the launch of ConvaFoamTM in the United States. The purpose of this advanced foam dressing family is to satisfy the needs of medical professionals as well as patients. Since ConvaFoamTM may be applied to a range of wound types at any stage of the wound journey, it's an easy dressing solution for wound care and skin protection. - Surge in the adoption of telemedicine - The demand for precise wound assessment and data exchange has increased as telemedicine and remote patient monitoring have become more common. For instance, 52% of American adults polled in 2022 said they had used telemedicine, which involved a live video conference with their doctor. When compared to 2021, the utilization of all telemedicine modalities increased in 2022.

This trend is driven by the fact that wound measuring devices allow healthcare professionals to examine and monitor wounds remotely, thereby reducing the need for in-person visits; and improving patient access to care. In light of the above-mentioned factors, the digital wound measurement devices market is predicted to grow steadily in the upcoming years. - Increased integration of AI in medical devices - Digital digital wound measurement devices are increasingly integrated with AI and machine learning. These technologies can help to automatically measure wounds, identify tissue types, and predict wound healing stages as well as provide more precise diagnostic information for healthcare professionals.

For instance, with the latest advancements in deep learning and artificial intelligence, the inSight® 3D imaging and wound assessment system empowers doctors to make data-driven decisions for patient care. This month, eKare introduces its brand-new Remote Monitoring function, which enables clinicians to provide suitable patients with smartphone access to a condensed version of inSight®, enabling them to take care of their wounds and practice self-care.

Challenges

- Absence of centralized framework - Even though wounds cause more deaths than any infectious or chronic sickness, they are not recognized as disorders or diseases. Attributed to this, the Center for Excellence in wound management and wound care is highly fragmented, unlike those of diabetes, cancers, and other fatal ailments. The adoption of digital wound measurement devices in commercial settings is limited by this lack of a central framework to support and coordinate the multidisciplinary network composed of surgeons, specialist nurses, health economists, or other professionals.

High investment - Growth in the market may be hampered by the high initial cost of developing and implementing digital digital wound measurement devices solutions, particularly for large-scale projects.

Digital Wound Measurement Devices Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

5.5% |

|

Base Year Market Size (2025) |

USD 480.61 million |

|

Forecast Year Market Size (2035) |

USD 820.95 million |

|

Regional Scope |

|

Digital Wound Measurement Devices Market Segmentation:

Wound Type Segment Analysis

Chronic segment is estimated to hold digital wound measurement devices market share of over 60% by the end of 2035. The rising prevalence of chronic conditions such as diabetes, obesity, and cardiovascular disease has resulted in an increase in the frequency of chronic wounds such as diabetic ulcers, pressure ulcers, and vein ulcers. According to a report by IDF, 783 million adults, or one in every eight of the population, will have diabetes by 2045, a 46% increase. More than 90% of diabetes patients suffer from type 2 diabetes, which is caused by a mix of genetic, environmental, demographic, and socioeconomic factors.

These disorders frequently cause sluggish or non-healing wounds, necessitating continuing therapy and monitoring. Furthermore, as the world's population ages, chronic wounds become more common. Elderly people are more prone to chronic wounds due to decreased skin elasticity, loss of circulation, and concurrent conditions.

End-use Segment Analysis

In digital wound measurement devices market, hospitals segment is poised to dominate majority share by the end of 2035. Hospitals aim to provide high-quality patient care and improve results. Therefore, the growing number of hospitals is escalating the growth of the segment. For instance, approximately 2,845 beds are non-profit, 1,234 are for-profit, and 1,623 are government-owned in the US.

Wound measurement enables healthcare professionals to assess wounds in a precise manner, follow their progress, and keep an eye on them, devices help achieve this goal. Make the right choices about treatment, which may lead to better outcomes for patients. In addition, an effective and simplified approach to wound assessment is provided by digital digital wound measurement devices. They make it easier for healthcare professionals to take advantage of their time and resources to speed up the measurement of wounds.

Our in-depth analysis of the market includes the following segments:

|

Product Type |

|

|

Wound Type |

|

|

End-use |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Digital Wound Measurement Devices Market Regional Analysis:

North America Market Insights

North America region in digital wound measurement devices market is projected to account for more than 35% revenue share by the end of 2035. The market growth in the region is also expected on account of the surging adoption of advanced wound dressing and management solutions and the growing prevalence of complex and chronic wounds. For instance, O&M Halyard presents a cutting-edge wound dressing portfolio designed to satisfy the requirements of both patients and professionals. Healthcare professionals and caregivers now have a new option for managing both acute and chronic wounds due to HALYARD alginate, gelling fiber, and foam dressings.

The United States has a relatively high prevalence of chronic diseases such as diabetes and obesity. For instance, approximately 33% of people in the 18+ age group were obese as of 2022. The need for better wound diagnostic and management options is fueled by the fact that these disorders frequently result in chronic wounds.

Canadian healthcare providers are more likely to invest in and adopt digital digital wound measurement devices to provide high-quality wound care services, contributing to the market’s growth in the region. Also, the frequency of diabetic foot ulcers is increasing along with the number of persons who have diabetes mellitus. According to the data quoted by National Library of Medicine, diabetic foot ulcers (DFUs) can occur in up to 25% of the approximately 4 million Canadians with diabetes at some point in their lives.

APAC Market Insights

The APAC region will also witness huge growth for the digital wound measurement devices market during the projected period and will hold the second position owing to the increasing improvements in healthcare awareness. In addition to this, healthcare infrastructure and the rise in the number of laboratories with advanced medical facilities are some of the other factors propelling the market growth in the region.

Korea is known for its robust technological growth in the healthcare industry. Advances in material science have produced enhanced wound dressings that promote quicker and more efficient healing, like hydrocolloid and hydrogel dressings.

Digital wound measurement devices market in China is anticipated to grow majorly due to the increasing use of telemedicine. According to a report, by December 2023, 414 million Chinese citizens—or about 38% of the nation's Internet population—had accessed medical services via the Internet.

The increasing focus on research and development (R&D) is creating new opportunities for the Japan's market by allowing for the introduction of cutting-edge wound care products like tissue-engineered goods, growth factors, and bioactive dressings.

Digital Wound Measurement Devices Market Players:

- MolecuLight Inc.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Kent Imaging Inc.

- Essity AB

- Woundvision

- Parable Health

- eKare Inc

- ARANZ Medical Limited

- TISSUE ANALYTICS

- Swift Medical Inc.

- WoundMatrix

The companies mentioned below have used various strategic techniques to increase their market shares in domestic as well as international markets, some of these strategies include collaborations, mergers and partnerships formed to provide cutting-edge solutions that efficiently manage corporate operations.

Recent Developments

- MolecuLight Inc., the leader in point-of-care fluorescence imaging for the real-time identification of wounds with elevated bacterial loads, announced the debut of the MolecuLightDXTM, a new point-of-care device model tailored to the specific requirements of newly emerging wound care market segments in the USA.

- Essity has expedited the process of digital transformation across its whole enterprise. An innovative computerized tool for measuring and recording wounds is called Cutimed Wound Navigator, or the Cutimed Wound Navigator App. Through a straightforward interface, the app records important wound features, such as the ability to take an image from which wound measures can be automatically calculated.

- Report ID: 6063

- Published Date: Sep 17, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.