Wireless Network Security Market Outlook:

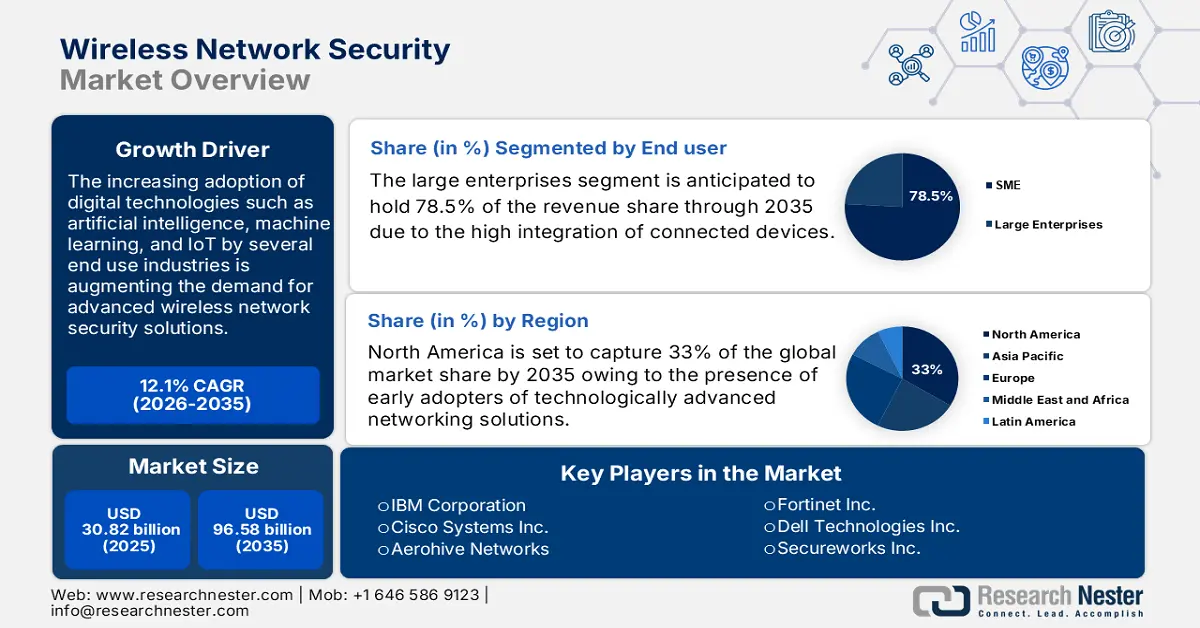

Wireless Network Security Market size was over USD 30.82 billion in 2025 and is projected to reach USD 96.58 billion by 2035, growing at around 12.1% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of wireless network security is assessed at USD 34.18 billion.

High adoption of wireless network security solutions across different sectors is a key factor expected to boost wireless network security market growth during the forecast period. Several industries are widely adopting digital technologies, including the Internet of Things (IoT) and Artificial Intelligence (AI) due to their effectiveness in enhancing overall business operations. This digital shift along with technological advancements, however, increases privacy concerns and cyber theft risks. To overcome these issues the end users deploy advanced wireless network security solutions. In April 2024, HPE Aruba Networking announced the launch of a robust Wi-Fi 7 to enhance wireless network security in enterprises and address challenges associated with AI and IoT.

Key Wireless Network Security Market Insights Summary:

Regional Highlights:

