Wood Plastic Composites Market Outlook:

Wood Plastic Composites Market size was valued at USD 8.9 billion in 2025 and is projected to reach USD 27.6 billion by the end of 2035, rising at a CAGR of 12% during the forecast period, i.e., 2026-2035. In 2026, the industry size of wood plastic composites is expected to reach USD 9.9 billion.

The global wood plastic composites market is witnessing stable expansion, fueled by growing demand for long-term, sustainable building materials. The trend leans towards higher product performance, appearance, and flexibility of application, and manufacturers are making positive innovations to meet evolving consumer and industry needs for sustainable alternatives to wood. For instance, Fiberon LLC, in February 2025, introduced a digitally color-matched railing system for its U.S. WPC decking lines, employing AI-based sensors to ensure accurate color consistency and improve appearance, a reflection of the industry's shift towards sophisticated product integration and design.

Market growth is backed by favorable government regulations and changing building codes that promote the adoption of WPC products. Officials increasingly are linking the advantages of WPC, recyclability, and reduced maintenance to long-term environmental and circular economy objectives. An example is the U.S. Environmental Protection Agency (EPA), which in July 2024 released new guidelines requesting the adoption of WPC products in federal landscaping projects, citing WPC recyclability, durability, and reduced maintenance, a trend set to considerably increase public sector orders for these new materials.

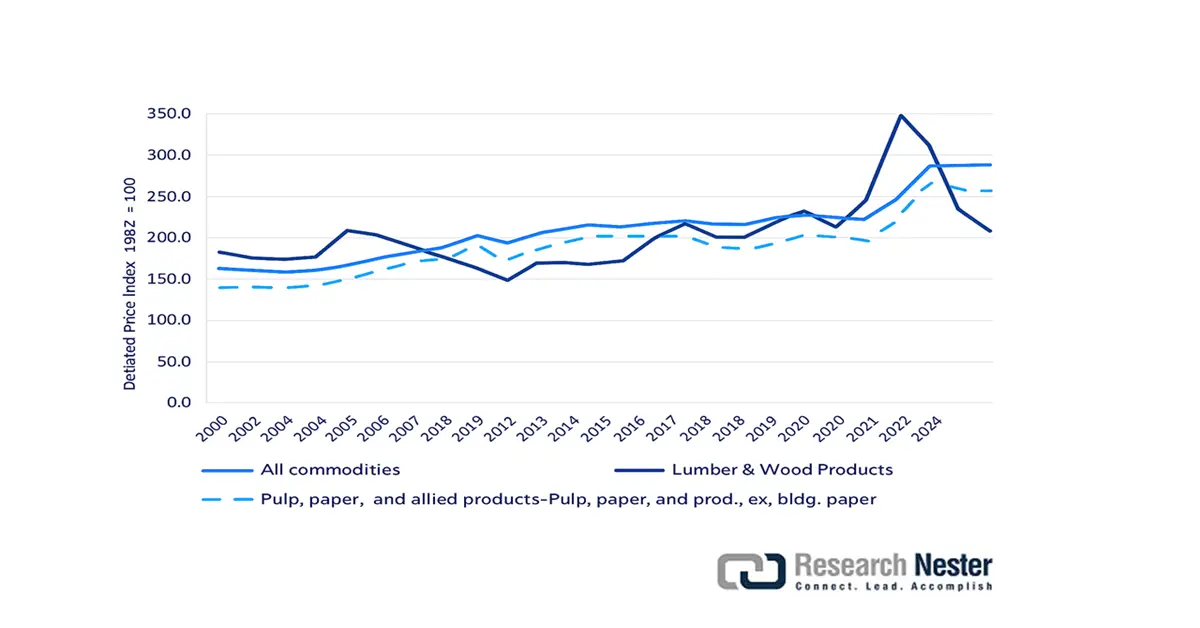

Lumber and wood products (LWP) outpaced the producer price index for all commodities in 2020, through 2022. The LWP PPI declined between 2000 to 2007 by 36.1%. The primary contributor to the decline was the Great Recession’s adverse impact on housing and construction, remodeling, and furniture manufacturing. The LWP index has fluctuated during this period until it stabilized at 347.0 in 2021 from 172.5 in 2012. However, the paper, unadjusted pulp, and allied products, except building paper (PPA), PPI remained consistent over the last few years. The PPA index stood at 286.8 in 2023 from 224.7.4 in 2020, according to 2024 Bureau of Labor Statistics (BLS) data.

Producer Price Index: All commodities, lumber and wood products, and pulp, paper, and allied products (ex. building paper), 2000 to the first half of 2024.

Source: UNECE, BLS 2024

In terms of raw materials, the hemicelluloses relevant wood yields include glucomannans (GM) and xylans, containing arabinose (Ara), galacturonic acids (GalA), and glucuronic acids (GlcA) substituents in mannans. Hemicellulose macromolecular composition comprises 30–32 wt % of softwood and 15-35 wt % of hardwood. Softwoods such as white spruce (Picea glauca) and Norway spruce (Picea abies) are popular raw material choices as these are rich in galactoglucomannan (GGM) and arabinoglucuronoxylan (AGX) (16-17% and 8-10% of dry wood weight). Paper birch (Betula papyrifera), a widely used hardwood, is rich in glucuronoxylan (GX) (15–30%) and has traces of GM (1–2%). Furthermore, Xyloglucans (XG) make up approximately 25% dicotyledonous angiosperms, 10% in softwoods, and 2–5% in grasses. Owing to their lower concentration in wood, XGs are usually not considered as hemicellulose sources.

Capacity Utilization of Wood Products

|

Capacity Utilization (in %, seasonally adjusted) |

2024 Proportion |

2024 Q4 |

2025 Q1 |

2025 Q2 |

2025 Feb. |

2025 Mar |

2025 Apr |

2025 May |

2025 June |

2025 July |

|

Wood Products |

1.65 |

77.4 |

77.1 |

76.1 |

78.0 |

77.0 |

76.1 |

76.7 |

75.5 |

75.9 |

Source: Federal Reserve

The rising emphasis on a circular economy has led to efficient usage of wood biomass instead of disposing in landfills. Forest trees are harvested less often than crops, thus making crops a key source of raw materials. Biomass is currently used for cellulose, hemicellulose, and lignin production. Implementing large-scale adoption of wood hemicellulose feedstocks is anticipated to provide incentives for new harvesting strategy developments and aid in the preservation of forests and optimal usage of biomass, also supporting the overall trade scenario. The global cellulose trade in 2023 was USD 6.8 billion, as mentioned by the OEC. The category has expanded at a 3.2% growth over the last five years. It ranked 460 in worldwide trade value, among 1217 products and accounted for 0.03% of global trade. The leading exporters were the U.S. (USD 1.43 billion), China (USD 1.15 billion), and Germany (USD 1.08 billion), whereas the key importers included India (USD 590 million), China (USD 551 million), and the U.S. (USD 446 million), as of 2023.

|

Polyethylene having a specific gravity of <0.94, Exports 2023 |

|

|

Saudi Arabia |

3,170,580,000 Kg |

|

U.S. |

3,341,890,000 Kg |

|

European Union |

1,021,060,000 Kg |

|

Netherlands |

839,022,000 Kg |

|

Belgium |

826,946,000 Kg |

Source: World Trade Integrated Solution (WITS)