Wood Preservatives Market - Growth Drivers and Challenges

Growth Drivers

- Shift toward green chemistry and safer alternatives: The wood preservatives sector is quickly embracing green chemistry concepts, concentrating on low-toxicity options, including copper azole and borate-based solutions. Governments are investing heavily in green chemistry through research and innovation moves. In India, the green chemical manufacturing is gaining traction through initiatives such as Make in India and the Production-Linked Incentive (PLI) Scheme to boost domestic growth and attract private investments. The green alternatives significantly cut down on chemical leaching and lessen environmental damage, which enhances their popularity in both residential and commercial building projects. Further, the green chemicals are leading to considerable advancements in biocide-free wood treatment products and complying with stricter environmental regulations around the globe.

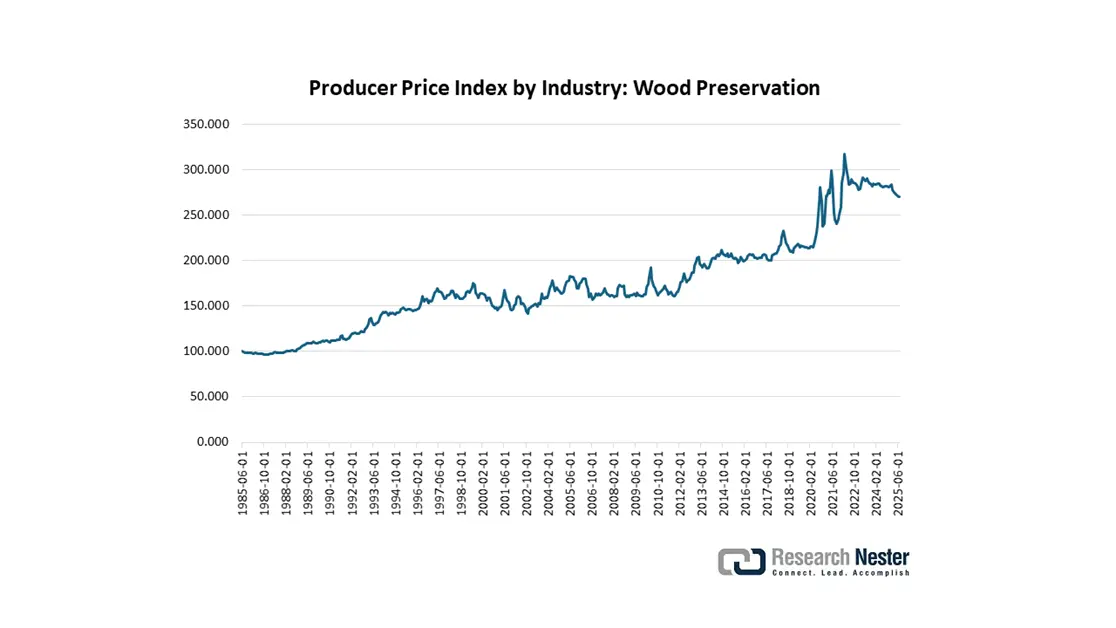

- Pricing trends in wood preservatives trade: The global wood preservatives market has undergone considerable transformation over the last few decades, shifting from conventional chemicals, such as creosote and chromated copper arsenate (CCA), to more sustainable alternatives, including copper azoles and borates. Unit sales volumes have consistently risen, propelled by an increasing demand in the construction, furniture, and infrastructure industries. Price trends have the potential to be influenced by various factors, including the costs of raw materials, changes in regulations, and geopolitical occurrences. Considering the prospects, the market is anticipated to maintain its growth trajectory, with a heightened focus on sustainable and eco-friendly preservatives. For example, the Federal Reserve Bank of St. Louis discloses that the producer price index for wood preservation stood at 270.016 in July 2025. The labor and energy costs, demand changes, and technological advancements drive the fluctuation in the PPI for wood preservation.

Source: Federal Reserve Bank of St. Louis

- Smart preservation technologies: Technological trends are likely to propel the production and commercialization of wood preservatives. The integration of advanced formulations with moisture sensors and antimicrobial coatings is set to enhance the characteristics of wood preservation chemicals. The growing consumer expectations for durability, sustainability, and smart functionality are opening lucrative doors for wood preservative companies. For instance, in May 2022, Archroma and the University of Goettingen launched a new eco-friendly wood protection technology called Siligen MIH liq that makes solid wood stronger and longer-lasting.

Challenges

- Raw material price volatility affecting pricing models: Global prices for raw materials used in wood preservatives have undergone considerable fluctuations. As per data from Trading Economics, the price of copper futures rose by USD 4.46 per pound in the last week of August 2025. The changes are driven by disruptions in the supply chain and geopolitical conflicts. The increase significantly boosts production expenses for copper-based preservatives such as copper azole. Smaller and medium-sized suppliers in the U.S. have found it difficult to manage these elevated costs, leading to reduced profit margins and difficulties in sustaining competitive pricing. The volatility in prices further complicates the establishment of long-term contracts and the overall stability of the market.

- Market access barriers and trade restrictions: The trade of wood preservatives encounters obstacles due to tariffs, varying regulations, and delays in certification. The evolving safety standards postpone the approval process for foreign wood preservatives by six months, resulting in supply chain disruptions and financial losses for exporters. Such regulatory hurdles impede market entry, elevate compliance expenses, and restrict growth prospects for suppliers. These trade restrictions also hinder the smooth flow of goods and pose significant obstacles to the growth of the international market.

Wood Preservatives Market Size and Forecast:

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

5.3% |

|

Base Year Market Size (2025) |

USD 2.5 billion |

|

Forecast Year Market Size (2035) |

USD 4.1 billion |

|

Regional Scope |

|

Browse key industry insights with market data tables & charts from the report:

Frequently Asked Questions (FAQ)

In the year 2026, the industry size of wood preservatives was over USD 2.6 billion.

The market size for wood preservative is projected to cross USD 4.1 billion by the end of 2035, expanding at a CAGR of 5.3% during the forecast period, i.e., between 2025 and 2035.

The major players in the market are BASF, Koppers, LANXESS, Lonza, Cabot Microelectronics, Troy, and others.

The construction segment is predicted to gain the largest market share of 42% during the projected period.

The Asia Pacific wood preservative sector is poised to hold a 43% share by the end of 2035.