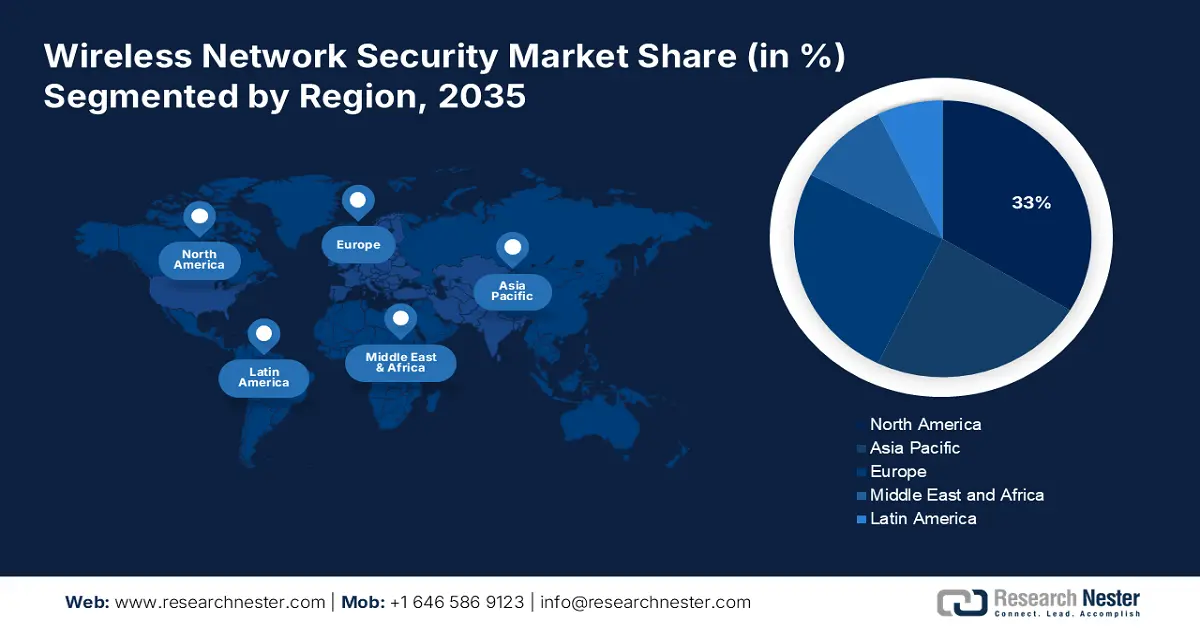

- North America dominates the Wireless Network Security Market with a 33% share, driven by the strong presence of key market players and early adopters, fostering growth through 2035.

- The Asia Pacific Wireless Network Security market anticipates substantial growth by 2035, fueled by the presence of high-potential economies and tech adoption.

Segment Insights:

- The Firewall segment is expected to dominate revenue share by 2035, driven by increasing cyberattack risks and advanced firewall solutions.

- The Large Enterprises segment is projected to achieve a 78.5% share by 2035, driven by rapid digitalization and adoption of AI, IoT, and cloud technologies.

Key Growth Trends:

- High adoption by the BFSI sector

- Generative AI offering advanced protection

Major Challenges:

- Lack of standard norms

- High investment cost & lack of knowledge

- Key Players: IBM Corporation, Fortinet Inc., Aruba Networks, Juniper Networks Inc., Broadcom Inc., and Cisco Systems Inc.

Global Wireless Network Security Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 30.82 billion

- 2026 Market Size: USD 34.18 billion

- Projected Market Size: USD 96.58 billion by 2035

- Growth Forecasts: 12.1% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (33% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Japan, Germany, United Kingdom

- Emerging Countries: China, India, Japan, South Korea, Singapore

Last updated on : 14 August, 2025

Wireless Network Security Market Growth Drivers and Challenges:

Growth Drivers:

-

High adoption by the BFSI sector: To compete with the tech-driven world organizations are integrating advanced communication and networking solutions. These solutions make operations more easy, effective, and efficient leading to high earnings. The BFSI is one the prime sectors ahead in the utilization of networking technologies to manage the vast data securely and effectively. For instance, as per the Carnegie Endowment for International Peace Report, in April 2022 investors lost around USD 180 million in the Beanstalk Farms cryptocurrency heist. Hence, to battle these issues, BFSI organizations are making high use of advanced wireless network security technologies.

- Generative AI offering advanced protection: The integration of generative artificial intelligence (AI) enhances the performance and ability to identify ransomware, malware, and other cyber threats of wireless network security solutions. Many organizations are employing generative adversarial network solutions to analyze vast amounts of data and detect and cope with any cyber theft. In May 2024, Fortinet revealed new updates to its GenAI product base to enhance security as well as network operations.

Challenges

-

Lack of standard norms: Cyber attackers are using various digital technologies to steal sensitive information from enterprises and organizations. The possibility that the cyber attacker can transfer a bug into a digital wireless network security solution is creating a trusted approach among end users, hampering the overall wireless network security market growth. Even though digital technologies offer advanced protection they can be also used against due to the non-presence of any reliable and authenticate standards.

- High investment cost & lack of knowledge: Companies running on tighter budgets are often deterred from adopting advanced wireless network security solutions owing to their high installation costs. Also, the integration of wireless network solutions with existing technologies is a complex process and requires the presence of skilled technicians, which increases labor costs. Apart from this, some companies resist adopting advanced security solutions due to a lack of knowledge and misconception, which hinders the wireless network security market growth to some extent.

Wireless Network Security Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

12.1% |

|

Base Year Market Size (2025) |

USD 30.82 billion |

|

Forecast Year Market Size (2035) |

USD 96.58 billion |

|

Regional Scope |

|

Wireless Network Security Market Segmentation:

Solution (Firewall, Encryption, Intrusion Detection Systems, Identity & Access Management, Unified Threat Management, Others)

The firewall segment in wireless network security market is anticipated to account for a dominating revenue share through 2035 owing to increasing threats of malicious and unauthorized visitors, susceptibility to cyber threats, and rising availability of advanced firewall solutions. In February 2023, WatchGuard announced the launch of a new line of firewall products to increase security for remote and distributed businesses.

End user (Small & Medium Enterprises, Large Enterprises)

Large enterprises segment is set to capture wireless network security market share of around 78.5% by the end of 2035, owing to the rapid digitalization trend. Many large-scale organizations are adopting digital technologies to boost their operational efficiency and manage vast amounts of data. In the manufacturing sector, the integration of technologies such as artificial intelligence, machine learning, the Internet of Things, and cloud computing is making workflow more effective and labor-free.

Our in-depth analysis of the global wireless network security market includes the following segments:

|

Solution

|

|

|

Service |

|

|

End user |

|

|

Industry Vertical |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Wireless Network Security Market Regional Analysis:

North America Market Forecast

North America industry is predicted to account for largest revenue share of 33% by 2035, owing to the strong presence of key market players and early adopters. The advanced IT infrastructure, early adoption of advanced technologies, and stringent regulations on cybercrimes are further contributing to the market growth in the region.

The U.S. wireless network security market is projected to expand at a significant CAGR during the forecast period. The increasing number of new product launches in the country underscores the high adoption rates of security solutions in the country. For instance, in September 2023, Zscaler, Inc. partnered with Imprivata and CrowdStrike to develop a zero-trust cybersecurity solution for healthcare organizations.

In Canada, the stringent regulations on network security and the rapidly expanding IT and telecommunication sector are significantly influencing the market growth. In July 2024, Get Wireless announced its plan to expand its presence and portfolio of IoT products and services in Canada.

Asia Pacific Market Statistics

Asia Pacific is the most opportunistic marketplace for wireless network security solution providers owing to the swift adoption of digital technologies in several sectors. The rapidly expanding BFSI sector in the region coupled with rising foreign investments is boosting the sales of wireless network security solutions. Asia Pacific is expected to capture 23.1% of the global wireless network security market share by 2035 due to the presence of high-potential economies such as China and India and technologically advanced countries such as Japan and South Korea.

India is witnessing robust growth in the telecommunications sector, which is directly boosting the sales of advanced wireless network security technologies. For instance, according to the India Brand Equity Foundation, the total volume of wireless data usage in the country increased from 4,206 petabytes in 2018 to 47,629 petabytes in 2024. Furthermore, the approval of the USD 1.65 billion production-linked incentive (PLI) scheme by the Union Cabinet for telecom & networking products is expected to fuel the wireless network security market growth in the coming years.

Key Wireless Network Security Market Players:

- IBM Corporation

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Ruckus Networks

- Aerohive Networks

- Fortinet Inc.

- Aruba Networks

- Juniper Networks Inc.

- Broadcom Inc.

- Cisco Systems Inc.

- Dell Technologies Inc.

- Sophos Ltd

- Motorola Solutions Inc.

- Amazon Web Services Inc.

- Edgecore Networks

- Secureworks Inc.

Key players in the wireless network security market are adopting several organic and inorganic strategies to maximize their earnings and boost market reach. They are investing heavily in research and development activities to introduce innovative wireless network security solutions. Industry giants are collaborating with other players to enhance their product offerings and increase their audience base. Furthermore, they are also employing mergers & acquisitions and regional expansion strategies to grab lucrative opportunities.

Some of the key players include:

Recent Developments

- In June 2024, Cisco Systems Inc. announced the launch of its AI-enabled network security solution to offer a more secure and connected environment. The company also announced a USD 1.0 billion investment for the expansion and development of reliable AI security solutions.

- In November 2022, Fortinet Inc. announced the launch of managed cloud-native firewall services. This artificial intelligence-based network security solution is available on Amazon Web Services.

- Report ID: 6586

- Published Date: Aug 14, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Wireless Network Security Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.